Presented by

CLOSING BELL

Bonds Going Wrong Way

Markets were falling and all eyes were on treasury yields on Friday, as the market digested the rate cut that’s been on the table since before September.

The S&P 500, Nasdaq, and Russell fell 1-2% off record highs this week. It was sell-off mode after following a bond market sell-off as long-term hedgers demanded higher rates for the 10 and 30-year after mixed and cautious commentary from Fed speakers. Sure, the Fed is cutting now, but will they even cut at all next year?

Speaking of next year, the President said there were two top contenders for the tough role of a guy named Kevin that’s going to cut like they are making paper snowflakes: Former Fed Gov. Kevin Warsh, or Econ Council Dir. Kevin Hassett.

On the topic of inflation, a month-long investigation by Consumer Reports found Instacart shoppers were guinea pigs in a “charge as much as possible” AI pricing scheme.

Anyway, tech was also ripped down as traders felt a sore spot with a second giant AI builder this week, Broadcom reporting great results if it were 2023, but boring results in the year of our lord 2025. After Oracle’s similar beat but not enough results on Wednesday, it’s starting to form a trend.

Retail reports looked hot, though, as the ever-powerful American consumer kept buying leggings and furniture. 🙏

STOCKS

Consumer Instacart Basket Is Gouging Across All Income Levels 🛒

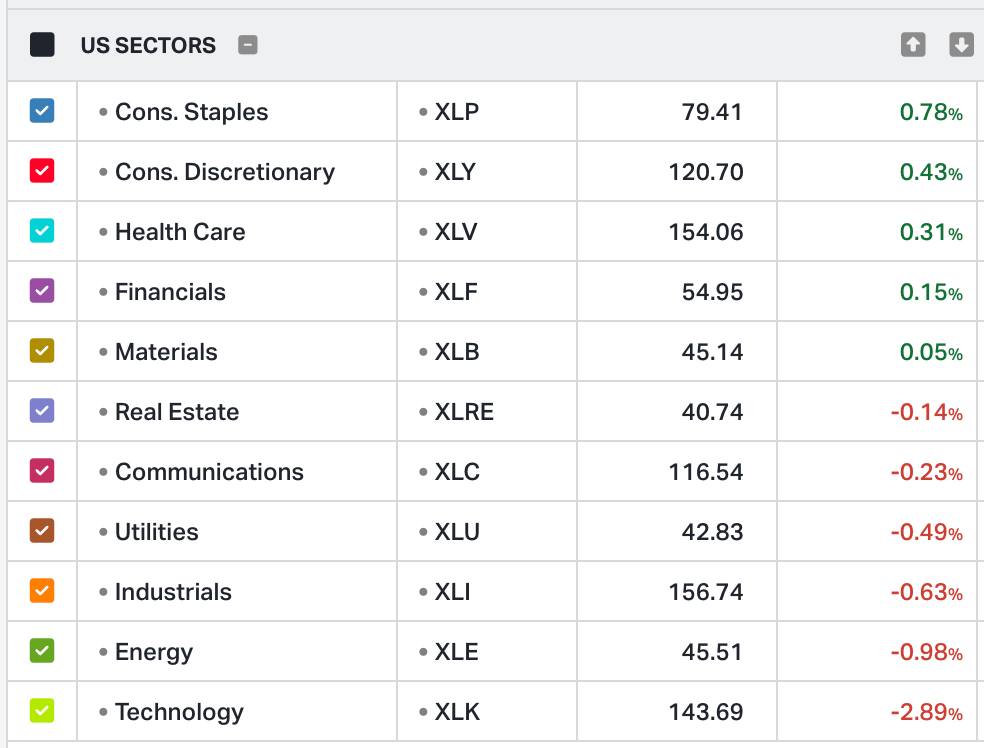

Looking out over a sea of 250 million online orders, Consumer Reports investigators said they found a common thread: everyone is getting screwed.

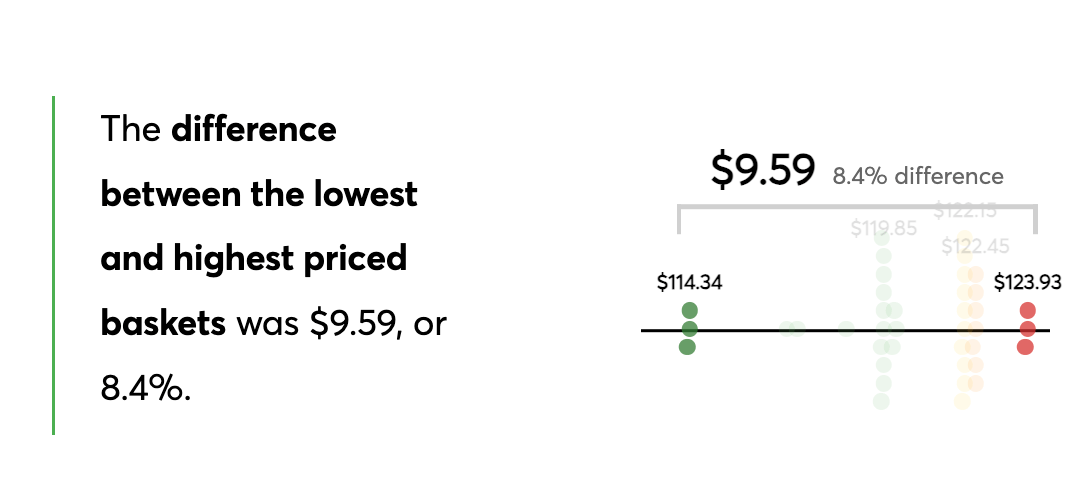

437 volunteers divided into four groups across the U.S. took part in the survey, each completing an identical basket of goods from Safeway and Target, compared to a fifth group of in-person shoppers. Investigators report items varied by price, of up to $2.56 per item.

It doesn’t sound like much, but the outliers showed the company skimming nearly $10 from shoppers. Applied to my weekly grocery runs, +$10 would turn into $360 a year, basically buying Instacart nearly four weeks of extra groceries.

“Based on how much Instacart says the typical household of four spends on groceries, the average price variations observed could translate into a cost swing of about $1,200 per year.”

Some items were upcharged by nearly a quarter of the cost. The real damage in these minute changes is that experts told CR these pricing differences are experiments into how price-sensitive we all are.

An insider at Instacart leaked ‘smart rounding’ work with Costco to use machine learning to boost sales by millions simply by raising prices higher. If you ask yourself why everything is 30% more expensive at checkout than it was in 2019, this technique might be why.

Errol Schweizer, Whole Foods executive, told CR the gamesmanship was “all to keep pace with the competition and to wring a few more pennies out of people,” he says. “And as things get more competitive for grocers and suppliers, it’s going to get more and more complicated, wackier, and out of control for the customer.”

Instacart said only 10 of its partners use the tools. Inflation comes from many places, but AI-adjusted nickel and dimming every last penny out of Americans’ pockets is one of the darkest sources I can imagine.

The findings were supported by writer Derek Kravitz, Angel Han, and Alan Smith of Consumer Reports; Lindsay Owens and Katie Wells of Groundwork Collaborative; and Eric Gardner of More Perfect Union. Statistical analysis by Debasmita Morgan and Nayeon Kim for Consumer Reports. Data visualizations by Evan O’Neil.

SPONSORED

The Newsletter Wall Street Hopes You Never Find

Wall Street has built an empire on investor ignorance. They sell “diversification” while feeding you old, recycled strategies.

With the H.E.A.T. Formula we show you what they won’t say out loud:

That most portfolios are sitting ducks — and your advisor probably doesn’t know it.

You’re not just reading a newsletter. You’re joining the side that sees the game for what it is — and knows how to play it.

The H.E.A.T. Formula is a radically different way to look at investing your portfolio.

👉 Click here to get the one newsletter Wall Street prays you never find.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Treasury Bond Yields Are Not Following The Doctor’s Orders 🫢

Back to the market, it was red after a bond sell-off triggered by an unexpected rise in Treasury yields. Bond investors are spooked by the Fed's cautious language and the underlying inflation risks, even though a cut should ya know… lower rates.

Hawkish Rhetoric and Fed Caution: The market focused on the "hawkish message" delivered by Federal Reserve Chair Jerome Powell and other officials. Powell hinted that the bar for further rate cuts is now much higher.

Comments from officials like Cleveland Fed President Beth Hammack further spooked the market. Hammack, who will be a voting member next year, indicated she would prefer a "slightly more restrictive stance" for monetary policy, arguing that inflation remains too sticky and stuck near 3%.

Long-term yields are most sensitive to inflation expectations and government debt supply. The market is demanding a higher premium to hold long-term debt because of lingering concerns about that sticky inflation number, and the omnipresent threat of massive Government debt.

The poor sap that has to worry about all of this after Powell finally steps down in May is also still up in the air, according to new comments Friday.

President Trump said the next Federal Reserve Chair remains unsettled, naming former Fed governor Kevin Warsh as his current top choice, while National Economic Council Director Kevin Hassett remains firmly in contention.

“Yes, I think he is. I think you have Kevin and Kevin. They’re both… I think the two Kevins are great,” he said in a WSJ interview.

The President used the announcement to voice his strong belief that the Fed should pursue aggressive rate cuts, stating he would like interest rates to be around 1% or lower within a year. He argued this is necessary to reduce the cost of financing the U.S. government's roughly $30 trillion in debt. Trump also suggested that the next Fed Chair should consult with the White House on rate decisions, with little room for Fed Independence.

The candidates he favors seem ripe for that arrangement. Warsh served as a Fed governor from 2006 to 2011 and is known to favor lower rates, while Hassett, a key economic advisor to Trump since 2017, has also been seen as a front-runner.

INDUSTRY NEWS

Trump Eyes Executive Order to Reclassify Marijuana 🚀

President Donald Trump is reportedly moving forward with a potential executive order to reclassify marijuana from a Schedule I drug, the same category as heroin, to a less restrictive Schedule III substance.

This would signal that the drug has an accepted medical use and a lower potential for abuse, significantly easing federal barriers to research and access. The discussions included House Speaker Mike Johnson, Health Secretary Robert F. Kennedy Jr., and CMS chief Mehmet Oz, with an executive order possibly being signed as early as next year. It’s a true ‘buy the rumor’ event.’

This development sent marijuana stocks surging, with Tilray Brands $TLRY ( ▲ 4.9% ) shares shooting higher Thursday, pushing the Stocktwits sentiment to "extremely bullish."

POPS & DROPS

Top Stocktwits News Stories 🗞

Oracle denied data center delay after shares slid.

Abveris stock plunged after delayed audit filing.

Trump moves to reclassify marijuana, boosting the weed industry.

Fermi America shares plunged after losing $150M in funding.

Broadcom received analyst approval, despite tanking shares.

Trump's 'Core 5' Club is top-tier donor group backing presidency.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

DTCC, Ripple, Tether & JPMorgan: Crypto Adoption Just Leveled Up

MEME MACHINE

Responsible Mining?

Michele Steele sat down with Eric Desaulniers, Founder, President, & CEO of NYSE $NMG ( ▲ 4.63% ) to discuss the critical importance of graphite, NMG's unique vertical integration strategy in Quebec, and the company's business outlook for the booming battery market.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋