CLOSING BELL

Blackwell Chips For Rent

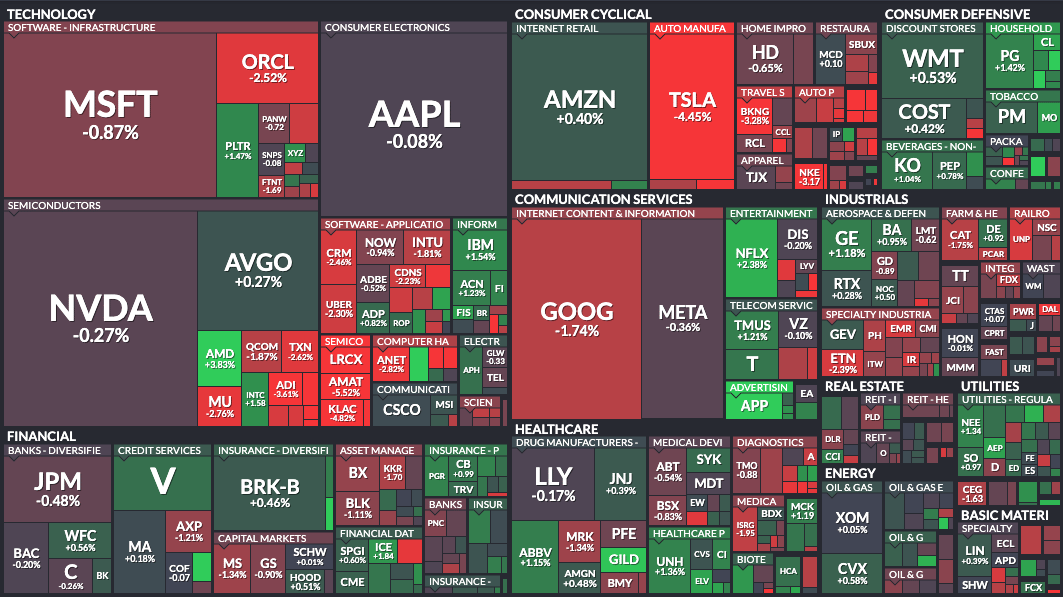

Markets fell Tuesday, and not even new Tesla cars could shift the tech market higher. Gold climbed past $4,000 for the first time, in risk-off moves to move some eggs out of the U.S. equity basket. Bridgewater founder Ray Dalio said investors should buy more gold, comparing today’s environment to the inflation-heavy, high government spending times of far-off 1970. Bitcoin bounced off a record high and ended the day lower, pulling down crypto companies.

The gov. shutdown halted last week’s jobs numbers, and Carlyle analysis this week found the economy added just 17,000 hires. If the BLS reported those numbers, it would be the worst month in five years, except for March’s -13k report. It ain’t all bad: Goldman Sachs data found September hirings boosted +80k positions.

Fed Governor Stephen Miran, Trump’s recent pick, said he is not worried about the economy and wants to cut 50 basis points again and again. Fed Prez of Minneapolis Neel Kashkari disagreed, cautioning that drastic cuts could fan the flames of inflation. 👀

Today’s RIP: Oracle is losing money renting Nvidia chips, Tesla’s affordable car looks expensive, and more. 📰

5 of 11 sectors closed green, led by staples $XLP ( ▲ 0.87% ) while discretionary $XLY ( ▲ 1.52% ) lagged.

STOCKS

Oracle’s Nvidia Chip Rentals Are Not Pulling In The Big Bucks ❌

Oracle fell $ORCL ( ▲ 3.42% ) Tuesday, helping to pull down the entire tech market after investigative reporting from The Information found the company was losing money on its scheme to buy up Nvidia chips, and rent their processing power out. Oracle lost $100M renting out chips, according to CNBC. If they are struggling to profit, investors are worried the rest of the AI world will struggle too.

The company pulled in $900M in its cloud business in the three months ending in August, which sounds great if you are anyone but Oracle. The rent-a-brain plan had a gross margin of 14%, compared to Oracle’s overall 70% margin.

That signals two things: Nvidia chips are extremely expensive to purchase and host, and Oracle may have its work cut out for it to generate profits. The company said last month it had a huge backlog for data center contracts, which climbed 359% to $455 billion, stretching out to 2030. Compared to 2025’s estimated $14B, that’s a pretty nice on-ramp to superstar status, but today’s warning cast a shadow on those hopes.

"The thing that is on everyone's mind is: What is the business and the profitability of AI?" Michael Antonelli, a market strategist at Baird told WSJ. "Any little data point about profitability will obviously be looked at with a magnifying glass."

INDUSTRY NEWS

Is Tesla’s $40K EV Cheap Enough? 🙁

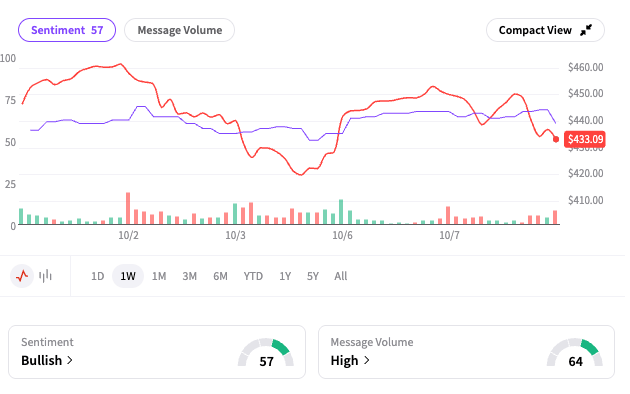

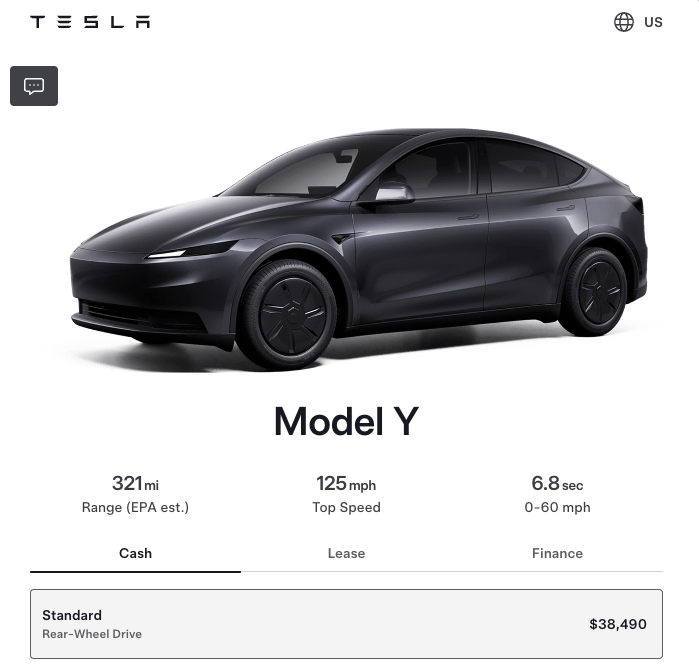

Tesla shares fell $TSLA ( ▲ 2.39% ) despite long-awaited news from the EV giant: it was launching more affordable electric car models this year, including a $40,000 Model Y, and a $38k Standard model.

The keyword was more, because $40k is still $40k, in a market that seems set on buying used cars worth $27-$30k. Investors sold off the stock, after what feels like a decade-long wait for an affordable EV. A $40k Tesla, especially after the U.S. government cut the $7,500 tax credit for green vehicles, enters a crowded market.

Nissan, Hyundai, Chevy, Toyota, Subaru, Volkswagen, and Ford all sell fully electric cars under $40k, and that’s just to mention a few. If you throw in Chinese companies like $BYD ( ▲ 1.89% ), (if you can smuggle one of their cars into the U.S.), buyers can expect prices as low as $12,000, or $20k after taxes.

It’s the first Tesla product update since 2023’s Cybertruck. The Cybertruck has so far sold just over 50,000 units, according to WIRED. That’s worse than EV SUV and truck competitor Rivian delivered in 2024. Ford sold nearly 58,000 EV trucks, SUVs, and vans in the past nine months.

Ford Chief Jim Farley last week warned U.S. buyers are not looking for EV’s over $30,000.

Speaking of Ford, the stock was hit $F ( ▲ 4.11% ) with a sell-off after a major fire hit its aluminum supplier. The plant supplies nearly half of all sheet aluminum to the U.S. auto industry, but Ford’s F-150, the top-selling thing on four wheels in America, uses a ton of aluminum.

PARTNER MESSAGE

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Qualcomm acquired Arduino to boost AI hardware portfolio.

Nvidia pledged to continue sponsoring H-1B visas despite Trump’s fee hike.

McCormick fell 4% after profit forecast cut on trade pressures.

Rigetti Computing gained 5% on $50 target and quantum deals.

Trilogy Metals surged 211% after U.S. bought 10% stake.

Boeing received conditional EU approval for $4.7B Spirit deal.

Constellation Brands rose 1% on beer strength and loyalty gains.

AST SpaceMobile climbed 2% after $800M equity offering.

IREN climbed 6% on $875M convertible notes deal.

NYSE owner ICE climbed on $2B Polymarket investment.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

HIT THE BID WITH KENNY GLICK

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Vice Chair Barr Speaks (9:30 AM), 10-Year Note Auction (1:00 PM), FOMC Meeting Minutes (3:00 PM), FOMC Member Kashkari Speaks (3:15 PM), Fed Vice Chair Barr Speaks (5:45 PM). 📊

After-Market Earnings: AlphaTON Capital Corp. ($ATON), Nutex Health Inc ($NUTX), Richardson Electronics, Ltd. ($RELL), and AZZ Inc ($AZZ). 🌕

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋