Presented by

CLOSING BELL

Days Since Semiconductor News: 0

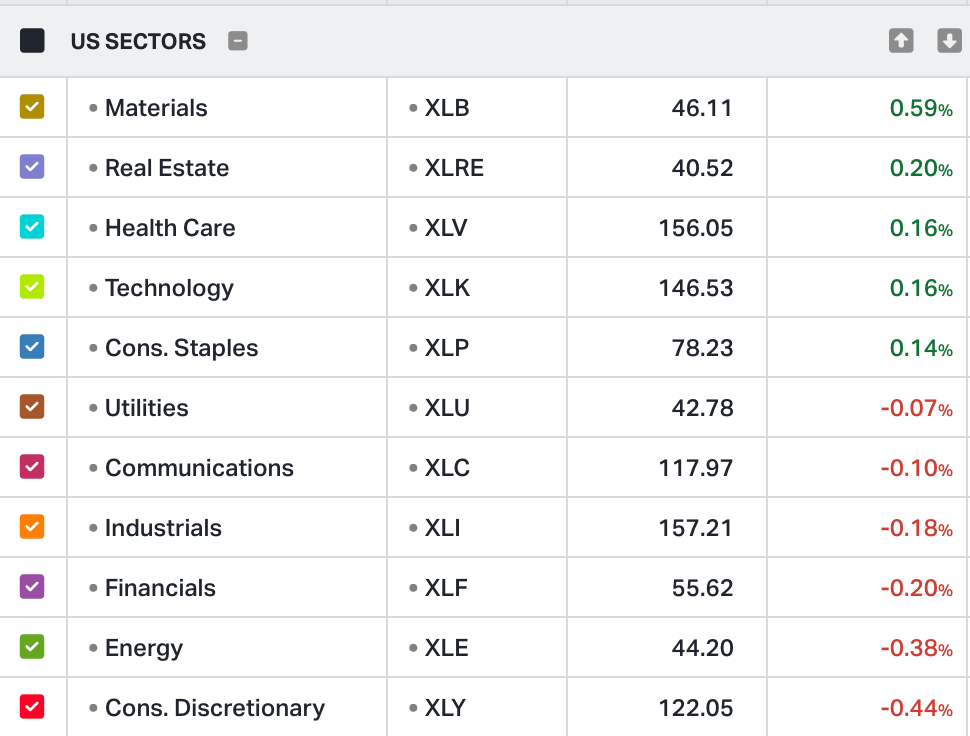

The market was doing its best to keep its head above water on a low volume Christmas hangover Friday.

Prices started the day in a good place, at Chrsitmas eves half-day record highs, and though little changed Friday, metal prices made up for the action with fresh records of their own. Each index gained more than 1% in a short holiday week.

Gold spot prices climbed nearly to $4,550, and silver broke $76/oz. Copper was over $12,252/ ton, about $900 away from the record hit over the summer. It’s flush times for defensive materials stock buying. High labor market stress, sticky 3% inflation, and calls for rate cuts meet a reality of a pessimistic but credit card-wielding, retail-buying, therapizing consumer. No one beats the U.S. consumer. 🛍

Semiconductors were making news again, after Nvidia bought out, (but sortof diddnt buy out) an unheard of startup called Groq that makes the part of AI chips that do all the thinking.

💫 I hope everyone is having wonderful, safe, and successful holidays. 💫

DEAL NEWS

Nvidia Secures $20B Groq Deal to Dominate AI Inference Market

We are back from the holiday, and the big news isn’t a merger -- it’s Nvidia’s "acquisition but not acquisition" sortof buy out merger with an AI chip startup, Groq.

Nvidia is paying $20B in cash for ‘assets’ in Groq, which includes CEO Jonathan Ross, and President Sunny Madra. Other senior leaders are joining the Nvidia team, according to a blog post, though the startup will continue as an independent company led by CFO Simon Edwards.

Who ever heard of Groq in the first place?

It’s still flush times for AI startups, even if big names like Oracle are paying for it. Startups are taking full advantage of astronomical CapEx spending pledges from the largest tech firms in the world. The startup was valued three months ago at just under $7B in a funding round, and virtually sold for three times that amount Wednesday.

Bank of America described the transaction as "expensive but strategic," comparing its potential impact to Nvidia’s 2019 acquisition of Mellanox.

BofA and Baird both reiterated "Buy" and "Outperform" ratings today with a price target of $275. Analysts note that while Nvidia dominates AI training with its GPUs, the Groq deal provides the specialized hardware needed to lead in real-time AI "thinking" otherwise known as ‘inference.’ 🚀

SPONSORED

Double the Current: Next-Gen Energy Meets Leveraged Trading

Every AI model running in a data center has a voracious appetite for electricity, forcing suppliers to innovate.

Traders bullish on energy disruptors use Tradr ETFs to seek 200% daily leverage on four big names in this space – without the complexity of margin accounts or options strategies:

Tradr 2X Long SMR Daily ETF (Cboe: SMU) – targets NuScale Power (SMR), pioneer in small modular reactors (SMRs).

Tradr 2X Long CEG Daily ETF (Cboe: CEGX) – targets Constellation Energy (CEG), leader in nuclear and clean energy generation.

Tradr 2X Long GEV Daily ETF (Cboe: GEVX) – targets GE Vernova (GEV), powerhouse in grid solutions, renewable energy and gas power.

Tradr 2X Long ENPH Daily ETF (Cboe: ENPX) – targets Enphase Energy (ENPH), which develops advanced solar microinverters and energy storage.

Try Tradr for amplified exposure on SMR, CEG, GEV or ENPH.

Disclaimer: Visit the Tradr ETFs website for an explanation of leveraged ETFs and their significant risks. www.tradretfs.com.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TRENDING NEWS

Semi-Tech, Biotech, Bullion, and Share Splits, Oh My!

🚀 Tech and Semiconductors

AMD $AMD ( ▲ 8.77% ) : Shares are gaining traction after securing a major order from Alibaba for its MI308 chips, which are designed to compete directly with Nvidia’s H200. This win underscores AMD’s growing footprint in the Chinese cloud infrastructure market despite ongoing trade tensions. 칩

Micron $MU ( ▼ 0.7% ) and Samsung: Samsung is set to begin mass production of HBM4 memory in Feb. 2026 after reportedly passing Nvidia's qualification tests. This move puts pressure on Micron as the industry races to supply Nvidia's next-gen "Vera Rubin" platform and Google’s TPU clusters. 💾

Coupang $CPNG ( ▲ 0.05% ): South Korea’s e-commerce giant is rebounding after clarifying that a recent data breach was far less severe than feared. The company successfully recovered leaked data from a former employee, confirming that only 3,000 accounts were actually compromised rather than the 33M initially discussed. 📦

🏥 Biotech and Healthcare

Biohaven $BHVN ( ▲ 2.42% ) : The stock tumbled 14% following a disappointing update from its Phase 2 study of BHV-7000 in major depressive disorder. Investors are recalibrating expectations for the drug's proof-of-concept as the company navigates a crowded psychiatric pipeline. 💊

Adicet Bio $ACET ( ▲ 6.21% ): Shares are hitting new all-time lows as the company announced a reverse stock split to maintain listing requirements. The move reflects ongoing capital concerns for the micro-cap biotech firm. 📉

🛍️ Retail and Consumer

Target $TGT ( ▲ 1.92% ) : Shares are on watch following reports from the Financial Times that an activist investor is building a significant stake in the retailer. The move comes as Target struggles to regain its "cheap-chic" momentum and improve margins compared to rivals like Walmart. 🎯

Precious Metals: Gold and silver extended their holiday gains this morning as investors continue to hedge against 2026 fiscal uncertainty. The "hard asset" rally remains one of the most consistent trends of the fourth quarter. 🥈

📊 Micro-Caps and Splits

Reverse Splits: Two notable adjustments as Assertio $ASRT ( ▼ 0.83% ) implements a 1-for-15 split and RB Global $RBNE ( ▲ 0.88% ) executes a 1-for-5 split.

Sidus Space $SIDU ( ▲ 3.45% ) : The stock is trending as it approaches the $3 level following the successful closing of its secondary offering. Traders are monitoring the ticker for volume-driven volatility in the final sessions of the year. 🌌

POPS & DROPS

Top Stocktwits News Stories 🗞

Sidus Space climbed 24% as retail bullishness continues a monthly surge.

John Deaton warned against rewriting history in Caroline Ellison's release.

Micron tripled in 2025 due to surging AI memory demand.

Tom Lee endorsed a viral 4chan prediction for crypto in 2026.

Bitcoin held below $90k ahead of record options expiry.

Tim Cook showed early insight into Nike's potential before Wall Street.

STOCKTWITS VIDEO

Prediction Markets & How Platforms Are Reshaping Investing | The Howard Lindzon Show

It’s a holiday edition of The Howard Lindzon Show with Michelle Steele, and the conversation spans everything from the Degenerate Economy Index to the future of prediction markets, regulation, and Gen Z’s relationship with risk.

Links That Don’t Suck 🌐

💰 Powerball winner for $1.817 billion jackpot bought lucky ticket in Arkansas. Here are the numbers.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋