NEWS

Don't Watch the Mouth — Watch The Hands

Hannibal Buress Reaction - GIPHY

The market ended the week at a loss, falling slightly on Friday as investors try to price out the first trade deal with the UK, wait for trade talks over the weekend, and reason with a Federal Funds rate that is not changing any time soon.

President Trump said that he would not pre-cut tariffs on China, but today, he said that maybe 80% would be a better starting place, but we’ll have to wait and see what they up with. The UK deal was touted as a win, but nearly all imports from the UK will still see 10% tariffs. So much for the price of orange chocolates. 👀

Today's issue covers Google’s in hot water, and The Trade Desk loves it, what to expect from China talks, and more. 📰

Here’s the S&P 500 heatmap. 5 of 11 sectors closed green, with consumer discretionary (+0.48%) leading and health care (-1.09%) lagging.

S&P 500 Map - finviz

And here are the closing prices:

S&P 500 | 5,660 | -0.07% |

Nasdaq | 17,929 | flat |

Russell 2000 | 2,023 | -0.16% |

Dow Jones | 41,249 | -0.29% |

NEWS

Look Out, Google, The Sharks Are Circling The Mag Seven

There are signs the rest of the market is looking for any opening they can find into the trillion-dollar market cap club. The Mag Seven pulled the entire market higher in the past year, but firms feeling left out have to find a way in.

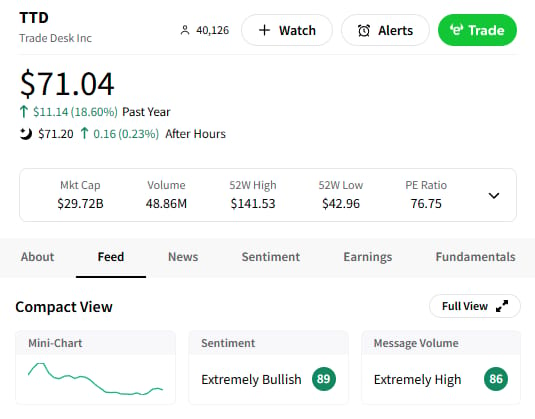

The Trade Desk $TTD ( ▲ 0.84% ) posted strong Q1 results, with EPS of $0.33, beating the expected $0.25, and revenue of $616 million, exceeding the forecast of $575.31 million. Despite the beat, the company guided for $682 million in Q2 revenue, reflecting 17% YoY growth, which is lower due to the absence of political ad spend. Still, the advertising technology firm stands to win big depending on a court case attempting to break up its largest rival $GOOG ( ▼ 0.01% ).

Trade Desk Chief Jeff Greene, a long-term Google critic, said on the company’s call that Google’s focus has long shifted toward YouTube and AI search, and ‘open internet’ searches have become far less important.

“I'm confident that one way or another, Google will exit the open Internet. If you think about it, most of their antitrust and regulatory problems come from how they managed the open Internet in the past,” Greene said. “I think Google will leave a very big hole eventually, which is a big opportunity for the rest of us in the open Internet.”

Greene said Google has been the biggest block to the internet supply chain, but he expects it to change this year or next.

Google recently faced a major shake-up. In a massive antitrust trial that wrapped up Friday, the firm was ordered to share its advertising and search data and stop the practice of implementing deals that pay for its engine to show up in tech products, like Apple’s Safari. The District Court of Virginia, in United States et al. v. Google, found the internet giant violated antitrust law by monopolizing the open-web digital advertising markets.

Trade Desk Inc - Stocktwits users are ‘extremely bullish’

SPONSORED

StartEngine: One Check, Exposure to Dozens of Pre-IPO Companies

StartEngine is the platform allowing accredited investors to gain exposure to some of the world’s most coveted private companies— without paying millions.¹

But it’s not just access: StartEngine is also a smart diversification play. Why?

StartEngine has a 20% carried interest in some of its Private pre-IPO offerings. That means their success (and potentially yours, too) is tied to the success of these companies.²

So your upside can grow with some of StartEngine’s best offerings— like Series for OpenAI, Perplexity, and Databricks.¹

So, how do you get involved? By becoming a shareholder in StartEngine. The window is open (but closing soon) for you to join over 45,000+ who have invested $84+ million in StartEngine to date. Get in on the action before this round closes in June.

1. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. This is offered only to accredited investors per regulation D rules.

2. StartEngine receives a small percentage of equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. Fees are subject to change. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that StartEngine will be profitable. To understand the impact on margins, see financials.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TARIFF TALK

What To Expect When You’re Expecting

Trump said he was thinking about 80% tariffs on China, in a last throwaway comment before he escaped to play golf for the weekend while Treasury Secretary Bessent goes to work (hopefully) negotiating trade deals in Switzerland.

Earlier this week, Trump said he would not bring down tariffs at all before the meeting. Of course, both the U.S. and China have already lowered their initial salvos of tariffs, about a quarter of the way lower.

Columnist David M. Drucker wrote in Bloomberg this week, he has learned to survive as a political columnist by not listening to what Trump says.

Don’t watch the mouth, watch the hands.

So, learning from the UK deal, what can the market expect from Bessent bickering near Basel?

Well, Trump and the UK developed more of a proto deal- it still has 10% tariffs, besides on metals and the first 100k Aston Martins. On the positive side, Columnist Allison Schrager said the agreement eliminates Non-Tariff Restrictions, or NTBs. The UK agreed to fast-track U.S. goods through customs, and that’s a win for both nations.

The IMF estimated that eliminating NTBs with all of the EU would increase trade by up to 5%. Maybe if China and the U.S. talks start similarly, the two nations can take down trade barriers? Though in tariff warfare, with two sides separated by trenches 145% and 125% wide, 5% would not go very far. Based on last year’s numbers, trade between the U.S. and China amounted to $582B. Under current tariffs, it would cost $1-$1.5T to trade last year’s goods.

Fed speak

Federal Reserve Governor Michael Barr warned that recent tariff increases could lead to higher inflation and slower economic growth, citing disruptions to global supply chains. He emphasized that small businesses may face the greatest challenges, as they struggle to adapt to shifting trade policies and rising costs.

More Money More Problems

In other news about money, Trump said he supported raising taxes on the rich by a little, as his party explored ways to pay for the hefty “Big Beautiful Bill” they are writing in Congress. The current rate of top income earnings is 37%, and Trump told Speaker Johnson to consider raising it back to 39.6%. The GOP aims to cut trillions in taxes with tax breaks, both old and new, like the proposed cuts to overtime taxes. If they fail to find a way to pay for it, everyone loses, and we all get tax increases.

STOCKS

Other Noteworthy Pops & Drops 📋

Akamai Technologies $AKAM ( ▲ 0.05% ) fell the most on the S&P 500 after reporting Q1 revenue of $915M, missing estimates of $930M, while SoundHound AI $SOUN ( ▲ 4.37% ) dropped 3.8% following a mixed earnings report. SoundHound reaffirmed its FY25 revenue guidance of $157M–$177M, despite missing Q1 revenue expectations.

Lyft $LYFT ( ▼ 1.59% ) surged to a five-month high after Engine Capital ended its activist campaign following Lyft’s expanded $750M stock buyback program. The company plans to deploy $500M over the next 12 months, with analysts upgrading the stock on improved financial outlook.

Coinbase $COIN ( ▲ 10.87% ) received mixed reactions from Wall Street after reporting Q1 earnings of $2.03B, slightly missing estimates of $2.08B, with adjusted EPS at $1.94 versus the expected $1.93. The company also announced a $2.9B acquisition of crypto derivatives exchange Deribit, aiming to expand its global presence in digital asset trading.

Rocket Companies $RKT ( ▼ 3.28% ) stock slipped after the company forecast Q2 revenue between $1.175B and $1.325B, missing analysts’ expectations of $1.36B. CEO Varun Krishna cited tariff uncertainty and a delayed homebuying season as key factors impacting demand.

Affirm Holdings $AFRM ( ▲ 0.21% ) stock fell after the company projected Q4 revenue between $815M and $845M, below analysts’ expectations of $841M. CFO Rob O’Hare noted that growth rates were elevated in April but are expected to moderate moving forward.

Alphabet $GOOGL ( ▲ 0.05% ) agreed to pay $50M to settle a class-action lawsuit alleging systemic racial discrimination against Black employees. The settlement covers over 4,000 workers and follows claims that Google steered Black employees into lower-level roles and paid them less than their peers.

AstraZeneca $AZN ( ▼ 0.23% ) reported positive results from its late-stage POTOMAC trial evaluating Imfinzi in high-risk non-muscle-invasive bladder cancer. The study showed a statistically significant improvement in disease-free survival with Imfinzi plus BCG therapy compared to BCG alone.

Boeing $BA ( ▼ 0.94% ) received a price target increase from UBS to $226 from $207, citing improved free cash flow outlook and tariff risk management. The analyst noted Boeing’s proactive approach to supply chain continuity and its ability to absorb potential tariff impacts.

Ripple $XRP.X ( ▲ 6.7% ) reached a settlement with the SEC, reducing its penalty from $125M to $50M, with the remaining funds returned to Ripple. XRP surged 8% following the announcement, hitting a two-month high of $2.4.

Johnson & Johnson $JNJ ( ▼ 0.49% ) announced that its experimental psoriasis drug, icotrokinra, met the primary goal in a late-stage study, with 66% of scalp psoriasis patients and 77% of genital psoriasis patients achieving clear or almost clear skin. The company highlighted the drug’s potential to set a new standard in plaque psoriasis treatment, with retail sentiment remaining neutral.

Wolfspeed $WOLF ( ▼ 1.37% ) plummeted after warning it may add "going concern" language to its upcoming SEC filing, signaling financial distress. Citi and JPMorgan downgraded the stock, citing liquidity risks, missed earnings, and uncertainty over CHIPS Act funding.

InspireMD $NSPR ( ▼ 0.54% ) reported a Q1 net loss of $11.17M (-$0.22 per share), wider than the expected -$0.20 per share. Revenue increased 1.2% YoY to $1.52M, driven by continued adoption of its CGuard technology.

PRESENTED BY STOCKTWITS

Don’t Cry Because It’s Over, Smile because it happened

Check out our favorite moments from the inaugural Cashtag Awards 2025 presented by eToro— last week’s awards night in NYC where the Stocktwits and Fintwit community came together to honor the boldest creators, the sharpest minds, and the most game-changing innovations in trading, investing, and finance.

Co-hosted by Howard Lindzon (Stocktwits CEO), Katie Perry (Daily Rip Live Host), and Ben Cahn & Emil DeRosa (Weekend Rip Hosts), this unforgettable night featured:

✨ Over 100,000 community votes

✨ Surprise stand-up moments and roasts

✨ Big wins across categories like Best Educational Creator, Best New ETF, Chartist of the Year, Cashtag Legend Award and more…

Special thanks to our presenting sponsor eToro, as well as Alto, Lowenstein, LA Golf, Manscape, Komos, Ari Soho, Watchbox, Wall Street Bound, CMT Association, and Money Show for making this event possible.

By the community, for the community — the community decides who wins.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Have a request, did I miss something? Email me, Kevin Travers, your feedback, and follow me on Stocktwits. I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋