CLOSING BELL

BUCKLE UP 💺

The market climbed after a two-day pullback, digesting a fresh three-week trade pause. Bitcoin hit a fresh high, Nvidia became the first firm to break the $4T valuation mark, and warnings of high levies did little to slow down equities.

Delta Airlines earnings are finally coming tomorrow, the precursor to the true start of the earnings season. With the market reaching records even without fresh revenue reasons to rise, you better bet it will be a fun ride, so buckle up, buttercup. 👀

Today's issue covers: Nvidia breaks through $4T, FOMC is confused while Trump looks at Powell’s Replacement, and more. 📰

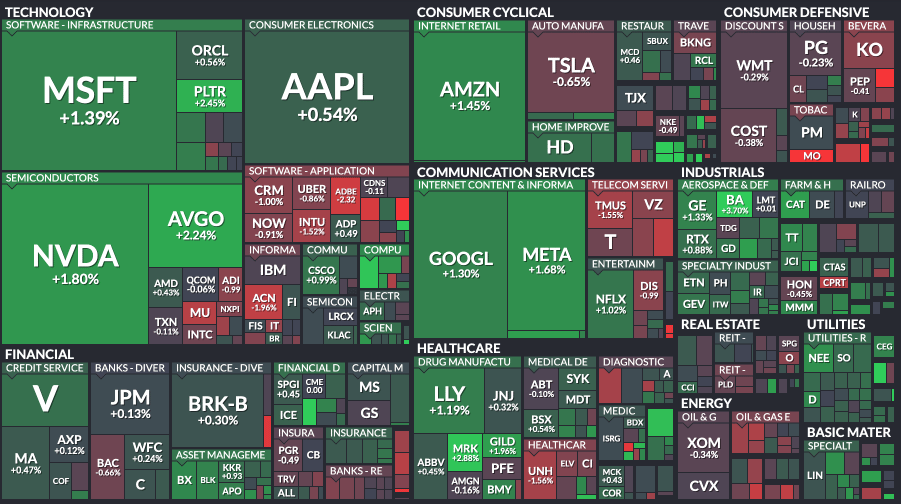

With the final numbers for indexes and the ETFs that track them, 8 of 11 sectors closed green, with utilities $XLU ( ▲ 0.38% ) leading and staples $XLP ( ▼ 1.05% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,263

Nasdaq 100 $QQQ ( ▲ 1.36% ) 22,864

Russell 2000 $IWM ( ▲ 0.56% ) 2,252

Dow Jones $DIA ( ▲ 0.58% ) 44,458

STOCKS

Nvidia Becomes First Firm To Reach $4T 💾

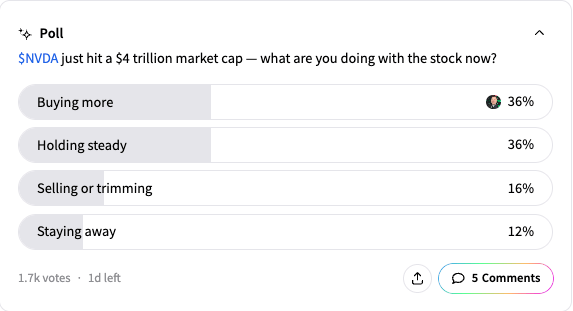

Nvidia became the most valuable public company after hitting a $4 trillion market cap, surpassing Apple’s record as investors double down on AI chip demand.

The price tag put Nvidia at a higher total valuation than nearly half the S&P 500. 👀

In total, tech stocks make up a third of the S&P 500’s value, and the top seven, including Amazon, Broadcom, Microsoft, Meta, and both Googles, make up a third of the weighting.

Nvidia might have company at the top soon: Microsoft is at $3.7T, and Apple is at $3.15T. The firm closed below the record at just $3.97T or so, sitting up 15% in the past month, and 22% in 3035.

Stocktwits Users are back to ‘bullish’ on the stock

SPONSORED

Bitcoin ATM Market Leader Delivers Strong Q1

Bitcoin Depot (Nasdaq: BTM) is the world’s largest Bitcoin ATM operator, leading an industry primed for exponential growth — and their Q1 financials show some strong momentum:

Revenue up 19% YoY to $164.2M

Q1 net income up to $12.2M (from prior-year loss)

Adjusted profits up 92% YoY to $33.1M

The best part? Bitcoin Depot’s growth has historically been driven by Bitcoin ATM usage, not Bitcoin’s price.

The above is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation, or solicitation to buy or sell a particular financial instrument. Bitcoin Depot is not a registered investment adviser under the U.S. Investment Advisers Act of 1940. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by Bitcoin Depot to buy or sell any securities or other financial instruments

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

… EXCEPT DEATH AND TARIFFS

Another Day, Another List Of Levies That Someone Might One Day Pay 🛒

On the closing day of the 90-day pause, the president announced a slew of new tariff warnings for smaller countries on Wednesday, following letters sent out this week. The market seemed chipper in the face of slightly lower numbers and the three-week pause deadline. Here’s a quick look at the tariffs announced today and this week:

50% on Brazil

30% tariffs on Sri Lanka, Algeria, Iraq, and Libya. Of this group, Iraq exporter the largest dollar amount of goods to the U.S., about $7.5B of mostly crude oil.

25% tariffs Moldova

20% tariffs on all goods from the Philippines, the largest exporter of Wednesday’s list, at about $14.2B, according to the Census Bureau.

Wednesday’s letters for new trade numbers brought the week's total to 22 nations, with the largest traders being Japan, South Korea, Thailand, Malaysia, Indonesia, and South Africa, all taxed at rates of about 25-36%. The Wall Street Journal reported that Trump only implemented this ‘final’ three-week pause on behalf of Treasury Secretary Bessent, who was eager to secure deals with India and the EU.

SPONSORED

IQSTEL, Inc. (Nasdaq: IQST) $IQST ( ▲ 2.09% )

$101.5 Million Preliminary Net Revenue for Jan-May 2025 Puts AI Telcom Leader On Track to Meet $340 Million Annual Forecast:

IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

IQST Has Organic Growth, Acquisitions and High-Margin Product Expansion.

New IQST Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

IQST and CYCU Announce the Advancement of Their Strategic Partnership to Serve the Global Cybersecurity Market with AI-Powered Platform.

$IQST and $CYCU are launching “Cyber Shield,” a white-label cybersecurity platform that major telecom carriers can offer to their own customers

For more information on $IQST visit: www.iQSTEL.com

Disclaimer: https://corporateads.com/disclaimer/ Disclosure listed on the CorporateAds website *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Rhythm Pharma surged after its obesity drug Bivamelagon showed significant BMI reduction in brain-injury-related cases, prompting plans for a late-stage trial. Read more

Plug Power jumped 23% after signing a multi-year hydrogen supply deal through 2030, aiming to cut costs and boost network efficiency. Read more

Perplexity AI has launched its AI-driven browser Comet in a challenge to Chrome, blending conversational search, analysis, and task execution into a single workflow-focused experience. Read more

Linda Yaccarino stepped down as CEO of Elon Musk’s X after two years, citing progress on advertiser trust and platform transformation amid deepening ties with xAI. Read more

Boeing rallied to a 15-month high after Susquehanna hiked its price target and Thai Airways flagged a possible jet order amid tariff deal negotiations. Read more

Meta reportedly acquired a 3% stake in EssilorLuxottica to bolster its smart glasses push and may increase holdings to 5%. Read more

Aehr slumped 12% after its CEO warned of tariff-driven order delays, despite optimism around new AI processor testing opportunities. Read more

Merck will acquire Verona Pharma for $10 billion to add the COPD drug Ohtuvayre to its expanding cardio-pulmonary pipeline. Read more

Estee Lauder climbed after Wells Fargo raised its price target by $30 on signs of a sales recovery in China following years of sluggish demand. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS RETAIL RADAR

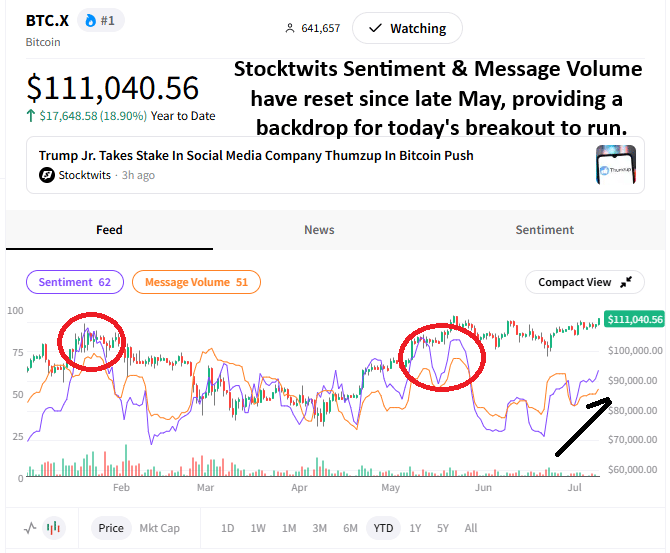

Retail Sentiment Reset Supports Bitcoin’s Breakout ($BTC.X) 🧐

Bitcoin broke out to fresh all-time highs today, begging the question of whether this is the real deal or a fakeout. Stocktwits Sentiment and Message Volume suggest there’s room to run, and platform chatter shows retail sticking with the trade.

When prices become extended and one side of the trade becomes too crowded, it can be difficult for a trend to sustain itself in the short term. The last two times Bitcoin peaked above $100,000 (February and May), Stocktwits Sentiment and Message Volume were in “extreme territory,” leaving little room for the next marginal buyer. 😬

When Bitcoin reached $110,000 in May, it had already experienced a 50% rally off its April lows in just six weeks, making it difficult for bulls to get on board. Now, with prices resetting at this higher range, it’s clear to buyers they won’t be getting a bargain at lower levels. This clean technical setup gives them the confidence that they’re buying a fresh breakout rather than chasing a long-in-the-tooth rally. Sentiment moving into ‘Bullish’ territory today quantifies their enthusiasm. 👍

From both a sentiment and technical perspective, the recent reset is being viewed by traders as a healthy development. Today’s breakout to new highs and strength in the altcoin market suggest risk appetite remains strong and that the Stocktwits community is looking for the next leg of Bitcoin’s rally to begin. 📈

Add $BTC.X to your watchlist to monitor this development. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto. 🔓

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in Bitcoin as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

POPS & DROPS

No One Will Be Seated During The FOMC Minutes Reading 💤

The Federal Open Market Committee released its meeting minutes for the June rate decision on Wednesday. It recorded another unanimous vote to keep rates in place, but the individual dot projections and comments paint a more detailed picture.

Most of the 19 members present agreed that it was a great idea to cut rates this year and expected tariff price pressures to be temporary and moderate. Tariffs smariffs, I know, but Fed Chair Jerome Powell has said that without the admin’s fun excursion into international trade, the FOMC would have already lowered rates.

Some members said they could see cuts in June, and some saw July as a perfect time to cut. Seven members saw the current rate as pretty close to the legendary ‘neutral’ level, or one that enables great economic conditions without major downsides.

That means seven members saw no cuts for the rest of the year, while 10 saw at least two. In the face of these worries, economic data has not shown trade-based price inflation: last month’s CPI prices climbed 2.8% YoY, matching a four-year low. The Fed’s favorite PCE inflation indicator rose 2.4%, just 0.1% MoM. Even in inflation terms, that’s really close to the 2% goal.

That’s why Trump has called for Powell’s removal and today called for 3 points of rate cuts. He said that Powell is directly costing the U.S. taxpayer $1T by keeping rates high.

The race is on

In the running for Powell’s replacement are three or four close allies, according to the president, and one is Treasury Secretary Bessent. The other two, reported by the Wall Street Journal, are both named Kevin. Kevin Warsh is a former Fed governor, and Kevin Hassett is a trade advisor and frequent TV interviewee who regularly explains Trump’s decisions.

The worry, as always with succession, is that markets will freak out if the Fed looks more like a political organization with hand-picked order followers. Elections are cool and all, but the bond market is serious business and will accept nothing but independent.

Bessent said last year the president could attempt to choose a replacement early to sort of force the Fed’s hand with future policy decisions.

Bessent told Barrons in October, “You could do the earliest Fed nomination and create a shadow Fed chair. No one is really going to care what Jerome Powell has to say anymore.”

Besides the fact that Bessent catches breakfast with Powell once a week, and must make for awkward talk over eggs, it also could look like a scary political move. Still, Powell was selected long before the due date on Janet Yellen’s term, and no one freaked out.

And depending on the party you ask, the FOMC’s decision to lower rates in the lead up to the election last year was political. Just ask Hassett, who in June said the current Fed tried to help elect Harris with their rate cut.

Of course, last fall, Hassett said the move was a great idea, but that type of TV reframing could be what the White House is looking for. 🎥

Links That Don’t Suck 🌐

Get In Touch 📬

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋