CLOSING BELL

How Do You Do, Fellow Patriots

The market closed higher, despite weekend news that 30% tariffs are coming to an EU near you. JP Morgan analysts predict yet another ‘meh’ when the new duties come due Aug 1, and either a pause or new warnings. And even if tariffs come true, end-of-the-world price climbs have not begun.

Kevin Hassett, kissing butt in the running for the FOMC chair seat, said tariffs aren’t driving up prices thanks to “patriotism buying.” On behalf of my retirement investments, thank you all for spending money. 🫡 🦅

Tomorrow brings a fresh inflation print, and the biggest of the big banks reporting their last quarter. Bloomberg forecasts a moderate CPI inflation print tomorrow morning, and not a lick of tariff price increases. 👀

Today's issue covers Meta will cover Manhattan with server farms, what to expect from bank earnings, and the trade news you missed. 📰

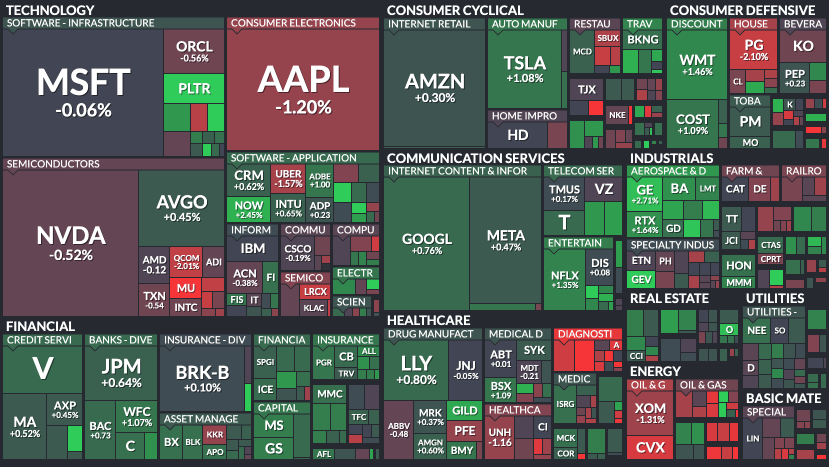

With the final numbers for indexes and the ETFs that track them, 7 of 11 sectors closed green, with communications $XLC ( ▲ 0.69% ) leading and energy $XLE ( ▼ 0.09% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,268

Nasdaq 100 $QQQ ( ▲ 1.07% ) 22,855

Russell 2000 $IWM ( ▲ 1.09% ) 2,249

Dow Jones $DIA ( ▲ 0.78% ) 44,459

STOCKS

Zuck Wants To Beat Everyone To The Singularity ⭕

Mark Zuckerberg took to Threads, a social media platform on track to surpass X in daily active users, and said Monday that the firm is investing heavily to bring multiple gigawatt-sized computing centers online in the coming years.

Zuck plans to have a computing footprint that would rival the size of a section of Manhattan, from around 9th up to 110th above the park.

Zuck excluded the Times Square area, but if you have spent any time in Manhattan, you would too.

Meta and gang are calling the first part of the datacenter push “Prometheus,” due to come online in 2026, in New Albany, Ohio. Zuck also said the firm is working on a 5GW ‘Hyperion’ hivemind in Louisiana. The firm expects to host 2GW of computational power there by 2030.

The news sent nuclear stocks flying, like Oklo Inc. ($OKLO), Nano Nuclear ($NNE), Nuscale Power ($SMR), and more.

The projects will soak up millions of homes’ worth of electricity and water, and the news dropped the same day the New York Times reported Meta’s Georgia data center has caused nearby tap water to run dry. 🌊

Still, if an investor likes holding data center supply firms and the stocks that make the chips Meta will buy up in its fight to the top of the computing space, the news is huge. ⚡

SPONSORED

IQSTEL, Inc. (Nasdaq: IQST) $IQST

$101.5 Million Preliminary Net Revenue for Jan-May 2025 Puts AI Telcom Leader On Track to Meet $340 Million Annual Forecast:

IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence, and More.

IQST Has Organic Growth, Acquisitions, and High-Margin Product Expansion.

New IQST Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

IQST and CYCU Announce the Advancement of Their Strategic Partnership to Serve the Global Cybersecurity Market with AI-Powered Platform.

$IQST and $CYCU are launching “Cyber Shield,” a white-label cybersecurity platform that major telecom carriers can offer to their own customers

For more information on $IQST visit: www.iQSTEL.com

Disclaimer: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

What To Expect When Expecting Bank Earnings 🏦

The big boys are coming to town Tuesday, ready to jump-start the true Q2 earnings season with earnings calls that are way too early in the morning for anyone to listen to.

JP Morgan, Wells Fargo, and Citigroup are expected to show strong Q2 investment banking activity in their reports.

According to estimates compiled by Yahoo, the market expects EPS of $4.47 for JPM, and Rev $43.98B. It would be an earnings decline from April’s report. For Wells Fargo, the market wants $1.4/share and Rev $20.76B, right above last quarter’s result. Citi analysts want $1.6/share and Rev $20.83B, also below last quarter’s earnings result.

FactSet data implies this season will show a 5% jump in EPS overall, compared to the Q1s tariff inflation-conscious reports.

CFRA Research's Ken Leon told Yahoo Finance that April reports felt like "the world was coming to an end, and these banks were going to be in trouble because of the high uncertainty, but we haven't seen that.”

Instead, successful IPOs like Circle might pump the M&A side of investment banking toward high buybacks and dividends. Some analysts expect banks to push guidance for the rest of the year even higher, though with stock prices at all-time highs for bank giants like Goldman Sachs, also due to report this week, the market reaction may not be a price jump.

Speaking of price jumps, The Trade Desk flew 14% after hours Monday after S&P Global said the stock would replace ANSYS Inc. in the S&P 500. Robinhood investors are left sighing again as it’s overlooked. 😢

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Bitcoin surged past $123,000 in pre-market trading, sparking rallies in XRP, Dogecoin, and crypto-linked stocks like MSTR and MARA as short sellers faced $750M in liquidations. Read more

Boeing remains under scrutiny after Air India’s CEO warned the crash probe into flight AI 171 is “far from over,” despite a preliminary report clearing mechanical faults. Read more

Morgan Stanley downgraded CrowdStrike to Equal Weight, saying the stock’s 50% run-up has priced in growth prospects despite continued bullish retail sentiment. Read more

Rocket Lab hit an all-time high after Citi raised its target to $50, citing strong Neutron rocket momentum, satellite growth, and government contract tailwinds. Read more

Autodesk ended its pursuit of acquiring PTC, opting instead to focus on organic growth, AI innovation, and strategic margin improvement. Read more

BitMine stock surged over 15% after doubling its Ethereum treasury to $500M post a $250M private placement, positioning itself alongside crypto treasury leaders. Read more

Trump promised “top of the line” weapons for NATO and warned of 100% tariffs on Russia if no peace deal is reached within 50 days. Read more

STOCKTWITS RETAIL RADAR

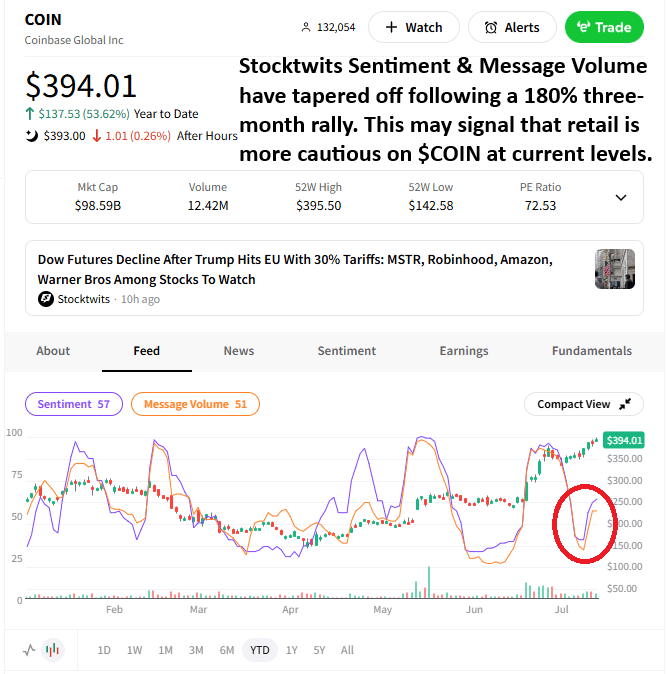

Retail Turns Cautious On Coinbase ($COIN) 🪙

Last week, Bitcoin broke out to new all-time highs and markets, with retail’s reset providing a strong tailwind for the bulls. Coinbase also posted its highest weekly closing price ever as crypto-linked stocks soared. However, after a weekend of jubilation, Coinbase and other crypto-linked stocks faded throughout today’s trade. Let’s see what Stocktwits Sentiment may be suggesting about their next move. 👇

With Coinbase in the news for trading above $100 billion market cap, Stocktwits Sentiment and Message Volume remain well off their highs. While not inherently bearish, it may suggest that retail is looking for opportunities elsewhere rather than jumping on the stock after its 180% three-month rally. 🚨

From a technical perspective, last week’s closing price was the highest ever, putting prices firmly above resistance near 340-370. Looking ahead, bulls will use that as a point of reference on the downside to signal that this breakout is the real deal. Traders are still using this fresh breakout to get involved in a risk-defined way. However, some investors are looking for the stock to digest its gains before jumping back in. ⏸

Other popular crypto-linked stocks like Robinhood, SoFi Technologies, and Marathon Digital also saw some volatility today, putting traders on watch for a potential reversal. While the long-term trends for these stocks remain bullish, caution flags are being raised by some in the community following record short-term runs. ⚠

Add $COIN to your watchlist to monitor this development. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto. 🔓

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in Coinbase or any other stocks/crypto mentioned as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

EXPEVT DEATH AND TAXES

Tariffs Threats Over The Weekend, And What They Mean 😎

The president announced a 30% tariff on European and Mexican goods, although he said the door is still open for talks before the two-week timeframe ends. The EU Trade Chief, Maroš Šefčovič, said he would like to reach an agreement and avoid a trade war, but it will require the friendly cooperation of both sides. What could go wrong?

In line with the Meta data center news, Trump will reportedly announce $70B in private-sector AI and energy investments—featuring data centers, power infrastructure, and workforce training—during Tuesday’s summit in Pittsburgh. The news arrived after the Pentagon awarded $200M contracts to xAI, Google, OpenAI, and Anthropic to accelerate military AI adoption through agentic systems for logistics, cyber defense, and enterprise support.

Though X’s Grok AI keeps giving pro-Hitler responses in a 2000s edge lord sort of way, the private firm announced it would start building AI for government use soon.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: OPEC Monthly Report (7:00 AM), CPI (8:30 AM), FOMC Member Bowman Speaks (9:15 AM), Fed Vice Chair for Supervision Barr Speaks (12:45 PM). 📊

Pre-Market Earnings: JPMorgan Chase ($JPM), Wells Fargo ($WFC), Citigroup ($C), BlackRock ($BLK), Albertsons Companies ($ACI), and Bank of New York Mellon ($BK)🛏️

After-Hour Earnings: Castellum ($CTM)🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋