CLOSING BELL

Billions For PLTR Means Data Market Is In Growth Mode

Markets climbed Monday after a pullback week. The EU said it was pausing its tariff clap back after new rates came out last week, and Switzerland said it would try harder for a better deal with a 39% tariff dropping on Thursday. The post-weekend positivity sent the S&P 500 and Nasdaq to their best days since May.

It’s another full earnings week, but so far reports are going well: 2/3 of S&P 500 companies have reported so far, and 80% have reported beats, according to FactSet. 👀

Today's issue covers PLTR reports its first billion-dollar quarter, why did Berkshire’s report suck, and more. 📰

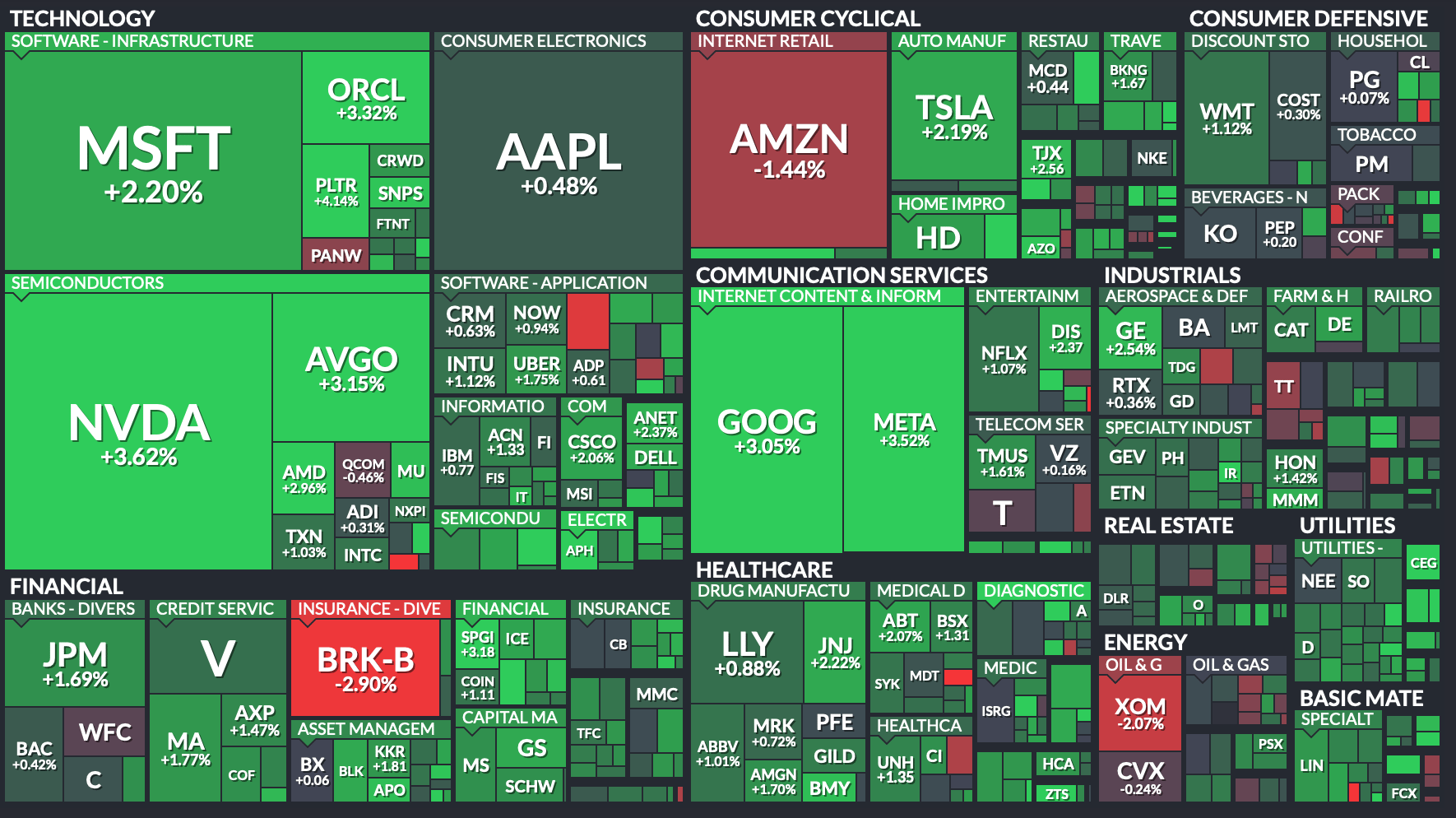

With the final numbers for indexes and the ETFs that track them, 10 of 11 sectors closed green, with tech $XLK ( ▲ 1.99% ) leading and energy $XLE ( ▼ 0.58% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,339

Nasdaq 100 $QQQ ( ▲ 1.36% ) 23,188

Russell 2000 $IWM ( ▲ 0.56% ) 2,212

Dow Jones $DIA ( ▲ 0.58% ) 44,173

STONKS

PLTR Reports First Billion Dollar Quarter 🤖

One of retail’s favorite stocks climbed Monday after reporting its first-ever $1B revenue quarter, above estimates. 🪙

EPS came in at $0.16, up 77% in a year, and revenue came in at $1.004B, climbing 48% in a year. $PLTR ( ▲ 4.46% ) climbed even after it enjoyed a 490% price jump since last August.

Broken down by segment, U.S. government revenue came in at $426M, unharmed despite the new administration’s aims to cut spending. Commercial revenue grew 93% from last year to $306M. 🍊

Analysts expected earnings of $0.14/share on revenue of $939M according to FactSet. For the full year, analysts were looking for earnings of $0.58, and revenue at $3.9B, and the firm beat these expectations too by raising its full-year guidance.

The AI and military contracting firm said its full year 2025 would be a great one, posting revenue guidance of about $4.15B. Contracts closed in Q2 came in above $2.2B, a 140% in one year, the company said.

PLTR user sentiment on Stocktwits climbed after hitting a month low on Monday

The massive climb in revenue sent the stock soaring and has so far minted five billionaires out of co-founders; most recently the data firm’s CTO, according to Bloomberg.

Palantir was a standout in Monday’s quarterly reports. $HIMS ( ▲ 4.24% ) fell 12% after hours, reporting revenue below estimates.

SPONSORED

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Why Did Buffett’s Berkshire Report Suck

The king of long-term investing posted a drop in operating profit, and economic uncertainty hurt one of the largest corporate cash piles on the market, according to the Berkshire Hathaway first half of the year financial report that dropped over the weekend.

The massive conglomerate with the oldest-looking website I can think of posted a Q2 operating income decline to $11.16B, or $7,7609 per Class A share. The firm reported $877 million in currency losses blamed on the declining U.S. dollar.

“The pace of changes in these events, including tensions from developing international trade policies and tariffs, accelerated through the first six months of 2025,” Berkshire said

Berkshire’s massive cash pile fell from $348B in March to $344.1B, and it sold about $4.45B in equities and stock. The company has still not sold its Kraft Heinz stock, which lost nearly $4B in its decade-old investment, which made up about 60% of Berkshire’s operating income losses. Berkshire bought more than a quarter of Kraft shares back during the 2015 merger of Kraft Foods and H.J. Heinz, and the weekend write-down of its stake is an admission that the purchase was not a very good idea, according to Bloomberg.

A WSJ report in July said ketchup ain’t what it used to be. Kraft Heinz was recently considering organizational alternatives, including a split up of its 200 brands into two separate tickers for sauce and deli meats.

If that was not bad enough, Berkshire said its insurance business felt a 12% decline in earnings, and the wizz kid Chief Warren Buffett is due to step down at the end of the year. 😭

$BRK.B ( ▼ 0.34% ) has fallen more than 16% from the start of the year, as the company shifted its stock holdings into a massive cash pile that many have called ‘dry powder’, ready to deploy when high equity prices reach a sell-off point. 🧨

Unfortunately, despite a massive April stock sell-off on tariff jitters, Berkshire has made no indication it is jumping back into the market yet on a large scale.

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Steelcase surged 64% after HNI announced a $2.2B acquisition deal, offering cash and shares to expand its footprint across workplace sectors. Read more

American Eagle stock soared over 13% after the President praised its Sidney Sweeney ad, contrasting it with failed campaigns and sparking retail enthusiasm. Read more

Apple may drop CoreCard as its payment processor amid a potential shift to JPMorgan, shaking retail confidence despite a $248M Euronet buyout. Read more

Joby Aviation surged 15% after acquiring Blade’s urban air mobility unit for up to $125M, gaining access to NYC and European passenger markets. Read more

Google secured a custom energy deal with AEP for its $2B Fort Wayne data center, enabling flexible power usage to reduce grid strain and lower costs. Read more

Tesla approved a $29B award of 96M restricted shares to CEO Elon Musk, vesting in 2027 if he remains active in product or operations. Read more

Speaking of Tesla, brand loyalty plunged from 73% to under 50% after Elon Musk backed Trump and launched his DOGE campaign, according to S&P Global. Read more

CommScope surged 91% after announcing a $10.5B all-cash sale of its CCS division to Amphenol, with proceeds earmarked for debt repayment and investor returns. Read more

GM reported a 115% YoY jump in EV sales for July, driven by the Chevrolet Equinox EV ahead of a looming tax credit cutoff. Read more

TG Therapeutics slipped 16% after Q2 revenue missed estimates, but the company raised full-year guidance and reaffirmed Briumvi’s multibillion-dollar potential. Read more

Firefly Aerospace lifted its IPO valuation goal to $6B, setting a price range of $41–$43 per share to support its lunar lander and orbital rocket ambitions. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

TRADE ZONE

Days Without New Trade Policy: (0)

President Trump threatened India with “substantially” higher tariffs over allegations it resells Russian oil for profit while ignoring the war in Ukraine. Read more

The European Union agreed to suspend countermeasures on Trump’s tariffs for six months, pending finalization of a broader U.S.-EU trade agreement. Read more

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Trade Balance (8:30 AM), S&P Global PMI (9:45 AM), ISM Non-Manufacturing PMI (10:00 AM), 3-Year Note Auction (1:00 PM), Atlanta Fed GDPNow (Q3) (1:00 PM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: Pfizer ($PFE) and Seanergy Maritime Holdings ($SHIP). 🛏️

After-Hour Earnings: Advanced Micro Devices ($AMD), Snap ($SNAP), Lucid Group ($LCID), Clover Health Investments ($CLOV), Rivian Automotive ($RIVN), Super Micro Computer ($SMCI), Opendoor Technologies ($OPEN), and Upstart Holdings ($UPST). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋