CLOSING BELL

Friday The 13th, Market Sells Off

The market sank Friday after overnight attacks from Israel into Iran struck home, and Iranian rockets volleyed toward Israel during the trading day. Outside of war, the week was set to end softly. Michigan Consumer Sentiment rose, earlier inflation data was low, and Oracle was still climbing from bang-up earnings.

Today's issue covers the market selling off following Middle East violence, why Walmart Coin is going to look genius in a few years, and more. 📰

With the final numbers for indexes and the ETFs that track them, 1 of 11 sectors closed green, with energy $XLE ( ▼ 0.58% ) leading and financials $XLF ( ▲ 1.76% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 5,977

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,631

Russell 2000 $IWM ( ▲ 0.56% ) 2,100

Dow Jones $DIA ( ▲ 0.58% ) 42,197

MARKET NEWS

Israel Launches Hundreds Of Drones, Missiles Into Iran

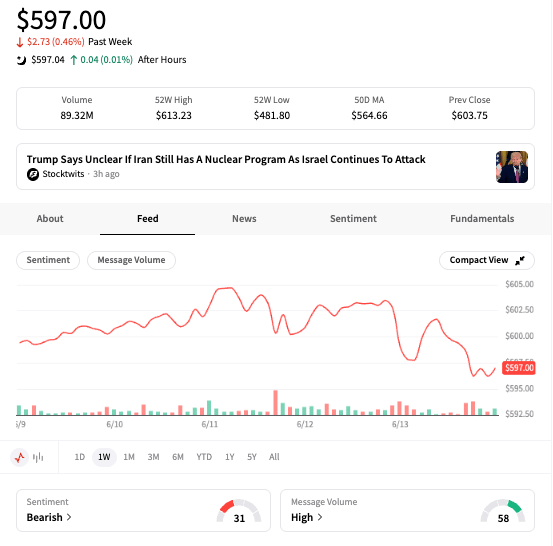

As the escalations between Tel Aviv and Tehran reached a flashpoint, the market took a chance to sell off hard. Few industries, all war or risk-off-related, climbed.

Crude oil soared to nearly six-month highs, jumping over 8% intraday and reaching around $75–77 per barrel. Gold almost hit records, and defense stocks rose, but equities overall were lower. Goldman Sachs analysts warned oil prices could hit $90/barrel if the Israel‑Iran conflict escalates further, while reports from Tel Aviv said Israel was going to keep up attacks for at least two weeks.

The strikes came after the Trump administration had attempted to give a two-month negotiation time frame between Israel and Iran over nuclear arms, a deadline reached as drones and missiles were launched Thursday night.

SPY started to tank late Thursday night.

Who’s Up?

Some of the only positive stocks on the S&P 500 were defense contractors and conglomerates. $PLTR ( ▲ 4.46% ) nearly broke its all-time high and trended heavily on Stocktwits.

Defense contractors climbed as $LMT ( ▼ 2.23% ), $NOC ( ▼ 2.97% ) , $RTX ( ▼ 1.2% ) , and $LHX ( ▼ 3.52% ) led the charge higher.

The only green sector on the S&P 500 was energy, fueled by the crude oil surge. Iran is one of the world's largest producers and exporters, accounting for approximately 3-4% of global oil production. $OXY ( ▼ 2.2% ) and $FANG ( ▼ 3.48% ) led the Nasdaq 100, while $CVX ( ▼ 0.66% ) held up the Dow as one of the only positive stocks.

Who’s Down?

Nicolas Forest, chief investment officer at Candriam, told Bloomberg the market took the chance to sell off. Most stocks within major indices finished the day red.

“The attack on Iran is a classic risk-off factor that leads to a decline in stocks and a flight to quality. The sharp rise in oil prices, if it continues, could negatively impact growth and inflation, reinforcing the potential risk of stagflation already present with the tariff war,” Forest said.

Airline and cruise line stocks fell as fuel prices rose, and nations and firms implemented travel restrictions. $UAL ( ▼ 0.01% ) and $CCL ( ▲ 0.9% ) were among the top losers.

Israel struck Iran’s Isfahan nuclear facility in a high‑altitude raid that killed top military leaders and scientists. Trump initially tweeted out for a return to the negotiation table, but by the market close, it was clear the talks would not continue this weekend. Trump said it’s unclear if Iran even still has a nuclear program to negotiate around.

The U.S., meanwhile, deployed naval destroyers to the region while the U.K. Prime Minister called for immediate de-escalation to avoid a broader conflict.

SPONSORED

StartEngine’s $30M Surge — Own a Piece Before June 26

Private markets are having a moment. More investors are chasing early access to high-potential companies in surging industries like AI. The UN projects that AI will continue growing into a “dominant frontier technology,” potentially becoming a $4.8T market by 2033.¹

That’s probably why VCs poured half (50.8%) of their funding into AI-focused companies in 2024, to the tune of $131.5B.² And yet, these deals (and potential gains) have largely been out of reach for everyday investors like you — until now.

StartEngine is the leading alternative investing platform helping investors access deals once reserved for VCs and insiders, including exposure to AI titans like OpenAI, Databricks, and Perplexity.³

How’s it going? In Q1 2025, StartEngine pulled off $30M in revenue, its biggest quarter ever (based on unaudited financials).⁴ Founders are flocking to the platform to raise capital outside the VC echo chamber. And investors? They’re showing up in droves to tap into pre-IPO value.

But StartEngine isn’t just a middleman. The company earns 20% carried interest on select pre-IPO offerings. So when the companies on its platform win, StartEngine (and its shareholders) win too.⁵

How can you tap into this diversification play? By investing in StartEngine.

StartEngine has crowdfunded $85M+ to date, and you can get involved before the company’s current round closes on June 26.

If you believe in a future where private investing is more accessible and more rewarding, now’s the time to be part of it. Join the 45K+ shareholders who have backed the future of finance by investing in StartEngine.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Walmart Coin Is Going To Look Genius In A Couple Of Years 🪙

As the GENIUS Act stablecoin framework act makes its way through the Senate, one sector is keeping a close eye- retailers. According to an exclusive story from WSJ, Walmart and Amazon are exploring the possibility of shifting high volumes of cash and credit transactions onto internal coin systems.

That’s if the bill passes, of course, and it’s on track- the Senate voted it past a procedural vote this week by 68-30, a wide margin.

On the news, $V ( ▲ 2.05% ) Visa and $MA ( ▲ 2.34% ) fell, the largest processors in the world.

Payment processing costs retailers billions every year, but internal networks could let them process it all in-house.

The “push to instant payments is inevitable and represents a risk” to the credit giants TD Cowen analyst Jaret Seiberg said.

Outside of retail, Airline points and even loyalty programs at brands like McDonald’s or Starbucks could see upsets with access to new internal currencies pegged to the dollar.

NurPhoto via Getty Images

POPS & DROPS

Top Stocktwits News Stories 🗞

Coinbase and Amex teamed up to launch a single card offering 4% Bitcoin rewards—but retail investors remain bearish on crypto markets. Read more

AMD launched new AI chips designed to challenge Nvidia’s market dominance, targeting data center and enterprise workloads with improved performance and cost efficiency. Read more

RH surprised with a quarterly profit, sending shares up over 20% in extended trading; CEO Gary Friedman highlighted efforts to mitigate tariff impacts, including shifting production out of China. Read more

Sharplink Gaming stock plunged over 66% after acquiring $462 million in Ethereum, making it the largest publicly traded ETH holder but sparking investor concerns over treasury strategy. Read more

Akero Therapeutics was identified by Jefferies as one of the biotech firms with potential takeover appeal, citing its promising NASH drug pipeline as a key asset. Read more

OpenAI commits to scaling its AI partnership, aiming to accelerate the deployment of advanced models across industries and deepen collaboration with strategic partners. Read more

Ford CEO Jim Farley highlighted the risks to electric vehicle production from potential rare-earth magnet shortages, emphasizing efforts to diversify suppliers and technologies. Read more

ASTSpaceMobile secured long-term U.S. and Canada rights to 45 MHz of mid‑band spectrum in a $550 M deal—with court and FCC approval expected by late June—to boost its direct-to-smartphone satellite broadband service. Read more

Apple supplier reportedly sends more India‑made iPhones to the U.S. as production shifts to diversify supply chain. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

WEEKEND RIP WITH BEN & EMIL: A WET HOT AMERICAN MELT UP

The melt-up is molten and the boys are barely holding it together. Inflation came in cooler than your ex’s new girlfriend, markets won’t go down even with missiles flying, and Apple just gave us "Liquid Glass" — aka Liquid A$$. Tesla’s driving itself, Bitcoin’s still above 100K, and somehow Fartcoin launched on Coinbase. Meanwhile, Powell’s ghosting the rate cut group chat and the VIX aged out of the teens.

🔹 Markets Melt Up, Ben Melts Down: The S&P and Nasdaq log one of their strongest runs in decades. Ben didn’t capitalize, but Emil did, with some VT Sacks. Ben lowercase-d on it.

🔹 Tesla Unmanned & FartCoin Dumps: Elon’s driverless Teslas spotted in Austin. Ben's calls are aging like milk. He’s out of FartCoin, still has ButtCoin, and deeply regrets his trading lineage.

👉 Will Jesus return before a rate cut? Is liquid glass just liquidass? And are the robots already planning our demise? Find out on this week’s episode of the Weekend Rip.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

StartEnginge Disclaimer: This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. No broker-dealer or intermediary involved in offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information, please see the most recent Offering Circular and Supplements and Risks related to this offering. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion. 1. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. 2. Based on our Q1 2025 Form 10-Q/A. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $24.6 million of the $30 million in revenue from Q1 2025. To understand the impact on margins, see financials. 3. StartEngine receives 1% equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that the company will be profitable.

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋