CLOSING BELL

Beware the blob! Or, Invest In It?

Markets climbed Wednesday, with an increasing number of voices cautioning that the AI bubble is here, or as Axios coined, the “AI blob” of massive firms that are swapping deals with each other.

Nvidia CEO Jensen Huang dismissed AI bubble fears, citing a trillion-dollar industry, compared to the dotcom bubble’s combined ~$40B size. Of course, he would; his $4.5T company and OpenAI are the source of most of the industry’s circular funding deals for data centers and processing power.

There is still no end in sight to the gridlock in Washington over the government shutdown, and Gold hit yet another record above $4,050/oz. 👀

Today’s RIP: ASTS flies on space phones, FOMC is conflicted, Beware Buy the AI blob, and more. 📰

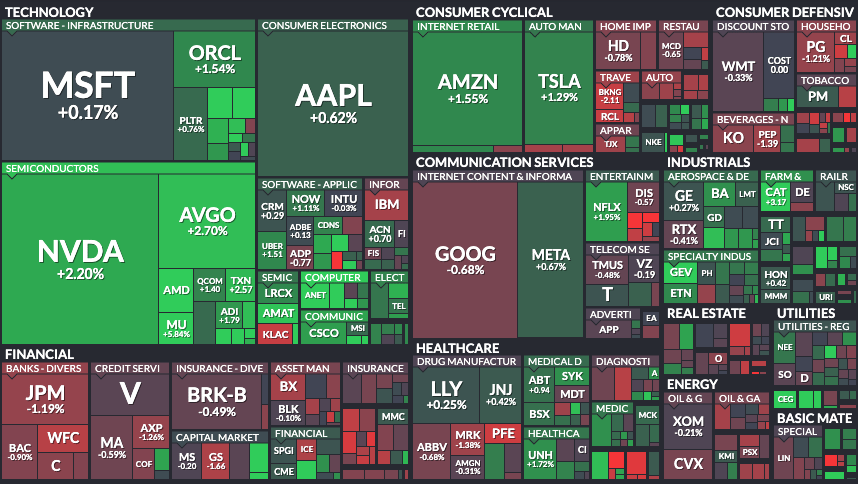

6 of 11 sectors closed green, with tech $XLK ( ▲ 1.36% ) leading and energy $XLE ( ▼ 0.04% ) lagging.

STOCKS

Space Cell Phones, Coming To A Yesteryear Near You 🌙

AST SpaceMobile was leading the trending list on Stocktwits Wednesday, climbing $ASTS ( ▲ 2.16% ) after announcing a Verizon satellite phone deal.

Readers of the Saturday edition will recognize AST as a major momentum mover, climbing last week after a deal with a Canadian cellphone company to offer its bread and butter: cell service from space.

Chief Abel Avellan of AST said the goal is to offer space phones to all of the U.S. The stock is flying, up 250% so far this year.

The news from Verizon is a second expansion ot a partnership announced last year. In fact, digging up the old press release, it’s hard to tell what is different a year later. In May last year, AST announced this deal, with a $100M price tag, to cover 100% of the U.S. with space cell phone 850 MHz waves.

Since the last announcement, AST has reported tens of millions in losses every single quarter. Maybe this finalized deal will be the one to push cash flow in the right direction (next year?) 💫

Guess which headline is from today, which is from 2024?

SPONSORED

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Fed Is Going To Cut Rates, But Disagreed On How Much, When 🦳

A divided FOMC showed in meeting minutes from last month’s rate cut decision that they were planning to ease target rates for the rest of the year, hoping to save the job market while weathering worse inflation numbers.

The committee voted 11-1 to cut by 25 basis points, with Stephan Miran wanting more. For the rest of the year, six of the 19 total voices saw one or no cuts. 😶

“Most judged that it likely would be appropriate to ease policy further over the remainder of this year,” the minutes recorded. “…most participants observed that it was appropriate to move the target range… because they judged that downside risks to employment had increased over the intermeeting period and that upside risks to inflation had either diminished or not increased.”

A few members even saw merit in continuing to wait before cutting rates. The median vote was to for two more 25-basis-point cuts this year. One basis point is 0.01%, and the September move represents a quarter-point cut in the target Federal Funds rate.

Members said if they pull down rates too quickly, inflation could become “unanchored” and their job would become much harder. On the flip side, high rates for any longer could see the unemployment rate rise, and the economy slow.

AI TRENDS

Everyone Is Playing Hot Potato With AI Capital 🥔

Fears of the next dot-com bubble are alive and well in the market, with massive AI spending projects this fall coming under scrutiny for their self-serving nature.

Each day that passes brings another headline, another massive number next to a company name, to pay for space for large language models to think. This week was $AMD ( ▲ 8.81% ), still climbing on an OpenAI deal for a stake and processing power, but last week was $NVDA ( ▲ 0.74% ), and the week before $ORCL ( ▲ 3.34% ).

It’s a who’s who of big fat companies swapping billions with each other, and sometimes with smaller firms like Figure $FIGR ( ▼ 1.77% ) or CoreWeave $CRWV ( ▲ 9.14% ) that rocket higher on deal news. The circular nature of a Microsoft deal with OpenAI, an OpenAI deal with Nvidia and AMD, a Nvidia deal with Oracle, and an Oracle deal renting Nvidia chips, resembles a snake eating its tail. 🐍

“If we get to a point a year from now where we had an AI bubble and it popped, this deal might be one of the early breadcrumbs,” Morningstar Analyst Brian Colello told Bloomberg. “If things go bad, circular relationships might be at play.”

Experts are watching from the sidelines, and this week started to speak up: there might be a bubble. Investigators found Oracle’s nearly billion-dollar war chest for renting out Nvidia processing is only making meager returns. Not everyone is concerned; Guggenheim Analyst John DiFucci said in a note that the margins on Oracle’s deal would start low and climb. 📈

Still, most of the deals lead back to OpenAI and Nvidia. One is a massive startup that is on track to lose money until the next president takes office, burning $6.7B in costs in the past six months, and targeting $13B in revenue this year. As a private entity, it basically has nothing to do besides spending money to grow.

The other company is at least making cash hand over foot: Nvidia pulls in tens of billions in profit every single quarter. It’s using that cash to invest in smaller companies (every company is smaller than Nvidia). 🤏

Still, experts are worried as tech and AI make up a larger and larger share of the S&P 500. Yale researchers cited leaders who were worried in their insight This is how the AI Bubble Bursts.

Goldman Sachs CEO David Solomon said, “a lot of capital that was deployed that [doesn’t] deliver returns.” Amazon founder Jeff Bezos called the AI spending “kind of an industrial bubble.” Even Sam Altman, CEO of OpenAI, warned that “people will overinvest and lose money” in AI.

TLDR: AI giants keep paying themselves in revenue/ investment deals, but it wasn’t too long ago that a Chinese startup called DeepSeek came out with high AI results it attributed to a way cheaper training budget. It feels like the market is flying higher, waiting for that moment to come again. But maybe the other shoe won’t drop. 🤷

POPS & DROPS

Top Stocktwits News Stories 🗞

AMD jumped 11% after OpenAI stake deal praised.

Tesla climbed slightly after adding cheaper Model 3/Y variants.

POET Technologies rose 16% after closing record $75M private placement.

Dell rose 9% after bullish outlook and analyst upgrades.

Freeport-McMoRan rose 5% after bullish analyst upgrades.

PepsiCo faces activist pressure ahead of Q3 earnings.

Joby fell 8% after announcing $513M discounted share offering.

Critical Metals rose 17% after signing rare earth supply deal.

MetaMask launched perpetual trading.

Ford fell slightly after analysts flagged $1B fire impact.

GM canceled plan to extend EV tax credit scheme.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Let It RIP — Trending Stocktwits Names Brought To You Every Morning

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Chair Powell Speaks (8:30 AM), Jobless Claims (8:30 AM), FOMC Member Bowman Speaks (8:35 AM), 30-Year Bond Auction (1:00 PM), Fed Vice Chair Barr Speaks (1:00 PM), FOMC Member Bowman Speaks (3:45 PM), FOMC Member Daly Speaks (9:40 PM). 📊

Pre-Market Earnings: Tilray Brands Inc ($TLRY), Delta Air Lines, Inc. ($DAL), PepsiCo Inc ($PEP), and VinFast Auto Ltd. ($VFS). 🛏️

After-Market Earnings: Applied Digital Corporation ($APLD), Kaixin Holdings ($KXIN), and Levi Strauss & Co. ($LEVI). 🌕

Links That Don’t Suck 🌐

📺 The shutdown is delaying Trump's farm bailout. Farmers say it won't be enough even when it happens.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋