Presented by

CLOSING BELL

Inflation Climbs, Cuts Still Coming

The market rebounded from the worst multi-day pullback since April on Friday, after inflation data showed prices were climbing, but not to a level that would prompt the FOMC to stop cutting rates. Of course, that’s what investors hope, and the Fed seems convinced 3% inflation at year’s end is on the way.

Every sector was climbing on Friday, despite fresh tariff threats from the Trump administration. Trump said there would be a 100% duty on drugs unless the producer is at least attempting to build factories in the U.S. Healthcare stocks climbed on the news, finally with a goalpost in sight. Trump also wants chipmakers to match domestic chip production with foreign production, offering exemptions.

Markets still closed the week lower. It was an insane week for OpenAI, bagging $100B from Nvidia, scaling Stargate to $400B with Oracle, and an integration with Databricks. 👀

Today’s RIP: EA is getting a buyer, and Gov shut down on the way? 📰

All sectors closed green, with utilities $XLU ( ▲ 1.11% ) leading and staples $XLP ( ▲ 0.87% ) lagging.

STOCKS

M&A Keeps Going, And EA Games Might Be Next 🎮

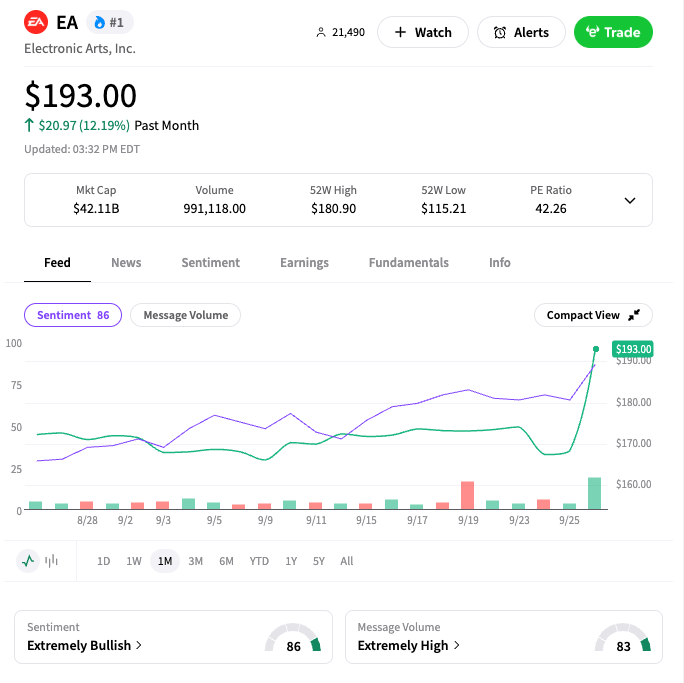

Electronic Arts $EA ( ▲ 0.26% ) flew shortly after 2:30 PM on Friday, after a Wall Street Journal report the company was close to a deal to go private, with finalization as close as next week.

The buyers in question are a group of investors led by Silver Lake Private Equity and Saudi Arabia’s Public Investment Fund. The fund recently bought out a Middle East media giant MBC Group for $2B.

Two sources said the deal could value the company at $50B, and share prices jumped toward that market cap late Friday.

EA makes games like FIFA, Madden NFL, and, of course, The Sims. EA is due to release Battlefield 6 next month. The Journal reported that if the deal goes through, it would be the largest levered buyout of all time, bigger than the Texas Utility buyout in 2007, and the Medline Industries buyout for $30B in 2021.

SPONSORED

AI’s $500B Boom Runs on Power. NUAI is Building It.

Global AI infrastructure spending is projected to surge from $375B in 2025 to $500B in 2026. New Era Energy & Digital (NASDAQ: NUAI) is seizing this opportunity with energy-resilient, AI-native infrastructure — anchored by a hyperscale data center now underway in the Permian Basin, a milestone in transformative growth.

New Era Energy & Digital develops next-generation digital infrastructure and integrated power assets to meet the massive energy demands of AI, HPC, and cloud. The strategy starts with identifying prime sites in key compute corridors with ready access to power, water, and fiber. By securing and preparing these locations ahead of customer build-outs, the company's power-ready land and shells accelerate data center deployment timelines and reduce costs.

Anchored by on-site natural gas generation and designed with future optionality for renewables, New Era Energy & Digital's behind-the-meter model ensures reliable, cost-stable energy while bypassing grid constraints. The result is scalable, resilient infrastructure that underpins the backbone of tomorrow’s digital economy.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

U.S. Government Likely To Shut Down 🏦

Democrat refusal to pass a seven-week stopgap funding bill to keep the Fed lights on until November will likely cause a government shutdown next week, the first in seven years.

Trump has threatened to use the opportunity of a shutdown to fire federal employees who don’t follow his marching orders, and even if courts one day decide he can’t do that, it’s enough of a threat to worry Democrat lawmakers.

Government shutdowns put hundreds of thousands of federal employees, as well as key macroeconomic data such as job reports, on hold until lawmakers can reach a compromise. Republicans want to continue with current spending levels, and Democrats want to use the opportunity to place health-care protections on tax credits for the Affordable Care Act.

Congress needs to pass 12 bills by September 30 to finance the government. Even if the bill passes the House, the bill would need 60 votes to get through the Senate, but the GOP only has 53 seats. Last shutdown, 850,000 employees were furloughed, and during the 2018 partial shutdown over the border wall, GDP, CPI, and jobs numbers were delayed two weeks, according to Wells Fargo Economist Michael Pugliese.

PARTNER MESSAGE

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Amgen adds $650M Puerto Rico plant, stock flat.

White House confirms tariff exemptions for trade partners.

Starbucks dips as CTO exits amid layoffs.

Fractyl Health surges 32% on Revita trial results.

Boeing jumps on FAA certification shift.

Klarna falls below $40 IPO level.

ByteDance will keep 50% TikTok U.S. profit post-sale.

Costco falls 2.9% despite Q4 beat, valuation concerns.

bioAffinity Technologies surges 55% on CyPath Lung case data.

Gorilla Technology climbs 6% on $1.4B Freyr deal.

Big Pharma rises ~1% on Trump tariff conclusion.

United Airlines falls on FAA Starlink approval.

Tesla rises 4% on Wedbush $600 target.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Options vs Leverage: The Cleanest Ways to Ride This Tape

I covered the top trending stocks on Stocktwits earlier today, check it out:

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋