CLOSING BELL

6 Gigawatts? In This Economy?

The market climbed Monday, closing at fresh highs after news of an OpenAI stake option in AMD to get their hungry AI paws on 6 gigawatts of processing power.

It wasn’t the only name moving: OpenDoor climbed in the late afternoon hours, App Lovin tanked, the Uncle Sam bag buying rumor mill sent a rare earth suppliers climbing, and Bitcoin crushed fresh highs at $126,000 on week two of the Government shutdown.

There were other trending names, too many to count today, as if U.S. equities got up on the right side of the bed. Good thing too, it’s a long week. Without government economic data, we’ll be tracking Michigan consumer sentiment and FedSpeak, and awaiting Pepsico and Delta to kickstart the third-quarter earnings season. 👀

Today’s RIP: Modelo is suffering from consumer fear, AMD flying on OpenAI buy, trending rare earths, and more.

6 of 11 sectors closed green, with tech $XLK ( ▲ 1.3% ) leading and real estate $XLRE ( ▲ 0.28% ) lagging.

STOCKS

Constellation Said People Are To Scared To Drink Modello 🍺

Constellation Brands $STZ ( ▲ 0.41% ), the beer and beverage maker behind Modelo and Corona, climbed in the poist market after posting a fall in second quarter sales, and a drop in beer sales overall. The numbers were bad but better than the street’s estimates.

Q2 sales fell 15% from last year to $2.48B, and beer sales fell 7%. Adjusted earnings per share were $3.63, above estimates. Wine and spirit sales were even worse, falling 65%, although the CFO attributed this to the 2024 divestiture of Svedka.

The company said it wasn’t just consumers’ wallets, it was attitudes. Half of Constellation customers are Hispanic, and the company said 80% of their shoppers were worried about the socioeconomic environment.

The company said their customers were afraid of going outside over the summer, and were fearful of going shopping, enjoying themselves in public spaces, and in their private homes with family, all activities Americans love paired with beer.

It isn’t just the scary times; beer is falling out of vogue with younger generations, according to Barron’s. The earnings came in after Constellation management slashed its full-year outlook in September, projecting a 4-6% drop in net sales.

In the first half of the year, Anheuser-Busch sales fell 2%, and Molson Coors sales fell 1.6%, sending shares of both stocks down 19%.

IN PARTNERSHIP WITH

Jeff Bezos Says This New Breakthrough is Like “Science Fiction”

He called it a “renaissance.” No wonder ~40,000 people backed Amazon partner Miso Robotics. Miso’s kitchen robots fried 4M food baskets for brands like White Castle. In a $1T industry with 144% employee turnover, that’s big. So are Miso’s partnerships with NVIDIA and Uber. Initial units of its newest robot sold out in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

AMD Flies On News 6 Gigawatt OpenAI Deal, Option For Stake Buy 📈

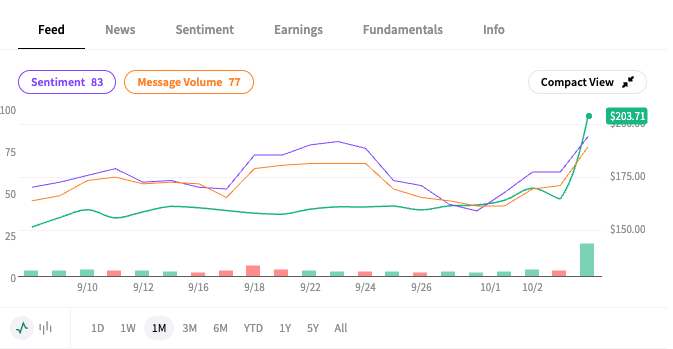

AMD $AMD ( ▲ 8.77% ) flew on news it was getting the ultimate golden goose of private AI spending power: OpenAI is soaking up a ton of computing power from AMD’s Instinct Graphics over the next couple of years, starting with 1-gigawatts in H2 2026.

Part of the deal gives OpenAI options for 160M shares in AMD common stock, in a deal cited at billions in value, though OpenAI would not state the exact dollar amount.

Two weeks ago, OpenAI dropped a $100B equity and data supply deal with Nvidia $NVDA ( ▲ 0.68% ), but Monday’s news left the king of chip makers feeling high and dry.

Chief Lisa Su said her company now has a major buying partner, setting AMD’s growth at the center of a 10-year AI growth path.

“You need partnerships like this that really bring the ecosystem together to ensure that, you know, we can really get the best technologies, you know, out there,” she told CNBC. “So we’re super excited about the opportunities here.”

AMD sentiment and message volume spike on Stocktwits after the news

TRENDING NEWS

Figma, OpenDoor, Rare Earth Miners Fly Monday 🪨

Speaking of OpenAI, Figma $FIG ( ▲ 10.83% ) climbed 7% after OpenAI showed off in chat apps during its developer day. Chief Sam Altman showed a user asking Chat to use Figma to turn a sketch into a diagram.

It wasn’t the only name trending on Monday, a day of newsbreaks that spurred equities to fly.

Spruce Biosciences $SPRB ( ▲ 8.66% ) soared a whopping 1300% after FDA breakthrough designation for one of its treatments. The small-cap San Fran-based biopharma flew on the news, soaking up the attention at the top of the Stocktwits trending list.

It was joined at the end of the day by Opendoor $OPEN ( ▲ 6.9% ), climbing after a tweet from new Chief Kaz Nejatian suggesting he may take seriously the idea of letting users buy homes with Bitcoin. Big if true, though it’s unclear how many Bitcoin maxis would part with their coins for all-time high home prices.

Archer Aviation $ACHR ( ▲ 3.31% ) shares climbed after the air taxi startup showed off its Midnight aircraft tech at an airshow, and the company posted a video that had a Tesla robot in it. 🤷 Tesla also posted a fan spinning with a Tesla logo on it.

Applovin $APP ( ▲ 3.31% ) shares fell after a Bloomberg report from the SEC probing the companies in app ads and monetization practices.

The news that took the cake for most big if true Monday was rare earth miners, climbing on speculative ‘maybe Uncle Sam is still buying’ after Lithium Americas $LAC ( ▲ 10.28% ) jumped last week when its lithium mine project was rolled into a stake.

Critical Metals $CRML ( ▲ 4.07% ) shares were climbing earlier in the day, following rumors Friday. The company that has its fingers in Greenland’s largest rare earth metal project. A Bloomberg report stemmed the bull tide, reporting that the previous report was just a rumor.

Then the market closed, and the Trump Admin had real news to share: it was investing $35M to support Alaskan mining, through a 10% stake in $TMQ ( ▲ 9.23% ), a Canadian mining company. Shares were flying 150% at the time of writing.

“This was something that should have been long operating and making billions of dollars for our country and supplying a lot of energy and minerals and everything else,” Trump said in the Oval Office.

To date, Uncle Sam has rolled up loans into stake buys in INtel $INTC ( ▲ 5.71% ), MP Materials $MP ( ▲ 4.92% ), as well as Lithium Americas.

POPS & DROPS

Top Stocktwits News Stories 🗞

Plug Power surged 8% on hydrogen project momentum.

Streamex surged 33% on gold-backed token launch.

Paramount Skydance acquired The Free Press, naming Weiss CBS editor.

Wynn Resorts and Casinos rebounded as Macau cyclone threat faded.

Fundstrat Granny Shots ETF hit $3B AUM after 28% YTD gain.

American Battery jumped 12% on lithium supply chain optimism.

Qualcomm sued for $647M in UK over royalty abuse claims.

Bitcoin hit $125,800 as crypto market topped $4.4T.

Gold prices hit $3,970 amid shutdown-driven equity fears.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

$AMD’s OpenAI Shockwave, Galaxy Goes Retail, ETH Setups, and Space Story Stocks Take Off

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Trade Balance (8:30 AM), FOMC Member Bostic Speaks (10:00 AM), FOMC Member Bowman Speaks (10:05 AM), NY Fed Consumer Expectations (11:00 AM), FOMC Member Kashkari Speaks (11:30 AM), 3-Year Note Auction (1:00 PM)📊

Pre-Market Earnings: McCormick & Co. ($MKC). 🛏️

After-Market Earnings: Diginex Ltd. ($DGNX) and Saratoga Investment Corp ($SAR).🌕

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋