Presented by

CLOSING BELL

Market Contorts to Fresh Highs

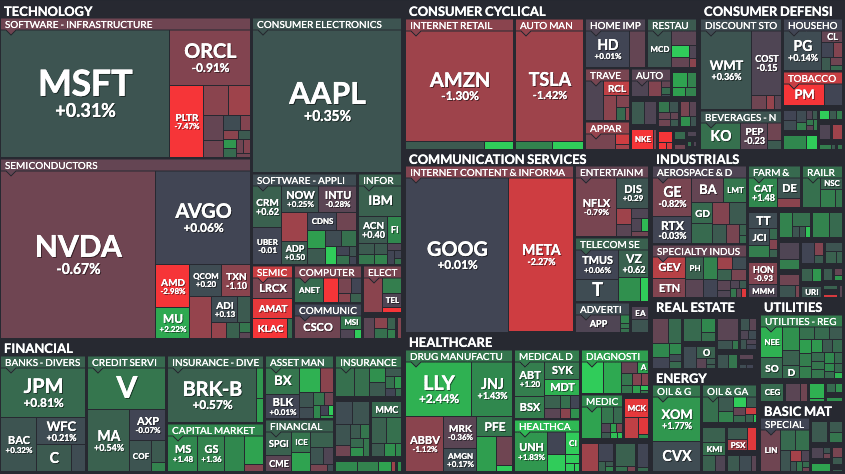

The market barely held on Friday, falling initially with a lack of Fed jobs data for the first time this shutdown. The Senate again voted against a funding package, so next week’s shutdown is a go. Bitcoin was flying on shutdown news, within 1% of all-time highs. S&P 500 and Dow hit new records.

Private reports from ADP and Challenger Gray & Christmas showed private companies cut 32k jobs in September, and hiring plans this year were at their lowest since 2009.

Tech pulled back, but pharma ended with its best week performance in a decade after tariff troubles were cleared up.

Today’s RIP: Army don’t like PLTR’s new tech, Macro data you can count on when the Fed’s gone dark, and more. 👀

8 of 11 sectors closed green. Utilities $XLU ( ▲ 1.11% ) leading and discretionary $XLY ( ▲ 1.52% ) lagging.

STOCKS

The Army Does Not Like Palantir’s New Comms System 🎧

Palantir dropped $PLTR ( ▼ 1.35% ) Friday, after a report from Reuters and Breaking Defense report that Palantir and partner Anduril’s Army comms system is flawed, insecure, and hard to use.

It led the Nasdaq 100 $QQQ ( ▲ 1.07% ) lower Friday, alongside a general tech pullback. The company issued a response: the program has been patched, and no vulnerabilities were found.

The report was based on an old Army memo from September 5th, that cited vulnerabilities. Anduril and Palantir won a $100M contract to help the Army develop its next-gen decision-making capability NGC2, including armored trucks with data center level command centers inside. 🚒

“These issues collectively create a significant risk to data, mission operations, and personnel by rendering the system vulnerable to insider threats, external attacks, and data spillage,” the document said, signed by Army CTO Gabriele Chiulli.

Anduril said it was undergoing the normal process of pushing updates and testing resaults, but either way investors were not happy. PLTR has flown 900%+ in two years. The company trades at a valuation that makes sense if the company keeps on this revenue trajectory past 2030, but any bump in the road shakes the price.

SPONSORED

For a limited time, get up to $3K in stock when you open & fund a SoFi Active Invest account.

SoFi Invest offers members the ability to invest in IPOs before they trade on the public market & access private market investing opportunities.

Plus, get up to $3,000 in stock when you open & fund a SoFi Active Invest account.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

No Fed Means No Fed Data, Here’s Where Investors Are Looking Instead 🏚

Friday, jobs day came and went without so much of a peep from the Bureau of Labor Statistics, but give them a break, it’s down to literally one person until the Senate can decide how much taxpayer money they are going to spend till the end of the year.

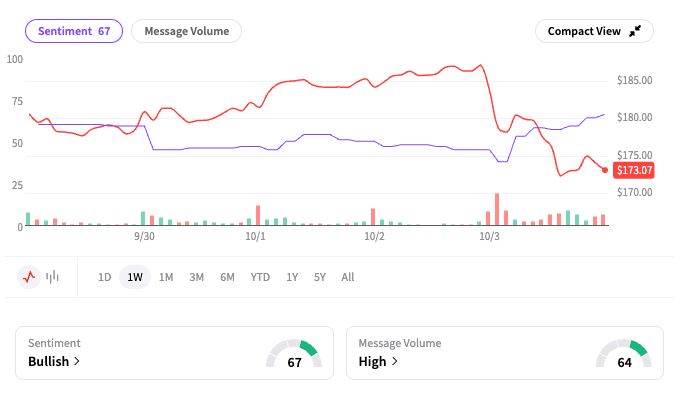

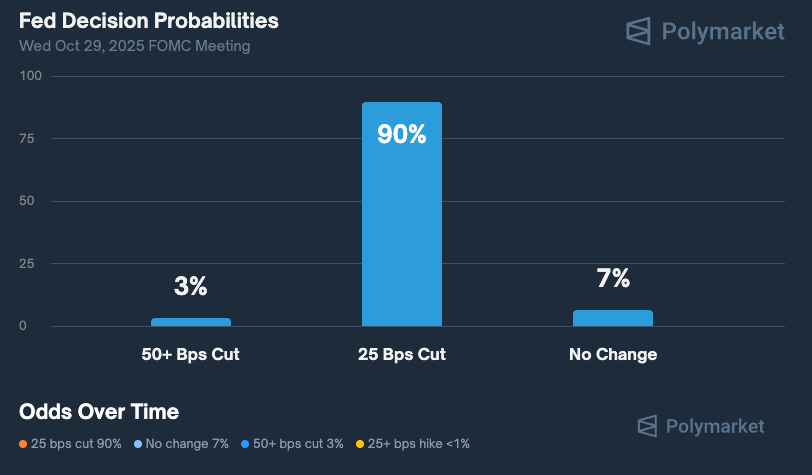

It could not come at a worse time for nail biters everywhere waiting for the next FOMC rate cut, coming at the end of the month, right before Halloween. Though betting markets— and the Fed’s own rate cut predictions from last meeting— are convinced two more cuts are coming this year, it’s not good to not see the unemployment market. It’s like driving on a foggy night, without headlights, and no rearview mirror to see how many cones you ran over.

Up until August, the data was showing a freezing labor market unlikely to thaw as the leaves fall this autumn. Unemployment was at 4.3% at last check, and private company data was cold enough this week to help imagine things are getting progressively worse. The latest PCE data, the Fed’s preferred inflation calculator, showed that Core prices had inflated by about 3.0%, and overall inflation was at 2.7% compared to last year.

Economists started to check private data, like ADP numbers, a massive employer, and Indeed, which showed a 9% drop in open positions year over year this week.

Bank of America’s credit showed spending was on an uptick, in good news for the economy, with card outlays up 2.2% from last year. Fiserv’s small business index showed annual sales also climbed 2.3% from last year, according to CNBC.

Dow Jones forecasted about the same unemployment, 4.3%, though a jump to 4.4% would be the highest rate since 2021.

“With each week you lose, you’re losing some time to collect this data,” said Stephen Juneau, senior US economist at Bank of America.

The last time the government fully shut down for 16 days in 2013, BLS jobs numbers and inflation data took two months to come through, according to Yahoo Finance.

IN PARTNERSHIP WITH

Markets And Soccer Match Day!

There’s still time to register for the NYC CMT Association "Markets & Match Day" meetup this Saturday! Come get VIP treatment at the New York Red Bulls game and hear from top technicians.

Sponsored by OANDA Corporation and Stocktwits

n-cmt-association-new-york-chapter-event-markets-and-soccer-match-day*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Bitcoin gained amid shutdown, neared record high.

Stellantis clashed with GM and Ford over tariffs.

Berkshire Hathaway climbed 0.95% as Greg Abel named CEO.

UnitedHealth saw shareholder push to split CEO and chair roles.

Tesla fell despite JPMorgan target hike.

Fed’s Goolsbee flagged inflation and jobs risk, urged gradual cuts.

Unusual Machines rallied 9% on $800K Red Cat drone deal.

Apple rose despite Jefferies downgrade on iPhone hype.

Goldman’s David Solomon warned of tech-driven drawdown.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

🟢 WEEKEND RIP WITH BEN & EMIL: THE TRUMP TRUTH ON CBD

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋Sponsorship Disclaimer: INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE Brokerage and Active investing products offered through SoFi Securities LLC, member FINRA(www.finra.org)/SIPC(www.sipc.org). For a full listing of the fees associated with Sofi Invest, please view our fee schedule. Investing in IPOs comes with risk, including the risk of loss. Please visit https://www.sofi.com/iporisk/. Offered via SoFi Securities LLC, Member FINRA/SIPC. Investing in alternative investments and/or strategies may not be suitable for all investors and involves unique risks, including the risk of loss. An investor should consider their individual circumstances and any investment information, such as a prospectus, prior to investing. Interval Funds are illiquid instruments, the ability to trade on your timeline may be restricted.