NEWS

Best Gains Since ‘04

The market climbed to finish out the ninth straight session for the S&P 500 in the green, the best run for the index since 2004. Bouyed by tech resilience and Q1 earnings that showed a demand boost from consumers worried over future prices, the market retook all of its losses since Liberation Day.

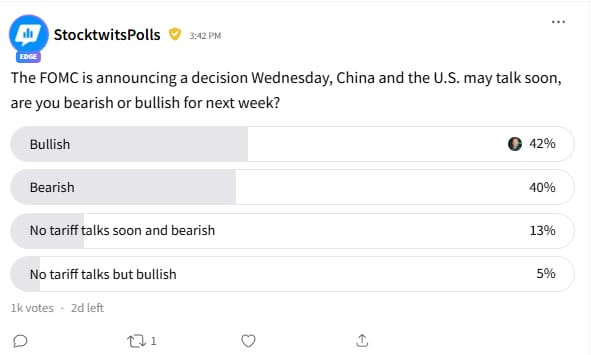

Forward guidance is mostly unclear, and predictions for imports are harsh. Still, the Wall Street Journal reported that the U.S. and China have quietly cut a quarter of tariffs and are trying to begin negotiations. The FOMC will decide on monetary policy next week, with negative growth in GDP, low PCE inflation, and low unemployment data to sort through. 👀

Today's issue covers earnings beats and busts with Berkshire on the way, China and U.S. might get back together, and exclusives from Stocktwits. 📰

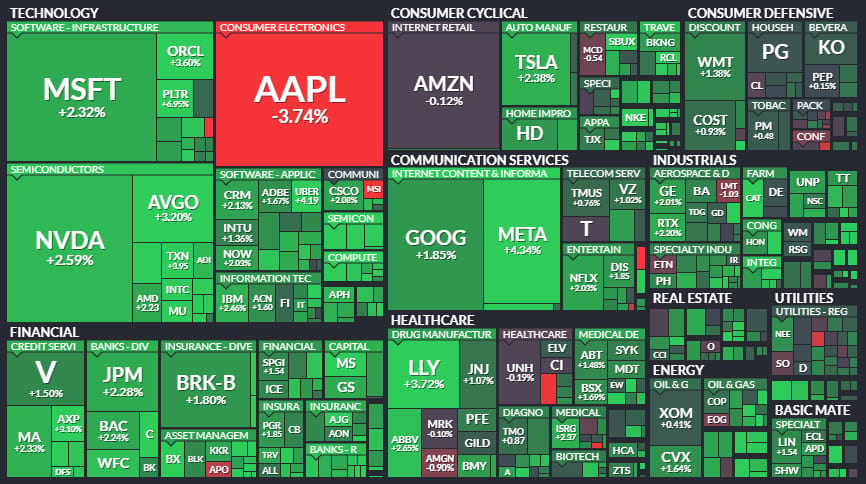

Here’s the S&P 500 heatmap. All sectors closed green, with technology (+1.67%) leading and consumer staples (+0.54%) lagging.

S&P 500 Map - finviz

And here are the closing prices:

S&P 500 | 5,687 | +1.47% |

Nasdaq | 17,978 | +1.51% |

Russell 2000 | 2,021 | +2.27% |

Dow Jones | 41,317 | +1.39% |

STOCKS

Earnings Beats And Busts 🐻

Friday’s positive market gave plenty of room for individual stocks to fly or falter after reporting results. Let’s break down some standouts.

Doulingo ($DUOL +21%): The language learning app flew after reporting earnings better than expected, and issued a Q2 guidance topped forecasts. Chief Luis con Ahn went on Bloomberg TV to show off his firm’s AI tools that help users learn.

Block ($XYZ -20%): Bitcoin and brokerage sales were disappointing for CashApp owner Block, sending the stock lower. It also cut its 2025 guidance, warning that consumer spending in Q1 caused it to miss badly, and it was not improving.

Atlassian ($TEAM -9%): Dropped after reporting Q3 revenue growth of 14%, down from 21% in the prior quarter. The firm, known for making Jira Software, was the lowest stock on the Nasdaq 100. They issued cautious guidance, citing macro risks and execution challenges, while retail sentiment remained neutral with extremely high message volume.

DexCom ($DXCM +16%): On the other end, pulling up the Nasdaq 100 after the glucose tracking tech med tech beat earnings. Revenue grew 12%. Management said two of the three largest pharmacy firms covered their glucose tech. The company received FDA approval for yet another Glucose Monitoring drug.

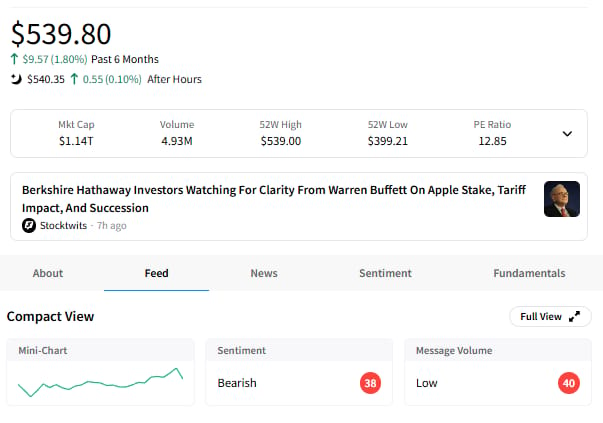

Berkshire Hathaway ($BRK.A) ($BRK.B) Warren Buffett’s cash cow did not report just yet- the firm will hold its annual meeting, the “Cochella for Investing” tomorrow. All eyes will watch its pile of cash, currently sitting at more than $330B, and whether the investment firm has moved that money anywhere. Stocktwits will stream the presentation as soon as it goes live, and keep watch for any retirement news from the big man himself. 🧓

SPONSORED

Adobe-Backed AI Startup Grows from $5M to $85M, Partnering with Top Brands 📋

Introducing RAD Intel, a high-growth AI startup driving success in the $633B content, data, and influencer marketing industry. Brands like Hasbro, Skechers, and Sweetgreen are using RAD Intel’s AI-powered platform to achieve up to 3.5X ROI, delivering real results that set them apart.

With backing from 7,800+ investors, including employees from Google, Meta, Amazon, and support from Adobe's Fund for Design, RAD Intel has skyrocketed from a $5M to $85M valuation in under three years. The company has already raised $35M, and now is your chance to invest early in this proven tech disruptor.

RAD Intel's platform uses AI to provide brands with data-driven insights, helping them cut through the noise and engage their audiences with precision.

Don’t miss out!

*This is a paid advertisement for RAD Intel’s Regulation CF offering. Please read the offering circular and related risks at invest.radintel.ai.

TARIFF NEWS

China And The U.S. Nearly On Speaking Terms 😄

The U.S.-China trade war directly hit the largest tech importers this week, after both Apple and Amazon said the next couple of quarters would take a heavy hit from tariffs. Lucky for them, nations are finally getting ready to come to the table and talk taxes— let’s break down what happened.

📦 Apple’s Moves: Apple plans to source $19 billion in U.S.-made chips this year while shifting most U.S.-bound iPhone production to India by 2026, hedging against trade uncertainties. Chief Tim Cook said on the firm’s earnings call Thursday that they expect costs upwards of $900M this quarter due to trade levies. 📊

🇨🇳 China’s Trade Play: Beijing quietly exempted $40 billion worth of U.S. imports from tariffs, about a quarter of their U.S. imports. Meanwhile, Huawei aims to ship over 800,000 AI chips to key Chinese firms, filling gaps left by U.S. export bans ⚙️.

🌎 The U.S. Plays Nicer: China’s tariff walkback matches steps from the White House to tone down some of the U.S.’s freshly minted tariffs. The Trump Administration made smartphones and other electronics exempt from 145% levies on China three weeks ago. It amounts to about $102B or 22% of imports from China last year, according to Gerard DiPippo, director of the RAND China Research Center.

💊 Beijing Looks For Ways To Start: Beijing leaders are trying to devise a way to address the fentanyl trade that Trump has used as a reason to institute tariffs. Wang Xiaohong, Chinese security czar for leader Xi Jinping has asked what the Trump Admin wants them to do about Chinas chemical production, according to the WSJ. Friday, China’s Commerce Ministry said it was weighing starting talks about the trade war.

STOCKS

Other Noteworthy Pops & Drops 📋

Take-Two ($TTWO): Shares dropped over 5% after the firm said it was delaying its flagship videogame, GTA VI, to May 2026. JPMorgan maintained its "Overweight" rating, while EA stock climbed on expectations for a new Battlefield installment.

Netflix ($NFLX +2%): Hit an all-time high of $1,155.97, extending its longest-ever winning streak to 11 consecutive sessions. Analysts cite strong subscriptions at the streaming giant and advertising growth.

Chevron ($CVX +2%): Reported Q1 net income of $3.5B, down YoY, with EPS of $2.18 beating estimates. Oil revenue missed forecasts, but refining margins helped offset lower upstream earnings.

AstraZeneca ($AZN +3%): The pharma firm announced its Breztri therapy met primary endpoints in Phase 3 asthma trials, showing statistically significant lung function improvements compared to standard treatments.

Shell ($SHEL +3%): Reported Q1 earnings of $5.58B, beating estimates. The oil giant pledged a $3.5B stock buyback, marking its 14th straight quarter of repurchases.

Frontier ($ULCC +8%): Slipped 2.5% after forecasting a Q2 loss and capacity curtailments due to weak demand. The discount airlines’ retail sentiment remains highly bullish despite recession fears.

Roku ($ROKU -8%): Q1 revenue rose 16% YoY, beating estimates, but shares fell as the streaming tech firm showed guidance that flagged tariff-related headwinds in the devices segment.

Reddit ($RDDT -4%): Rallied post-earnings after reporting Q1 EPS of $0.13, reversing an $8.19 loss a year ago. Revenue jumped 61% YoY, beating estimates. By the end of the day though, the stock had fallen after management at the social media giant said daily active user growth was flat.

PRESENTED BY STOCKTWITS

Exclusive Double Header: Make Sure To Catch These Two Exclusive Stocktwits Features 🎥

The Weekend Rip’s Ben & Emil Entered The Bear Cave

Check out Friday’s special edition of Weekend Rip as Ben & Emil welcome investigative financial journalist Edwin Dorsey, the founder of The Bear Cave newsletter.

Known for his deep dives into corporate misconduct, Edwin has made headlines by uncovering issues that have led to significant market reactions. 👀

Katie Perry Interviews Robinhood CEO Vlad Tenev

Robinhood is one of the most active stocks among the Stocktwits community and retail investors, and we lined up an EXCLUSIVE post-earnings interview with Chief Vlad Tenev. Check out the replay, and:

Watch the premiere of Stocktwits’ CEO Howard Lindzon’s interview with Robinhood CEO Vlad Tenev next Tuesday, May 6th, on Stocktwits and YouTube 🤩

COMMUNITY VIBES

One Tweet To Sum Up The Week

Congratulations to community contributor of the year DonCorleone, and thank you to everyone who joined us at the first Cashtag Awards in NYC!

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋