Presented by

CLOSING BELL

Dow Hit Records While Gold Tanks

The market ended exactly flat on Tuesday, a rare sight to see. The S&P 500 was flat, while the Dow hit a record close, as earnings reports rolled in, boosting winning names higher.

Netflix failed to rise to expectations, but 3M busted through estimates and helped pull the Dow higher, alongside giants that beat reports like Coca-Cola and Salesforce. Gold sold off heavily, the worst day decline since 2013, as the precious metal rally hit a pause, and as India, the world’s second-largest buyer, went off to celebrate Diwali.

The gov shutdown is still ongoing, the Trump Whitehouse claiming the Democrats have taken the Fed hostage through the budget bill. Speaking of bills, Trump’s team has approved a $40B bailout for Argentina’s failing economy, including a $20B currency ‘swap’ for the crashing Peso, and a $20B investment bank debt facility. Argentina already received a $20B bailout from the International Monetary Fund earlier this year, its 20th since 1950, according to WSJ.

Right after the bell, news dropped of yet another AI compute deal in the tens of billions range, between Anthropic and Google. 👀

Today’s Rip: Netflix misses, GM beats, Beyond Meat squeezes, and DraftKings makes predictions 📰

5 of 11 sectors closed green. Discretionary $XLY ( ▲ 1.52% ) lead and Utilities $XLU ( ▲ 1.11% ) lagged.

AFTER THE BELL

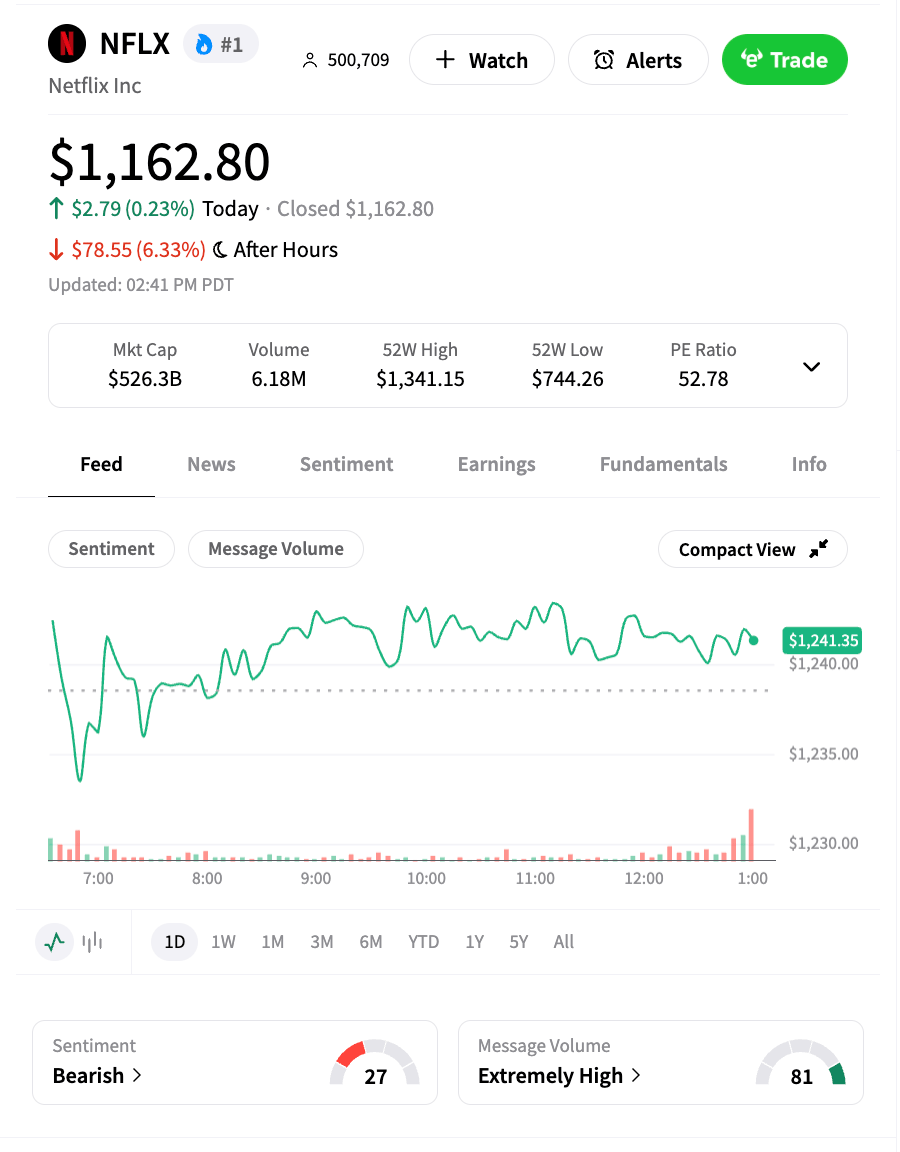

Netflix Ad Rev Explodes, Stock Drops On EPS Miss

Netclix $NFLX ( ▲ 2.66% ) fell after its post-market report Tuesday, after revenue beat but the streamer posted a $619 million charge from a tax dispute in Brazil that cut into profit. EPS was more than a dollar lower than estimated at $5.87.

For an otherwise record revenue quarter, it was a sorry sight to see red for the streaming giant, and the first major tech name to report this season. Revenue climbed 12.2% from last year to $11.51B, and net income was $2.5B, but Wall Street wanted to see nearly $3B.

Operating margin was 28%, lower after a massive payout to settle taxes with Brazil dating back to 2022. The company said it would have been a record margin quarter without the issue, not noting it in previous guidance because they did not think it would be a huge deal.

“We don’t expect this matter to have a material impact on future results,” the company said.

On the back of the massive success of K-pop Demon Hunters, Netflix raised its full-year free cash flow expectations to $9B. KPDH is a hit with the kids, taking the top five most popular Halloween costumes this year according to Google Trends and Frightgeist. 🧙

IN PARTNERSHIP WITH POLYMARKET

Predict Earnings, Not Price: New Earnings Markets on Polymarket

Polymarket, the world's largest prediction market, has launched Earnings Markets, letting you make a simple Yes/No trade on specific outcomes:

“Will TSLA beat EPS?”

“Will NVDA mention China?”

"Will NFLX beat estimated EPS?"

Profit directly from your conviction on an earnings event, regardless of what the stock price does after.

Why trade Earnings Markets?

Upcoming markets include TESLA, NFLX, IBM, and more! Built for how traders actually trade.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS NEWS

Top Giant Companies Reporting Tuesday

Netflix wasn’t the only earnings mover on Tuesday. Here are some quick hits from the largest reports:

3M $MMM ( ▲ 0.07% ) was flying, pulling up the Dow with a beat and raise. The new guidance projected a smaller $1.75/share earnings in the fourth quarter, but 3.2% adjusted sales growth was better than the consumer goods company has shown in the past.

Coca-Cola $KO ( ▲ 0.2% ) climbed despite soft demand for its soft drinks, but still showed Q3 EPS and revnue above estimates, at $0.82 and $12.41B. The company said it was trying to break into the dollar store environment, with flat case volume in Latin and North America, hoping to sell lower-priced but higher cost per oz mini cans.

“After a slower start, we ended with improved performance during the quarter,” CFO John Murphy said on the company’s conference call.

Haliburton $HAL ( ▲ 1.56% ) climbed despite posting impairment charges that pulled down its earnigns to $18M, just 2 cents a share, compared to last years $571M, or 65 cents a share report.

GM was the real leader, $GM ( ▲ 2.05% ) climbing after a pre-market report. Shares hit a record high Tuesday after the car giant pulled back on its EV production in the past quarter, and raised its 2025 earnings guidance to $9.75/$10.50 a share. GM delivered 710,000 vehicles in the quarter, up 8%, 66k of which were electric. CFO Paul Jacobson said they were aiming to bring North American profit margins back to 8-10%, after a 6.2% report for Q3, following a $1.1B cut from tariffs. 🛻

Texas instraments $TXN ( ▼ 2.96% ) was falling 8% after its post-market report. The chip and calculator company posted a net income miss, and revenue beat, and lower than expected Q4 guidance. 🧮

TRENDING

Stocktwits Trending Equities Prove Earnings Aren’t Everything

Beyond Meat $BYND ( ▲ 4.73% ) was flying higher Tuesday, after a 127% jump from record lows Monday. The stock was the most recent target for addition to the Roundhill $MEME ( ▲ 1.47% ) meme stock ETF. The news, along with a deal with Walmart to get vegan meat on its shelves, sent the stock into a short squeeze, with 63% of shares sold short, according to FactSet.

The imitation meat company dropped a qhopping 48% last week after issuing new shares to pull together $800M to refinance its debt.

Draftkings $DKNG ( ▲ 2.57% ) was also up on the Stocktwits trending list, making moves to keep its name high in the highly competitive betting world. DraftKings said it was buying Railbird to launch a super user-friendly prediction market betting app in the coming months. DraftKings was in hot water after competitors like Kalshi and Polymarket soaked up bet volume, or at least bet attention. Kalshi partnered with Robinhood and passed $1B monthly contract volume in September, according to Dune analytics.

The news follows a Bloomberg report last week that CME Group, the largest derivatives exchange in the U.S., is gearing up to join the sports betting market.

“We are excited about the additional opportunity that prediction markets could represent for our business,” DraftKings CEO Jason Robins said in a statement to CNBC. “We believe that Railbird’s team and platform—combined with DraftKings’ scale, trusted brand, and proven expertise in mobile-first products—positions us to win in this incremental space.”

STOCKTWITS VIDEO

Join Me At Stocktoberfest Watching The Markets!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Crude Oil Inventories + Cushing (10:30 AM), 20-Year Bond Auction (1:00 PM)📊

Pre-Market Earnings: AT&T ($T) and Vertiv Hldgs ($VRT). 🛏️

After-Market Earnings: Tesla ($TSLA), QuantumScape ($QS), IBM ($IBM), Southwest Airlines ($LUV), Viking Therapeutics ($VKTX), Alcoa ($AA), and Las Vegas Sands ($LVS). 🌕

Tesla $TSLA ( ▲ 2.39% ) reports Q3 earnings Wednesday after the close, with analysts expecting EPS around $0.55, down 24% year-over-year but likely to beat on recent record deliveries and energy deployments. Revenue is expected to rise 4.3% to $26.7B, according to Yahoo Finance's average estimates.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍