Presented by

CLOSING BELL

Ain't Nothin Spooky In Friday Trade

It was a green end to a long week, markets climbing Friday following Amazon’s industry-leading earnings beat.

🎃🎃🎃🎃🎃HAPPY HALLOWEEN 🎃🎃🎃🎃🎃

It was a big October. All three major indexes closed the month well within the green. The Nasdaq was up 4% for the second consecutive month in a row, and rounding out with fresh Mag 7 tech earnings helped seal the deal.

Amazon was leading tech higher, the market waking up to the reality that it was a major cloud provider as well as a box mover.

In Macro, Dallas Fed President Lorie Logan said a weak jobs market does not mean the Fed should cut rates willy-nilly. arguing that the risk of a slowing job market didn't justify swerving away from the task of corralling inflation.

Speaking at a conference in Dallas Friday morning, Logan said inflation is still nowhere near 2%, so he doesn’t want to cut when employment isn’t even rising all that much. Kansas City Fed Prez Jeff Schmid said if he had his way, we would not have cut rates this week at all! No one tell the old heads investing in the Dow Jones Industrial Average. 👀

Today’s RIP: Amazon, Apple, MSTR trending after reports, Consumer demand and inflation driving up household good prices, and more. 📰

7 of 11 sectors closed green. Discretionary $XLY ( ▲ 1.52% ) Utilities $XLU ( ▲ 1.11% ) lagged.

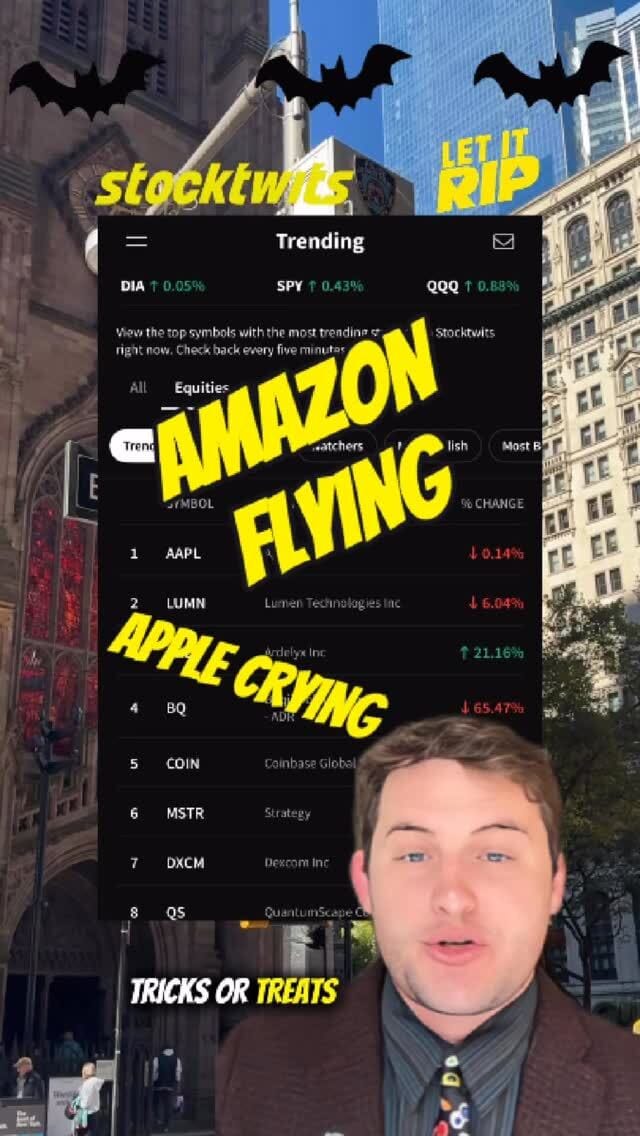

TRENDING STOCKS

Amazon $AMZN ( ▲ 1.6% ) surged Friday, lifting broader markets after delivering blockbuster earnings. It hit a record high close. The company reported $180 billion in quarterly revenue, surpassing expectations and marking a 20% year-over-year increase in AWS datacenter services. It was the fastest growth for the segment in three years.

AWS acceleration says one thing to traders: cloud servers and data centers, which might as well mean AI. Analysts noted that Amazon’s retail margins also improved, driven by logistics efficiencies and Prime engagement. On the earnings call CFO Brian Olsavsky emphasized Cap EX investment in generative AI, and automated package fulfillment, highlighting “record-breaking operational throughput” across North America.

Apple $AAPL ( ▲ 2.24% ) edged lower after reporting $102 billion in Q4 revenue. While overall topline growth remained strong, iPhone sales missed expectations, and China revenue declined by $2 billion. The shortfall was attributed to competitive pressures and macro headwinds in the region.

MicroStrategy $MSTR ( ▲ 0.73% ) rallied after posting a surprise $2.8 billion profit, reversing a trend of consistent quarterly losses. The company, known for its aggressive Bitcoin accumulation strategy, benefited from crypto market strength and strategic asset revaluation. Executives reiterated their bullish stance, forecasting Bitcoin to reach $150,000 by year-end.

First Solar $FSLR ( ▲ 0.44% ) climbed 13% despite issuing a lowered forward outlook. The company nearly doubled its profit compared to last year, driven by strong module shipments and favorable pricing. Thursday’s earnings call revealed cautious optimism, with management citing temporary delays in the timelines of utility-scale projects. However, the stock rallied after analysts issued nine buy ratings, citing long-term tailwinds from IRA incentives and global decarbonization mandates.

SPONSORED

Meet the ChatGPT of Marketing – Still Just $0.81

RAD Intel is tackling a timeless, trillion-dollar problem — helping companies find and influence the right customers. Their AI platform reads real-time culture across TikTok, Reddit, and other hard-to-see corners of the open web, surfacing precise audience segments and the creative angles that drive up to 3.5X ROI.

The tech is fast, battle-tested with F-1000 brands, and backed by Adobe, Fidelity Ventures, and insiders from Meta, Google, YouTube, and Amazon.

Already trusted by the who’s-who of Fortune 1000 brands and leading global agencies.

Momentum is clear — valuation is up 4,900% in four years, recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI. Shares are now available privately at $0.81 in the Reg A+ round.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

SCARY DROPS

Weak Consumer Demand Hits Household Goods Maker 🖊

(Photo by Jaque Silva/NurPhoto via Getty Images)

Newell Brands $NWL ( ▼ 0.65% ) dropped after cutting its full-year EPS forecast to $0.56–$0.60 and warning of deeper macro pressures. Q3 sales fell 7%, missing expectations, with revenue at $1.81B vs. $1.89B estimates. Operating cash flow was lowered to $250M–$300M, and tariff costs rose to $180M. CEO Chris Peterson cited weak retailer inventory, Brazil slowdown, and rising costs as key headwinds.

The stock was one of the lowest falling names above a $1B market cap in the entire world, after gross margins were hit hard by tariffs and inflation. No one wants to buy Coleman grills, Sharpie markers, or Rubbermaid, for that matter, when prices on coffee are climbing, apparently. CEO Chris Peterson said he expects a $180M hit from tariffs this year, up from its previous estimate of $155 million, made just two months ago.

“These trade disruptions have affected short-term consumer and retailer behavior,” Peterson said during a post-earnings call. “We sold incremental distribution and promotions in tariff-advantaged categories, and we took pricing actions where necessary to offset the tariff costs.”

It’s not just pens and Papermate: this year, chocolate prices for trick-or-treating have crept higher, up 20% from last year and 78% in five years, according to Circana and the BLS. 🍫

PARTNER MESSAGE

7 Mistakes People Make When Choosing a Financial Advisor

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

U.S. oil production hit record 13.8M barrels/day in August.

Apple seen entering next growth phase via AI.

Coinbase CEO says firm is becoming AWS for crypto.

Trump offered tariff cuts if China curbs fentanyl exports.

Cabaletta Bio surged 45% on bullish Cantor forecast.

Roku rose 7% after strong earnings and outlook.

FDA to ease review for gene therapies.

Bitcoin faces pullback warning amid trend reversal.

Nvidia CEO hopes to resume Blackwell chip sales to China.

Cloudflare rose 13% after upbeat guidance and earnings.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO Preview

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍