Presented by

CLOSING BELL

Fed Unpauses Rate Cut Pause

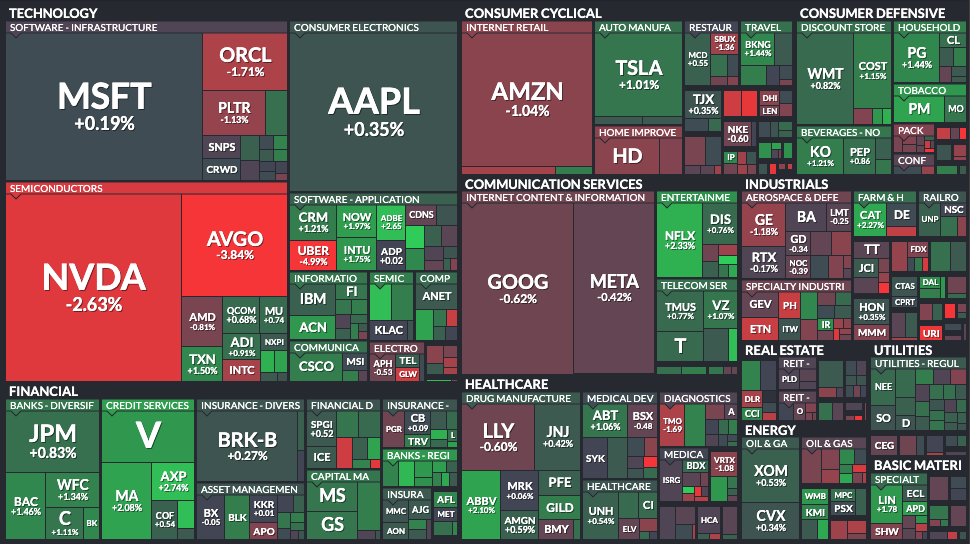

The market climbed Wednesday right after the FOMC cut interest rates 25 basis points, but ten minutes later, prices fell. Financial stocks were happy, leading sectors on the S&P 500 higher, as the promise of lower mortgage rates sent refinancing applications up 60% in the past week.

As tech fell, smaller companies led the Russell 2000 higher, and the Dow climbed on financials and staples. 👀

Today’s Rip: FOMC cut like everyone though they would, StubHub falls after NYSE IPO, and more. 📰

7 of 11 sectors closed green, with financials $XLF ( ▲ 0.49% ) leading and industrials $XLI ( ▲ 1.23% ) lagging.

MACRO

FOMC Cut Rates Like Everyone Thought They Would ✅

The FOMC cut rates by an expected 25 bps on Wednesday, in an 11-1 vote. Newly appointed Trump ally Stephen Miran wanted a 50 bps cut, and is likely the sole decenter in the forward-looking dot plot that called for a target rate below 3% by the end of the year.

A cut together version of the Fed Dot Plot shows one member stood out with an outsized attitude to cut

Fed Chair Jerome Powell, speaking at 2:30pm ET, said it was a risk management cut. He was asked, in layman’s terms, if prices are rising, and the Fed expects them to keep rising, why are they cutting rates?

The Fed unanimously cut because the labor market has deteriorated, he said, and it’s the greater of two evils to focus on. Compared to June, when seven voting members saw no rate cuts for the rest of the year, opinions on the path forward have changed drastically.

The projection now sees a majority of members see two more rate cuts this year, or 50 bps, with two meetings to go in October and December. That’s a new average target of 3.50-3.75%. Compared to June, September's median estimates from voting members on where GDP, inflation, and target rates will be in Jan ‘25, ‘26, and ‘27 had not changed much.

Forward estimates have not changed much, though the FOMC sees higher growth and higher prices next year.

The USD index hit its lowest since 2022, when rate hikes began. That’s the Trump Admin plan: make dollars cheaper so financing houses, factories, and trade is way easier. The problem is it might be short cited. The majority of fund managers surveyed by Bank of America expect inflation to climb big time, and nearly none expect the Fed to do anything about it.

Still, bets on Polymarket shifted toward a three-cut outcome after the first cut all year on Wednesday.

SPONSORED

Drone as a Service: Making Drone Tech Accessible and Scalable

Drone as a Service (DaaS) is a subscription or pay-as-you-go model giving businesses and government the power of drones without the owning and operating hassles. No capital costs, pilots, maintenance or regulatory compliance. Companies can easily switch to using drones for speed, precision, and safety benefits when they need them—for surveying, inspections, crop management, maintenance, indoor inventory audits and more. ZenaTech has a national vision to make drone technology more accessible and scalable across tasks and industries.

ZenaTech’s Growth Strategy for DaaS

We’re accelerating the DaaS model by acquiring established land surveying, inspection, power washing, and other legacy service businesses ripe for drone innovation and converting them into drone multi-service hubs. To date, we’ve completed eight US acquisitions toward our goal of establishing 25 Drone as a Service locations nationwide by mid-2026. This strategy allows us to modernize traditional service businesses, centralize and scale data management platforms, and unlock new and recurring revenue streams—all while positioning our ZenaDrone drone products at the center of a fast-growing drone economy.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

IPO NEWS

StubHub Punches Ticket to Ride Public Markets, Falls After Debut 🎟

StubHub climbed upwards of 12% after its noon launch onto the New York Stock Exchange, but fell to end the day in the red $STUB ( ▲ 2.69% ).

The online ticket seller priced at $23/share, raising $800M in its first day of trade, which the company said would go toward long-term debt. After 25 years in business, you better believe StubHub has some debt to pay off: Most recently, the firm took on debt when it was rebought from eBay by co-founder Eric Baker in 2020 for $4B.

Initially, the goal was to hit markets back in April before Trump’s liberation tariff day sent markets into a tailspin, but since then, the IPO market has exploded.

In an age where Taylor Swift’s live shows can sway the GDP of an entire nation, selling tickets online has brought in the profit. StubHub filed a Q1 revenue growth of 10% from last year to $397.6M. Unfortunately, the company operates at a loss, and with rising revenue, its losses climbed this year to $35.9M.

IN PARTNERSHIP WITH THE CMT ASSOCIATION

Dubai Awaits: Attend The CMT Association’s Global Investment Summit 🌍

The Global Investment Summit 2025 brings together some of the brightest minds in finance — from market pioneers to global strategists. Don’t miss the chance to learn directly from experts shaping today’s markets through high-impact panel discussions, technical analysis skill workshops, and exclusive networking opportunities.

It’s all happening at Dubai’s iconic Museum of the Future from September 30 to October 2. The CMT Association is offering a special discounted rate exclusively for the Stocktwits community. Register below—and we’ll see you there! 🎫

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Roivant jumps 7.8% as drug hits trial goals.

Apple edges up 0.4% on iPhone 17 demand.

General Mills dips 0.8% as CEO warns on pricing.

Reddit flat as Google AI deal talks swirl.

Opendoor surges 14.5% on bullish retail flow.

Frontier flat after the CEO defended the discount model.

Gorilla Technology spikes 13.1% on retail momentum.

Eli Lilly slips 0.6% despite obesity pill win.

Lyft pops 13.1% on Waymo robotaxi deal.

Nvidia drops 2.6% despite China-fueled bull case.

Trump faces scrutiny over dual mortgage pledges.

Workday climbs 7.2% after Guggenheim upgrade, activist stake.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

IN PARTNERSHIP WITH

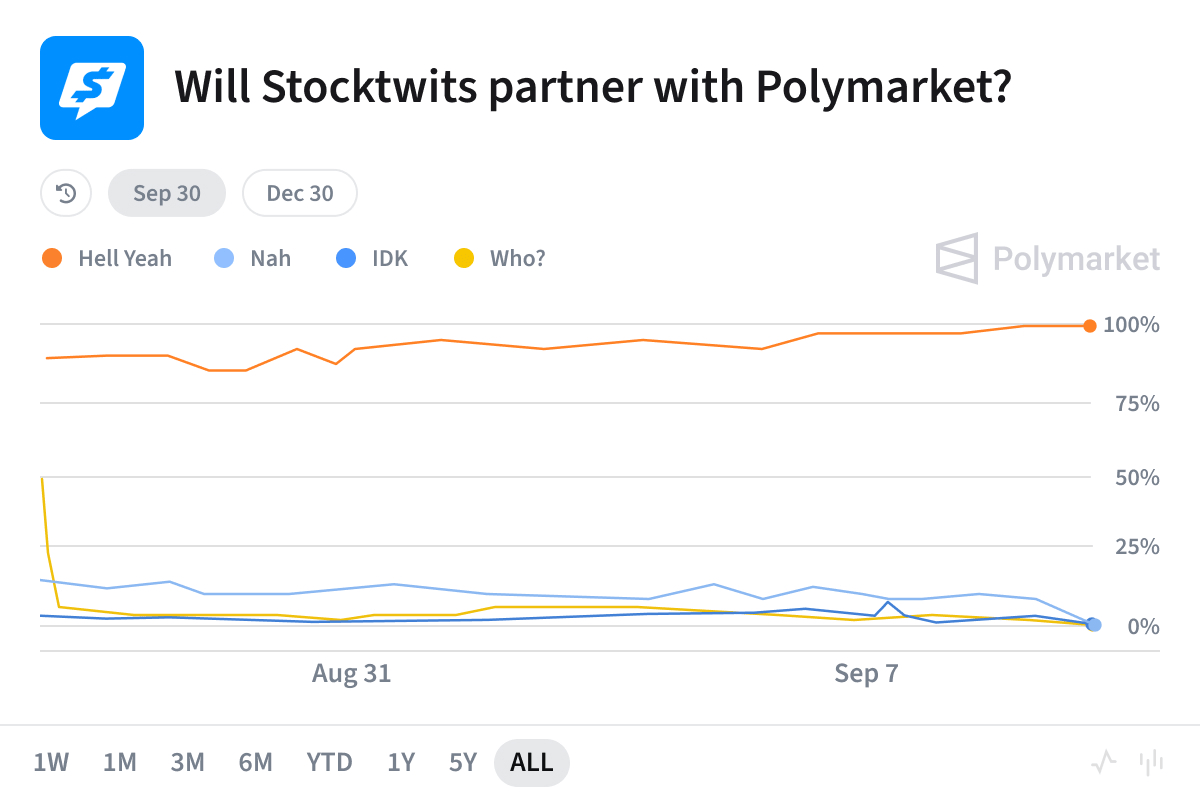

🔮 Stocktwits x Polymarket: Real-Time Predictions Are Here

We’ve officially teamed up with Polymarket, the world’s largest prediction market platform, to bring crowd-priced probabilities straight into your Stocktwits feed.

This partnership makes Polymarket our Official Prediction Markets Partner, unlocking real-time sentiment on everything from rate cuts to election outcomes to earnings calls.

See Polymarket odds of the biggest events baked into your daily scroll

Track how traders are pricing macro events, earnings, and more to make more informed decisions

Cut through the noise to discover the crowd-priced truth, not the headlines

Prediction meets conviction. Welcome to the future of financial sentiment.

Use the crowd signal. Watch probabilities move as news breaks and use that signal to size a position, hedge, or stay patient.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

LIVE

COMMUNITY RIP LIVE W/GPAISA, JFDI & HOLDINGBAGS

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: IEA Monthly Report (4:00 AM), OPEC Monthly Report (7:00 AM), CPI (8:30 AM), Initial Jobless Claims (8:30 AM), 30-Year Bond Auction (1:00 PM), Fed’s Balance Sheet (4:30 PM). 📊

Pre-Market Earnings: Kroger ($KR), Lovesac ($LOVE), and Cheetah Mobile ($CMCM). 🛏️

After-Market Earnings: Adobe ($ADBE) and Rent the Runway ($RENT). 🌕

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋