CLOSING BELL

Save Your Pennies

The market did not change much on Tuesday, though policy decisions continued to send specific names and industries into all-time highs. Copper flew after President Trump said sector-specific tariffs were on the way at a Cabinet meeting Tuesday, including a surprise 50% levy on copper imports— hope you saved your pennies. Copper futures hit an all-time high, and had their best day since at least 1988.

According to Jonathan Morgan, our Litepaper writer and resident coin expert, pennies minted before 1982 are 100% copper, worth about 3C a coin. Makes cents to me. 👀

Today's issue covers they tariff copper right after cutting penny production, regulatory snoozefest moved industries and more. 📰

With the final numbers for indexes and the ETFs that track them, 4 of 11 sectors closed green, with energy $XLE ( ▼ 0.58% ) leading and utilities $XLU ( ▲ 0.38% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,225

Nasdaq 100 $QQQ ( ▲ 1.36% ) 22,702

Russell 2000 $IWM ( ▲ 0.56% ) 2,228

Dow Jones $DIA ( ▲ 0.58% ) 42,240

STOCKS

Of All Times To Turn Up Penniless, It’s Today 🫠

The White House put on another wonderful edition of ‘House Husbands Of Pennsylvania Ave” on Tuesday, this edition filled with more trade and war talk.

First, copper levies were raised to match taxes on steel and other metals.

September futures on copper hit $5.89 a pound shortly after the news. The U.S. imports half of all its copper from Chile, and it’s the third most consumed metal in the country, according to the U.S. Geological Survey.

Then, there was talk of other sector tariffs. Trump said to expect a major tax on foreign pharmaceuticals coming soon, somewhere “like 200%.”

The news sent $MRNA ( ▲ 4.0% ) and other pharma names higher, though Moderna climbed alongside news that the firm would sue RFK Jr. for allegedly unlawful vaccine rollbacks.

After a Monday comment that suggested the new trade letters were merely an extension, Trump reaffirmed that all tariffs will take effect on August 1 with no concessions, declaring all dues “payable.” And pay they will; Trump said he expects the new taxes to pull in $300B by the end of the year. 🫰

The president also said he was close to an EU deal, coming sometime this week. Germany warned on Tuesday that the EU will retaliate if a fair trade deal isn’t reached with Trump, having reviewed the 14 social media letters sent to nations on Monday, and likely getting nervous. ☠

SPONSORED

Get Fast ETF Updates, Market Moves, and Strategy Ideas—Free to Your Inbox

Markets move fast—and serious traders don’t wait for the news to catch up. When you subscribe to Direxion’s Xchange enewsletter, you’ll get direct access to timely updates on our Leveraged and Inverse ETFs, strategy tips, market insights, and alerts on stocks & indexes that matter to active traders. Whether you're looking to play short-term momentum or hedge with precision, this is where the pros stay informed. It’s free, fast, and designed to keep you one step ahead of the crowd.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Tuesday’s Regulatory Snoozfest Moved Stocks 🛌

There was more regulatory news that helped push along stock Tuesday, and yes, in an aside, I look forward to earnings season news for more variety. I promise we’ll return to non-political topics next week with the fresh start of Q2s reports.

Fair Isaac’s ticker $FICO ( ▲ 6.04% ) fell after the FHFA approved VantageScore 4.0 for mortgages, ending its longtime dominance in GSE credit scoring.

Fair Isaac sells the FICO score, and any boost to competitors, such as Fannie Mae and Freddie Mac’s VantageScore, hurts its dominance in the credit world. FICO is the choice for 90% of the top lenders in the U.S.

Bill Pulte, director of the Federal Housing Finance Agency, said on Tuesday that $FMCC ( ▼ 5.45% ) will allow mortgage lenders to use the 4.0 model to evaluate creditworthiness.

Albemarle $ALB ( ▲ 5.11% ) and other major chemical producers climbed after positive news of deregulation within their industry. The Fed said it was withdrawing rules that limited 18 chemical substances, first proposed in 2023.

Finally, the solar industry fell after some harsh words from the president. $FSLR ( ▼ 13.43% ) and $RUN ( ▼ 2.79% ) led the way. The president not only helped push through legislation that removed green energy financing tax breaks, but Monday he signed an Executive order to cut any 'preferential treatments’ green tech has received. He called solar power “stupid” and “ugly.” It’s like he was bullied by a solar panel in middle school. ☀

SPONSORED

Cybersecurity Leader Cycurion (NASDAQ: CYCU) $CYCU Poised for Growth Now!

$69 Million in Recent Contract Awards for Innovative, Disruptive Cybersecurity Leader with a Multi-layered SaaS Solution: Cycurion, Inc. (Nasdaq: CYCU) $CYCU

$CYCU Reports 2025 Q1 Gross Profit of $677,673, Up 95.4% Year-Over-Year, with 17.5% Gross Margin Increase.

Clients and Partners Include: US Dept. of Defense, Defense Intelligence Agency, Dept. of Homeland Security, US Navy, Fortune 100 & 500 Companies and Major Private Sector Companies.

Advancement of Plans for AI-Powered Next-Generation Cybersecurity Platform with Partner $IQST

Expansion into Latin America via Partnership with LSV-TECH International Extending Sales Presence Into 135 Countries via Nokia Agreement.

Other Notable Cybersecurity Leaders: Palo Alto $PANW, Zscaler $ZS, CrowdStrike $CRWD, Category F5 $FFIV, Checkpoint $CHKP, CyberArk $CYBR, Fortinet $FTNT, Okta $OKTA and Cloudflare $NET ( ▲ 5.28% )

Disclaimer: https://corporateads.com/disclaimer/, Disclosure listed on the CorporateAds website

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Shein confidentially filed for a Hong Kong IPO to accelerate listing plans and pressure U.K. regulators after its London push stalled over Xinjiang supply chain disputes. Read more

BigBear.ai saw a 260% three-month surge, but declining sentiment and message volume suggest retail enthusiasm may be waning. Read more

GE Vernova rose 2.6% to near record highs after UBS gave it a “Buy” rating with a street-high $614 target, citing AI-driven electricity demand and 70% projected earnings growth. Read more

Hershey appointed Wendy’s CEO Kirk Tanner to lead the company as part of a broader succession strategy amid evolving food market dynamics. Read more

IBM launched its Power11 servers to support AI, hybrid cloud, and critical workloads across banking, healthcare, and retail, with quantum-resistant security and on-chip AI arriving in Q4. Read more

Honeywell is exploring strategic alternatives for its Productivity and Warehouse divisions ahead of a corporate split into three independent companies. Read more

AppLovin received an “Outperform” rating and $430 price target from Scotiabank, which cited strong EBITDA margins and revenue growth but noted retail sentiment remains cautious. Read more

Novo Nordisk submitted an application to the EMA for a 7.2 mg dose of Wegovy after trials showed 21% average weight loss and a well-tolerated safety profile. Read more

Medtronic named Chad Spooner CFO of MiniMed, its new diabetes unit slated for spin-off and IPO, with the move expected to be accretive to earnings. Read more

Robinhood CEO Vlad Tenev defended offering OpenAI and SpaceX tokens, saying equity status is “not entirely relevant” to giving retail investors access. Read more

Dan Ives urged Tesla’s board to anchor Elon Musk’s focus on the EV business with new incentives and political guardrails, calling it “a tipping point” in the company’s story. Musk told him to “Shut up, Dan.” Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS RETAIL RADAR

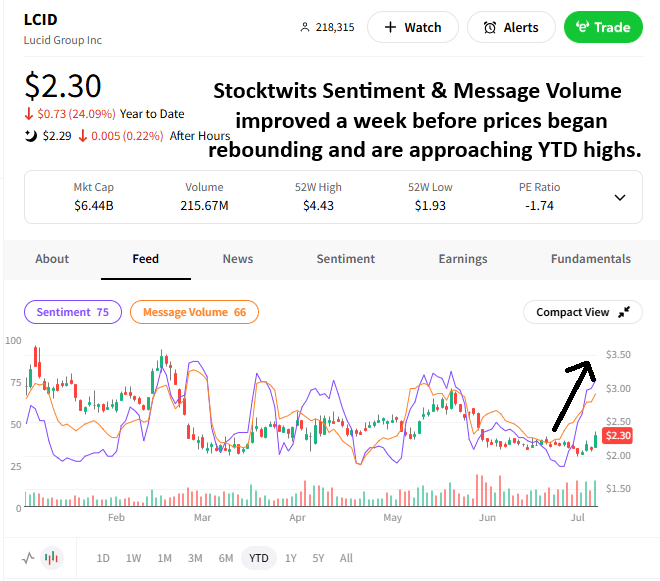

Retail Looks For A Bounce In Lucid Motors ($LCID) 🧐

The electric vehicle maker’s shares recently probed all-time lows, but are making a turn to the upside this week. Stocktwits Sentiment and Message Volume turned positive ahead of this run and now suggests retail is looking for further upside. ⚡

As the chart below shows, Stocktwits Sentiment hit a fresh low in late June before reversing sharply to the upside to start July. Now, both metrics are approaching their YTD highs following the announcement that Lucid’s premium Grand Touring Air drove 1,205 km on a single charge, surpassing the previous world record by 160km. The elevated chatter and sentiment suggest retail is looking for further gains ahead.

From a technical perspective, many traders in the Stocktwits community are using the recent lows near 2.00 as a point of reference, looking for a move toward broken support/resistance and the 200-day moving average at 2.60. 🧭

Although the stock remains in a long-term downtrend, traders on StockTwits are looking to capitalize on this renewed momentum. Any weakness back toward 2.00 is viewed as a buying opportunity, while heavier selling is expected near 2.60.

Add $LCID to your watchlist to monitor this development. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto. 🔓

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in Lucid Motors as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Crude Oil Inventories (10:30 AM), Cushing Crude Oil Inventories (10:30 AM), 10-Year Note Auction (1:00 PM), Atlanta Fed GDPNow (Q2) (1:00 PM), FOMC Meeting Minutes (2:00 PM). 📊

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋