CLOSING BELL

Market Climbs On Hope For Peace

[belated]

The market climbed after a weekend of protests and parades when news reports said Iran was trying to communicate with the U.S. to achieve a ceasefire with Israel.

It was a fast turnaround, following drone, missile, and jet air combat raging about four days before Israel said it had achieved air superiority over the western corner of Iran. Like Ukraine just two weeks ago, Israel softened up targets by smuggling in thousands of munitions and drones that launched near anti-aircraft and nuclear infrastructure sites.

Besides hope for peace, the market is watching the start of the G7 meeting in Alberta, Canada, and awaiting the FOMC meeting, which is unlikely to bring a rate cut but is expected to show an updated dot plot of economic projections. Big win for chart nerds if true. 👀

Today's issue covers Japan’s buying $X finally, G7 get’s cracking, and more. 📰

I hope everyone had an excellent Father’s Day! Thank you to all the dads out there; without you, where would we find strength, bravery, or the love of beat-up white sneakers? 👟

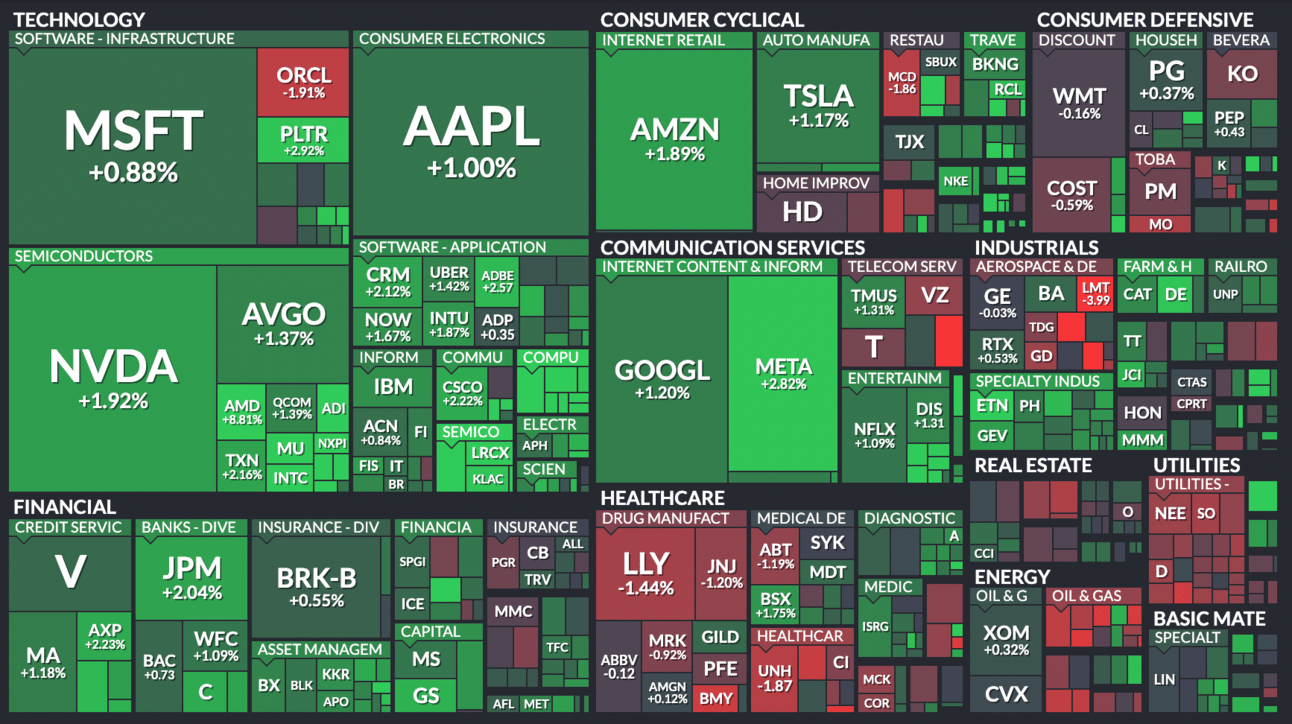

With the final numbers for indexes and the ETFs that track them, 8 of 11 sectors closed green, with communications $XLC ( ▲ 0.21% ) leading and utilities $XLU ( ▲ 0.38% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,033

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,937

Russell 2000 $IWM ( ▲ 0.56% ) 2,124

Dow Jones $DIA ( ▲ 0.58% ) 42,515

STOCKS

Japan Buying U.S. Steel? Fed Can Say X-Nay On Outsourcing 👛

$X ( ▼ 0.02% ) climbed after President Trump approved Nippon Steel's $14.9 billion acquisition of U.S. Steel, marking the end of an 18-month review process. It ends the long, what feels like years journey for the failing steel firm as it sought a buyout rescue.

The deal gives the U.S. government a ‘golden share,’ or full authority over production and trade matters, while Nippon Steel will help pay for the deal through $11B in U.S. investments for the next three years.

The president tried to claim victory, though both he and President Biden had resisted the notion of a foreign firm buying a staple century-old company. Still, commerce Secretary Howard Lutnick posted that the golden share deal gives the Fed the final say on operations, including hiring, materials sourcing, and limits on shifting production outside the U.S.

SPONSORED

StartEngine’s $30M Q1 — Own a Piece Before June 26

Private markets are having a moment. More investors are chasing early access to high-potential companies they believe in before the IPO buzz hits.

StartEngine is making those connections possible. The leading alternative investing platform is helping everyday investors like you access deals once reserved for VCs and insiders, including exposure to private market titans like OpenAI, Databricks, and Perplexity.¹

How’s it going? In Q1 2025, StartEngine pulled off $30M in revenue, its biggest quarter ever (based on unaudited financials).² Founders are using to the platform to raise capital outside the VC echo chamber. And investors? They’re showing up to tap into pre-IPO value.

But StartEngine isn’t just a middleman. The company earns 20% carried interest on select pre-IPO offerings. So when the companies on its platform win, StartEngine (and its shareholders) win too.³

How can you tap into this diversification play? By investing in StartEngine.

StartEngine has crowdfunded $85M+ to date, and you can get involved before the company’s current round closes on June 26.

If you believe in a future where private investing is more accessible and more rewarding, now’s the time to be part of it. Join the 45K+ shareholders who have backed the future of finance by investing in StartEngine.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

…EXCEPT DEATH AND TAXES

Speaking Of Foreign Production, G7 Sitdowns Started In Maple Land 🇨🇦

On Monday, Japan, member nations of the EU, Canada, and Mexico descended to Alberta, Canada to talk international politics. The theme of this year’s talk is clear: tariffs and war in the Middle East, and Trump already met with Canadian Prime Minister Mark Carney this morning to talk border taxes.

It’s not just an opportunity to get in front of the tariff setter himself but also a chance for Trump to get any ounce of agreement with the largest U.S. allies before his self-imposed three-month deadline for tariff pauses ends in July.

Trump has a concept of a plan, he said; he just needs to mesh it with Carney’s concept. Sounds failure.

“We’re going to see if we can get to the bottom of it today,” Trump told WSJ this morning, “We have a tariff concept, Mark has a different concept, which is something that some people like.”

Early news reports Monday said the EU was considering accepting a flat 10% tariff rate with the U.S. to get the concession game rolling. Monday afternoon, the EU denied the claims, and it’s up to member nations France, Germany, and Italy to play nice this week to pursue other options.

Late Monday, Bloomberg reported that British Prime Minister Keir Starmer signed a deal with Trump on the deal framework worked out last month. Really a banner time for accomplishing things twice. /s

SPONSORED

TNL Mediagene (NASDAQ: TNMG) Asia's Next-Generation Media and Data Analytics Company

$TNMG is headquartered in Tokyo and operates 25 media properties across the spectrum from lifestyle blogs, tech & gadgets to business news, and includes well-known IPs such as Gizmodo Japan, Business Insider Japan, Tech Insider, and Money Insider, among others.

The Company generates revenue by selling advertising, sponsored content, and adtech products across its media properties and generated $48.5m revenue in FY2024 at a 35% YoY growth rate and near break-even adjusted EBITDA.

Highlights:

45M+ monthly unique users and 189m+ monthly digital footprints across 25 media properties

Prestigious client base of 850+ clients, including leading multinational companies and strong regional players

M&A roll-up that has acquired 10 companies since 2018 and maintains an active target sourcing pipeline

Analysts at Benchmark recently initiated coverage on the Company

“We see tremendous potential in cultural convergence and digital growth across Asian markets,” said Joey Chung, Co-Founder and CEO of TNL Mediagene.

Add $TNMG to your watchlist and stay up to date with us as we power Asia’s next generation media.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Reddit introduced AI-powered ad tools, including Reddit Insights and Conversation Summary Add-ons, to help brands analyze trends and boost engagement by featuring positive user comments. Read more

Roku stock surged over 10% after announcing an exclusive partnership with Amazon Ads, granting advertisers access to 80 million U.S.-connected TV households via Amazon's DSP. Read more

Alibaba unveiled Qwen3 AI models optimized for Apple's MLX architecture, enabling advanced AI features across iPhones, iPads, and Macs. Read more

AMD stock surged nearly 10% intraday to a six-month high after analysts raised price targets, citing enthusiasm over new AI product launches and growing enterprise adoption. Read more

CoreWeave stock has surged nearly 290% since its March IPO, prompting Bank of America to downgrade it to "Neutral" from "Buy," citing valuation concerns despite raising the price target to $185. Read more

Amex announced its largest-ever investment in a Platinum Card refresh, expanding Centurion Lounge locations, enhancing dining perks, and introducing new business-focused features. Read more

Celsius stock rallied over 6% after TD Cowen upgraded it to "Buy" from "Hold" and raised its price target from $37 to $55, citing improved sales trends and strategic expansion efforts. Read more

PRESENTED BY STOCKTWITS

Daily Rip Live: Stagflation Talk, Solar Bounce, and the Death of Bitcoin Proxies

Welcome to Daily Rip Live with Katie Perry and guest host Tom Bruni, sitting in while Shay is out celebrating his birthday. 🥳

Tom brings the heat with a full macro rundown, from Fed policy confusion and oil’s trend reversal to Bitcoin sentiment shifts and solar’s under-the-radar rebound. If you’re trying to find the signal in a noisy summer tape, this one’s for you. 👇

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: IEA Monthly Report (4:00 AM), Retail Sales (MoM) (May) (8:30 AM), 5-Year TIPS Auction, Atlanta Fed GDPNow (Q2) (1:00 PM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: Kirkland’s ($KIRK), Jabil ($JBL). 🛏️

After-Hour Earnings: VistaGen Therapeutics ($VTGN), Beyond Air ($XAIR). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

StartEnginge Disclaimer: This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. No broker-dealer or intermediary involved in offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information, please see the most recent Offering Circular and Supplements and Risks related to this offering. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion. 1. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. 2. Based on our Q1 2025 Form 10-Q/A. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $24.6 million of the $30 million in revenue from Q1 2025. To understand the impact on margins, see financials. 3. StartEngine receives 1% equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that the company will be profitable.

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋