CLOSING BELL

Four Day Climb

The market climbed on Wednesday as Americans journeyed home for turkeyday.

It marks four days of gains after a 5% pullback to start November, amid AI spending concerns and daylight saving time making investors grumpy. Rate cut calls from FOMC members in the past trading sessions helped turn that frown upside down.

Big tech helped lead the way, though Alphabet reversed its record run, swapping with Nvidia climbing higher instead. JPMorgan even said it saw a 7,500 milestone for the S&P 500 by the end of the year, and higher in ‘26 if the Fed keeps cutting rates.

Speaking of the FOMC, it looks like the White House is narrowing down the finalists to replace Chair Jerome Powell next year, with economic advisor Kevin Hassett in the lead.

Bitcoin climbed past $90k again, after hitting a low near $80k five days ago.

Markets will remain closed tomorrow for Thanksgiving, and only open for a half day on Black Friday. I hope you get the chance to break bread with loved ones tomorrow, and give thanks for life’s simple joys: health, wealth, and happiness.

🦃🦃🦃Here’s some market chatter to talk about over gravy: 🦃🦃🦃

10 of 11 sectors closed green. Utilities $XLU ( ▲ 1.11% ) lead and healthcare $XLV ( ▼ 0.42% ) lagged.

TRENDING STOCKS

Hood Climbs After Crappy Month 🏹

(Photo Illustration by Thomas Fuller/SOPA Images/LightRocket via Getty Images)

One standout for retail favorite stocks on Wednesday was brokerages, $HOOD ( ▲ 2.24% ) led the S&P 500 higher, rebounding from a bad month. The stock seller said it was buying MIAX Derivatives Exchange to offer futures trading, and partnering with market maker Susquehanna International Group to build out prediction markets, according to a release.

This acquisition gives Robinhood the infrastructure to launch its own dedicated futures and derivatives exchange by 2026, solidifying prediction markets as a core product. Robinhood worked with Kelshi in the past to offer prediction markets, and it quickly became the fastest-growing product on the platform, with 9B contacts in the past year.

Hood wasn’t the only brokerage name moving on prediction news Webull $BULL ( ▲ 2.86% ) was trending heavily on Stocktwits as the stock bounced sharply off recent lows. The chatter follows Webull's recent Q3 earnings call, where management previewed the launch of new products, including Crypto futures and sports prediction markets.

SPONSORED

Join Derek Jeter and Adam Levine

They’re both investors in AMASS Brands Group. You can join them and get up to 23% bonus stock. But only if you invest by Thursday, Dec. 4.

Why invest? They’re growing fast. Their brands cover everything from organic wine to protein seltzers. So with consumers seeking healthier options in the $900B beverage market, it’s no surprise AMASS has made over $80M to date, including 1,000% year-over-year growth.

They have even more ambitious plans for the future too. They’ve reserved the Nasdaq ticker $AMSS, enlisted a major investment bank to fuel their growth, and plan to 3X their retail footprint by 2028.

But your chance to amplify your investment with bonus stock ends soon. Become an AMASS Brands Group shareholder and secure your bonus stock by Dec. 4.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

5 Key Takeaways for the December Fed Meeting 🧐

The FOMC released the Beige Book summary of economic conditions across the 12 U.S. regions on Wednesday. The latest look at the US economy confirms a worrying "K-shaped" split, showing resilient activity among the wealthy and manufacturers, but widespread weakness in the job market and among low- and middle-income consumers. This report is crucial as the Fed's Dec. 9-10 meeting approaches, lacking fresh official economic data due to the recent government shutdown.

1. The Labor Market Continues to Sputter 📉

The job market cooled across the country, with employers’ appetite for hiring falling in half of the 12 regional divisions. Businesses are using attrition and hiring freezes instead of direct layoffs, and it is getting easier for companies to find workers, easing overall labor pressure.

2. The K-Shaped Consumer Split Deepens 🛍️

Consumer spending has pulled back sharply, except among the wealthy; multiple districts reported that higher-income customers were "unconstrained" while lower- and middle-income shoppers are "tightening the belt" and actively seeking discounts. Anecdotally, car dealers reported fewer EV sales after subsidies expired, and restaurants noted regular customers cutting visits and full meals.

3. Inflation Remains Moderate But Persistent 🛡️

Overall prices rose moderately, but manufacturers and retailers continue to face elevated input costs driven by tariffs and rising healthcare costs, which are straining budgets. While some firms are eating the costs and accepting lower margins, others plan to implement price increases on products with stronger demand.

4. Artificial Intelligence Is Creating a Two-Sided Impact 🤖

AI is driving booming investment and orders for related infrastructure, according to the Boston Fed. Conversely, some companies are pulling back on entry-level hiring, relying on AI for basic tasks, and the technology is causing concern among students about job replacement in fields like data science.

5. Government Shutdown Took a Toll 🥶

The recent government shutdown was noted as a negative force, impacting consumption as federal workers pulled back on spending (e.g., auto sales in Pennsylvania). Community organizations also reported increased demand for food assistance due to disruptions in SNAP benefits distribution.

EARNINGS REPORTS

Inflation Squeezes the Bottom Half

Reports from this season’s quarterly earnings are nearly through: 95% of the S&P 500 have reported. Though four out of five have beaten street expectations, above five and ten-year averages according to FactSet, the qualitative data paints a different picture.

Commentary from CFOs and executive teams on retail earnings confirms what many are feeling — America's consumer economy has split into two distinct tiers, with inflation and high prices forcing low-income families to pull back spending on everything but the basics sharply. In their place, higher-income spenders are moving into lower-income shopping options to look for better deals.

The Price Pain: High prices for essentials (housing, groceries, gas) are eating up low and middle income consumer dollars. They are increasingly running down savings and leaning on credit cards just to afford necessities.

The Market Winner: Discount chains like Costco and Walmart are capitalizing, seeing trade-down traffic from budget-conscious middle-income shoppers looking to save money.

The Losers: Specialty retailers and brands focused on discretionary goods are struggling with uneven demand, signaling that the spending spree for non-essentials is running out of steam for much of the country.

Anyway, enough yapping, here is some price action from reports today:

Workday $WDAY ( ▲ 0.79% ) – The Guidance Trap. The stock fell 8% today despite beating estimates and providing a strong outlook for the coming year. While adjusted EPS of $2.32 topped the forecast, the market reacted negatively to slower-than-expected growth in subscription backlog and deferred revenue, raising concerns about the pace of future growth.

Zscaler $ZS ( ▲ 4.24% ) – Growth Not Enough. Zscaler helped lead the S&P 500 lower, despite the cloud security leader reporting adjusted EPS of $0.96 and revenue of $788.1 million, both of which were strong beats. The decline was fueled by high expectations, as the market focused on slightly lower-than-anticipated billings growth, which investors view as a key predictor of future revenue.

CleanSpark $CLSK ( ▲ 5.4% ) – The Profit Turnaround. The Bitcoin miner climbed 14% Wednesday, driven by its successful shift back to profitability. While the company's revenue of $223.65 million was a slight miss compared to expectations, the market celebrated its substantial adjusted EPS of $1.12, marking a massive turnaround. CleanSpark pulled in a loss of 69C and $1.30 in the past two Q4 reports.

TOP VOICES

IVES: AI Bubble Bath Is Just Warming Up

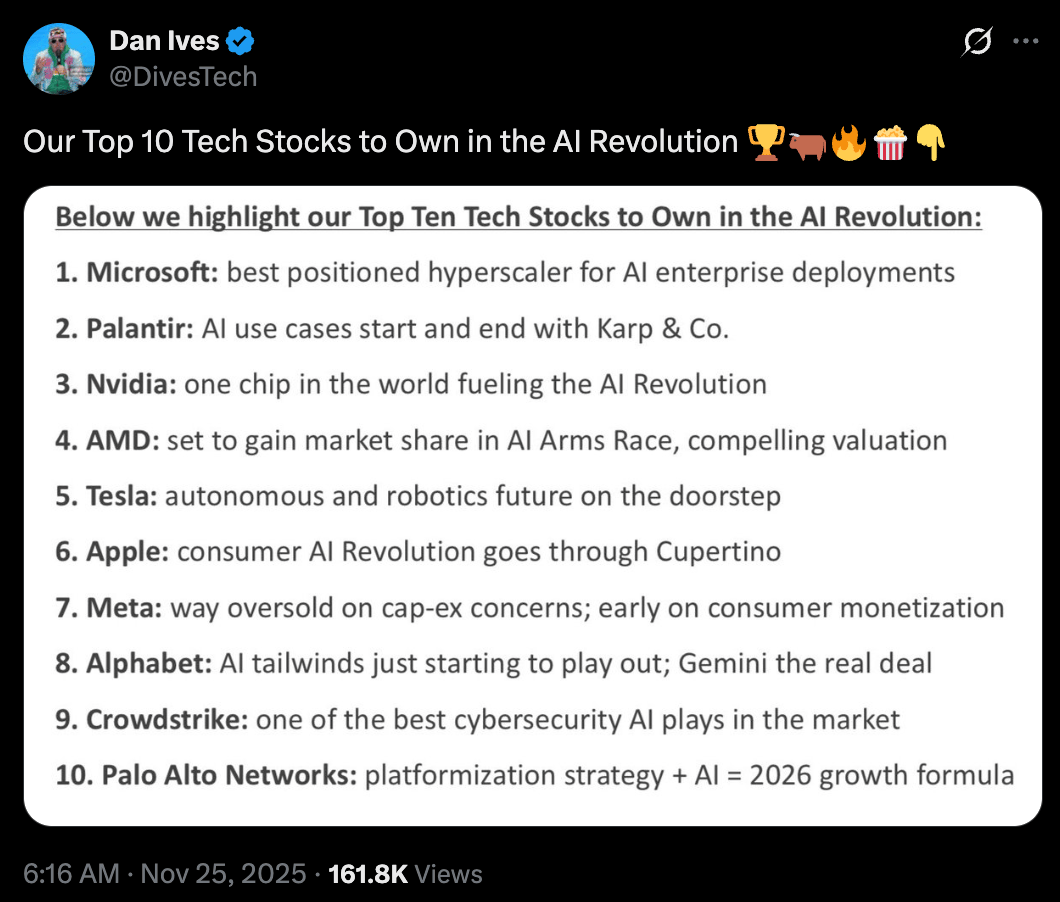

Wedbush analyst Dan Ives, a top Wedbush analyst and major tech bull, is doubling down on his controversial call: "There is no AI bubble."

He posted a top list of stocks he wants traders to focus on during the still ongoing AI ‘revolution’. He insists the boom is in just the second or third inning of a multi-year growth cycle driven by enterprise spending.

There is planned spending of $1 trillion over the next decade, which will flow primarily into core tech players, Ives said, taking his stump speech to Yahoo Finance, “Opening Bid.” Ives argued that current tech valuations are supported by massive free cash flow, high margins, and expanding software/service opportunities.

Pointing to this week’s Google TPU rumor about peer hyperscaler Meta, Ives said the real spending surge is now moving past buying Nvidia chips and into the actual software and security platforms needed to run AI.

POPS & DROPS

Top Stocktwits News Stories 🗞

PagerDuty stock fell 23% to an all-time low after issuing weak guidance.

Ambrx Biopharma stock rose 56% today on positive clinical trial data news.

Tether (USDT) was downgraded to weak after Bitcoin exceeded its reserve cushion.

Blackstone is set to acquire MacLean Power Systems in a $4 billion deal.

Arrowhead Pharmaceuticals stock rose 23% after Morgan Stanley hiked its price target.

Broadcom received a 15% price target increase from Goldman Sachs before earnings.

SMX stock climbed 194% today following a corporate strategy update that caused a buying spree.

Oracle stock jumped after an analyst said the OpenAI partnership is undervalued.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Top Moving Stocks Today

Links That Don’t Suck 🌐

🤖 JPMorgan sees S&P 500 reaching 7,500 in 2026 — or surging past 8,000 if the Fed keeps cutting rates

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋