CLOSING BELL

Fly Me To The Moon

The market closed higher Thursday, the S&P 500 and Nasdaq soaring to fresh records following the smash hit earnings results from Delta that sent airline stocks… flying. 🕊

Bitcoin hit a couple new records, climbing nearly 8% this week so far. A 30-year bond auction today went relatively well, sending the yield slightly down and equities up. U.S. initial jobless claims came in lower, while continuing claims remained at a two-year high, but investors championed continued stability in the labor market.

All in all, a hot day and possibly a sneak preview of the earnings season to come? Time will tell. 👀

Today's issue covers tariffs miss travel but hit Slim Jims, Uncle Sam becomes rare earth buyer #1, and more. 📰

With the final numbers for indexes and the ETFs that track them, 9 of 11 sectors closed green, with discretionary $XLY ( ▲ 0.22% ) leading and communications $XLC ( ▲ 0.21% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,280

Nasdaq 100 $QQQ ( ▲ 1.36% ) 22,829

Russell 2000 $IWM ( ▲ 0.56% ) 2,263

Dow Jones $DIA ( ▲ 0.58% ) 44,650

STOCKS

Hard To Tariff Travel, But Easy To Tax Slim Jims 🛫

Delta, ahem* flew to a four-month high after the firm restored its full year guidance, reporting earnings Thursday morning above estimates.

Per share profit still fell YoY, at $2.01 vs. Q2 ‘24s $2.36, but updated guidance painted a pretty picture for the second half of the year where consumers are more confident, trade negotiations are smoother, and travel demand overall increases.

The firm expects EPS of $5.25-$6.25, with free cash flow up to $4B.

It was a far call away from Q1’s report, when the firm cut its full year guidance, leading the way for an entire earnings season of shrugs and puzzled CEO faces blamed on trade mahem. Three months later, the tariff-queasy consumer everyone had imagined turned out to have flown just fine, generating slightly lower earnings but about the same revenue as the previous year.

The stock climbed $DAL ( ▲ 0.29% ) and helped lead all airlines higher.

$UAL ( ▼ 0.01% ) rose, alongside $AAL ( ▲ 1.29% ), $ALK ( ▲ 3.75% ), $ULCC ( ▼ 0.32% ) and $JBLU ( ▼ 3.23% ).

It was a wonderful day for services, but in stark contrast $CAG ( ▼ 2.98% ) a grocery and snack giant reported a 4.3% decline in net sales to $2.78B, below estimates, alongside an adjusted EPS miss at 56C, and a revenue miss.

The Slim Jim owner said the second half of the year would bring even further pain, as tariffs and inflation hurt the bottom line.

Chief Sean Connolly said not to expect miracles in fiscal 2026. “We expect elevated inflation and macroeconomic uncertainty to persist,” he said.

Levi posted after the bell, and climbed 7% when it raised its full-year guidance and said it was trying its best to wring out supply issues from its South Asian manufacturers in the face of levies.

The firm posted a full-year adjusted EPS above estimates, in the $1.29-$1.25 range, but weighed its guidance on the idea that China will bear the brunt of tariffs. Levi makes just 1% of its jeans in China, according to CNBC, and if tariffs are worse in the rest of the world, it will hurt its margins. 👖

SURVEY BY INVESTMENT TRENDS

Share your views on investment and trading!

At Stocktwits, we strive to continually improve how we serve you. One tool that helps us understand and meet your investment and trading needs is the annual Investment and Trading Survey from Investment Trends.

We would like to hear, from you, how we can improve. If you would like to participate, please fill out the survey by clicking the button below.

To show our appreciation, you can participate in a draw* to win an Amazon.com gift card valued at $2,000. The four runners-up will each receive a $300 Amazon.com gift card.

On top of that, you can choose to receive the below benefits for free:

Complimentary one-month subscription to FXStreet Premium, valued at US$40

Highlighted findings from this survey, a great tool to find out about other investors’ views.

And as a bonus, Investment Trends will award a Microsoft Surface Pro 9 (128GB/Intel Core i5) valued at appr. $749.99 for the most comprehensive response^. Please complete your entry by midnight on Sunday, July 27th 2025.

The survey should only take 15-20 minutes.

Privacy: Your responses are confidential and will only ever be shown in aggregate after being combined with those of other survey respondents. The survey is being conducted by specialist researcher Investment Trends. Investment Trends abides by the ICC/ESOMAR International Code on Market and Social Research. If you wish, you can review our privacy policy here. If you have any questions, please email us. *You can view the terms and conditions for the draw here. ^Judges’ decision is final and no correspondence will be entered into.

POPS & DROPS

Top Stocktwits News Stories 🗞

Teradyne jumped after reports linked its automation technology to Amazon’s Vulcan robot, sparking bullish bets on robotics exposure. Read more

Goldman warned that the dollar’s safe-haven status is eroding amid Trump's escalating trade war, citing weakening global confidence and rising currency diversification. Read more

Helen of Troy plunged 22% after issuing a weak Q2 forecast, citing sluggish demand and increased costs tied to Trump’s tariffs. Read more

Intuitive Surgical received FDA clearance for its advanced energy surgical instrument, expanding the capabilities of the da Vinci system in soft-tissue procedures. Read more

Vertiv dropped after Amazon unveiled custom cooling technology for Nvidia chips, raising concerns about competitive pressure in the AI data center space. Read more

Ford recalled over 850K vehicles in the U.S. due to engine stalling risks tied to a defective fuel pump module. Read more

Walmart recalled 850K Ozark Trail water bottles after three reported injuries linked to a faulty lid design, prompting safety concerns ahead of peak summer sales. Read more

Polestar reported a 38% YoY jump in Q2 retail EV sales, driven by strong U.S. demand and expanding global distribution. Read more

Elon Musk said Grok will roll out in Tesla vehicles next week at the latest, marking the AI assistant’s long-awaited expansion beyond X, shortly after the chatbot started praising mechaHitler. Read more

Bit Mining more than doubled after announcing a $300M Solana treasury strategy, aiming to deepen crypto exposure and diversify blockchain operations. Read more

TSMC posted a 40% revenue surge despite a 17% drop in June, fueled by ongoing demand for AI and advanced chip manufacturing. Read more

Bitcoin extended its breakout rally this week, buoyed by a reset in retail sentiment and renewed optimism across crypto markets. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

POPS & DROPS

Daddy War Bucks Becomes M&A Favorite 🦅

It is a banner year for mergers and acquisitions, the belle of the ball within the investment banking world. MP Materials is one of the latest winners, climbing $MP ( ▲ 1.97% ) an immense amount on Thursday.

Unlike other deals, the source of the $400M that grants its new majority shareholder voting rights over the firm’s rare earth mines might surprise you: Uncle Sam. 🧨

God bless America and the new $1T defense budget, because the Pentagon became the virtual key holder to Mountain Pass, California. The buy has to do with foreign dependence on refined metals, with 70% of imported refined goods originating from China, according to the U.S. Geological Survey.

It was a point of contention during the most recent trade truce between the White House and Beijing. With purchases like this one, it looks like Uncle Sam wants less friction in its international dealings.

Chief James Litinsky told CNBC that the Pentagon investment is a public-private partnership that will help them build a rare earth magnet supply chain right here in the U.S. The deal calls for a factory expected to come online in 2028, able to output on a scale that vastly exceeds current U.S. magnet production, according to WSJ.

The Mountain Pass Rare Earth Mine & Processing Facility, owned by MP Materials. (Photo by George Rose/Getty Images)

$UUUU ( ▲ 0.4% ) also climbed on the news, a uranium and rare earth firm based on CO. The deal comes after Italian candy maker Ferrero struck a $3B deal to buy WK Kellogg $KLG ( 0.0% ).

It was not all positive M&A news on Thursday:

Autodesk fell nearly 7% after reports surfaced it’s considering a potential acquisition of software peer PTC, sparking investor concerns over valuation and strategy.

PTC jumped 17% right as Bloomberg dropped the news Wednesday, then fell back Thursday, interestingly enough. JP Morgan analysts wrote in a note that Autodesk, the owner of professional modeling software AutoCAD, has completed 50 acquisitions since its founding. Oppenheimer said in a note that if the deal goes through, it will position Autodesk better in the AI space.

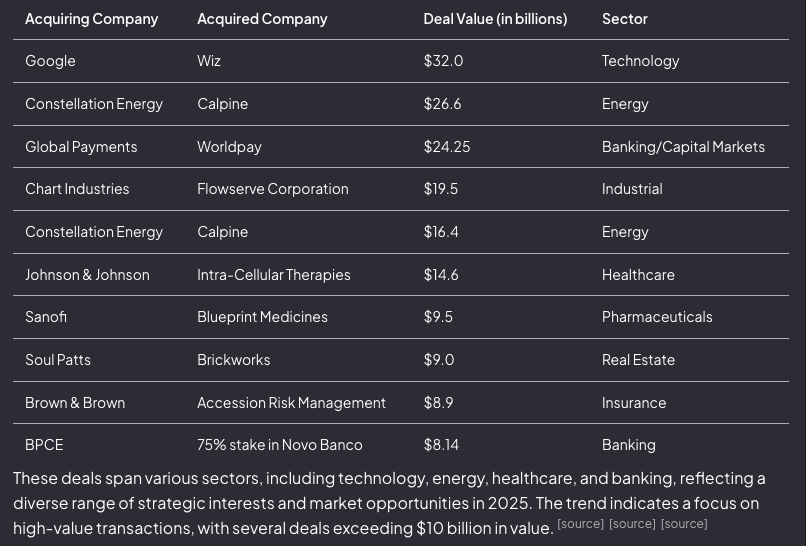

According to data provided by Finchat, 2025 has been a major year for buyouts.

PRESENTED BY STOCKTWITS

Quantum Computing TODAY: D-Wave CEO on Real-World Breakthroughs & AI Synergy $QBTS ( ▲ 4.88% )

In this Stocktwits Executive Interview, Katie Perry sits down with Dr. Alan Baratz, CEO of D-Wave Quantum, to talk all things quantum computing—today, not decades from now. Baratz dives into:

✅ How D-Wave is solving real-world business problems

✅ How D-Wave achieved quantum computing supremacy over classical supercomputers

✅ The massive energy efficiency advantages of quantum systems

✅ Why AI and quantum are natural partners—and how D-Wave could reshape AI model training

Don’t miss this insightful discussion on the future of computing, AI, and the role quantum technology will play in shaping global industries. $QBTS ( ▲ 4.88% )

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: IEA Monthly Report (4:00 AM), WASDE Report (12:00 PM), U.S. Baker Hughes Oil Rig Count (1:00 PM), U.S. Baker Hughes Total Rig Count (1:00 PM), Federal Budget Balance (Jun) (2:00 PM). 📊

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋