Presented by

CLOSING BELL

Amazon's Hosting Hits A Firewall

The market climbed Monday, on the back of an Apple all-time high after results from iPhone 17 sales in China looked good.

Speaking of China, trade talks further de-escalated. Treasury Secretary Scott Bessent said meetings with China were continuing this week in Malaysia.

The government shutdown is still going after the 11th and most recent vote failed, with BLS CPI inflation numbers finally expected Friday the 24th after a delay in data from last week’s scheduled post.

Amazon’s AWS service went down Monday morning, pulling with it major company networks like United, social media like Reddit, but also retail trading infrastructure like Robinhood, Coinbase, and crypto projects. 👀

Today’s RIP: Apple rips on Chinese demand, AWS was down, and stocks were up, and more. 📰

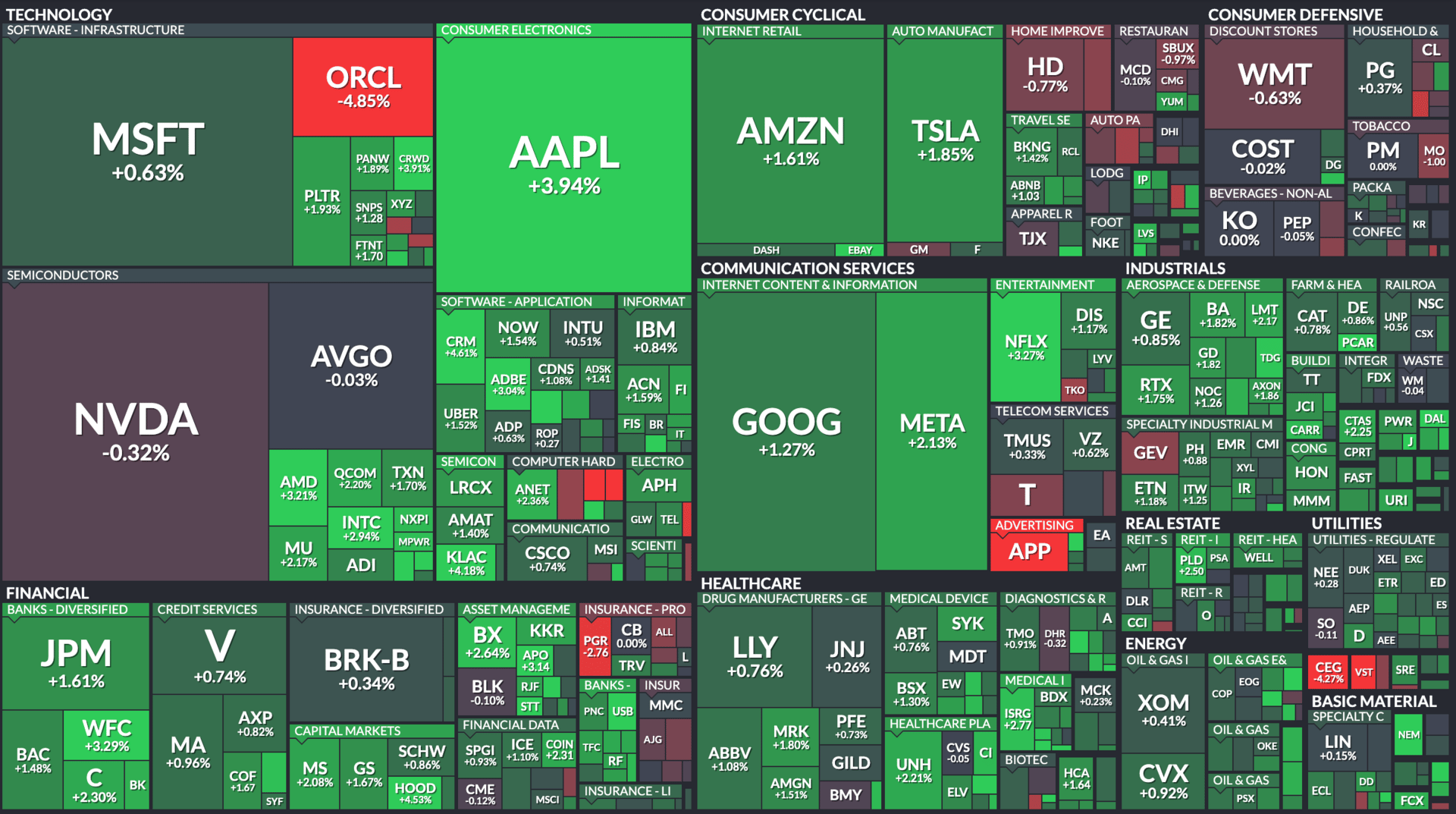

9 of 11 sectors closed green, with materials $XLB ( ▲ 0.76% ) leading and staples $XLP ( ▲ 0.87% ) lagging.

STOCKS

iPhone 17 Selling For iPhone 16 Prices Boosts Apple In China 📱

iPhone sales were doing great, outselling the iPhone 16 by 14% in the first 10 days it launched, according to market research firm Counterpoint. The research report was enoughto send $AAPL ( ▲ 2.24% ) climbing, the highest reaching Mag 7 name.

The stock hit its first new record for 2025. Loop Capital Markets raised the stock, and Analyst Amanda Baruah said it’s finally a sign that demand for the new batch of phones is climbing. Last year, investors were disappointed after a distinct lack of sales bump following the iPhone 16 drop.

Their sales data showed customers were eating up the ‘more for the same’ pricing structure of the new “Base” iPhone 17 model. Customers see the new chip and camera at the same price as last year’s phone, according to Senior Analyst Mengmeng Zhang at Counterpoint.

SPONSORED

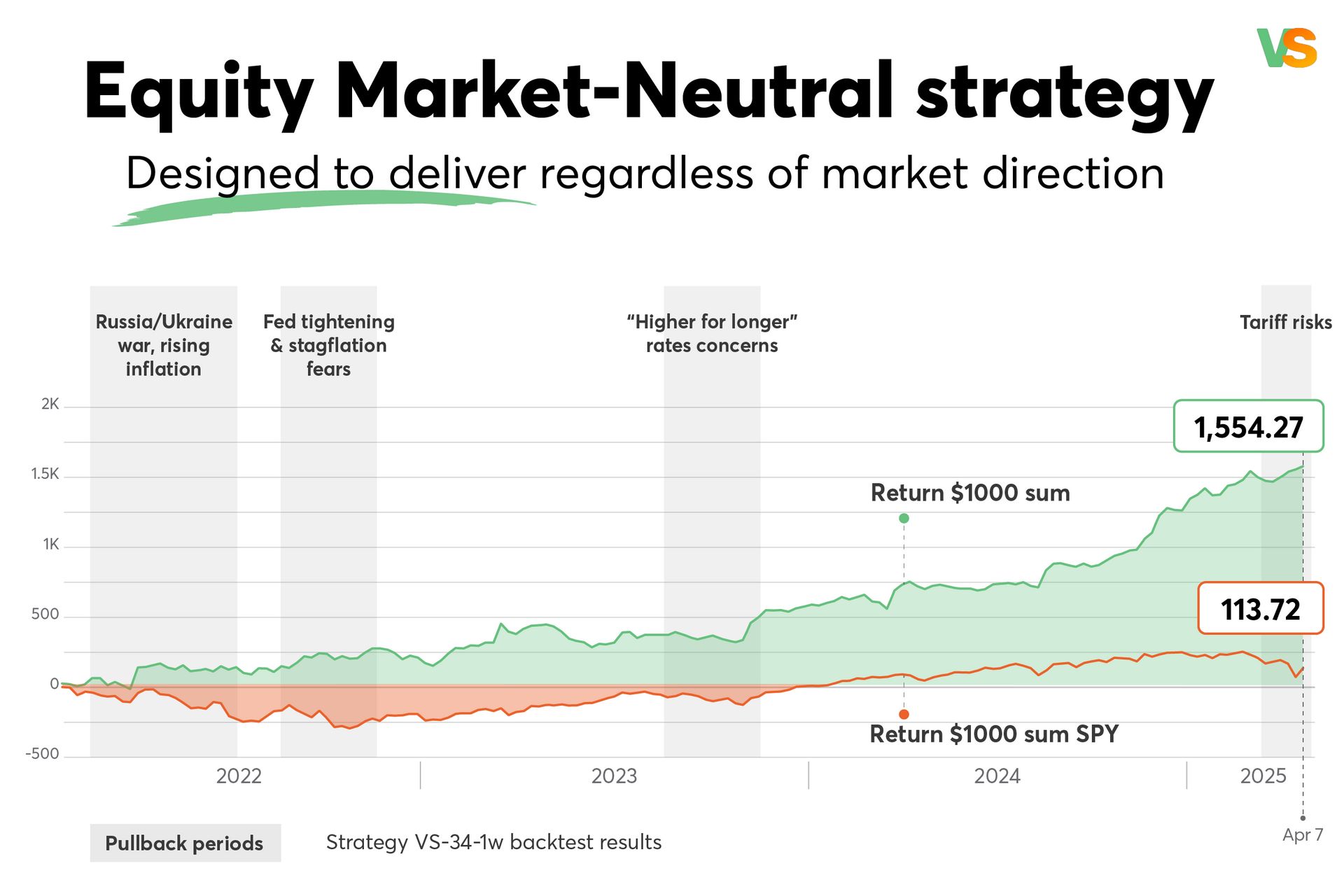

Major hedge funds are pushing Market-Neutral strategies. Why?

Blackrock highlighted 3 major risks of today’s market:

- increased volatility compared to 2010-2019

- stocks and bonds now move in the same direction

- Mag 7 dominate market direction and risk

Market-Neutral strategies are one of the few ways to reach true diversification

Why does it work? Buy strength, short weakness, balance exposures.

The payoff for traders? Smoother equity curves, smaller drawdowns, and decisions grounded in rules—not headlines. It’s a way to keep compounding when the index whipsaws.

We engineered a top-performing, backtested version of this approach—stress-tested across regimes and built to run in under an hour a week. In our research we evaluated 758 thousand variations to lock in a robust, rules-based playbook.

Want to know how to trade staying Market-Neutral?

Past performances don't guarantee future results. Visual Sectors provides data and backtest results, not financial advice or money management.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

The Great AWS Is Down Again-ing-ing

You can find anything from A to Z on Amazon, and there’s a good chance that anything else you're looking for you can’t find on Amazon is also hosted on Amazon… Web Services.

That’s great when you're Jeff Bezos and own 8% of a $2.31T company, but not great when your site goes down. Monday, sites from A to Z went down after a mis-engineered update went live at 3 am ET. Facebook, McDonald’s, Roblox, Reddit, and even financial services like Venmo, Fidelity, Robinhood, and Coinbase had trouble loading, especially on the East Coast. Even Stocktwits was feeling the pain, with rolling blackouts, including when our lowly newsletter writer was typing this. 😢

Stocktwits users lit up overnight, facing trades that would not go through on and unresolved webpages. In the face of this calamity, the stocks mentioned all seemed to cllimb. $HOOD ( ▲ 2.24% ) $COIN ( ▲ 1.12% ) and even $AMZN ( ▲ 1.6% ) were up to end the day, despite retail investor fears.

As Cryptotwtis’ Jonathan Moragan can write better than I, crypto is as decentralized as Russia’s economy is. 😆

According to Cryptoslate, AWS outages affect nearly 40% of the Eth ecosystem. For a promised goal of 'decentralization, it is a jarring reality that much of the crypto world still runs on ‘legacy’ hardware, as crypto natives call “Web 2” tech, or as the rest of the world calls the normal internet.

Just like normal companies, crypto startups find it easier to pay for hosting space on the world’s largest provider than to run nodes in-house. 🤷

POPS & DROPS

Top Stocktwits News Stories 🗞

Zions Bancorp climbed as retail traders speculated on credit risk reversal.

Evernorth announced Nasdaq debut to build $1B XRP treasury.

Solana joined Gemini’s crypto credit card lineup.

Adobe rose after launching its new AI Foundry platform.

SEALSQ falls after unveiling its first chip with built-in post-quantum encryption.

10x Genomics partnered with Anthropic to bring Claude AI tools to researchers.

Celcuity surged 35% after completing Phase 3 breast cancer trial enrollment.

GRAIL climbed 17% after announcing $325M private placement to fund expansion.

Replimune surged 98% after FDA accepted RP1 resubmission for melanoma treatment.

Trump signed critical minerals deal with Australia to boost U.S. supply chain security.

Goldman Sachs said the bar for rate cuts will rise after October inflation data.

No links today, as the news site is down, but check in when Amazon figures out its issues and comes back online.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

EARNINGS

Cleaveland Cliffs Climbs After Report, Zions Climbs After Hours, Netflix On The Way

Even with a third of the internet down, prices jumped on earnings reactions. This week is the beginning of the major tech reports, with Netflix expected on Tuesday, Tesla on Wednesday, and Intel on Thursday.

Cleveland-Cliffs climbed $CLF ( ▼ 1.76% ) Monday, after the steel company announced a major shift into rare-earth development.

"Beyond steelmaking, the renewed importance of rare earths has driven us to re-focus on this potential opportunity at our upstream mining assets," Chief Lourenco Goncalves said.

$ZION ( ▼ 0.17% ) Zions Bancorp was up after the bell. The recently in trouble regional bank beat estimates for earnings per share of $1.48, and quarterly revenue rose 8.7%. The bank formally recognized a $50m charge off from two corporate loans, and fronting $10M in cash, but said it was beginning a lengthy legal process to make up for losses. The stock recovered after credit losses looked more manageable, after losing $1B in market cap last week.

What to Watch:

Netflix $NFLX ( ▲ 2.66% ) reports Q3 earnings after Tuesday’s close, with analysts expecting $6.97 EPS on strong ad-tier growth, new content, and price hikes. With subscriber counts no longer disclosed, investor focus will be on revenue momentum, operating margins, and the scalability of its monetization strategy.

Tesla $TSLA ( ▲ 2.39% ) reports Q3 earnings Wednesday after the close, with analysts expecting EPS around $0.55, down 24% year-over-year but likely to beat on recent record deliveries and energy deployments. Revenue is expected to rise 4.3% to $26.33B, according to Investors’ Business Daily.

Intel $INTC ( ▲ 5.71% ) reports Q3 earnings on October 23, with analysts expecting break-even EPS of $0.01 and revenue near $13.11B. Forecast downgrades and cautious “Hold” ratings reflect concerns over margin pressure and muted growth outlooks for 2025 and 2026.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Waller Speaks (9:00 AM), API Weekly Crude Oil Stock (4:30 PM) 📊

Pre-Market Earnings: JPMorgan Chase ($JPM), Wells Fargo ($WFC), Johnson & Johnson ($JNJ), Citigroup ($C), Goldman Sachs Gr ($GS), BlackRock ($BLK), Domino’s Pizza ($DPZ). 🛏️

After-Market Earnings: Netflix ($NFLX), Intuitive Surgical ($ISRG), and Texas Instruments ($TXN). 🌕

Links That Don’t Suck 🌐

📈 Uncover the next big winners early with the MarketSurge Blue Dot––try 6 weeks now for only $49.95*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋