NEWS

Flip A Coin. Heads, The Market's Green

Source: tenor

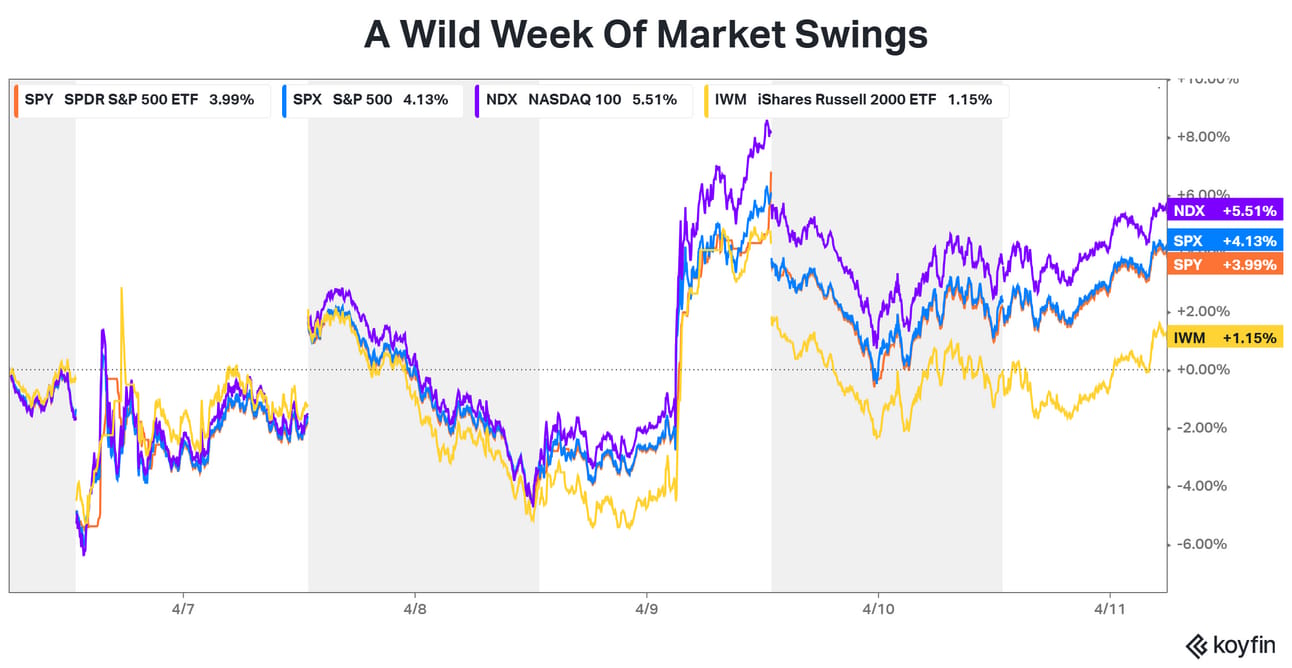

It was the best week for the market since 2023, if you don’t zoom out. The S&P 500 closed up more than 5%, but the U.S. Dollar Index climbed 3%, and the U.S. 10-year yield climbed 11%. The tariff trouble started with a crazy chart last week in the Rose Garden, and despite a pause, Q2 is not looking rosy. 👀

Today's issue covers what happened this week, what we learned, and the big bank earnings keeping us calm. 📰

Here’s the S&P 500 heatmap. All sectors closed green, with tech (+3.98%) leading and real estate (-0.54%) lagging.

Source; finviz

And here are the closing prices:

S&P 500 | 5,363 | +1.81% |

Nasdaq | 16,725 | +2.06% |

Russell 2000 | 1,860 | +1.57% |

Dow Jones | 40,213 | +1.56% |

STOCKS

What Even Happened This Week 🙊

Years ago, when it was last weekend, financial Twitter flew at a breakneck speed. Concepts like Black Monday 2.0 and “the r-word” flew off the shelves. China responded overnight with tariffs of its own, and one thing was for sure: Monday would be a bloodbath. Instead, traders looked for any glimmer of hope to keep prices higher.

A misquoted tweet about a 90-day tariff pause sent markets flying $6T, only for the White House to call it "fake news," reversing gains. By the close, the S&P 500 dipped just 23 bps—a painfully slow crawl down. 🦀

Larry Fink of BlackRock spoke Monday at the Economic Club of New York like the great American Experiment had ended. He said we were in a bear market recession and that the way forward was down, and FOMC would not help.

On Tuesday, real tweets hit hard: the White House announced 104% tariffs on China, sinking markets further. Bond traders dumped long-term notes, driving 10-year and 30-year yields to record fast climbs not seen in decades.📉

On Wednesday, Jamie Dimon all but declared a recession on Fox Business. Hours later, Trump called it a great day to buy and soon flipped the switch to pause tariffs.

The Walter Bloomberg tariff pause from Monday actually came true after 1 p.m. ET, and major indices soared: The S&P 500 flew +9.52% and added $4.3T to its market cap, the Nasdaq hit +12.16%, in its best day since 2001, the Dow Jones saw its biggest one-day point gain in history. 🤑

Then, Thursday morning came, and the market fell as reality set in. The fewer tariffs, the better, but Trump’s 90-day 10% tariffs, plus 145% on China and 25% on key trading partners, left U.S. trade taxed at record highs while bond sell-offs continued.

If overlooked, tariffs risk no resolution before the deadline, and 75 nations will scramble to negotiate.

Friday, the market flipped again as large financial institutions printed results without giving very positive guidance. China increased its tariffs to 125%, called the U.S. a “joke,” and said they were through going tit-for-tat. Though markets ended the week positively, investors were left with major lessons from a very long week. 😮💨

Source: Koyfin

PRESENTED BY STOCKTWITS

The Weekend Rip: Special Guest Cem Karsan 🤩

Markets rip higher, volatility surges, and Ben cashes in on fart coin as the Weekend Rip crew dives into tariffs, debt chaos, and a looming generational reset.

Trump’s tariff pause shocks markets—and Ben’s short blows up. 🔹

Fart coin moons, SPY pops, and Ben spirals into Zyn-fueled coping. 🚀

Cem predicts 10% yields, stagflation, and a market breakdown. 📉

Japan’s backchannel diplomacy props up America’s debt game. 🗾

Millennials turn to Bitcoin as supply-side economics collapses. ₿

COMPANY NEWS

Themes That Sucked This Week 👻

Gold And Bonds Are Both Climbing- For The Wrong Reasons

Gold hit all-time records two days in a row this week as investors looked for safer assets than US Treasury bonds. According to Bloomberg, the U.S. 10-year yield saw its highest weekly increase since 2001. +0.50 changes are huge for treasury notes- each 0.001 of a bond seems small, but take Wednesday’s 10-year auction, for example:

The bonds sold for $39B, according to Reuters. At 4.3% yield, the rate at the time, that’s $16.77 billion paid out over the course of the bond- the U.S. has to pay off nearly 150% of the principal. The fewer willing buyers, the higher the yields go up, and the more expensive debt will become.

De-dollarization:

Bond sales, along with a drop in the dollar, scared investors this week. The USD index was down 3%. Investors shifted away from U.S. assets toward gold and the Euro. Some investors even suggested that China, the second largest foreign bond owner, was targeting the sale of U.S. treasuries as part of the new tariff war.

SMBC Nikko Securities analyst Ataru Okumura wrote in a note that “China may be selling Treasuries in relation.”

It’s impossible to tell who is selling right now, but doubts like those are pushing investors toward alternatives, like the Swiss franc and Japanese Yen.

Macro We Missed:

While tariffs moved the market, we missed regular macroeconomic updates that investors would normally cling to for guidance.

FOMC meeting minutes showed members were worried they would not be able to tell if price climbs came from inflation or tariff increases. 🫠

Consumer Price Index numbers from March showed inflation actually fell month over month, one of the few times that has happened this decade, but markets were nonplussed. PPI numbers also came in negative, showing that producer inputs were much cheaper than before. At least inflation was falling before liberation.

Michigan Consumer sentiment and inflation expectations Friday were more up to date: 60% of respondents had unprompted complaints on government policy, and one-year inflation expectations hit over 6%, the highest since the 80s.

Then there were Fed speakers. New York Fed President John Williams said that growth could slow and that inflation could rise to 4%. Boston Federal Reserve President Susan Collins said Friday that markets were operating properly, but the Fed would step in if necessary.

Minneapolis Fed President Kashkari told CNBC that the market was nowhere near as stressed as when businesses shut down during Covid.

He said if things got worse, the Fed has tools to use, but they would not prioritize keeping target rates where they were. Ominous. 😨

STOCKS

Other Noteworthy Pops & Drops 📋

Theratechnologies ($THTX +65%): A privately held contract manufacturer and packager of pharmaceutical and nutraceutical products, Future Pak, offered $3.51 to $4.50 per share to acquire the full company.

Lucid Group ($LCID -1%): The EV maker will acquire select facilities and assets in Arizona previously belonging to bankrupt EV truck maker Nikola Corporation.

Stellantis ($STLA -0.1%): The automaker’s first-quarter consolidated shipments fell by 9% YoY, citing a drop in shipments in North America and Europe.

Warner Bros. Discovery ($WBD -2%): John C. Malone will not stand for re-election to the board and will transition to the role of Chair Emeritus, effective upon the expiration of his term at the 2025 annual meeting of stockholders.

Cigna Group ($CI +1%): Canada’s Competition Bureau announced an investigation into Express Scripts Canada over alleged anti-competitive conduct that could prevent or limit competition in the country's drug retail market.

STOCKTWITS CASHTAG AWARDS PRESENTED BY ETORO

In NYC On April 30th? Join Us Live At The Stand! 🤩

The hottest night in social finance is happening live in NYC on Wednesday, April 30th, and the guest list continues to grow. Are you on it? 🤔

If you’re in the New York area and are interested in attending, reply directly to this email with the words “I’m In.” We’ve got limited tickets available, but will do our best to hook our loyal newsletter readers up so we can see you there!

Want to guarantee you can attend? Grab your tickets now! 🎫

Join us to celebrate the biggest names in finance. Plus, network with personalities you know and love at our open-bar happy hour and cocktail reception. 🍻

COMPANY NEWS

Big Banks Reported, Is This How Q1 Is Going To Go? 🫠

The largest financial institutions ushered in the start of the first quarter earnings season Friday, and despite market turbulence, they mostly beat expectations:

$WFC: Wells Fargo beat estimates, with an EPS of $1.39, but showed revenue that declined YoY. CEO Charlie Scharf said Wells Fargo expected "continued volatility and uncertainty" and was "prepared for a slower economic environment in 2025." The firm expects net interest income at the low end of their range this year.

$MS: Morgan Stanley beat estimates, reporting first-quarter earnings of $2.60 a share. CEO Ted Pick was optimistic about M&A dealmaking but said players are pausing. “But we are still, I will call it, cautiously optimistic that we won’t go into recession,” he said on Friday’s earnings call. 🤗

$BLK: BlackRock, the world's largest asset manager, reported earnings of $11/share, beating estimates. AUM climbed 11% in Q1 from a year earlier to a record $11.58 billion. Chief Fink has made his pessimism about the market this week clear. On Friday, he said on CNBC, “We are close, if not in, a recession now.” He sees a 90-day pause as three months of uncertainty.

$JPM: JPMorgan, the largest bank in North America, reported first-quarter earnings of $5.07 a share, on revenue of $45.3 billion, topping forecasts. CEO Jamie Dimon said the world economy continues to face "considerable turbulence," citing, among other things, "potential negatives of tariffs and trade wars.”

Source: Stocktwits

Each banker who spoke Friday warned of caution, but their institutional ability to make money even during times of instability is what sets them apart as powerhouses. Next week, more banks will report, alongside tech firms like TSMC and Netflix. Let’s hope they took a lesson from Delta’s book and pared expectations to avoid a sell-off. 💸

COMMUNITY VIBES

Does He Mean A Good Explode Or A Bad One? 🙃

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋