CLOSING BELL

Au Contraire

The market climbed Monday to start the week. After two Powerball Jackpot tickets were sold over the weekend, traders are awaiting for a potential jackpot for the housing market: Inflation data this week that might signal upwards of a 50 basis point cut next week.

The market is also filled with contradictions. JPMorgan traders told Bloomberg a rate cut might be a sell-the-news event, after 20 S&P 500 all-time highs and a 30% climb since April lows.

September tends to bring a slowdown anyway, stemming from pension and mutual fund rebalancing, while retail buying and corporate buybacks freeze as the weather goes cold on Wall Street. 🍂

The Trump Admin keeps things interesting with contradictions. The White House loves American first manufacturing, but last week’s raids on a Georgia Hyundai battery make it look like the shop’s closed to investment. LG Energy is pausing its own facility build while the dust settles. In an on-the-nose development, Trump was a Rolex guest of honor in his hometown Queens Sunday, but Trump just set a 39% on the very same expensive Swiss imports. 👀

Today’s rip: SpaceX buys spectrum for satellite cellular, Hood and APP fly and IPO’s on the way, Apple’s new light iPhone, and more. 📰

6 of 11 sectors closed green, with tech $XLE ( ▼ 0.42% ) leading and utilities $XLU ( ▲ 0.34% ) lagging.

STOCKS

SpaceX Phone Service? Musk-Backed Company Buying Wireless Spectrum

EchoStar $SATS ( ▲ 0.22% ) flew into the stratosphere Monday after news that SpaceX is buying AWS-4 and H-block wireless spectrum licenses for $17B.

The half cash, half stock deal comes after a $23B spectrum purchase from AT&T, and gets EchoStar out of questioning from the FCC.

The FCC in the spring said SATS was not using the full extent of the network it owns, after winning the spectrum in an offshoot of the T-Mobile Sprint merger, according to Bloomberg.

EchoStar is using the cash to pay down its impressive $25B debt pile, and SpaceX is looking forward to using the spectrum toward a direct-to-cell Starlink internet model, according to Hamid Akhavan, EchoStar's Chief. Apparently, if you want to beam internet from space to someone’s phone to watch college football, you need to work with a company on the ground that owns the license to that spectrum of electromagnetic energy. ☀

Boost Mobile uses EchoStar’s 5G platform and will let users access SpaceX Starlink through the partnership, according to Stocktwits news.

AST SpaceMobile $ASTS ( ▼ 4.03% ) fell, a competitor in the broadband service space. It wasn’t the only broadcast spectrum news Monday, Sirius XM $SIRI ( ▼ 0.24% ) fell briefly after an on-air gag that Andy Cohen would replace Howard Stern.

SPONSORED

POET powers AI connectivity with cutting-edge optical engines and modules.

With industry validation from customers such as Mitsubishi Electric, Foxconn, Luxshare and NTT, POET has entered a phase of rapid commercialization.

In 2025, it opened a state-of-the-art manufacturing facility that prepares it for the expected growth in demand from current and future customers. POET's Optical Interposer-based products are lower cost, consume less power than comparable products, are smaller in size and readily scalable to high production volumes.

In addition to providing high-speed (800G, 1.6T and above) optical engines and optical modules for AI clusters and hyperscale data centers, POET has designed and produced novel light source products for chip-to-chip communication within and between AI servers, the next frontier for solving bandwidth and latency problems in AI systems.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

LISTING NEWS

HOOD and APP Fly On S&P 500 Adds On IPO Week

Applovin $APP ( ▲ 7.23% ) and Robinhood $HOOD ( ▲ 5.64% ) were flying after their Friday addition to the S&P 500.

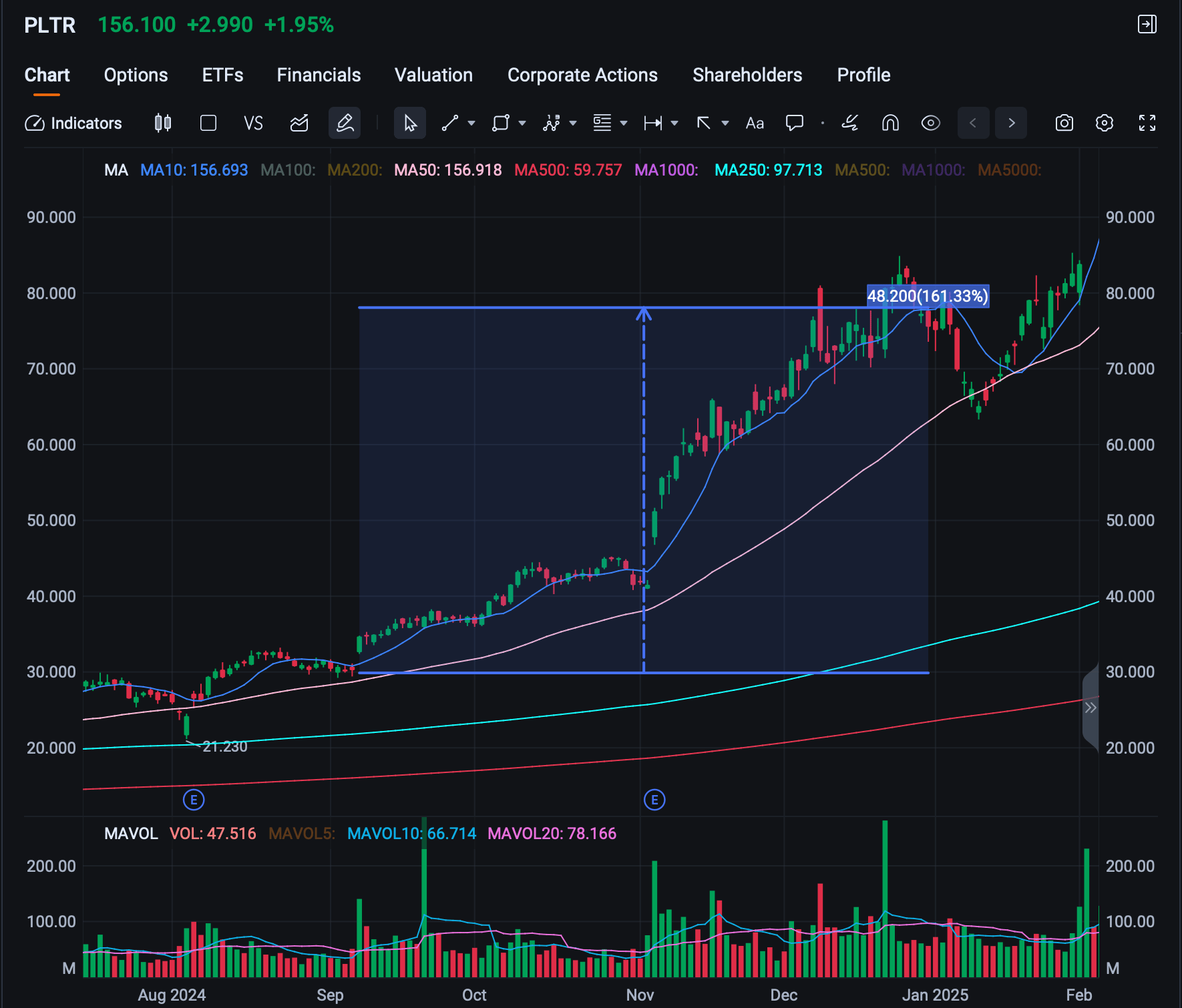

Users on Stocktwits were quick to point out that fan favorite military intelligence stock PLTR climbed 14% on its announcement letter, and a whopping 160%+ for the remainder of the year.

It wasn’t the only listing news moving markets on Monday. Klarna is due for an IPO this week and is enjoying a soaring valuation at $14B, 20 years after its founding in Sweden.

The Gemini crypto exchange parent is coming to markets this week, selling 16.6M shares at about $18/share, according to CoinMarketCap. StubHub and NetSkope are hitting the road to promote their public offerings this fall. It’s a total of six companies hitting public markets this week, each generating $250M in proceeds, according to MarketWatch.

It’s been a banner year for public offerings, as the US IPO’s raised $24.4 billion so far this year, over the $20.4 billion raised in the same period last year, according to Bloomberg. The question is, will retail keep buying?

IN PARTNERSHIP WITH

iPhone Takes Ozempic, Goes Lighter? 💊

Speaking of buying, Apple is holding its annual ‘look at our new tech’ conference tomorrow. The tech industry is abuzz with what might be in store, and there are rumors that a new iPhone Air is on the way, according to Bloomberg.

The rumor mill expects an even thinner screen, alongside a drop in battery life and camera hardware. Bloomberg reports that the phone is expected to be priced between the lowest-end model and the pro model, following Apple's regular four-model layout for new releases since 2020.

iPhones pull in half of Apple's sales, but the tech giant has struggled to keep users coming back for minor changes. Last year, the company released a larger screen size, and the year before a USB-C charging port. Each model comes with an iterative improvement in camera quality, but is that enough to get purchasers to buy a $1,000 phone?

The company is also likely to introduce new watches and AirPods. ⌚

Unconfirmed leak images of the new iPhone Air from MacRumors.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

AppLovin hit $555 after S&P 500 inclusion; Robinhood jumped 15%.

Planet Labs surged 47% after beating Q2 revenue and EPS estimates.

Oracle rose 2% after Barclays raised its target.

Klarna IPO expected this week, pricing at top range.

Canada Goose jumped 12% after TD Cowen upgraded to Buy.

Trump posted RFK Jr.-linked video claiming vaccines contain toxins.

ASML rose 1% after BofA backed its $1.5B Mistral AI stake.

QuantumScape jumped 22% after Ducati EV battery demo.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

OCTO Explodes 400%: Live Trade, Short Squeeze & Lessons Learned

Sean Dekmar kicks off Money Monday with a wild pre-market session led by OCTO, which ripped from $3 to $10+ on a $250M private placement and $20M investment from BMNR. Sean walks through the news, his game plan, and even shows his live $2,700 loss after getting caught in a short squeeze. 100% transparency—wins and losses included.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: EIA Short-Term Energy Outlook (12:00 PM), 3-Year Note Auction (1:00 PM) 📊

Pre-Market Earnings: FuelCell Energy ($FCEL), Hello Gr ($MOMO) 🛏️

After-Market Earnings: GameStop ($GME), Oracle ($ORCL), AeroVironment ($AVAV), Lakeland Industries ($LAKE), and Synopsys ($SNPS) 🌕

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter: Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋