Presented by WealthyVC

CLOSING BELL

Apple Falls Announcing Nothing New

When Apple says IOS 19 is now IOS 26

The market climbed for the second session in a row, though the only major news this weekend covered national guard action in LA, and twitter back and forths that were decidedly not stock market related.

The S&P 500 closed over 6k again, on its way toward retaking highs set in February, if Civil War II doesn’t break out. 👀

Today's issue covers Apple Has Another Chance To Wow With AI, Robinhood Did NOT Make It This Time, and more. 📰

With the final numbers for indexes and the ETFs that track them, 4 of 11 sectors closed green, with consumer discretionary $XLY ( ▲ 0.22% ) leading and utilities $XLU ( ▲ 0.38% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,005

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,798

Russell 2000 $IWM ( ▲ 0.56% ) 2,144

Dow Jones $DIA ( ▲ 0.58% ) 42,761

STOCKS

Apple Has Another Chance To Wow With AI 🤖

A year ago, Apple said, “How do you do, fellow tech companies,” when it announced Apple Intelligence at its summer tech conference. Since then, the only thing Apple Intelligence seems to do is turn text notifications into… text notifications.

The tech giant has a fresh chance to win over investors this week at their WWDC25 conference, which started today. Apple needs a win recently, having spent untold amounts of money moving production around while Tim Cook tries to get President Trump to stop bullying his smartphone firm with tariffs.

Monday, Apple announced a new digital design that makes apps transparent, a new IOS naming convention, updates to its expensive VR system, Apple TV, and music updates, and a ChatGPT partnered image generation app.

Apple’s "liquid glass“ looks great and all… but it’s not AI, right?

It’s only been a day, but the changes and products seem marginally interesting at best, and decorative at worst. The stock fell Monday, and sentiment climbed, as investors ask the obvious: Where is the smart Siri AI assistant?

Stocktwits Sentiment showed investors are peaking interest at Apple’s tech week, but not buying just yet.

Presented by WealthyVC

This $0.20 Gold Stock Is Building a Mine Now & Hardly Anyone’s Watching

Central banks are buying gold at the fastest pace in over 50 years. Global debt is spiralling out of control. Investors are ditching U.S. bonds and piling into gold— not just for safety, but for serious upside. Now the smart money is rotating into gold equities. And one little-known company has quietly landed at the center of it all.

$30B mining giant Barrick bought 5.5 million shares— and is snapping up all the land around its bonanza-grade discovery. Why? Because this isn’t just another explorer.

It’s fully permitted, has construction financing commitments, and is just months from construction. It sits beside a 13.5 million Oz gold mine owned by one of the world’s biggest producers.

Insiders hold most of the shares. No cheap paper. No bloated float. Key upcoming catalysts could drive a meaningful re-rating of the share price.

The market hasn’t caught on… But it will. This isn’t a trade. It’s a setup.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Robinhood Did NOT Make It This Time 🐂

Robinhood shares fell $HOOD ( ▲ 5.9% ) after the firm failed to secure a spot in the S&P 500 during the latest quarterly rebalancing, despite speculation that it was a top candidate for inclusion.

Friday, investors watched and flooded the S&P Global site to watch for the stocks edition, among other top contenders. The site was overwhelmed and crashed for a couple of hours.

Even without the edition, retail is ‘extremely bullish on Robinhood.

In the end, the firm announced no new editions in the June rebalance. Investors were also betting on the inclusion of Applovin, Interactive Brokers, and Carvana.

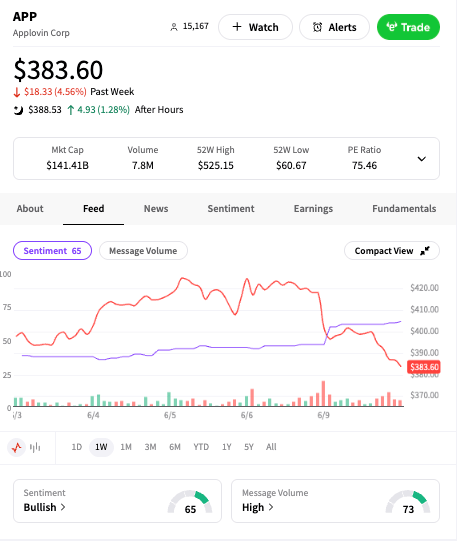

$APP ( ▲ 7.89% ) was the hardest hit of the suspected additions, falling throughout the day.

Investor sentiment on Stocktwits rose after the listing fell through

POPS & DROPS

Top Stocktwits News Stories 🗞

Apple unveiled iOS 26, featuring a Liquid Glass redesign that introduces translucent interface elements, dynamic wallpapers, and enhanced customization options. Read more

Waymo suspended its downtown Los Angeles service after five of its self-driving cars were set on fire during anti-ICE protests, with demonstrators also vandalizing businesses in the area. Read more

Warner Bros. Discovery will split into two publicly traded companies by mid-2026, separating its streaming and studios division, including Warner Bros., DC Studios, and HBO Max, from its global networks unit, which will house CNN, TNT Sports, and Discovery. Read more

VinFast reported a Q1 net loss of $712.4 million, widening 20% year-over-year, despite a 150% revenue jump to $656.5 million and EV deliveries surging 296%. Read more

Amazon is investing $20 billion in Pennsylvania to expand AI and cloud infrastructure, creating 1,250 high-skilled jobs and supporting thousands more in the data center supply chain. Read more

OpenAI has reached $10 billion in annual recurring revenue, doubling from last year, as demand for ChatGPT and its enterprise AI solutions continues to surge. Read more

Pfizer CEO Albert Bourla stated that the company made no commitments on drug pricing during meetings with the Trump administration, despite discussions on most-favored-nation pricing. Read more

Microsoft is entering handheld gaming with the ROG Xbox Ally, developed with ASUS, featuring a full-screen Xbox experience, cloud gaming support, and an optimized Windows 11 interface. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: EIA Short-Term Energy Outlook (12:00 PM), 3-Year Note Auction (1:00 PM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: Academy Sports ($ASO), United Natural Foods ($UNFI), Designer Brands ($DBI), and JM Smucker ($SJM).🛏️

After-Hour Earnings: GameStop ($GME), Dave & Buster’s ($PLAY), Stitch Fix ($SFIX), GitLab ($GTLB), PetMed Express ($PETS), MIND Technology ($MIND).🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋