CLOSING BELL

You Made It To The Weekend!

It was a good week overall, though sentiment jumped around. The market fluctuated between red and green days before ultimately finishing the week up at a barely record close. It was the first week of record-high tariffs, but the market seems uncertain about how to price them, except for higher. 👀

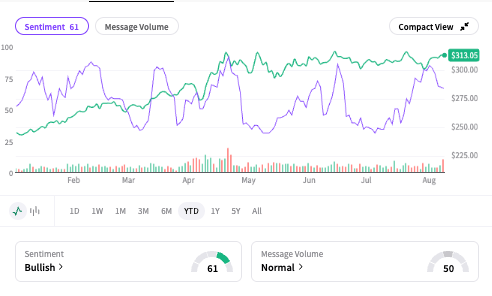

Yields climbed as treasuries sold off throughout the day, but Stocktwits Sentiment kept getting greener for the first full week in August. Trump said after the market closed, the U.S. would meet with Russia as early as next week to try to call a ceasefire in the Ukraine-Russia war.

Today's issue covers: the largest IPO in history might relaunch 2008 mortgage lenders on the NYSE, Gold flew on tariff trouble, and more. 📰

With the final numbers for indexes and the ETFs that track them, 9 of 11 sectors closed green, with tech $XLK ( ▲ 1.3% ) leading and real estate $XLRE ( ▲ 0.28% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,389

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,611

Russell 2000 $IWM ( ▲ 1.09% ) 2,218

Dow Jones $DIA ( ▲ 0.78% ) 44,175

STOCKS

Frannie And Freddie Might Make History 🤑

Freddie Mac jumped 20%, Fannie Mae up 18% after news out of the White House.

The stocks climbed the most they have in months after the Fed said it would spin out 5-15% of the government-sponsored entities into publicly traded stocks. According to Bloomberg, the plan values the companies at $500B, and aims to sell $30 billion in shares.

Feddie Mae and Mac were mortgage debt-selling companies bailed out by the government during the 2008 housing crisis, and have sat in conservatorship ever since.

During an IPO-heavy year, it would be the largest public offering ever, even surpassing Saudi Aramco’s $29.4B listing in 2019. The stocks stopped trading on the NYSE in 2010, but trade over the counter, or through a broker-dealer network directly between buyer and seller.

Trump has met with the chiefs of the largest banks in the U.S. to talk about the deal. He met with CEO Jan Fraser of Citigroup, members of Goldman Sachs, JPMorgan Chase, Wells Fargo, and Bank of America in the past two weeks, according to Bloomberg.

SPONSORED

RAD Intel's Private Round

If you missed Tesla at $1, RAD Intel is still at $0.63—and built for real returns. 3.5× ROI. 1,600% valuation growth. 9,000+ investors. Backed by Adobe & Fidelity. Accredited only via Reg D.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Termoil In The Gold Markets 🥇

Gold futures hit a record high after the U.S. announced tariffs on one-kilogram and 100-ounce gold bars, impacting global supply chains. The chaos started after the U.S. Customs and Border Protection ruled that traded gold bars would be subject to reciprocal tariffs.

A Swiss refiner had sought clarity on the deal, and after the decision was posted on the Customs website, futures freaked out. The White House made a clarifying statement Friday that it would put together a clearer executive order to clarify gold tariffs, according to a statement sent to Bloomberg.

It would have been an all-time closing high of $3,491.30 after the news. Futures had hit a high of $4,490 per ounce after the Financial Times initially reported the news.

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Sweetgreen, Expedia Group, and Monster Beverage drew the highest retail chatter among consumer stocks on Stocktwits, all after the firms reported quarterly results. Read more

JPMorgan reportedly now expects the Federal Reserve to cut interest rates as soon as September, with three more cuts anticipated before the end of the year. Read more

Uber Eats has teamed up with Dollar General and pOpshelf to bring over 14,000 of their locations onto the Uber Eats app so customers can order essentials or food from the “Grocery” or “Convenience” sections for delivery starting today. Read more

Centrus Energy’s CFO, Kevin Harrill, is resigning after four years to pursue other opportunities, with Todd Tinelli stepping in as his replacement effective August 11; Harrill will remain through August 29 to ensure a smooth transition. Read more

Ray Dalio, billionaire hedge fund manager, warns that if income growth continues to lag behind debt growth, borrowers may get stuck borrowing more just to service existing debt. Read more

U.S. and Russia are reportedly working on a territorial deal that could pave the way for a ceasefire in Ukraine and a potential summit between Presidents Trump and Putin next week. Read more

Tesla has secured a rideshare permit in Texas for its Robotaxi LLC under new autonomous vehicle rules effective September 1. Read more

Netflix is reportedly in talks with MLB to acquire streaming rights for the Home Run Derby and potentially other baseball content. Read more

Heartflow stock surged 66% in its Nasdaq debut after pricing its IPO at $19 per share, raising about $316.7 million. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Axon Stock Explodes, Google Gets No Love, and AI Is Replacing Wall Street

Stocktwits CEO Howard Lindzon is back with another hard-hitting episode of This Week in the Degenerate Economy, where the lines between tech, markets, and culture get blurrier by the day.

This week, Howard breaks down the quiet dominance of Axon (formerly Taser), the AI prompts that are replacing Wall Street analysts, and how a viral moment with Sydney Sweeney pumped American Eagle’s stock. Plus: Why Google’s stock performance doesn’t match its profits, why retail investors aren’t going anywhere, and a sharp look at Galaxy Digital’s crypto climb.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋