CLOSING BELL

Market Fears Semi Tariffs, Hopes For Alaskan Peace

The market fell Friday after the White House announced the possibility of heavy semiconductor tariffs in the 200-300% range, and consumer confidence fell for the first time in four months. The Dow closed less than 50 points from a record, after Berkshire’s purchase of UnitedHealth stock sent the index higher.

Today's issue covers Trump heads to Alaska to make a deal, Solar stocks heat up on tax break, and more. 📰

With the final numbers for indexes and the ETFs that track them, 4 of 11 sectors closed green, with health care $XLV ( ▼ 0.02% ) leading and financials $XLF ( ▲ 1.76% ) lagging.

MACRO

Trump Heads To Alaska To Bargain With Putin

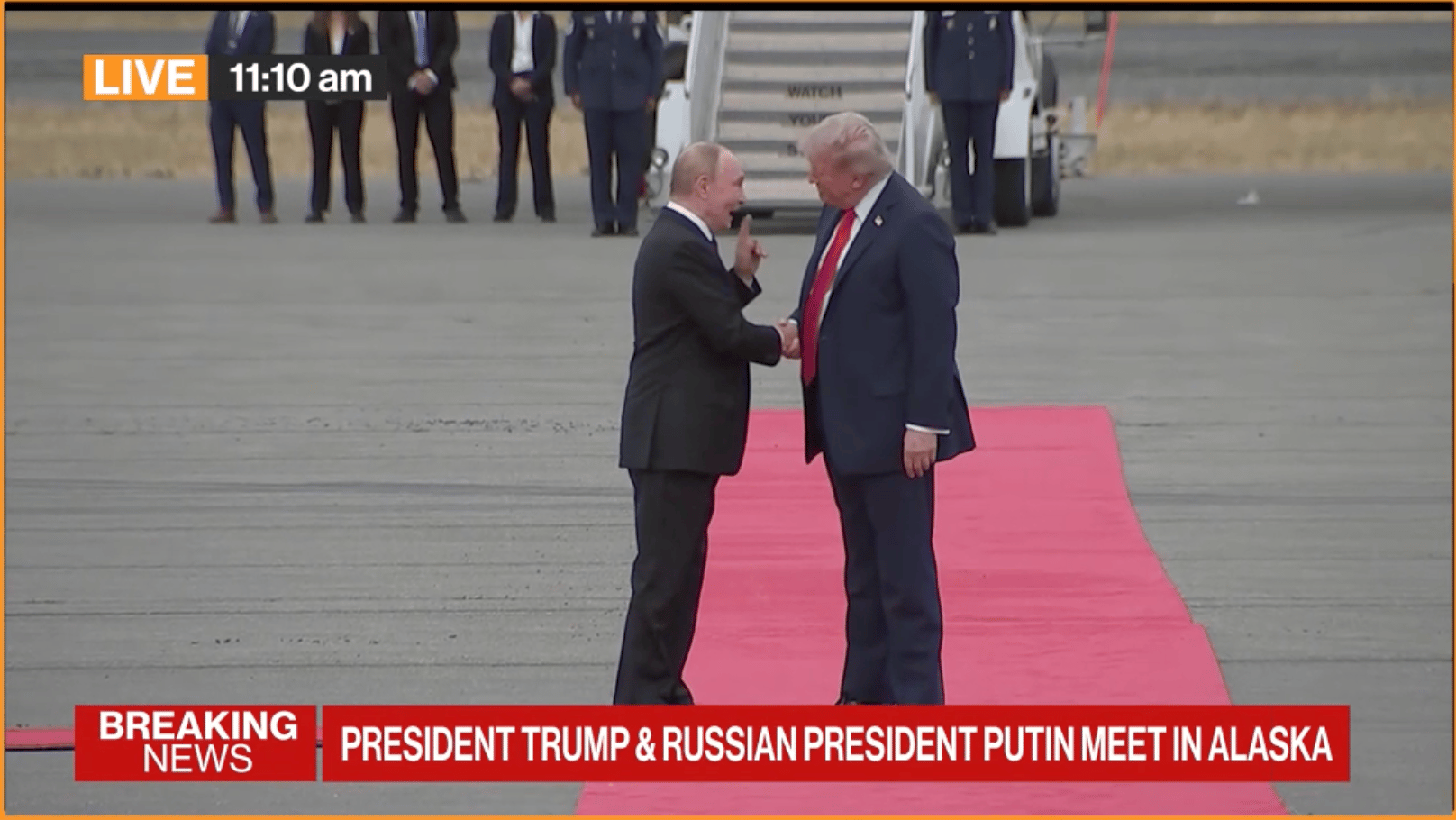

All eyes were facing West on Friday, waiting for President Trump and Russian President Vladimir Putin to meet on U.S. soil in Anchorage, Alaska, to talk about ending the war in Ukraine.

Bloomberg TV, right before a low-flying show of strength spooked the small Russian man.

Trump has reportedly eyed harsher tariff sanctions on buyers of Russian oil, security guarantees, and restarting twice-cut military aid to Ukraine to try to weigh the scales, but has warned he might walk out of the meeting if it proves a waste of time. The last time Putin was in the U.S. was in 2015 at the UN after he had already started his campaign to invade the Ukraine Donbas region.

Joining Trump on the U.S. side are economic advisors Commerce Secretary Hoaward Lutnik, Treasury Secretary Scott Bessent, and Secretary of State Marco Rubio.

As the two walked from their respective planes and shook hands before meeting behind closed doors, Putin stopped to watch a low flyover from a stealth B-2 bomber right over his head. 🦅

SPONSORED

New Circle Leveraged ETF - CCUP Now Trading

The wait is over! The T-REX 2X Long CRCL Daily Target ETF (CCUP) is now live!

CCUP offers 2X exposure—allowing you to position yourself with precision without directly investing in CRCL shares.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Solar Stocks Heat Up, In Part Because Of Tax Break ☀

Solar and green energy stocks climbed Friday after an update from the U.S. Treasury Department and IRS for new guidance on clean energy production and tax credits.

The update said most wind and solar facilities meet a physical work test to qualify for tax credits that are due to expire. The GOP Big Beautiful Bill sent green tax credits to the chopping block, set to expire by 2027 for projects not already under construction in one year’s time.

According to lawyers at the Private law firm Holland & Knight, the new rules allow any work on a green energy site to count as construction started.

TLDR: New projects in the solar and wind industries are not losing their tax credits just yet. Solar stocks surged Friday: Sunrun $RUN ( ▼ 2.79% ) , Enphase $ENPH ( ▼ 1.41% ) , First Solar $FSLR ( ▼ 13.43% ) , SolarEdge $SEDG ( ▼ 0.12% ) were all higher.

TAN, the largest Solar ETF by AUM, was seeing ‘extremely bullish’ chatter Friday

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Bitcoin cooled to $121K after hitting a record high, while Cardano led altcoin gains and traders awaited key inflation data.

Intel shares rose nearly 3% after reports surfaced that the Trump administration may take a stake in its Ohio chip facility.

Applied Materials plunged 14% after issuing weak Q4 guidance and warning of declining China demand.

Opendoor shares jumped 9% following CEO Carrie Wheeler’s resignation and a surge in retail activist momentum.

Tilray Brands requested a Nasdaq compliance extension and is considering a reverse stock split to stabilize its capital structure amid bullish retail sentiment.

U.S. retail sales rose 0.5% in July, driven by strong auto demand and in line with analyst expectations.

Lyft received a ‘Neutral’ rating and $15 price target from UBS, citing robotaxi partnerships and European expansion as signs of a steady path forward.

Goldman Sachs warned that the current “Goldilocks” market could face turbulence from an economic slowdown or tighter Fed policy.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Affirm Joins The Degenerate Economy Index, Polymarket Heats Up, and the Wealth Gap Widens

Stocktwits CEO Howard Lindzon is back with a new episode of This Week in the Degenerate Economy, where money, tech, and memes keep colliding.

In this week’s breakdown, Howard adds Affirm (AFRM) to the Degenerate Economy Index, shares why Polymarket might eat the gambling industry alive, and unpacks how Google Calendar became Gen Z’s secret weapon. Plus: the growing wealth gap, the Wall Street–Silicon Valley merger, and why growth stocks keep steamrolling the market.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋