CLOSING BELL

All's Well That Ends ATH

The market climbed gleefully on Thursday, just one point away from all-time highs on the S&P 500. AI led the way as Nvidia continued to print records, closing at yet another all-time high.

The political news world talked about the big beautiful bill, working its way through the Senate before a White House-imposed July 4th deadline. GDP growth data came in low for the first quarter in the third and final estimate, showing the U.S. economy contracted 0.5% in the first three months of the year. 👀

Today's issue covers earnings you missed, BigBear’s big moves, the search for a new Powell, and more. 📰

With the final numbers for indexes and the ETFs that track them, 9 of 11 sectors closed green, with energy $XLE ( ▼ 0.09% ) leading and real estate $XLRE ( ▲ 0.28% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,141

Nasdaq 100 $QQQ ( ▲ 1.07% ) 22,447

Russell 2000 $IWM ( ▲ 1.09% ) 2,172

Dow Jones $DIA ( ▲ 0.78% ) 43,386

EARNINGS

Earnings You May Have Missed 📈

It’s a couple of weeks from the start of the next earnings season, but the late bloomers are still posting results. Here’s what you may have missed:

$NKE ( ▲ 1.59% ) the shoe-making giant reported better-than-terrible Q4 results that beat estimates, but the firm said its sales took a 12% drop in the quarter. Profit fell 86%, but Nike said its decline to turn around. Nike already said as much in Q3, that its end of year would see the worst of trade troubles, but conditions have worsened since.

Walgreens climbed slightly $WBA ( ▲ 0.5% ) after the pharmacy chain showed better-than-expected adjusted sales results for its fiscal third quarter. It might be the last earnings results before the firm goes private, after finalizing a $10B deal with Sycamore Partners in March.

$MKC ( ▲ 0.68% ) McCormick, a massive spice maker, climbed for a 52-week record day after reporting better-than-expected Q2 EPS and sales results.

COMPANY NEWS

BigBear Is Making Big Moves This Week 🐻❄

On the $IWM ( ▲ 1.09% ), one stock has stood out all week. Bigbear AI $BBAI ( ▲ 5.12% ) climbed 20% Thursday, after a four-session run that sent the defense and intelligence ‘decision dominance’ firm over $1T in market cap this week.

Tuesday, the firm announced a partnership to deploy its biometric ID software across major U.S. international airports like JFK, LAX, and Chicago O’Hare, alongside two separate DoD contract wins this year.

Benzinga writers pointed out the firm responds to good news with volatility because 22% of the firm’s float is shorted, or about 65 million shares. It’s not always a good thing to receive revenue from the government, as the Motley Fool reported 40% of the firm’s revenue is tied to government contracts in an age of spending cuts.

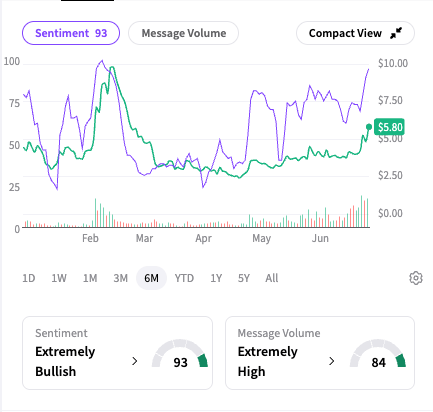

Stocktwits users are ‘extremely bullish’ on BBAI

SPONSORED

StartEngine: Riding Tech IPO Tailwinds Into Today’s Deadline

You may have seen the headlines: the tech IPO market is finally showing signs of life.

Chime just went public, following strong IPOs from Circle and eToro.¹

And that could be great news, not just for Wall Street, but for investors like you.

Why? StartEngine.

This alternative investing platform doesn't just offer exposure to pre-IPO companies like OpenAI, Perplexity, and Databricks.² StartEngine (and its investors) can potentially benefit when these companies succeed, thanks to 20% carried interest in some of the platform's pre-IPO offerings.³

Investors are paying attention. In a quieter market, StartEngine pulled off $30M in revenue in Q1 2025, its biggest quarter ever (based on unaudited financials).⁴

Now StartEngine is preparing to close its current fundraise this week. If you want to tap into pre-IPO value while supporting the future of fintech, join more than 5K+ investors who have already committed $14.2M in this round.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

… EXCEPT DEATH AND RATES

The Hunt For A Powell Replacement Starts Early 🧓

As FOMC Chair Jerome Powell’s Trump-appointed tenure comes to an end in May 2026, the new White House administration has made it clear they may field a successor before the term is up, in what some have called an attempt to speed up interest rate decisions.

The concept is known as a “shadow chair” to make decisions that the market will price in ahead of the actual decision, though not everyone believes it would work: Chicago Fed President Austan Goolsbee told CNBC that a shadow chair would not help speed up rate changes.

Still, even the mention of new members has moved futures markets, and Fed Speak about the next rate cut.

Two Fed members, Governor Bowman and Governor Waller, said in the past seven days that they would consider a rate cut in July. Markets are now pricing in a one-in-five chance of a rate cut next month, according to CME.

"Media reports that Trump is considering an early appointment for the next Fed chairman are further bolstering dovish bets," ING strategist Francesco Pesole told CNBC.

CME FedWatch tool

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → https://event.tixologi.com/event/5863

#Stocktoberfest25

POPS & DROPS

Top Stocktwits News Stories 🗞

Micron stock is on track to hit a one-year high after a Q3 earnings beat and bullish guidance sparked a wave of price target hikes from Wall Street analysts. Read more

JetBlue’s second-largest investor, Vladimir Galkin, may sell his $212 million stake if the airline’s turnaround plan fails, citing deep financial struggles and poor performance. Read more

Google and Pearson announced a multi-year partnership to embed AI into education, using tools like Gemini and LearnLM to personalize learning and equip teachers with real-time insights. Read more

Salesforce CEO Marc Benioff said AI now handles 30% to 50% of the company’s workload, including software development and customer support, as part of a broader shift toward automation. Read more

Rocket Lab stock soared to a record high after securing its first-ever contract with the European Space Agency to launch low-Earth orbit navigation satellites. Read more

Fed official Thomas Barkin warned that Trump’s tariffs are likely to push inflation higher in the coming months, though not to pandemic-era levels, as businesses pass on rising import costs. Read more

Tesla senior executive Omead Afshar, a close confidant of Elon Musk, has left the company amid plunging EV sales and growing concerns over its robotaxi rollout. Read more

Core Scientific stock surged over 30% to a six-month high after reports that CoreWeave is reviving acquisition talks, potentially finalizing a deal in the coming weeks. Read more.

The Trump Organization quietly removed “Made in the USA” claims from its T1 phone marketing, replacing them with vague phrases like “American-Proud Design” as questions swirl over the device’s true origin. Read more

Meta is reportedly in advanced talks to acquire voice AI startup PlayAI, aiming to boost its AI capabilities and integrate natural-sounding voice tech into future products. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: FOMC Member Williams Speaks (7:30 AM), PCE Price Index (8:30 AM), Michigan Expectations (Jun) (10:00 AM), Atlanta Fed GDPNow (Q2) (11:30 AM), Fed Bank Stress Test Results (4:30 PM). 📊

Pre-Market Earnings: Apogee Enterprises ($APOG). 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

StartEngine Disclaimer: This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. No broker-dealer or intermediary involved in offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information, please see the most recent Offering Circular and Supplements and Risks related to this offering. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion. 1. Source: Ron Shevlin, “The Chime IPO May Kickstart A Fintech Investment Comeback,” Forbes, June 14, 2025 2. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. 3. StartEngine receives 1% equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that the company will be profitable. 4. Based on our Q1 2025 Form 10-Q/A. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $24.6 million of the $30 million in revenue from Q1 2025. To understand the impact on margins, see financials.

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋