Presented by

CLOSING BELL

It Begins

The market fell on Thursday, and all eyes were on alternative “safe” assets and a fresh earnings season. Silver hit all-time highs above $51/oz. Silver shines as Gold, Oil, and Bitcoin fell, alongside falling equity prices. The S&P 500 and Nasdaq hit all-time highs for a moment today, but warnings of a dreaded AI bubble rang loudly this week.

“Is AI a bubble? Not yet, at least not to the extent that I think a ‘pop’ is imminent,” said Tom Essaye from The Sevens Report, told Bloomberg. “This isn’t a valuation bubble like we saw with Pets.com and others in the late 1990s. It’s a capital expenditure bubble.”

The government remains shut down, with Federal employee checks halted this week and two million more expected to go without pay next week if the shutdown continues.

In good world news, Israel and Hamas reached a cease-fire today in a chance to exchange prisoners and hostages, in a move proposed by the Trump administration. The end of the two-year war that devastated Gaza is almost in sight. 👀

Today’s RIP: Metal is a shining star, Delta said expensive seats are outselling, and more. 📰

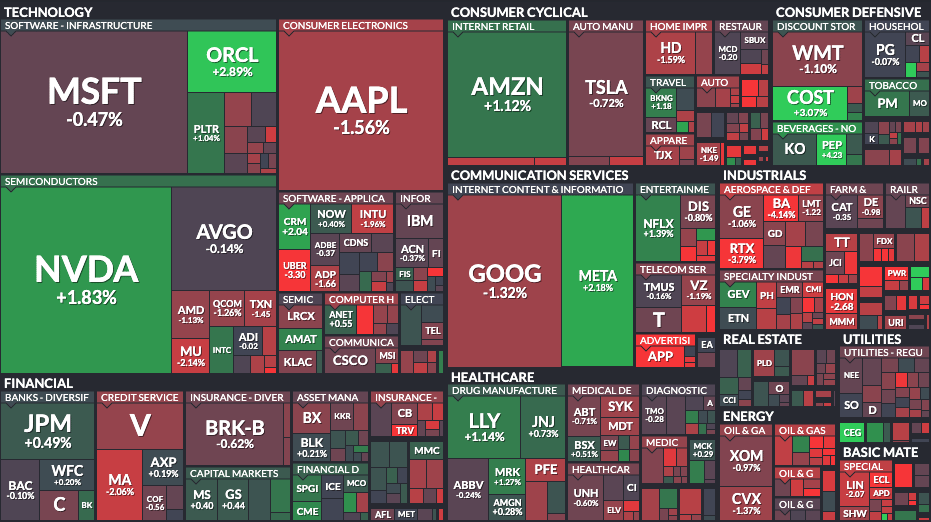

1 of 11 sectors closed green, with staples $XLP ( ▲ 0.87% ) leading and industrials $XLI ( ▲ 1.23% ) lagging.

STOCKS

Metal Is Glowing In Late Stage Bull Market 🪨

Just because gold took a breather today, despite nearly breaking all time highs again, does not mean metal is on its way out. Silver, and any rare earth miner you can think of, were climbing Thursday.

iShares $SLV ( ▼ 1.85% ) Trust was the top trending ticker on Stocktwits this morning, a rare sight to see, as investors are looking for alternatives to the AI blob market.

It wasn’t just hopeful de-dollaring that pushed on metal buying: trade played a roll. China tightened restrictions on its metal exports, in yet more grappling toward an eventual meeting between President Xi and President Trump. The two have a lot to talk about, well, mostly TikTok and tariffs, the talk of the town this year.

Beijing put in a rule requiring foreigners to obtain a license to export rare earths. Critical metals $CRML ( ▲ 4.07% ) flew, Albermarle $ALB ( ▲ 5.24% ) a lithium battery maker, was the top climber on the S&P 500. $TMQ ( ▲ 9.23% ) kept climbing, a week after a small stake buy from Uncle Sam, and $MP ( ▲ 4.92% ) climbed after its July stake deal with the Dept. of Defense. The $REMX ( ▲ 3.69% ) VanEck Rare Earths ETF was up overall, after hitting an all-time high Wednesday.

China’s moves are to give it a good opening in a conversation chess game scheduled for later this month, to “help to ensure a strong position for Xi to sit down with Trump,” Evercore ISI analyst Neo Wang told CNBC in a note to clients.

SPONSORED

Kara Water: Round Closes Soon!

With over $2M raised and 14,000+ reservations across Kara Water products, investors now have the opportunity to secure equity in the company redefining how the world drinks water. Round closes on October 16th 2025 at 11:59 PST.

Sponsorship Disclaimer: This Reg CF offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS NEWS

Third Quarter Reports: It Begins ✈

Delta Airlines $DAL ( ▲ 3.51% ) climbed, issuing forth a decree for all the land: consumers are still buying plane tickets. The largest airline in the U.S. said profit beat street estimates, and margins will look even better next year.

Chief Ed Bastian even said the airline’s premium seats may outsell economy tickets for two quarters next year. First class tickets brought in 9% more total revenue last year to $5.8B, compared to a 4% fall in normal tickets to $6B. Overall profit climbed 11% in the past three months, as cash sales climbed starting in July.

Despite the government shutdown sending air traffic control towers into disarray, Delta said it’s doing fine.

A Delta Airlines A321 airplane taxis at San Diego International Airport before departing on May 9, 2025 in San Diego, California. (Photo by Kevin Carter/Getty Images)

It wasn’t the only stock to report a good Q3, with Pepsi $PEP ( ▲ 0.73% ) shares up after, beating estimates for earnings and showing revenue climbed 1%. Pepsi improved its expectation of a 2025 earnings decline to just 0.5% a share.

Tilray $TLRY ( ▲ 4.9% ) jumped 30% after the weed seller swung to a profit of $1.5M, compared to losing $34 m a year ago.

Applied Digital $APLD ( ▲ 2.2% ) came in after the bell, shares climbing 12% after hours on a report of climbing revenue to $64M and a widening loss. Last year in the same quarter, the data center provider pulled in $35M.

Levis $LEVI ( ▲ 1.52% ) rounded out the reports with a falling stock despite a beat in revenue and earnings per share. It could be selling off due to a weak forward guidance of range that maxed out at $1.32, just a cent higher than the average street estimate.

IN PARTNERSHIP WITH

GraniteShares announced distribution rates for all GraniteShares YieldBOOST ETFs today, as listed in the table below.

Check out GraniteShares original X post here for more details!

*GraniteShares disclaimer located in the link

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Turn Therapeutics +370% premarket, +26% intraday after public listing

Serve Robotics +28% on DoorDash deal

Klarna flat after Google Cloud AI deployment

Lyft −6% on Tensor AV rollout

SEALSQ +38% on defense ‘quantum proof’ semi partnership

Amazon launched AI for business toolkit

Boeing −4% on Turkish Airlines’ threat to buy Airbus planes

AstraZeneca slight dip on $4.5B Virginia facility to skirt tariffs

UiPath +19% on new after last weeks OpenAi, Snowflake partnership

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Trending Stocks Every Morning, Let It Rip Wherever You Find Scrolling Video

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls (8:30 AM), Private Nonfarm Payrolls (8:30 AM), U6 Unemployment Rate (8:30 AM), Unemployment Rate (8:30 AM), Michigan Consumer Expectations (10:00 AM), Federal Budget Balance (2:00 PM). 📊

Pre-Market Earnings: Unity Bancorp, Inc. ($UNTY). 🛏️

After-Market Earnings: Waldencast plc ($WALD). 🌕

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋