CLOSING BELL

Fed Hits Bullseye With "Who Knows"

The market awaited the FOMC to make the announcement everyone expected: no change in rates today. Right after, the S&P climbed on clarity, but pulled back after reality set in. The war in the Middle East still rages, inflation will likely climb this year, and otherwise, there is not much to buy on as new tariffs are always just a tweet away. 👀

Today's issue covers stablecoin payments are nearly here, FOMC didn’t change anything, and who cares, and more 📰

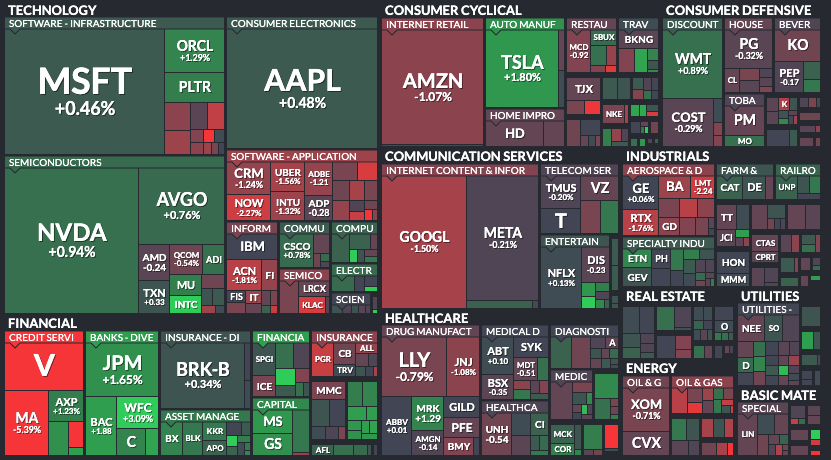

With the final numbers for indexes and the ETFs that track them, 5 of 11 sectors closed green, with utilities $XLU ( ▲ 0.38% ) leading and energy $XLE ( ▼ 0.58% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 5,90

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,719

Russell 2000 $IWM ( ▲ 0.56% ) 2,112

Dow Jones $DIA ( ▲ 0.58% ) 42,171

COMPANY NEWS

StableCoin Payments Are Here! Huge W For Crypto Fans That Preferred Visa

Coinbase flew today $COIN ( ▲ 14.01% ) to the highest percentage gain spot on the S&P 500 after the Senate passed the GENIUS stable coin framework act, and the coin seller said it will launch a Coinbase Payments b2b product. Basically, it enables firms to take payments in US Dollar Coin.

All the fun of crypto, plus all the boringness of Mastercard digital transactions, now in one space.

Move over, Visa: Coinbase and crypto firms like it are coming for the credit space to settle transitions in the $6T online payment space. Credit firms typically charge 1.5-3% for credit transactions, while Coinbase Commerce charges a flat 1% fee.

Though the current announcement is more like using USDC as a debit card, which banks tend to charge 0.7% for processing. ⚡

Earlier this week, JPMorgan Chase said it will launch a pilot tokenized USDC test on Coinbase's Base chain, to test out this new stablecoin thing the kids keep talking about. It’s called the JPMD. 🧓

The firm also said it is partnering with a futures clearing house called Nodal Clear to work with regulators to enable USDC as collateral in US futures trading. The GENIUS Act now heads to the House, where it will face a lot of talk.

Coinbase watchers on Stocktwits fought the long road to ‘extremely bullish’ as the Senate fought over the bill

SPONSORED

StartEngine’s $30M Q1 — Own a Piece Before June 26

Private markets are having a moment. More investors are chasing early access to high-potential companies they believe in before the IPO buzz hits.

StartEngine is making those connections possible. The leading alternative investing platform is helping everyday investors like you access deals once reserved for VCs and insiders, including exposure to private market titans like OpenAI, Databricks, and Perplexity.¹

How’s it going? In Q1 2025, StartEngine pulled off $30M in revenue, its biggest quarter ever (based on unaudited financials).² Founders are using to the platform to raise capital outside the VC echo chamber. And investors? They’re showing up to tap into pre-IPO value.

But StartEngine isn’t just a middleman. The company earns 20% carried interest on select pre-IPO offerings. So when the companies on its platform win, StartEngine (and its shareholders) win too.³

How can you tap into this diversification play? By investing in StartEngine.

StartEngine has crowdfunded $85M+ to date, and you can get involved before the company’s current round closes on June 26.

If you believe in a future where private investing is more accessible and more rewarding, now’s the time to be part of it. Join the 45K+ shareholders who have backed the future of finance by investing in StartEngine.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

…EXCEPT DEATH AND RATES

FOMC Kept Rates The Same… Who Cares?

The Federal Open Market Committee left the target Federal Funds rate unchanged at 4.25%-4.5% on Wednesday, as everyone and their brother expected. After five months of rates remaining unchanged, what piqued investor interest was the forward projection dot plot, shown below, which has been edited to fit in the newsletter.

Notably, although officials on average expect two 25-basis-point rate cuts for the remainder of 2025, seven Fed officials predicted no change to rates this year. The change in forecast follows expectations of higher inflation and worse economic growth since the March pre-liberation tariff day FOMC meeting.

The FOMC Dot Plot from today’s meeting

In a 2 pm statement, the Fed said the uncertainty of the economic outlook has diminished, unemployment remains low, labor market conditions remain solid, but forecasted a slight increase in unemployment, and a jump in inflation by 2026.

A target rate of 3.9% would likely represent two 25-basis-point cuts this year.

The Fed expects unemployment to rise to 4.5% by the end of the year, compared to 4.4% in March. Even though the committee expects inflation to reach 3% by Christmas, before falling to 2.4% by the end of 2026, they still stated that the cuts are on schedule for this year.

The forward projection did expect just one 25bp cut next year, instead of two. It is as if the Fed is pulling a cut forward from next year to still give us a two-cut prediction to enjoy on our market holiday tomorrow. Flattered by the promise of rate cuts eventually, the market climbed, and the S&P 500 peaked over 6k briefly.

Even The FOMC Can’t Predict Rate Cuts

Nick Timiraos, economic writer at the Wall Street Journal, pointed out that the dot plot, first introduced in 2012, is not always the surefire delving rod into monetary policy that the market prices it to be.

Minneapolis Fed President Neel Kashkari even said the measure places way more certainty in prediction than a Fed chair might feel.

“You’re having to make, essentially, forecasts that people take very seriously, and you can’t communicate just how uncertain you are, because you have to put these handful of dots down,” Kashkari said.

Tmiraos wrote that last June, the Fed predicted a 25 bps cut for the rest of the year, but two meetings later, it cut 50 bps, and went on for 50 more by the end of the year.

Remember, the target rate is the interest paid on most U.S. Treasuries, the baseline for most debt paid back in the U.S. When rates climb, it becomes a better option to hold on to money rather than deploy it investing in projects, and economic growth can slow. Hopefully, that means price inflation slows as well.

SPONSORED

CyberCatch Announces Acceptance in NVIDIA Inception Program

CyberCatch Holdings, Inc. (TSXV:CYBE) (OTCQB:CYBHF), an AI-enabled cybersecurity platform for continuous compliance and risk mitigation, has been accepted into the NVIDIA Inception Program.

The initiative offers startups access to NVIDIA hardware, software and AI tools, potential direct investment and go-to-market support.

“CyberCatch is honored to have been selected by NVIDIA to become an NVIDIA Inception Program member. We are excited to work with NVIDIA to further innovate our unique, patented, AI-enabled continuous cyber risk mitigation solution to move from using generative AI to using agentic AI and quantum computing, and also rapidly develop new world-class solutions to take advantage of emerging opportunities in select vertical markets and accelerate business growth,” said Sai Huda, CEO of CyberCatch.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Trump declined to confirm whether the U.S. will intervene in the Israel-Iran conflict, stating, “Nobody knows what I’m going to do,” as tensions escalate. Read more

Marvell stock surged over 7% after analysts raised price targets, citing optimism following the company’s custom AI silicon event and expanded market projections. Read more

Gold prices dipped as traders shifted focus to the Federal Reserve’s monetary policy decision, while Israel-Iran tensions continued to fuel safe-haven demand. Read more

Texas Instruments announced a $60 billion investment to build seven semiconductor fabs across Texas and Utah, marking the largest U.S. chip manufacturing expansion in history. Read more

Algorand enabled the first on-chain Mastercard debit card, allowing users to spend USDC directly from their wallets with instant finality and minimal fees. Read more

Nippon Steel finalized its acquisition of U.S. Steel, committing $11 billion in U.S. investments while granting the federal government oversight through a national security agreement. Read more

U.S. District Judge Mark Pittman upheld the FDA’s decision to remove Wegovy and Ozempic from the drug shortage list, rejecting claims that the move was arbitrary and capricious. Read more

Scholar Rock's stock surged after its investigational drug apitegromab demonstrated significant lean mass preservation in patients undergoing weight-loss treatment with Eli Lilly’s Zepbound. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

A Special OPEX Edition Of “The Weekend Rip” With Cem Karsan 👀

Volatility expert Cem Karsan broke the internet when he joined “The Weekend Rip” with Ben & Emil on April 11th. The great news is, we’re bringing this fan favorite back as a regular guest once a month, starting tomorrow! 🥳

Join the boys at 4:30 pm ET for a special, holiday edition of the show. With geopolitics keeping tensions high among investors, Cem, Ben, and Emil will cover everything you need to know about Friday’s options expiration. 📆

Can’t watch live? Don’t fret. We’ll be sending a special Daily Rip newsletter out with a full recap around 7 pm ET. So keep your eyes peeled for that. 🤩

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋