CLOSING BELL

Lib Day 2: 10% Off

Well, so much for that. The market pulled back Monday, waking up to grim new tariffs, still hungover from a blissful three days of closed trade.

On Sunday, Scott Bessent floated the idea that the pause was ending, and Monday, the president started sealing the deal, tweeting out letters to world leaders introducing 25-40% tariffs for not striking an agreement. The idea is that these new tariffs will take effect on August 1, as the 90-day tariff pause comes to a close on Wednesday. It must have been too hot in D.C. to hold a press conference in the Rose Garden this time of year.

Equities were not happy, dropping from a high Monday after having climbed more than 10% from the start of the pause. If it is clear to anyone to what end tariffs are being reintroduced, please share that information with the class. 👀

Today's issue covers: Musk is going all America First, Trump does Liberation Day 2, retail is riled up, and more. 📰

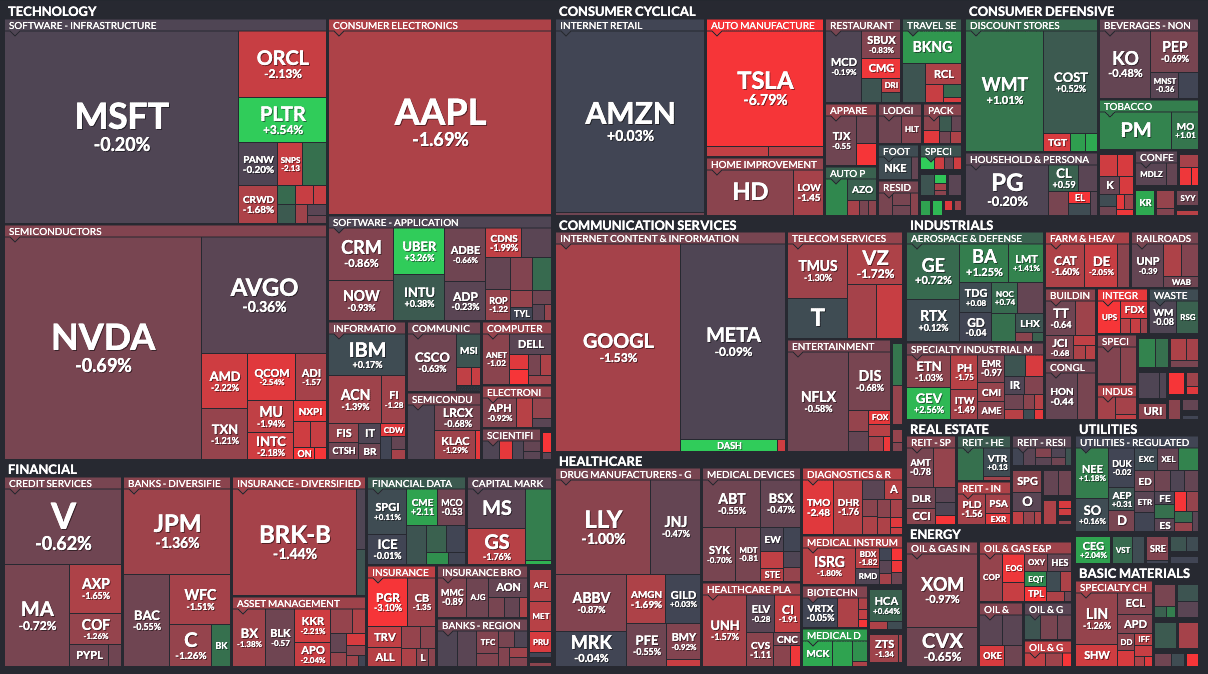

With the final numbers for indexes and the ETFs that track them, 1 of 11 sectors closed green, with utilities $XLU ( ▲ 0.38% ) leading and discretionary $XLY ( ▲ 0.22% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,229

Nasdaq 100 $QQQ ( ▲ 1.36% ) 22,685

Russell 2000 $IWM ( ▲ 0.56% ) 2,214

Dow Jones $DIA ( ▲ 0.58% ) 44,406

STOCKS

Tesla Investors Are Not Happy Musk Wants To Go America All Over Everybody’s Ass

$TSLA ( ▲ 1.68% ) fell Monday after some shareholders’ worst nightmare became semi-reality: it looks like Chief Elon Musk is not learning from his heavy involvement in politics in the first half of the year.

Musk began discussing the possibility of founding a new political party in the U.S. over the weekend, following a poll on X that was open to more than just U.S. voters (and bots).

The tech CEO said the party would focus on flipping Senate and House seats over the next year in his most recent dig against the same president he spent $300M to help elect less than a year ago.

While tech bulls like Wedbush’s Dan Ives warned that the move could hurt Tesla right when the firm needs Musk’s attention the most, Axios reported the deep-pocketed South African expat might have what it takes to appear on state ballots.

Despite the hype, third parties have struggled to do more than offer disruption in the long term, according to Bernard Tamas, author of “The Demise and Rebirth of American Third Parties.”

Either way, Musk wrote on X that his party would be pro-gun, pro-deregulation, and pro-bitcoin, which sounds awfully similar to the aims of the current GOP, which arguably controls all three branches of the Federal government. 😅

Retail sentiment drifted lower on fresh Musk Politics news.

SPONSORED

3 Things Venture Capital Firms Look For

For VCs, the best investments check three boxes: a massive market, a clear pain point, and founder-market fit.

No wonder prominent firms like Maveron backed Pacaso.

In the $1.3 trillion vacation home market, second homes were either too expensive or too much hassle. So after successfully exiting his previous business, a proven real estate founder applied his proptech expertise, selling fractions of homes and managing everything through streamlined tech.

That approach has earned Pacaso $110m+ in gross profits to date, including 41% YoY growth last year alone, across 2,000+ happy homeowners.

They even reserved the Nasdaq ticker PCSO. Join major VCs like Greycroft as a Pacaso investor for just $2.90/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

In Partnership With Amazon, Trump Instates Lib Day 2: Lib Prime, 10% Off On Tariffs 🛍

To really kick start the news week, Trump took to Truth Social Monday to tweet out brand new, revised tariffs on multiple nations, including Malaysia, Myanmar, Laos, Indonesia, Thailand, and more.

The latest levies are set to take effect on August 1, after the administration’s “90 deals in 90 days” concept evolved into ‘no deals in 90 days.’

Earlier in the day, the president stated that the U.S. was imposing 25% levies on Japan and 30% on South Africa. It was a shoot-from-the-hip afternoon for the White House.

The president also made sure to call out the BRICS developing country alliance, a ten-country axis of Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the UAE that met over the weekend in Brazil, for issuing a statement on trade worries.

He said any collusion or partnership would only lead to higher tariffs on anyone involved.

"Any country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% tariff. There will be no exceptions to this policy," Trump wrote on social media.

Brazilian President Luiz Inacio Lula da Silva condemned the threats.

The fresh trade letters look like a 10% off deal, not unlike Amazon Prime Day (but not actually in partnership with Bezos). The new trade numbers are lower than the originals imposed three months ago.

For example, Bosnia was announced at a rate of 30% when, on April 2, it was 35%. Myanmar's rate was cut from 44% to 40%, Laos' from 48% to 40%, and Kazakhstan's from 27% to 25%, and so on. At this speed, why not wait out the four years until tariffs hit 0%? /s

One of many Truth Social posts announcing fresh tariffs.

STOCKTWITS EDGE

Has BigBear.ai’s Short-Term Rally Overheated? 🥵

Small-cap AI company BigBear.ai Holdings is up roughly 260% from its April lows and is trending alongside some of the artificial intelligence (AI) space’s most popular names. However, Stocktwits Sentiment and Message Volume may be suggesting that this rally has run its course. Let’s take a look. 👇

As we can see, Stocktwits Sentiment and Message Volume both approached their year-to-date highs last week as prices rallied; however, both have begun to fall over the last few days, despite prices remaining stable. This could be an indicator that retail investors and traders are becoming slightly less bullish and that finding the “next marginal buyer” at these levels is becoming more difficult. 🤔

Traditional momentum indicators, such as the Relative Strength Index (RSI), are also flashing an interesting signal. Over the last two years, large spikes above 70 into “overbought” territory coincided with the start of price corrections. Not all of them did, but these are levels that raise a caution flag and are worth monitoring. ⚠

While there’s clearly significant social and price momentum behind this name over the long term, these signals suggest retail’s enthusiasm may be cooling slightly as they wait for more attractive prices to enter on the long side. Time will tell.

Add $BBAI to your watchlist to monitor this move. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto. 🔓

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in BigBearAI as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

POPS & DROPS

Top Stocktwits News Stories 🗞

Sandisk was initiated at ‘Buy’ by Jefferies with a $60 target, citing enterprise SSD momentum; however, retail sentiment on Stocktwits remains bearish. Read more

Shell expects weaker Q2 trading results to pressure earnings, although refining margins are expected to improve, and gas output is set to remain steady. Read more

CoreWeave fell after the firm announced it would acquire Core Scientific in an $9 billion all-stock deal, securing 2.3 GW of total power capacity. The merger, expected to close in Q4 2025, is expected to deliver $500 million in annual savings by 2027. Both stocks fell on the news. Read more

Stellantis faces a U.S. regulator recall query into nearly 1.2 million Ram trucks over potential brake transmission failures, sending retail sentiment from bullish to neutral. Read more

Amazon Prime Day is forecast to drive $23.8B in U.S. online sales, up 28%, as deep discounts fuel back-to-school demand amid Trump-era tariff pressures. Read more

Bitcoin hovered near record highs at $108,750 as investors eyed Trump’s July 9 tariff deadline and key crypto bills set for debate during next week’s “Crypto Week.” Read more

Bit Digital jumped 20% after shifting its crypto strategy to Ethereum, now holding over 100,000 ETH following a $172 million raise and aggressive BTC divestment. Read more

Helen of Troy had its price target cut by Canaccord to $47 over expected earnings pressure from Trump’s tariffs, with retail sentiment turning bearish. Read more

Iran signaled openness to U.S. talks despite past strikes on its nuclear sites, as President Pezeshkian told Tucker Carlson ahead of Trump’s White House meeting with Netanyahu. Read more

Trade Advisor Peter Navarro accused Apple CEO Tim Cook of stalling the iPhone production exit from China, calling it “the longest-running soap opera in Silicon Valley.” Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real-time. ✍️

STOCKTWITS COMMUNITY EVENTS

Join Us This Thursday In NYC For A Free Event! 🍻

Stocktwits and the CMT Association are hosting a “Summer Social” this Thursday, July 11th, in New York City. We’ve arranged a great panel discussing their second-half 2025 outlook and will spend the rest of the evening networking over food and beverages.

Grab a friend and register for free. CMT Charterholders, Stocktwits community members, media pros, and more will be there waiting for you! 🥳

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: NY Fed 1-Year Consumer Inflation Expectations (Jun) (11:00 AM), 3-Year Note Auction (1:00 PM), Consumer Credit (May) (3:00 PM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: No major reports, you can sleep in. 🛏️

After-Hour Earnings: Aehr Test Systems ($AEHR), Kura Sushi USA ($KRUS), Saratoga Investment ($SAR), and Penguin Solutions ($PENG)🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋