CLOSING BELL

Did Anyone's Earnings Not Suck Tonight?

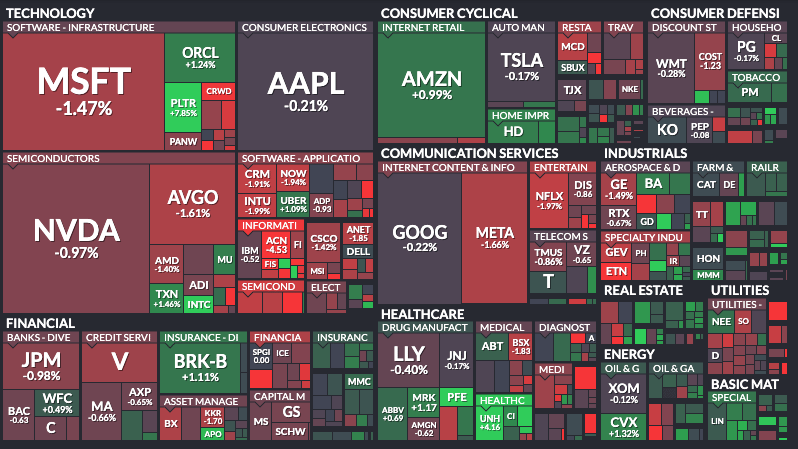

The market fell Tuesday after a post-weekend turnaround that turned out too weak to push prices higher on day two. It felt like Tuesday was more cautious with trade deals up in the air, with the anti-Russian oil tariffs arriving soon, high pharmaceutical levies on the horizon, and the upcoming China trade deal yet to be announced.

After-hours reports were rough, across tech and semiconductor firms that fell after posting results that were not up to snuff. Maybe Wednesday trade will be better. 👀

Today's issue covers AMD earnings were not enough, but it had friends falling with it Tuesday afternoon, and more. 📰

With the final numbers for indexes and the ETFs that track them, 4 of 11 sectors closed green, with materials $XLB ( ▲ 0.76% ) leading and utilities $XLU ( ▲ 1.11% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,299

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,301

Russell 2000 $IWM ( ▲ 1.09% ) 2,225

Dow Jones $DIA ( ▲ 0.78% ) 44,111

EARNINGS

Tuesday Afternoon Trade Punished Imperfect Reports 🔨

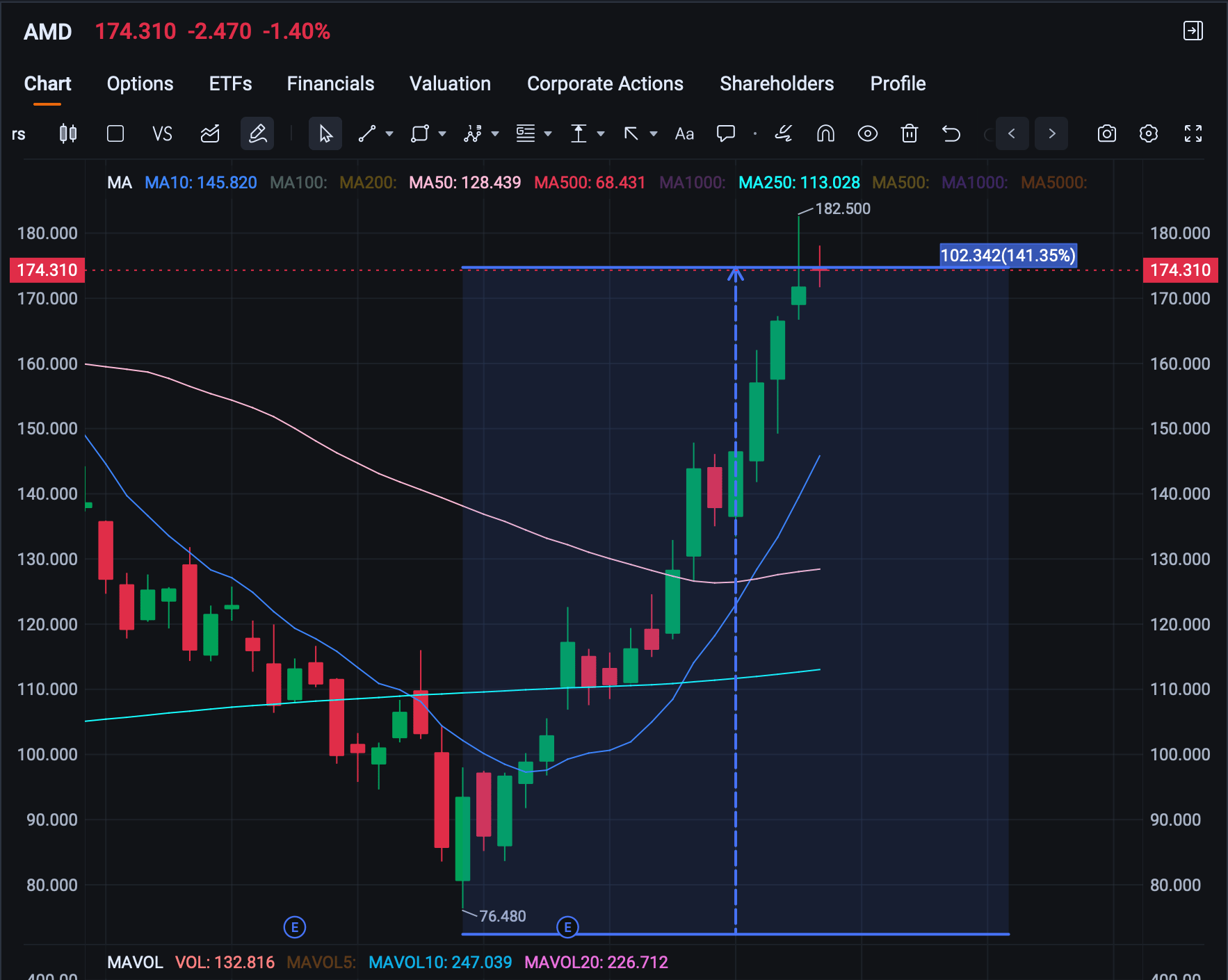

AMD fell after reporting results Tuesday, reporting adjusted earnings that were basically at analyst estimates. The semiconductor stock has been on a nearly 140% climb since an April low, and its close call to estimates might have pushed investors to sell.

AMD is up bigtime from April lows, but did that climb hurt Tuesday’s report trade?

AMD was down about 4%, posting a Q2 adjusted EPS $0.48, on revenue of $7.69B Analysts expected earnings of $0.48/share on revenue of $7.43B, according to FactSet. Bloomberg averages had a higher $0.49/share expectation.

“We achieved 32% year-over-year revenue growth and generated record free cash flow this quarter, reflecting our disciplined execution,” said Jean Hu, AMD EVP, CFO, and Treasurer. “Our strategic investments across hardware, software, and systems position us well to support robust future growth and drive long-term shareholder value.”

Granted, semiconductor stocks are on a tear and should expect trouble beating higher expectations, but the firm's looking guidance was also above range: $8.4B-$9B for the current quarter. Will investors worry that Nvidia, due to report later this month, will have expectations as high as this to beat for a stock gain?

Well, for one thing, the smaller chipmaker said its AMD M1308 AI chips were still banned in China, and expected an $800M loss. Nvidia, meanwhile, expects a $8B loss on its China-focused chips if trade rules do not change. 😱

SPONSORED

Galaxy (GLXY): Driving Crypto and AI Forward

Galaxy Digital (Nasdaq: GLXY) reported Q2 earnings today—its first since joining Nasdaq—and the momentum is clear: institutional adoption of crypto is accelerating. Relentlessly.

From trading and ETFs to lending and crypto treasury services, Galaxy is helping investors gain broader access, more choice, and deeper exposure to the digital asset economy.

But that’s not all. Galaxy is also building out one of the largest data centers in the North America, powering the future of AI and high-performance computing. This is where innovation meets infrastructure at scale.

Founded by famed macro investor Mike Novogratz, Galaxy continues to operate at the forefront of crypto, AI, and finance.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

This post, and the information contained herein, has been provided to you solely for informational purposes. Neither the information, nor any opinion contained in this post, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this post constitutes investment, legal or tax advice. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this post are the sole responsibility of the viewer. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) may have been obtained from published and non-published sources. Such information has not been independently verified. Galaxy Digital and its affiliates may buy, sell or hold investments in some of the companies, digital assets or protocols discussed in this post. Except where otherwise indicated, the information in this post is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

MORE EARNINGS NEWS

AMD Was Not Alone. SNAP, SMCI, And Rivian Fell After Hours 🙁

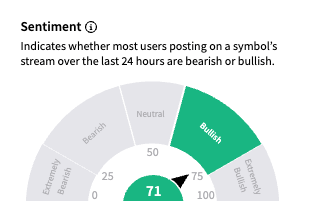

AMD was not alone. SMCI fell after it reported an all-around miss. Its Q4 EPS came in below estimates, and reported nearly $100M less in Q4 sales than analysts had hoped for. It trended to #1 on Stocktwits, and retail was still becoming bullish, despite a 16% drop.

SMCI Stocktwits sentiment was nearly ‘Extremely Bullish’

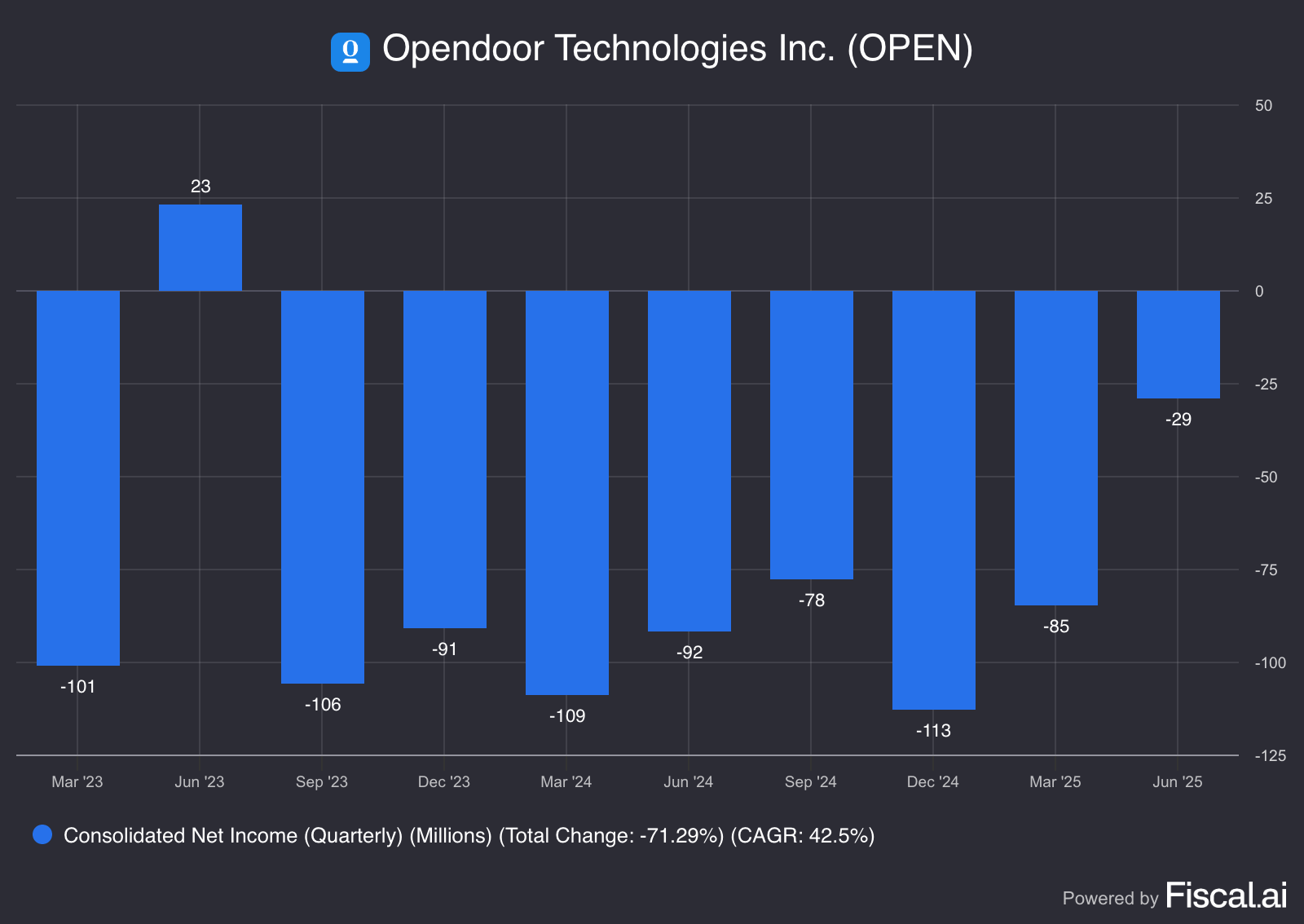

$OPEN ( ▲ 6.9% ), everyone’s favorite meme stock (or have you forgotten its one week of recent fame?) also dropped after reporting what everyone feared: the real estate home buying app is still not turning a profit.

Q2 revenue came in above estimates, at $1.6B, but Opendoor again posted a net loss, at -4C below what analysts, and a recent rash of retail investors, had hoped. The company has beaten analyst estimates for earnings per share in nine straight quarters, according to Benzinga, until Tuesday.

According to data from Fiscal.ai, net income at OPEN has turned around, but nowhere near the heights of June ‘23

$RIVN ( ▲ 1.07% ) fell after reporting a $1.12B loss in Q2. $LCID ( ▲ 5.09% ) was right there alongside its EV kin, falling after missing Q2 results and cutting its production forecast.

While we are talking about Tuesday reports, we have to mention $SNAP ( ▲ 0.81% ). Snapchat fell 15% after reporting it had shot itself in the foot. The social media company beat revenue estimates, but said its sales were blunted in Q2 after its advertising platform updates let major advertisers win contracts at heavy discounts.

The company reversed the changes, and also blamed trade war de minimis changes for hurting cheap product sales that are advertised on Snapchat. Together, the issues resulted in a $262M loss for the quarter.

It was not all bad, as Hinge Health $HNGE ( ▲ 4.32% ) climbed after reporting its first quarterly results since the firm’s IPO impressed. The company lost $13/share, but posted higher revenue than expected.

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Vertex Pharmaceuticals slumped 20% after revealing pipeline setbacks, triggering Wall Street skepticism despite a Q2 beat—retail traders now see a buying opportunity. Read more

BP doubles down on upstream oil projects after Q2 profit beat, citing strong execution and a major Brazil discovery; retail chatter surges 2,100% with sentiment firmly bullish. Read more

Tesla faces a class-action lawsuit from shareholders alleging securities fraud tied to robotaxi claims; retail message volume spiked 273%, but sentiment remains neutral. Read more

Caterpillar warns tariffs will squeeze full-year profit margins despite beating Q2 revenue estimates; retail message volume soared 1,150% as sentiment flipped to extremely bullish. Read more

Oklo hits a record high after reports that Trump-backed NASA plans could fast-track a nuclear reactor on the moon by 2030; retail sentiment turns slightly bullish despite lingering skepticism. Read more

OpenAI releases two open-weight AI models for deployment on Amazon’s AWS via Bedrock and Sagemaker, marking its first public release in over five years; retail sentiment is neutral on OpenAI but extremely bullish on Amazon. Read more

Pfizer surged 5% after beating Q2 expectations and raising guidance, as its CEO reveals active talks with the Trump administration on reducing U.S. drug prices and managing tariffs; retail sentiment shifts sharply to extremely bullish. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

TRADE

Days Since No Trade Policy Changes (0)

Relegated to the bottom of today’s issue, for the very reason that it has become boring, here are trade and monetary policy updates from the White House:

Trump warned of a 35% tariff on EU goods and confirmed a “substantial” hike for India within 24 hours, with pharma tariffs possibly reaching 250%. Read more

Trump confirmed four finalists to replace Fed Chair Powell, excluding Treasury Secretary Scott Bessent, who declined consideration. Read more

U.S. trade deficit dropped to $60.2 billion in June, beating forecasts as Trump’s tariffs triggered a sharp decline in goods imports. Read more

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Crude Oil Inventories (10:30 AM), FOMC Member Daly Speaks (12:45 PM), 10-Year Note Auction (1:00 PM). 📊

Pre-Market Earnings: Walt Disney ($DIS), Shopify ($SHOP), Uber Technologies ($UBER), Aurora Cannabis ($ACB), and Novavax ($NVAX). 🛏️

After-Hour Earnings: Virgin Galactic Holdings ($SPCE), DraftKings ($DKNG), Beyond Meat ($BYND), Airbnb ($ABNB), and Occidental Petroleum ($OXY). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋