CLOSING BELL

Big Week Starts With Sixth Record Close

The market climbed on Monday to start a huge earnings week, fresh from the weekend on news that the U.S. and EU had reached a trade agreement, featuring a 15% tax on European goods entering the U.S., alongside a $750 billion promise to buy energy.

China talks began Sunday, and the market looks forward to good news. This week, 150 stocks on the S&P 500 are reporting, with some fan-favorite tech companies like Meta, Google, Amazon, Apple, Microsoft, and smaller names like Robinhood and Reddit. Too many to list.

All that and more is coming this week, not to mention inflation data and a fresh FOMC disappointment rate decision. 👀

Today's issue covers Super Micro climbs because retail wants to see it climb, Samsung gets $16.5B to make Tesla chips, and more. 📰

With the final numbers for indexes and the ETFs that track them, 3 of 11 sectors closed green, with energy $XLE ( ▼ 0.09% ) leading and real estate $XLRE ( ▲ 0.28% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,389

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,356

Russell 2000 $IWM ( ▲ 1.09% ) 2,256

Dow Jones $DIA ( ▲ 0.78% ) 44,837

STOCKS

Super Micro Computer Hot With Retail Despite Lack Of Reason To Sizzle 🍳

Super Micro Computer, of all stocks, topped the trending charts on Stocktwits Monday, without major company-specific news to drive the excitement. The datacenter shelf and cooling tower maker enjoyed a $SMCI ( ▲ 1.37% ) price climb, on the outset of what investors hope to be a good week for semiconductor and data center companies.

Benzinga attributed the climb to hopeful news from China - U.S. trade negotiations, as the U.S. paused some tech export blocks and countries returned to the table to discuss for the third time in 2025.

SMCI gains whenever tech companies increase their CapEx for AI data center spending, and even though the firm started the year in the red after issues with reporting audited results and maintaining accounting controls, Super Micro is a fan favorite stock.

SMCI is set to report on August 5th, next week, its Q4 2025 results, although it may not include figures audited by a reputable accounting firm. Still, the market expects about $0.44/share, on revenue of $5.9B for the quarter, and $22.13B for the fiscal year. The stock has climbed more than 90% this year, and might enjoy some short squeeze retail chatter with short interest on 15% of shares outstanding.

SPONSORED

RAD Intel's Private Round

If you missed Tesla at $1, RAD Intel is still at $0.63—and built for real returns. 3.5× ROI. 1,600% valuation growth. 9,000+ investors. Backed by Adobe & Fidelity. Accredited only via Reg D.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TECH

Tesla Spending The Big Bucks On AI Chips From Samsung 💻

Tesla climbed Monday alongside it’s new manufacturing partner after a report that Samsung won a $16B multiyear deal to manufacture AI chips in Texas for driver assistance software.

Chif Musk confirmed on X that Samsung would make the A16 next-generation chip currently under construction. The firm makes Tesla’s A14, and TSMC is building the A15 in Taiwan. Samsung filed the partnership as confidential to protect trade secrets, according to a document CNBC translated from Korean.

The firm is expected to report on Thursday and may benefit from further partnerships with companies like Qualcomm for its 2-nanometer chip technology. The brand name means more to retail on a TV than on microchips, losing out on the race to companies like $MU ( ▼ 0.7% ) and the market expects the company to report up to half as much profit in the most recent quarter as last year.

SPONSORED

🚨 New on Stocktwits: Sentiment meets $SPY

The Stocktwits Sentiment Index now includes a live $SPY overlay. You can track real-time retail sentiment and market price in one clean chart, perfect for spotting moments where the community is early…or euphoric.

Sentiment surges while $SPY lags? That’s conviction.

Price pops as sentiment fades? That’s hesitation.

Both run hot? That’s FOMO.

Get a clearer read on the market, powered by what the community is truly feeling.

POPS & DROPS

Top Stocktwits News Stories 🗞

Chainlink, UBS, and SBI demonstrated atomic settlement and real-time NAV streaming for tokenized funds, signaling a leap toward 24/7 on-chain fund liquidity. Read more

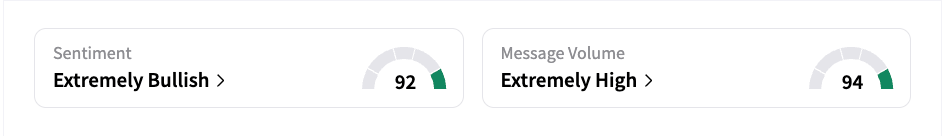

CervoMed reported that its dementia drug Neflamapimod slowed disease progression in Lewy body patients, pushing retail sentiment into “extremely bullish” territory. Read more

The GENIUS Act established the first U.S. federal framework for fully-reserved stablecoins, triggering “Stablecoin Summer” and opening the door for bank-grade tokenized cash and on-chain auditability. Read more

Nike stock surged toward 5-month highs after JPMorgan upgraded it to “Overweight” and hiked the price target to $93, sparking bullish retail chatter and $90 projections. Read more

LIDR stock surged over 5% after AEye began deploying its AI-powered lidar platform OPTIS, sparking explosive retail chatter and bullish sentiment on Stocktwits. Read more

Graphjet stock jumped 36% as its CEO claimed the company will benefit from Tesla and Samsung’s $16.5B chipmaking deal by supplying key graphite and graphene materials. Read more

The United States reportedly transferred B61-12 nuclear bombs to the U.K. via a C-17 flight, marking the first such move since 2008 and signaling resolve amid rising tensions with Russia. Read more

PayPal launched a “Pay with Crypto” option, letting U.S. merchants accept over 100 cryptocurrencies through wallets like Coinbase and MetaMask. Read more

Abercrombie stock gained on a JPMorgan price target hike to $151, but retail sentiment remained muted amid tariff concerns and margin pressure. Read more

WeRide secured an autonomous driving permit in Saudi Arabia, setting the stage for a full-scale robotaxi launch with Uber by year-end. Read more

Crocs stock climbed after UBS raised its price target to $110, as retail sentiment held bullish despite looming tariff uncertainties. Read more

Trump’s “Big Beautiful” tax bill could unleash a $15 billion annual cash flow windfall for Amazon through boosted AWS and AI investments, says Morgan Stanley. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Reddit, QBTS, UNH & More: How to Time Breakouts Using Anchored VWAP and Wyckoff Logic

Welcome back to CMT Lunch Hour with Michael Nauss, CMT @MichaelNauss 🎯 In this episode, Michael lays out a data-driven blueprint for navigating slow markets and high-risk names. From quant-tested setups and earnings catalysts to short squeeze logic and bottom-fishing traps, it’s a deep dive into how pros handle chop and prep for explosive moves.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Goods Trade Balance (8:30 AM), Retail Inventories ex Auto (8:30 AM), JOLTS Job Openings (10:00 AM), Atlanta Fed GDPNow (Q2) (11:30 AM), 7-Year Note Auction (12:00 PM), 📊

Pre-Market Earnings: Boeing ($BA), PayPal ($PYPL), SoFi ($SOFI), UnitedHealth ($UNH), Spotify ($SPOT), Royal Caribbean ($RCL), JetBlue ($JBLU), UPS ($UPS), Merck ($MRK), Procter & Gamble ($PG)🛏️

After-Hour Earnings: Marathon Digital ($MARA), Starbucks ($SBUX), Visa ($V), Teladoc ($TDOC) 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋