Presented by

CLOSING BELL

All’s Well That Ends Well

The market climbed to end the week, all but the Russell 2000 in the green after financials calmed down following scary loan losses, and tariff talk simmered. Bitcoin slid towards $100k, an estimated $600B erased from crypto market values since last week’s crash, according to CoinGecko.

Gold and Silver tumbled from highs, and two-year yields crept from their lowest rates since 2022. According to analysis by Bloomberg and Goldman Sachs of state data, weekly jobless claims fell. The Fed is still closed, and they haven’t dropped their full data since Sept 25.

Amex hit a record high, climbing the most since April after nearly $3B in profit for the past quarter, $18.43B in revenue, and an expected 10% growth in revenue for the rest of the year, all above expectations. Next week is the start of big tech earnings, with Tesla and Netflix on the way. 👀

Today’s RIP: Oracle falls despite lofty revenue goals, Quantum computing sector sells off, and more. 📰

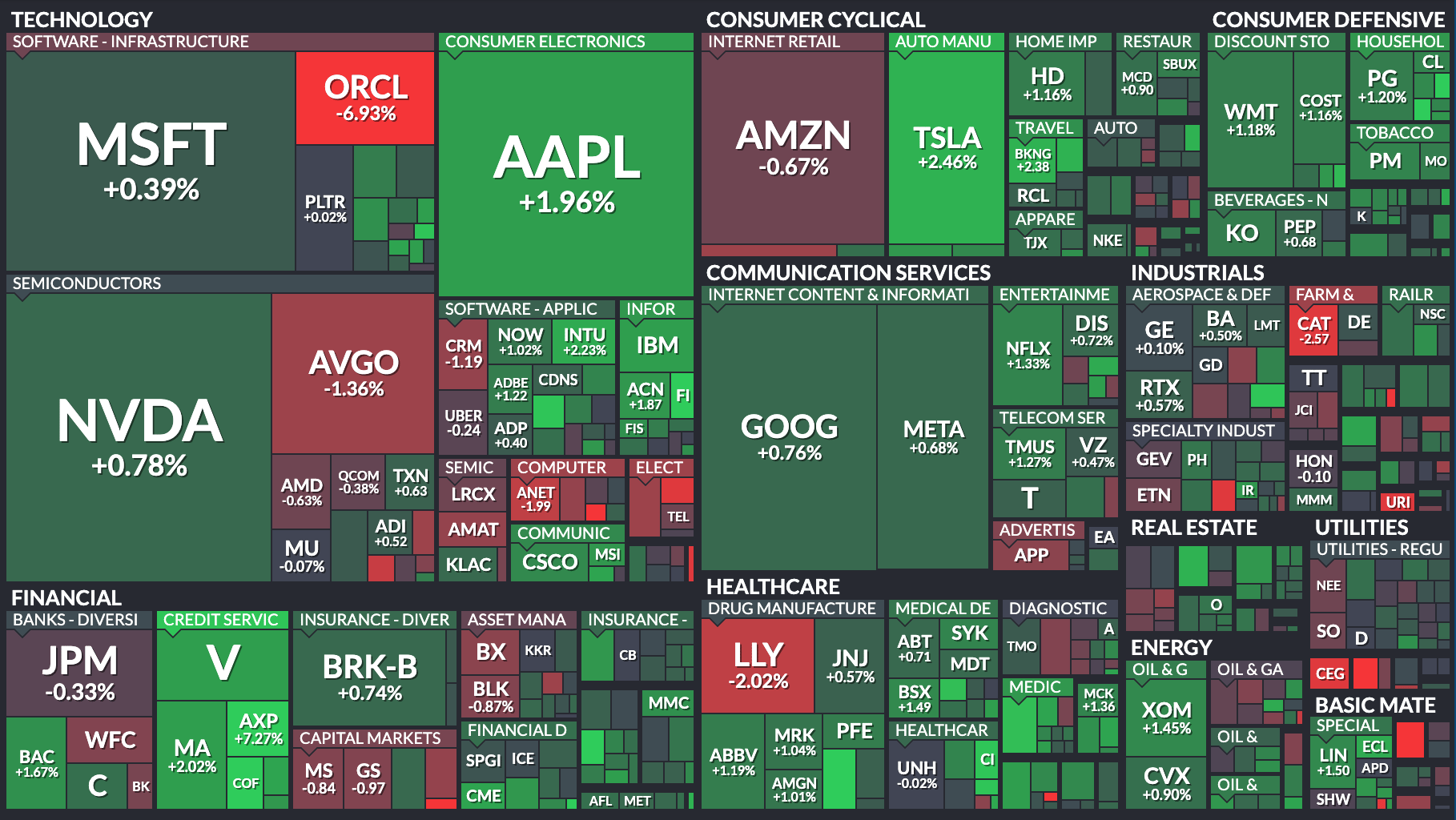

9 of 11 sectors closed green, with staples $XLP ( ▲ 0.87% ) leading and utilities $XLU ( ▲ 1.11% ) lagging.

STOCKS

Oracle Falls Despite Bullish Price Targets

The question in everyone’s mind watching Oracle $ORCL ( ▲ 3.42% ) fall Friday, is can they actually pull in $225B in revenue in 2030? Can they really expect to grow cloud infrastructure from $18B a year to a whopping $166B a year?

The company presented this lofty projection as a part of the Oracle AI World conference it put on in Las Vegas this week. Thursday, the numbers look great, next to the slot machines and craps tables, but Friday analysts started putting out notes that were positive, but that $225B a year might be a tall order. 🎰

″It feels like the stock may take a bit of a breather here as investors digest those numbers and try to get comfort around the achievability of long-term numbers,” Rishi Jaluria, Analyst at RBC Capital Markets said in a note to CNBC.

UBS Anlysts karl Keirstead raised his price target to $380 on the stock, but said in a bear scenario, the company might have trouble turning on that large of a datacenter project, and getting it running at the 30-40%+ margins it projects. Earlier this month, The Information reported Oracle was only pulling in 14% margins from its Nvidia AI chips in its quarter that ended in August.

Still, Oracle has made its fair share of deals to get the ball rolling. It pulled in a $300B estimated AI chip deal with OpenAI, and said Thursday it inked a deal for $65B in cloud infrastructure with a group of companies including Meta.

"Questions remain about Oracle's capex requirements to meet growing demand, as there was no forward-looking commentary on capex at the analyst day," Jefferies analyst Brent Thill wrote Thursday.

SPONSORED

Let this AI do the Heavy Lifting - At $0.81

RAD Intel powers a who’s-who roster of Fortune 1000 clients and agency partners leveraging our award-winning AI across brands like F1, Porsche, L’Oréal, Sephora, the World Cup, Nissan, and more.

10,000+ investors already in. $50M+ raised. Valuation up 4,900% in four years*. Nasdaq ticker RADI reserved. Backed by Adobe and insiders from Google, Meta, and Amazon.

The software pinpoints high-intent audiences and predicts what will convert — smarter and faster for the next era of AI.

Up 4900%. 2X contract growth is 2025. Shares are still just $0.81 and it’s still early. If you believe AI will set the pace, own the layer brands already rely on.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Quantum Stocks Sell Off After Breaking Records 🧬

Quantum stocks pulled back big time this week, and it was not due to a major news event.

$RGTI ( ▲ 2.87% ) Rigetti Computing, $IONQ ( ▲ 2.73% ) and $QUBT ( ▲ 2.92% ) all fell more than 15% since Thursday, shortly after each hit all-time highs. Quantum computing has been a fan favorite in the Stocktwits community, Rigetti flying from a low of $0.36 a share in 2023 to a fresh high near $60 this week. The underlying companies are trying to make the next generation of computers, with tech so advanced it’s hard to tell fact from speculation.

News events in the quantum space, outside of funding rounds or earnings reports, have been slim ever since Google made waves with its prototype Willow chip last year.

Slimmer still are the company earnings reports- no one makes money in the quantum space. D-Wave burned $35B in cash in six months this year, Rigetti spent $13.5B on R&D and only made $1.8m back, and IonQ spent billions on acquisitions this year. Most recently, IonQ bought Oxford Ionics for $1.08B.

That doesn’t mean one day, we all won’t be using quantum chips to consume the latest edition of the Daily RIP. It simply means, without profit, the only thing to watch for is price action and product announcements.

And what did quantum stockholders do this week when breaking records? Sell. Rigetti CEO turned one million shares into cash this week: Chief Subodh Kulkarni is out of the stock entirely, according to Benzinga. IonQ put up 10% of its shares for sale, and D-Wave insider holders sold more than $5M in shares in the past five days, according to SEC filings.

Can you blame anyone for taking profits? Of course not, where would be the sport in that? 😎

Importantly, this selling is just a minuscule fraction of trade on these stocks; the lowest volume name saw 30M of shares change hands Friday alone. It’s more of an optics thing than a major cause to sell.

The industry also isn’t selling off completely. Part of IonQ’s share sale was underwritten by JPMorgan, a firm that said it was committed to supporting $1.5T of investments in new tech over the next decade. 💰

POPS & DROPS

Top Stocktwits News Stories 🗞

Trump warned he may accelerate 100% China tariff hike before Nov.

Nukkleus fell 19% after announcing majority stake in new SPAC.

Artiva Biotherapeutics rose 120% after Wedbush hiked its price target.

Hims & Hers Health fell 14% Trump said he would cut GLP1 prices.

Micron Technology exited China server chip market after failing to recover.

American Express rose 7% after beating earnings estimates.

AST SpaceMobile fell 7% after Barclays issued a double downgrade.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

WEEKEND RIP WITH BEN & EMIL: QUANTUMANIA

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋