CLOSING BELL

Let Them Eat Tariffs

The market was a flat, still lake before a storm on Monday, if that storm was a ton of Fed Speak this week. Thankfully, the Fed Speak today was as dry and boring as ever, with NY Fed President John Williams telling a conference that they should take the summer off from worrying about rates. One thing is for sure: someone is looking forward to Memorial Day weekend. 👀

Oh, and Moody’s downgraded the U.S., and Trump called out Walmart for warning they would raise prices because of import tariffs, saying instead they should eat them. Yummy. 🍰

Today's issue covers: DNA For Sale, Fed Speak Reaches Year Peak, But Moody’s Outlook Bleak, and Home Depot Reports Tomorrow, Bang Or Bust? 📰

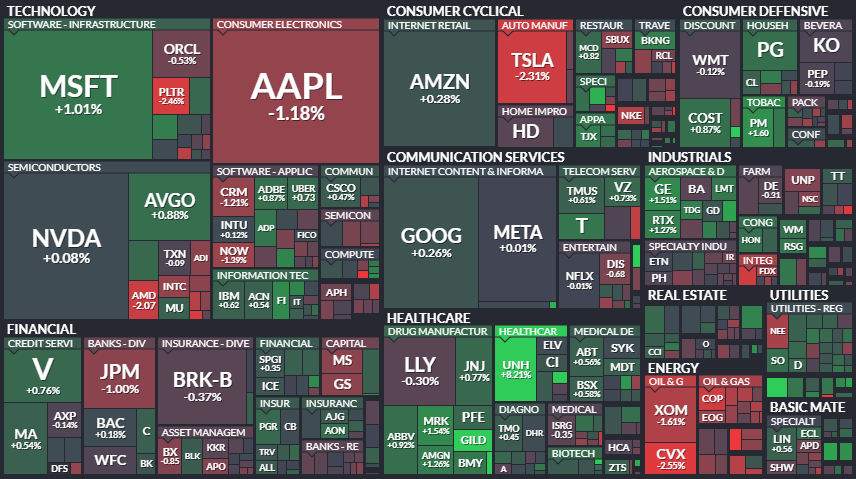

With the final numbers for indexes and the ETFs that track them, 8 of 11 sectors closed green, with health care $XLV ( ▼ 0.42% ) leading and energy $XLE ( ▼ 0.09% ) lagging.

COMPANY NEWS

DNA For Sale 🧬

It seemed like a great idea at the time: take advantage of our futuristic technology in the post-Y2K world to find out where each of us came from in this big, beautiful world.

Less than twenty years later, 23andMe filed for bankruptcy in March, and suddenly the millions of individual DNA samples the firm collected became just another line item on the balance sheet for creditors to sift through. Some argued it would be unconstitutional or, at the very least, gross, but here we are.

$REGN ( ▼ 1.89% ) bid $256M to acquire the DNA data of 15M people on Monday. The firm’s CEO, George Yancopoulos, said his firm can be trusted to safeguard the data, as they have yet to go bankrupt and sell DNA data. 👮

The firm uses DNA to develop treatments by identifying genes associated with illnesses.

In June, a court-appointed privacy check will present its findings on how that would affect users. Here is a quick rundown of the rise and fall of 23andMe, thanks to Reuters.

2006: 23andMe founded by Anne Wojcicki, Linda Avey, and Paul Cusenza.

2015: 23andMe re-launches its test kit after meeting FDA requirements.

2021: Goes public via Richard Branson’s SPAC, reaching a $6B valuation, under the ticker ME. The Stock Reached a high of $320/share.

2023: A major data breach exposed the genetic data of 6.9 million users.

2024: Wojcicki attempts to take the company private, but the board rejects her offer.

2025: 23andMe files for bankruptcy; Regeneron bids $256M to acquire its assets.

SPONSORED

$30M Q1 ‘25 Revenue: StartEngine’s Biggest Quarter Yet

StartEngine is the platform allowing accredited investors to gain exposure to coveted pre-IPO companies like OpenAI, Perplexity, and Databricks — without paying millions.¹

These offerings helped StartEngine achieve its best quarter yet: 3x revenue YoY to a record $30M and $1.7M GAAP net income ($5.2M adjusted EBITDA), based on unaudited Q1 2025 financials.²

And here’s the kicker: StartEngine is also a smart diversification play. Why?

StartEngine has 20% carried interest in some of its pre-IPO offerings. That means their success (and potentially yours, too) is tied to the success of these companies.³

Translation: your upside can grow with some of StartEngine’s best offerings.

So how do you get involved? By becoming a shareholder. The window is open (but closing soon) for you to join 45k+ who have invested $84M+ in StartEngine to date. Get in on the action before this round closes on June 26.

1. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. This is offered only to accredited investors per regulation D rules. 2. Based on our Q1 2025 Form 10-Q. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $24.6 million of the $30 million in revenue from Q1 2025. To understand the impact on margins, see financials. 3. StartEngine receives a small percentage of equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. Fees are subject to change. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that StartEngine will be profitable. 4. This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. No broker-dealer or intermediary involved in offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information, please see the most recent Offering Circular and Supplements and Risks related to this offering. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

…EXCEPT DEATH AND TAXES

Fed Speak Reaches Year Peak, But Moody’s Outlook Bleak 🐔

A deluge of Federal Reserve speakers are flapping their gobs this week. Stocktwtis is tracking 13 separate Fed speaking engagements, including Fed Chair Powell talking this weekend on Sunday, the day before Memorial Day. Sure to be a smash hit with a high view count. /s

Today, Federal Reserve Atlanta President Raphael Bostic said he imagined just one rate cut in 2025, citing prolonged uncertainty from tariffs and inflation expectations. He said the Fed needs more time to assess economic conditions before making further policy adjustments.

Williams seemed to agree and said policy makers would pour through data all summer and set to readjust their market expectations in September. The CME Fedwatch tool and betting apps show a 10% chance of a Rate cut in June when the Fed meets next.

Other, less government-affiliated speakers shared more conflicting outlooks.

JPMorgan Chase CEO Jamie Dimon warned that markets show “extraordinary complacency” after rebounding. He cautioned that inflation and stagflation risks remain high, and investors still don’t know the full impact of Trump’s tariffs. Cathie Wood said Trump’s tariffs could reduce trade barriers.

Speaking of Moody’s rating downgrade, Ray Dalio warned that the new rating fails to account for the risk of the federal government printing money to pay its debt, which could devalue bondholder returns.

Moody’s rating agency joined Fitch and S&P Global Friday in downgrading U.S. creditworthiness from S tier to A on Friday, or in grown-up terms, AAA to AA1. They cited a decade of failure to address ballooning deficits. 🎈

STOCKS

Other Noteworthy Pops & Drops 🗞

Walmart shares dipped after President Trump criticized the retailer for warning of price hikes due to tariffs, urging it to “eat the tariffs” instead. Walmart said it wanted to sell cheap goods, but certain imported goods, like furniture and baby strollers, will see unavoidable cost increases.

Strategy $MSTR ( ▲ 0.73% ) gained despite facing a fresh class action lawsuit alleging misleading statements about its Bitcoin investment strategy. The company acquired 7,390 BTC for $764.9M, bringing its total holdings to 576,230 BTC, while legal filings highlight a $5.9B unrealized loss due to new accounting rules.

Novavax $NVAX ( ▲ 1.07% ) received full FDA approval for its protein-based COVID-19 vaccine, Nuvaxovid, making it the only non-mRNA option available in the U.S. The approval is restricted to individuals aged 65 and older and those 12 to 64 with underlying health conditions.

Super Micro $SMCI ( ▲ 1.37% ) fell even after the firm launched over 20 AI server systems featuring Nvidia RTX PRO 6000 Blackwell GPUs, optimizing enterprise AI workloads. The new MGX-based architecture aims to reduce server costs.

$UNH ( ▼ 2.97% ) gained after falling for eight sessions in the past two weeks. United Healthcare stock pulled the Dow lower, facing the departure of its CEO and allegations from the WSJ the Fed was looking into its Medicare Advantage dealings.

Nvidia CEO Jensen Huang called the Trump administration’s ban on H20 chip exports to China “deeply painful,” estimating a $15 billion loss. Huang emphasized that restricting AI chip sales won’t halt China’s AI progress.

PRESENTED BY STOCKTWITS

Home Depot Reports Tomorrow, Bang Or Bust?

One of the largest home goods and construction stores is due to report its most recent quarter tomorrow morning, and is expected to show a revenue of $39.3B with Wall Street estimating earnings per share of $3.60.

Do you think the firm will beat the rap sheet? Make your voice heard in our most recent poll:

WHAT’S ON DECK

Tomorrow’s Top Things - Lotsa Fedspeak📋

Economic data: Fed Barkin Speech (9:00am) Fed Bostic Speech (9:00am) Fed Collins Speech (9:30am) Fed Musalem Speech (1:00pm) Fed Kulger Speech (5:00pm) Fed Daly Speech (7:00pm) Fed Hammack Speech (7:00pm). 📊

Pre-Market Earnings: Home Depot ($HD), Canaan ($CAN), Bilibili ($BILI), Vipshop Holdings ($VIPS), Arbe Robotics ($ARBE), Eltek ($ELTK), DouYu Intl Hldgs ($DOYU), Pony AI ($PONY). 🛏️

After-Hour Earnings: Palo Alto Networks ($PANW), CXApp ($CXAI), Toll Brothers ($TOL), Beeline Holdings ($BLNE), and Viasat ($VSAT). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

**Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A offering and involves risk, including the possible loss of principal. The valuation is set by the Company. Please read the offering circular and related risks at invest.radintel.ai. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋