Presented by

CLOSING BELL

Inflation Is High But Low

The market closed higher Friday, the S&P 500, Dow, and Nasdaq hitting all-time highs, after delayed inflation numbers showed 3.0% growth in consumer prices in September. The release was late due to the ongoing government shutdown.

Wall Street feared prices would climb 3.1%. Despite the climb in prices year over year, the Fed is all but guaranteed to cut rates next week, traders pricing in nearly a 100% chance for a 25 basis point cut, from the target rate 4.0%-4.25%.

Compared to August’s +0.4% from the month before, +0.3% to prices looks great, apparently. Moody’s analysts see tariffs adding price increases in food imports like beef and coffee, and household goods, but otherwise still muted overall. The real problem is the ‘sticky 3%’ zone the U.S. has been stuck in for a year now. The Fed is focused more on labor data than prices now, an MD at B. Riley Wealth said.

Enjoy this CPI release, it will likely be the last one for a while, unless the gov opens again, the White House said. 👀

Today’s RIP: IBM + AMD going quantum, Coinbase gets an upgrade, and more. 📰

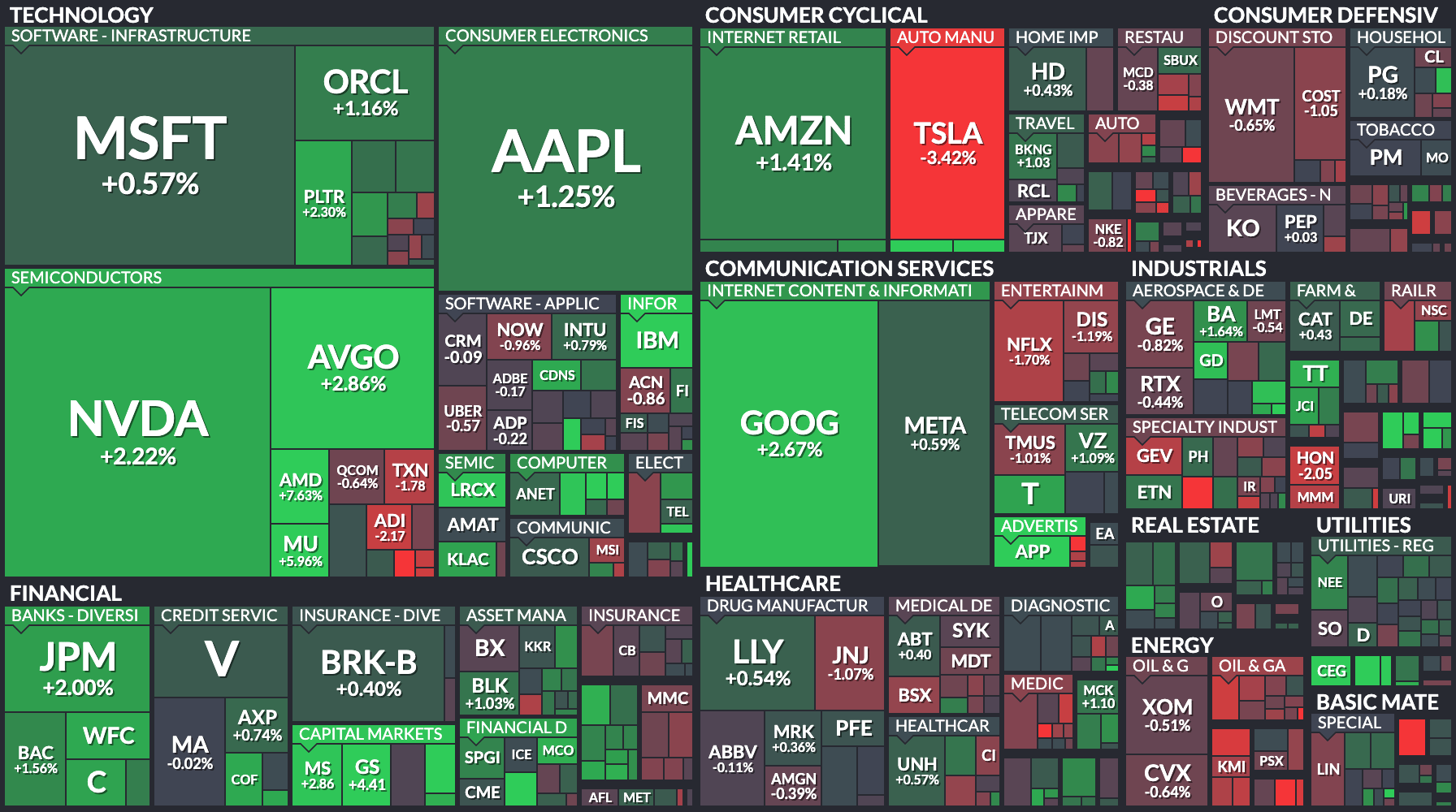

6 of 11 sectors closed green. Tech $XLK ( ▲ 1.3% ) lead and energy $XLE ( ▼ 0.09% ) lagged.

TRENDING

Chip Stocks Climbed, But Not Because Of Intel

Intel was leading chips higher Friday morning, after its Thursday report showed a return to profit in the past quarter, but its rally quickly faded. After all, the U.S.-owned chip maker is expecting $13.3B in Q4 sales, while Wall Street wanted $13.4B

But IBM stole the show. The cloud and chip service provider posted a pretty good quarter on Wednesday night, but showed its cloud software segment slowed a bit. Despite raising its rev guidance, the stock was down 6% Thursday.

That all changed after Reuters reported the company was using $AMD ( ▲ 8.77% ) chips to fix mistakes in its quantum computing errors. $IBM ( ▲ 2.67% ) went on a tear, climbing from -6% to +9% for the week.

The right news at the right time can make all the difference, and after rumors this week the White House was looking at buying stakes at quantum providers. Friday investors bought the hype that Uncle Sam need not need to look any further. 🤩

AMD was climbing on the news, leading the Nasdaq 100 to record highs.

Jay Gambetta, director of IBM research, told Reuters the work demonstrated IBM’s algorithms work alongside its quantum chips on AMD hardware. He specifically said they use AMD because their chips are not "ridiculously expensive."

"Implementing it, and showing that the implementation is actually 10 times faster than what is needed, is a big deal," Gambetta told Reuters.

IBM is working on a quantum chip called Starling, aiming to implement it in a full-fledged quantum computer by 2029. The error-correcting algorithm mentioned Friday arrived a year earlier than researchers had expected.

IN PARTNERSHIP WITH POLYMARKET

Trade the Outcome, Not Just the Stock Price.

Polymarket, the world's largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

Will GOOGL beat EPS?

Will NVDA mention China?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

Simple: Clear Yes/No outcomes.

Focused: Isolate the specific event you care about.

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include GOOGL, AMZN, MSFT, and more. Built for how traders actually trade.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Fed May Approve Accounts For Crypto Soon, Coinbase Gets An Upgrade 🪙

Coinbase was climbing, $COIN ( ▲ 1.12% ) reaching higher than the rest of the crypto industry, on news it is gearing up for big updates in the current pro-crypto regulatory environment. The exchange filed for a national bank charter, the company said Friday, joining Circle $CRCL ( ▲ 0.33% ) and Crypto.com.

The news follows comments from Fed Governor Christopher Waller, describing a “skinny” Fed account grant for crypto and innovative firms that have not been able ot recive full banking charters in the past.

Master accounts allow banks to access direct payments with the Fed. Crypto companies have for years tried to get their hands on them and become full national banks, but have failed for the most part. Waller said the ‘skinny’ accounts would see a streamlined approval timeline.

Coinbase Chief Brian Armstrong has become increasingly bullish about passing legislation in Congress this year. Coinbase also received a JPMorgan rating price target upgrade, describing its ‘Base’ layer 2 network as an up to $34B oppertunity for development.

PARTNER MESSAGE

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Sagimet jumped 24% on strong acne drug trial results.

Grindr surged 21% on $18/share take-private proposal.

Tether projects $15B profit for 2025, per CEO Ardoino.

Citi calls October rate cut a done deal.

Teladoc jumped after BofA praised its long-term positioning.

Zelle adopts stablecoin tech to compete in cross-border payments.

Grayscale ETF, multi-asset GDLC begins trading on NYSE.

JPMorgan to allow crypto as loan collateral by year-end.

Government shutdown may delay October CPI release.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Bilal Little, Director, Exchange Traded Funds at ICE Talks ETFS at Stocktoberfest

Links That Don’t Suck 🌐

📈 Level up your stock-picking skills with IBD—subscribe now and get your first 2 months for $6/month *

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍