NEWS

Chat, Are we Cooked?

Friday is usually a calm day to review the week’s accomplishments and gracefully usher in the weekend. Instead, the day started with an intercontinental tariff missile response from China, and equities ended the session with one of the worst weeks for the S&P 500 since 2020. 💣

Speaking of 2020, the VIX volatility index is at its highest since Covid. The carnage is not over yet, and depending on who you ask, it might get worse before it gets better. Looking at you, Powell. 👀

Today's issue covers Powell’s response to Trump’s tariffs, China’s returning salvo, and the industries hit the hardest. 📰

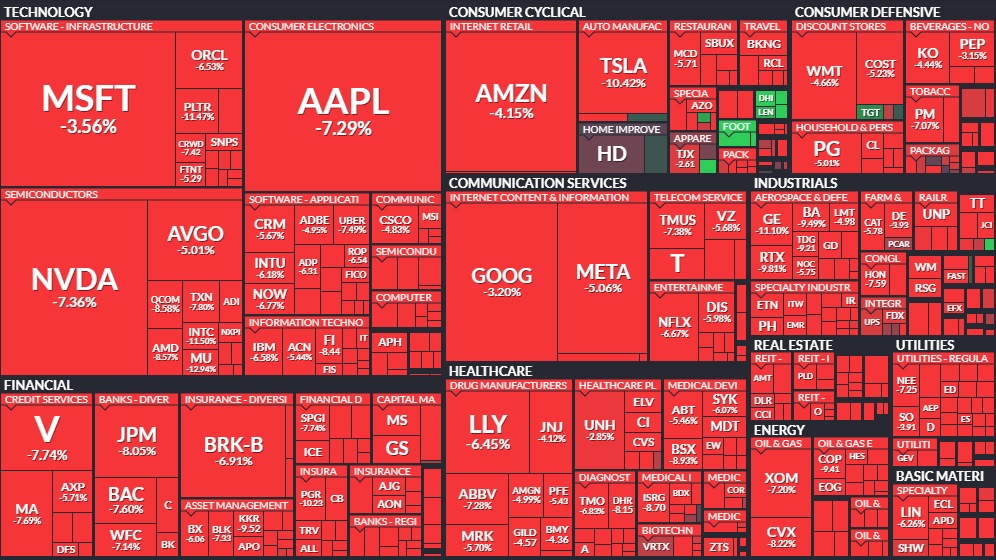

Here’s the S&P 500 heatmap. All sectors closed in the red, with real estate falling the least (-2%) and tech (-13%) lagging.

And here are the closing prices:

S&P 500 | 5,074 | -5.97% |

Nasdaq | 15,588 | -5.82% |

Russell 2000 | 1,827 | -4.37% |

Dow Jones | 38,315 | -5.50% |

STOCKS

Are we ‘Cooked’? Powell Responds 🐻

If there is one voice of reason, it is found in the eternally calm voice of Federal Reserve President Jerome Powell. Placed in office by Trump during his first term, Powell has overseen the most aggressive rate hikes in a generation to combat the worst spike of inflation since the start of the new millennium. 📆

Right before noon, Powell spoke at an Arlington, Va., conference for business writing and editing. He offered a remarkably frank and hawkish take on the tariff situation: We are in for pain, and the FOMC may not be able to do anything but watch for now.

Source: WSJ Live Coverage

He said he understood the desire for more economic progress despite the relatively low unemployment rate and the outsized progress toward combating inflation enjoyed by the U.S. compared to the rest of the world. 🌎

"People are still experiencing that higher price level- prices are not going to go down," Powell said. "Unemployment is low, and the economy is doing well, but the price increases of the past few years are weighing on people's budgets."

Still, he said that the higher-than-expected tariffs will likely increase inflation in the short term. One journalist quoted a business owner, looking for a reaction: "If there is a hint of a recession, we're cooked."

Powell said he does not make forecasts for recession at the Fed: "Uncertainty is high, tariffs are higher than almost anyone forecasted, but we still don't know the effects."

He added, "Inflation will be moving up, growth will be slowing," and that the Fed was in no hurry to move rates. One journalist said out loud, "Really?" 🤔

Powell said it wasn’t clear what the path of monetary policy would be to address the new terms of engagement, but if one-time tariff price increases started looking like long-term inflation, they would have to act.

He might be right, given the high volatility: the market is still pricing in what tariffs mean. Friday, the SPY S&P 500 tracking ETF saw its third-biggest day ever. According to Eric Balchunas, Senior ETF Analyst for Bloomberg, anything over $60B in volume is what he calls “big fear.” 😱

On Friday morning, Trump had a stated goal of convincing Powell it was time to cut rates, and the CME FedWatch futures tracking tool priced in four 25 bp rate cuts for the remainder of the year, twice the FOMC’s March estimates of two cuts.

Trump also reposted a TikTok message claiming he was purposely crashing the stock market. The message claimed Warren Buffett supported the move, which Berkshire Hathaway responded to with a statement: No, he did not. ⚔

COMPANY NEWS

China Responds with Tariffs, But Vietnam Might Dodge Thiers 😕

China responded Friday morning with increased tariffs of its own: 34% on all imported U.S. goods. It sent the market into mayhem. Industrial goods, leisure and travel, and oil began to tank.

According to CNBC, the U.S. imported $438B in goods from China last year and exported about $143B— let’s say $581B total in USD. If nothing changes, our combined levies would add ~$281B to the sum, meaning everything we trade will cost 150% this year. 😨

Chinese-related trade assets began to fall, including trade partner currencies. Chinese ETF KTEC fell 8%. AUD/USD fell 4%, and Copper ETF COPX fell 10%. Airlines fell 5%, led by Southwest and Frontier.

Oil futures were hit hard, falling 6% on Friday and -10 % for the past week, sending them back to prices last seen in 2021. OPEC+ did not help the situation, deciding Thursday to triple its planned output hike for May in a deliberate effort to lower prices. 🛢

Trump posted on Truth Social that China had made a mistake. He championed productive calls he had made with Vietnam Friday morning, claiming they wanted to do anything they could to bring their tariffs down to zero.

Nike, a firm that employs more than 400,000 workers in Vietnam, went from -5% to up 3% for the day. ◀

Financial service firms were hurt in an outsized way by Friday’s market negativity. The earnings season always starts with a heap of financial service and massive bank reports, and this quarter, it looks like the market is rapidly trying to adjust its expectations.

JPMorgan shares fell more than 7% on Friday after a price cut from Truist Securities. Truist analysts said in a note that they expect lower interest rates and slower economic growth to hurt JPM’s forward guidance, which is due one week from now. It was joined by Goldman Sachs, Morgan Stanley, Citigroup, Bank of America, Wells Fargo, and Blackrock. 🏦

Source: Bloomberg Television

Even planned IPOs for firms that are not publicly traded yet were suffering. Due to the shaky market environment, WSJ reported that Klarna, StubHub, and four other firms would delay their IPOs. 💵

STOCKS

Other Noteworthy Pops & Drops 📋

JPMorgan Chase (JPM -7%): North America’s largest bank tumbled after Truist Securities cut its price target on the stock to $264 from $268.

Toyota (TM -6%): The Japanese automaker dipped on a Nikkei Asia report that the company’s North American subsidiary has offered to help local auto parts makers with rising costs associated with a 25% tariff on some auto parts taking effect May 3rd.

Stellantis (STLA -4.8%): Jeep’s brand owner fell following reports that the company plans to extend its employee discount program to the broader public on most models.

Tesla (TSLA-10%): The EV maker fell 10% after industry data showed that UK sales rose to their highest level in March but that their market share in the region fell.

(QQQ -6%), (SPY -6%): U.S. President Donald Trump wasted no time in responding to Federal Reserve Chair Jerome Powell’s warnings. In a post on Truth Social following Powell’s speech, Trump called on the Fed to cut interest rates immediately, furthering the major indexes’ declines.

PRESENTED BY STOCKTWITS

The Weekend Rip: Capitulating With Ben & Emil 😱

Markets are crashing, vibes are weird, and Ben is coping the only way he knows how—by oversharing.

Here’s a rundown of today’s can’t-miss episode:

Buffett’s “Never Bet Against America” legacy (and maybe his life) is on the chopping block. 🧓

A dumb typing contest turns existential. ⌨

Markets drop hard; Ben’s portfolio drops harder. 📉

Brian Shannon says: buying now = fighting the trend. ⚔

Newsmax IPOs and Ben misses the trade of the week. 🙃

COMMUNITY VIBES

One Tweet To Sum Up The Week 😢

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋