Presented by

CLOSING BELL

Hidden Red October

Markets fell, after Wednesday’s good jobs data turned into Thursday’s bad jobs data when another private employer said October had 183% more layoffs than the month before.

It was a red October for job cuts, the worst in 20 years, according to the report, and treasurys rallied. Speaking of jobs, Nancy Pelosi said she was retiring next year, a big loss for growth investors tracking her trades.

AI and tech declined as good (fine) earnings reports from Arm and Qualcomm faced insane expectations. The Trump Admin said there would be no bailout for AI investments it was making, after a conference comment from OpenAI CFO Sarah Friar gained the attention of Chief Sam Altman. Altman wrote a book-long twitter post to say he didn’t expect a bailout if massive AI spending goes wrong.

Speaking of government, it’s the 37th day of a government shutdown, thousands of flights are set to be canceled tomorrow, while the Trump admin is arguing it deserves to declare emergency tariffs on anything at any time. The SCOTUS is not buying it yet. Big news if these past six months of import taxes are reversed, who knows what would happen to equity prices and trade deals. The admin also cut costs for weight loss drugs. 🌮

Today's RIP: Oct was a Red Jobs Month, Tesla shareholders approve Musks $1T pay package, a ton of earnings, and somehow more.📰

2 of 11 sectors closed green. Energy $XLE ( ▼ 0.09% ) lead and discretionary $XLY ( ▲ 1.52% ) lagged.

SHAREHOLDER DEMOCRACY

Shareholders Approve Musk’s Massive Pay Package 🤑

$TSLA ( ▲ 2.39% ) shareholders approved Elon Musk’s monstrous pay package on Thursday, granting the world’s richest person a roadmap to become even richer. The vote was positioned to give Musk 25% voting control over the Mag 7 giant Tesla.

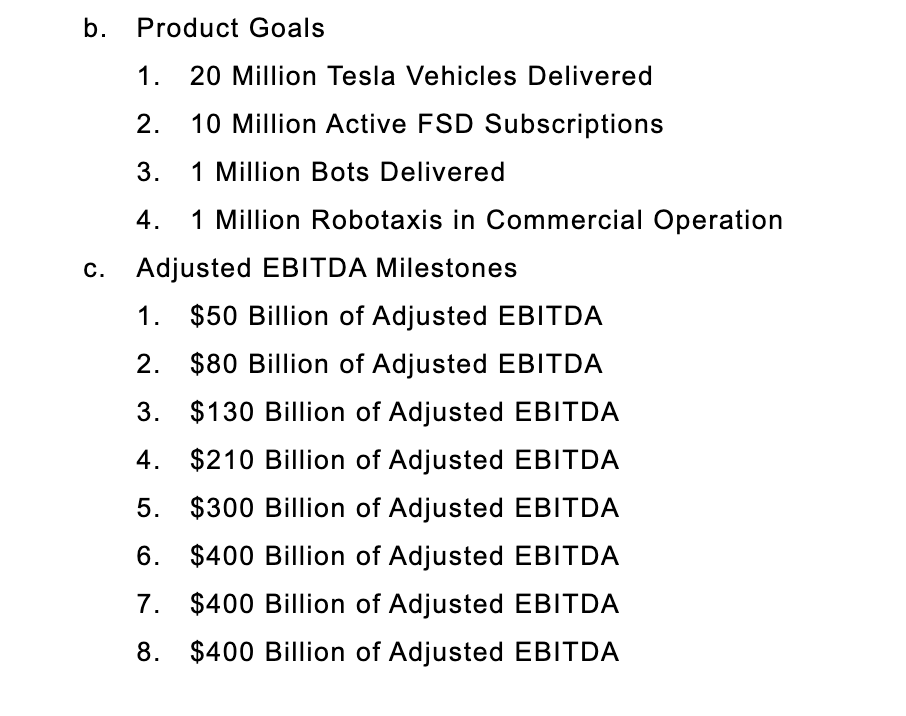

The deal gives Musk access to 423M more shares of the company, up to 12% of the adjusted share count, over 12 tranches released as long as the company meets performance goals. Each share reward comes after the company breaks $2T in valuation, then every $500B in valuation added, alongside operational goals shown below:

Tesla proxy filing

Romaine Bostick, CFA Editor at Bloomberg, pointed out the $1T number was a focus because, duh, it is absurdly large, but for many shareholders, the choice was about corporate control and job retention; they like Musk and think he can achive his vision of AI-driven cars and robots. Without a guarantee of voting control and job security, Musk can just “pick up his toys and go play somewhere else,” Bostick said.

More than 75% of the shareholders’ vote went in favor of the Musk pay package. Institutional investors, hedge funds, and pension plans were initially unknown factors in the voting process but ultimately supported the plan set by the board in favor of Musk.

Musk just needs to 8X Tesla bags to get his payout.

SPONSORED

Meet the ChatGPT of Marketing – And It's Still Just $0.81 a Share

It’s easy to see why 10,000+ investors and global giants are in on the action. Their AI software helps major brands pinpoint their perfect audience and predict what content drives action.

The proof is recurring seven-figure contracts with Fortune 1000 brands.

Think Google/Facebook-style targeting, but smarter, faster, and built for the next era of AI. Major brands across entertainment, healthcare, and gaming are already using RAD Intel, and the company has backing from Adobe and insiders from Meta, Google, and Amazon.

Here’s the kicker: RAD Intel is still private—but you can invest right now at just $0.81 per share. They’ve already reserved their Nasdaq ticker, $RADI, and the valuation has soared 4900% in just 4 years*.

This is what getting “in” early feels like. Missed Nvidia? Missed Shopify? This is your second shot. Early shares are still available—but not for long as the price changes this month.

Shares now open to investors - Lock in the $0.81 round before it changes Nov 20.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

AFTER THE BELL

No One Could Have Predicted DraftKings’ Predictions 🏈

Draftkings $DKNG ( ▲ 2.57% ) was falling after the bell following its Q3 report, posting an adjusted loss and $1.1B in sales for the quarter, which were a disappointment to traders betting on the upside.

The sports book cut its 2025 adjusted EBITDA estimate in half, from $800-$900 to a most $550M. It announced Thursday morning it would become the official sportsbook of ESPN, a great visibility and marketing play with Disney, but an unknown cost to shareholders.

DraftKings also announced prediction markets after acquiring Railbird Tech last month, mostly for the UI. The company wants to launch a prettier-looking app just for predictions, it said, after predictions markets Kalshi and Polymarket ate its lunch this past year. 🥪

Prediction markets are regulated federally, and circumvent more strict state regulations, effectively allowing betting anywhere.

It wasn’t the only declining stock after the bell. $XYZ ( ▲ 0.49% ) Block sank 10% after missing Q3 estimates with $6.11B in revenue and $0.54 EPS, both below consensus. Despite strong Cash App and Square GPV growth, investors punished the stock for weak margins and slowing Bitcoin revenue. $ACHR ( ▲ 3.31% ) Archer dropped 9% after announcing an 81M share offering at $8 to fund its $126M Hawthorne Airport acquisition.

It wasn’t all bad news- $AFRM ( ▲ 1.57% ) jumped 10% after posting a surprise Q1 profit of $0.23 per share and record $933M revenue, beating estimates GMV hit an all-time high despite few shopping holidays, and Q2 guidance came in strong.

MACRO NEWS

Bad Jobs Market (One Day After I Said Good Jobs Market) 🤼

Layoffs in the month of October were at their highest since 2003, according to research by Challenger, Gray & Christmas HR advisors. U.S. based employers announced 153,074 job cuts in October, second highest month this year for layoffs in a reversal of this week’s ADP October job hiring data which looked healthy.

The report found there have been 1.1M layoffs this year, a 44% jump from the first compared to 2024, and there’s still two months left to go. There was a huge number of cuts in March in their findings due to DODGE firings in the Federal Government.

Andy Challenger, CRO at the firm, said it was the worst start to a fourth-quarter labor market since the financial meltdown of 2008. Companies seemingly no longer wait until after the holiday season to cut the workforce, he said.

“Over the last decade, companies have shied away from announcing layoffs in the fourth quarter, so it’s surprising to see so many in October.”

It’s data like this, that pushes some to call for cuts at the Federal Reserve, releases the money supply, and get firms juiced up to hire again. The lack of official data from the Fed is prompting others to exercise caution. Chicago Fed’s Goolsbee said Thursday he wanted to get Fed data before deciding on more cuts.

MORE EARNINGS

Reporting Round Up 11/6 🤠

Snap $SNAP ( ▲ 0.81% ) Robinhood $HOOD ( ▲ 2.24% ) Celesius $CELH ( ▲ 3.05% ) and $DUOL ( ▲ 3.11% ) were still moving from their Wednesday night reports. Snap was climbing on its $00M perplexity deal and beat, Doulingo was falling on lower margins, and Celsius basically spent a ton of money on new drink acquisitions and stocking shelves, missing earnings estimates.

Here were the top names moving on Thursday reports:

e.l.f. Beauty $ELF ( ▲ 5.29% )

ELF crashed 29% after missing revenue estimates and guiding for a 17% EPS decline in fiscal 2026 due to $50M in tariff costs and slowing organic growth. Net sales came in more than $120M short. The Rhode acquisition is driving most of the growth, but margins and core brand momentum are under pressure.

Datadog $DDOG ( ▲ 1.77% )

Datadog soared 23% after crushing Q3 earnings with 28% revenue growth, strong free cash flow, and rising AI-native customer spend. The company raised full-year guidance and now serves over 4,060 enterprise clients with $100K in annual recurring revenue.

Moderna $MRNA ( ▲ 0.46% )

Moderna posted a smaller-than-expected Q3 loss of $0.51 per share and beat revenue estimates with $1B in sales, mostly from COVID vaccines. It cut R&D spending and narrowed its 2025 revenue forecast to $1.6–$2B amid declining vaccination rates.

D-Wave Quantum $QBTS ( ▲ 3.38% )

D-Wave beat Q3 expectations with $3.7M in revenue, up 100% from last year. D-Wave recorded a $140M net loss, attributed to warrants and warrant exercises, what CEO Alan Baratz told Barrons was just a “paper loss.”

POPS & DROPS

Top Stocktwits News Stories 🗞

SkyWater Technology rose 27% after CHIPS Act funding award.

CoreWeave fell 6% after announcing a $1.17B AI deal with Vast.

JPMorgan flagged Bitcoin as undervalued vs gold, est. $170K.

Boeing avoided criminal charges in DOJ deal over 737 Max crashes.

Fed’s Goolsbee warned rate cuts may be premature.

XRP fell 5% as Bitcoin ETFs posted major outflows.

Qualcomm fell 4% after a price target, weak near-term fundamentals.

Duolingo fell 21% after rising costs and margin pressure spooked investors.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: FOMC Member Williams Speaks (4:00 AM), Michigan Inflation Expectations (11:00 AM), NY Fed 1-Year Inflation Expectations (12:00 PM), U.S. Baker Hughes Total Rig Count (2:00 PM), Consumer Credit (4:00 PM) 📊

Pre-Market Earnings: Canopy Growth ($CGC), Enbridge ($ENB), Wendy’s ($WEN), Constellation Energy ($CEG), and Duke Energy ($DUK). 🛏️

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍