NEWS

Investors Eye China As Musk Makes Another Promise

It was another mixed day in the market, with Tesla’s comeback overshadowing most other news. With the market focused on big tech earnings, Wednesday’s Fed decision, and U.S. employment data, both bulls and bears are hesitant to press their positions. Let’s see what you missed. 👀

Today's issue covers Tesla trapping shorts with China news, an e-commerce stock breaking out, and SoFi shareholders’ continued suffering. 📰

Here's today's heat map:

9 of 11 sectors closed green. Consumer discretionary (+2.35%) led, & communications (-1.15%) lagged. 💚

Dutch medical devices maker Philips soared 27% after reaching a $1.10 billion settlement in the U.S. for personal injury cases associated with its sleep apnea device recall in 2021. 🤝

Uranium stocks gained on news that the White House is considering a Russian import ban on the raw material and reactor fuel. This is major news as roughly 25% of the uranium fueling U.S. reactors comes from Russia. 🚫

Natural gas prices perked up for the first time in weeks, rising more than 6% on the day as traders assessed its potential upside from here. 🔺

Cocoa futures had their worst down day in history, falling as much as 17% intraday as speculators unwind positions due to waning momentum. 😱

Paramount Global shares were mixed on news that CEO Bob Bakish is stepping down in favor of an “office of the CEO,” which will be led by three different industry executives to develop a comprehensive long-term plan for the struggling media giant. 👨💼

And Mullen Automotive shares jumped 80% on news that the California Air Resources Board has approved one of its vehicles for the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project. 🔋

Other active symbols: $AMC (-11.14%), $DJT (+12.40%), $PYPL (+1.56%), $IBRX (+22.31%), $XFOR (-6.44%), & $HWH (+41.67%). 🔥

Here are the closing prices:

S&P 500 | 5,116 | +0.32% |

Nasdaq | 15,983 | +0.35% |

Russell 2000 | 2,016 | +0.70% |

Dow Jones | 38,386 | +0.38% |

EARNINGS

Musk Traps $TSLA Shorts With His China Story

Just when it looked like the world had given up on electric vehicle stocks (and, more specifically, Tesla), CEO Elon Musk broke out the big guns to help get things back on track.

Last week, we covered the stock’s earnings, during which Musk moved up the timeline for the company’s affordable electric vehicle (EV) model to sometime later this year or early next. That sent the stock soaring as investors looked past the short-term headwinds facing the company and the overall industry. 🫨

And now, he’s pressing shorts even further as the company overcame a key hurdle to roll out its advanced driver-assistance technology in China.

Chinese regulators removed restrictions on its cars after passing the country’s data security requirements. That gave investors hope that Full Self-Driving (FSD) would soon be available in the largest market for electric vehicles. 👍

Tesla has struggled with pricing competition and comparative technology standards from overseas competitors like BYD in the Chinese market. However, this advanced FSD feature could be a material differentiator for its vehicles over competitors and give it the ability to maintain more pricing power in the country.

Additionally, the company reportedly inked a deal with Baidu, which will allow its mapping and navigation technology to be used in Tesla’s FSD feature. 🗺️

While many questions were left unanswered, short-term improvements are enough to squeeze some short sellers who showed up late to the party and provide long traders with upward momentum to ride.

$TSLA shares rose 15% on the day, yet retail skepticism remains, as Stocktwits sentiment sits in bearish territory. 🤔

As we’ve discussed, sentiment around China has been negative for much of the last year, but its stock market leaders and economy have shown subtle signs of life so far in 2024. The story below discusses one stock that’s breaking out and putting China back on investors’ and traders’ radars. 👇

STOCKTWITS “CHART ART”

JD’s Jump Puts Chinese Stocks Back On The Map 📍

Chinese stocks were more or less left for dead in 2023 after the country’s post-COVID reopening failed to deliver on the economic rebound investors had expected. Given almost every other country’s stock market was trending higher and geopolitical tensions between the West and China were heating up, there was little reason for investors to sit through the underperformance. 😢

However, as we’ve pointed out, the country’s stock market indexes and major companies have been quietly rebounding in 2024 and are beginning to catch investor attention.

Stocktwits user @OptionsSean pointed out the recent breakout and improving momentum picture for JD .com, one of the largest B2C online retailers in the country. Sean notes that although the recent move has been slow and steady, sentiment towards the space could really shift quickly if prices start to exhibit some sustained absolute and relative momentum. 🤩

If you liked this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

To sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

EARNINGS

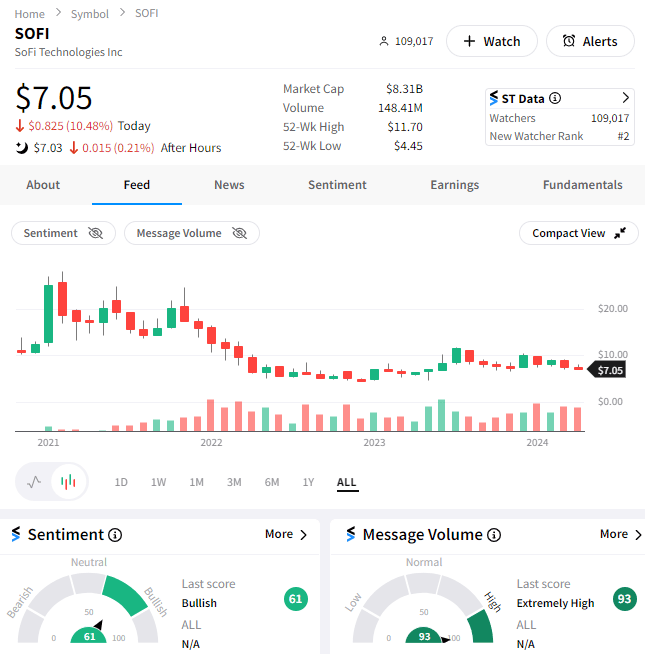

SoFi Shareholders Face Bank-Like Problems

SoFi Technologies shareholders continue to suffer through lackluster results, keeping the stock in a 2-year trading range. Today wasn’t much different, with the stock falling sharply despite results looking good on the surface. 🙃

Stocktwits user @StockMarketNerd broke down the numbers for our community today. It showed better-than-expected results across most major metrics. However, as his notes show, its light guidance for the coming quarter offset its strong annual forecast. 😞

Overall, the stock continues to struggle with the fact that it’s a bank that wants to trade at a tech/fintech public market valuation. No matter how much technology, UX, and other improvements you wrap around a bank, the core business doesn’t change materially.

It was a story stock during the pandemic. And right now, the story it’s telling Wall Street isn’t attractive enough for people to get and stay on board. 🤷

That said, the Stocktwits community remains bullish on despite a 10% decline today and shares trading in the middle of their 2-year range. 🐂

While we’re on the topic, it’s worth mentioning that Fintech company Dave jumped 10% after JMP initiated coverage with an outperform rating.

Its analysts say the company has achieved financial stability, with its profitable adjusted EBITDA giving it room to expand its product offerings. Time will tell if they’re right. ⌛

Bullets From The Day

⚠️ Regulators probe Ford’s BlueCruise system following multiple deaths. The National Highway Traffic Safety Administration (NHTSA) has opened an official investigation into the advanced driver-assistance software following its link to multiple fatalities while in use. The notes indicate the vehicles involved in data crashes hit stationary objects including vehicles stopped in a driving lane on the highway. The Verge has more.

🥡 Delivery startup Getir’s major strategic shift will impact 6,000+ jobs. The instant delivery giant rose to fame during the pandemic but is now crashing down post-pandemic growth normalizes in the crowded industry. It was once valued at close to $12 billion but is now shutting down its operations in the U.S., U.K., and Europe to focus its efforts only on its home market of Turkey. The move will impact thousands of workers but just 7% of its revenues, showing its inability to properly penetrate foreign markets. More from TechCrunch.

📝 Apple’s iPadOS subject to new EU tech rules, given six months to comply. The European Commission implemented the “gatekeeper” designation because of the operating system’s importance to business users. The decision followed an investigation launched in September, showing that although it does not meet the standard thresholds, iPadOS constitutes an important gateway through which many companies reach their customers. As such, it will be subject to stricter anti-trust rules and regulations. Reuters has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍