CLOSING BELL

DW Uncle Sam Is Buying Your Bags

The market was falling Wednesday, after PPI producer price inflation came in way higher than expected, at nearly 1% growth month over month. It was the highest climb for three years for wholesale input prices, but it did not move the needle much on futures markets expecting an FOMC rate cut in a month.

30-year fixed Mortgage rates fell to 6.58%, the lowest in the year.

The S&P 500 turned to a climb after news from the White House that Uncle Sam is considering buying a stake in Intel, after complaints from the president that Intel was floundering.

Trump is meeting with Putin in Alaska on Friday to talk about talking about ending the war. Wednesday, Taylor Swift crashed YouTube and Shopify checkouts with her 12th studio album, “The Life of a Showgirl.” 👀

Today's issue covers Berkshire buys UNH, Trump buys Intel, and more. 📰

With the final numbers for indexes and the ETFs that track them, 3 of 11 sectors closed green, with health care $XLV ( ▼ 0.02% ) leading and materials $XLB ( ▼ 0.37% ) lagging.

STOCKS

Berkshire’s Buying United Health🐻

UnitedHealth climbed 8% after Warren Buffett’s Berkshire Hathaway revealed a 5 million share stake in a 13F filing with the SEC Thursday. It became the 18th largest holding in the Kershire portfolio, behind Amazon and Constellation brands, according to VerityData.

The troubled, massive insurance company $UNH ( ▲ 3.56% ) has seen a 50% price decline in 2025, struggling to maintain its ‘always beat and raise’ record amid shrinking Medicare payouts.

In May, the company struck down its annual earnings outlook, and Chief Executive Andrew Witty stepped down. In July, UNH replaced the outlook with one that was still not up to Wall Street expectations.

Berkshire also bought $NUE ( ▲ 0.58% ) $LAMR ( ▲ 0.39% ) and $ALLE ( ▼ 1.9% ).

Will the classic buy low, sell high technique work on the struggling stock, or will UNH turn into another Kraft debacle for Berkshire? 🗝

SPONSORED

A New Investment Method Delivered An 89,900% Return

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors wait on the sidelines. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? That’s worth $1+ million, an 89,900% return on investment. No wonder thousands are taking the chance on Pacaso.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors that backed Uber, Venmo, and eBay also backed Pacaso. Now, you can join them and share in Pacaso’s possible upside for just $2.90/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Comparisons to other companies are for informational purposes only and should not imply similar success.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Uncle Sam Is Buying Bags 💰

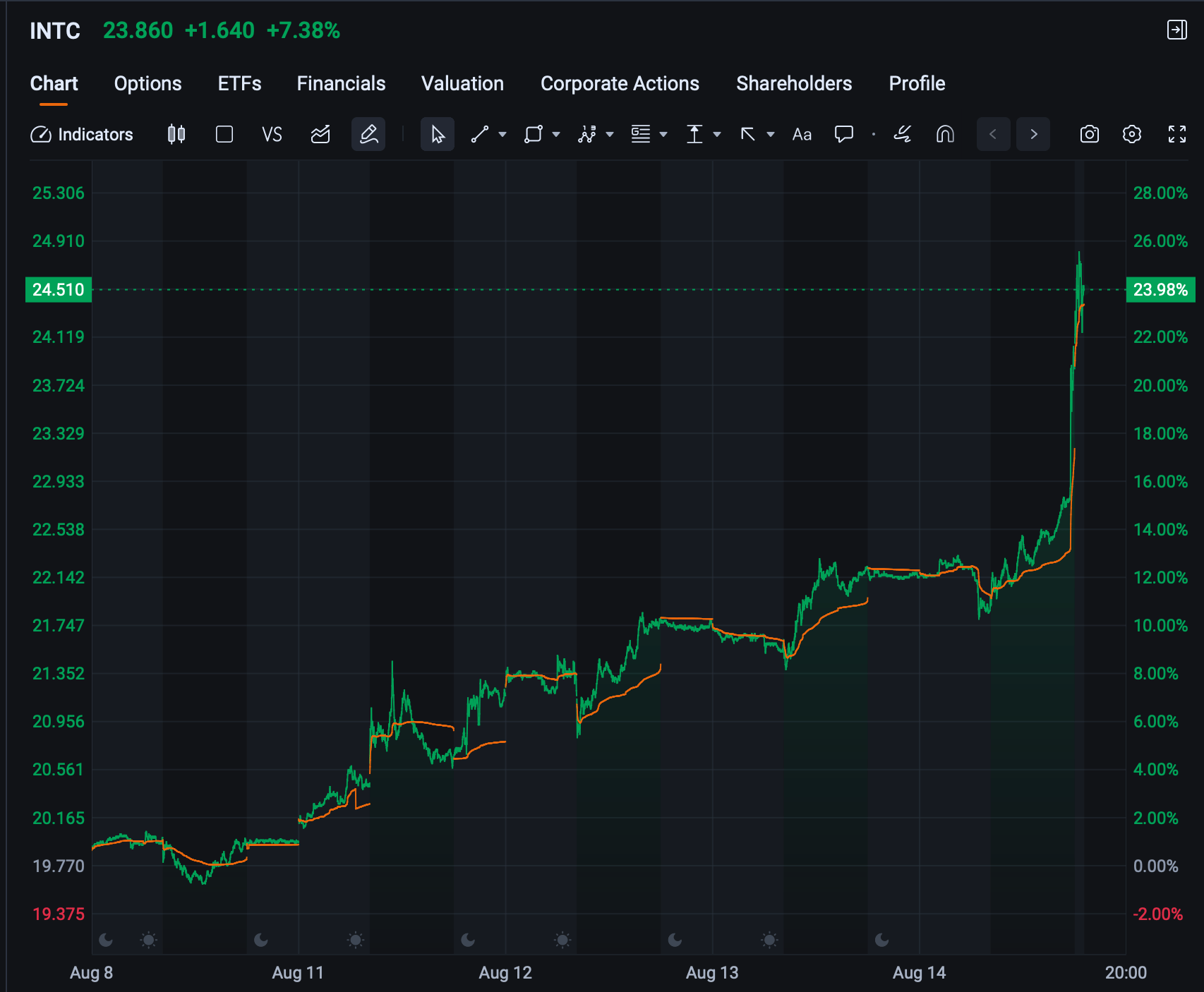

Intel Shares jump to session highs after news out of the White House. A week after commenting that the new CEO, Lip-Bu Tan, was doing a bad job, the Trump administration said it is talking about a U.S. stake in $INTC ( ▲ 1.74% ). The president sat down with Lip-Bu Tan and the cabinet last week to look at the future of the U.S.-based semiconductor giant.

One of the futures the cabinet discussed turned out to be buying a stake, according to Bloomberg reporting. 😤

Intel is the only fully U.S.-based company that has the ability to make the fastest and highest tech chips, CNBC reported, though Samsung and TSMC have factories in the U.S. Though in the past two years, the company has posted YoY revenue drops as it struggled to keep up with change.

Bloomberg’s Tom Giles said it is a move a centrally planned economy would take, like socialist China. He basically said ‘who knows if it is a constitutional or legal move,’ but when the stock climbs, does anyone care?

The story follows recent moves to take shares of profits from companies trading internationally, like Nvidia and AMDs 15% tax to trade with China.

Asset manager Shelby McFaddin, Analyst from Motley Fool Asset Management, said there’s a lot more news that has to come out before this trade settles, a lot more questions that need answers. But as Intel climbed after hours, she noted that the market has not traded on fundamentals for some time.

“Hopes and dreams are starting to matter a lot more than what the companies can put out themselves,” McFaddin said. “We don’t need to think about real, nominal looks good.”

Intel flew higher right at the close on Thursday.

It might not be that serious. Bloomberg Reporter Matt Miller said that if cash changes hands, it resembles the Biden Chips Act that was meant to disperse billions in grants to Chips companies, investments that have faced pauses as the new Admin makes moves to get their own chips deals in place.

Back in June, Commerce Secretary Howard Lutnick said some Chips Act deals were being renegotiated, and were “overly generous.”

One place Uncle Sam is not buying bags is Bitcoin. On Thursday, Treasury Secretary Scott Bessent stated that the U.S. currently holds $15B in Bitcoin and has no plans to purchase any time soon, even as the king crypto breaks through all-time highs of $124k. ETFs, Treasury firms, both public and private, hold $265B, according to Fisal.ai.

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → Grab Yours Now

POPS & DROPS

Top Tickers Today 🎞

$NEGG ( ▼ 4.67% ) Newegg Commerce hit new 52-week highs after announcing a $65M stock sale agreement, with momentum fueled by insider buying, high volume, and breakout technicals.

$AMCR ( ▼ 1.74% ) Amcor slipped after reporting Q4 EPS of $0.20, slightly below estimates, despite strong YoY revenue growth and bullish long-term synergy targets from its Berry Global acquisition.

$EVEX ( ▲ 0.84% ) Eve Holding fell after posting a $64.7M Q2 net loss driven by elevated R&D and SG&A costs, though it maintains liquidity to support operations through 2026.

$LUNR ( ▼ 14.34% ) Intuitive Machines dropped after upsizing its convertible notes offering to $300M, raising dilution concerns despite strong cash reserves and strategic funding plans.

$AAP ( ▼ 6.1% ) Advance Auto Parts declined after Q2 revenue fell 9% YoY and free cash flow turned sharply negative, prompting a cut to full-year EPS guidance.

$CRWV ( ▲ 0.86% ) CoreWeave slid after reporting a sharp drop in operating margin and rising interest expenses, despite triple-digit revenue growth and strong AI-driven demand.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

HOT OFF THE PRESSES

Top Stocktwits News Stories 🗞

JD.com shares dipped 2.5% midday as CEO Sandy Xu flagged intensifying competition and macro headwinds, but retail sentiment flipped to “extremely bullish” after Q2 revenue beat and surging food delivery growth.

Tapestry stock plunged 15% after CFO Scott Roe warned of a $160M profit hit in the Coach brand owner’s fiscal 2026 from Trump-era tariffs and the early end of de minimis exemptions, triggering a non-cash $850M impairment charge tied to Kate Spade.

Foxconn smashed Q2 earnings estimates with a 16% revenue jump, as booming AI server demand from Apple, Nvidia, and Amazon drove record results and bullish retail sentiment.

TeraWulf stock surged nearly 60% after securing two $3.7B AI hosting deals with Fluidstack, backed by Google’s $1.8B lease guarantee and 8% equity stake.

Birkenstock CEO Oliver Reichert said the July 1 Trump tariff-driven price hike triggered no consumer backlash or retailer cancellations, as retail sentiment hit a one-year high amid strong in-person shopping trends.

Deere stock slid over 7% after Q3 profit dropped 24% YoY, but retail chatter surged 1,400% on Stocktwits as EPS and revenue beat estimates, sparking “buy the dip” sentiment.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Initial Jobless Claims (8:30 AM), PPI (8:30 AM), Fed’s Balance Sheet (4:30 PM). 📊

Pre-Market Earnings: SharpLink Gaming ($SBET), Tuniu ($TOUR), Flowers Foods ($FLO). 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋