CLOSING BELL

Market Flat For Start Of Fed Speak Week

The market held back Monday as world leaders descended on the White House to find a united front against Russia after Friday night's ceasefire talks in Alaska went nowhere. Ukraine’s Zelensky met with Trump, alongside top reps from the UK, France, Finland, Germany, Italy, the EU’s President, and NATO Secretary-General.

This week will bring retail earnings data from giants like Walmart, and the Fed’s annual Jackson Hole summit. All eyes are on hints for how the FOMC will decide monetary policy in September, and how grocery stores have feared the latest batch of tariff changes. 👀

Today's issue covers Palo Alto climbs after the close, What data the FOMC will talk about, and more. 📰

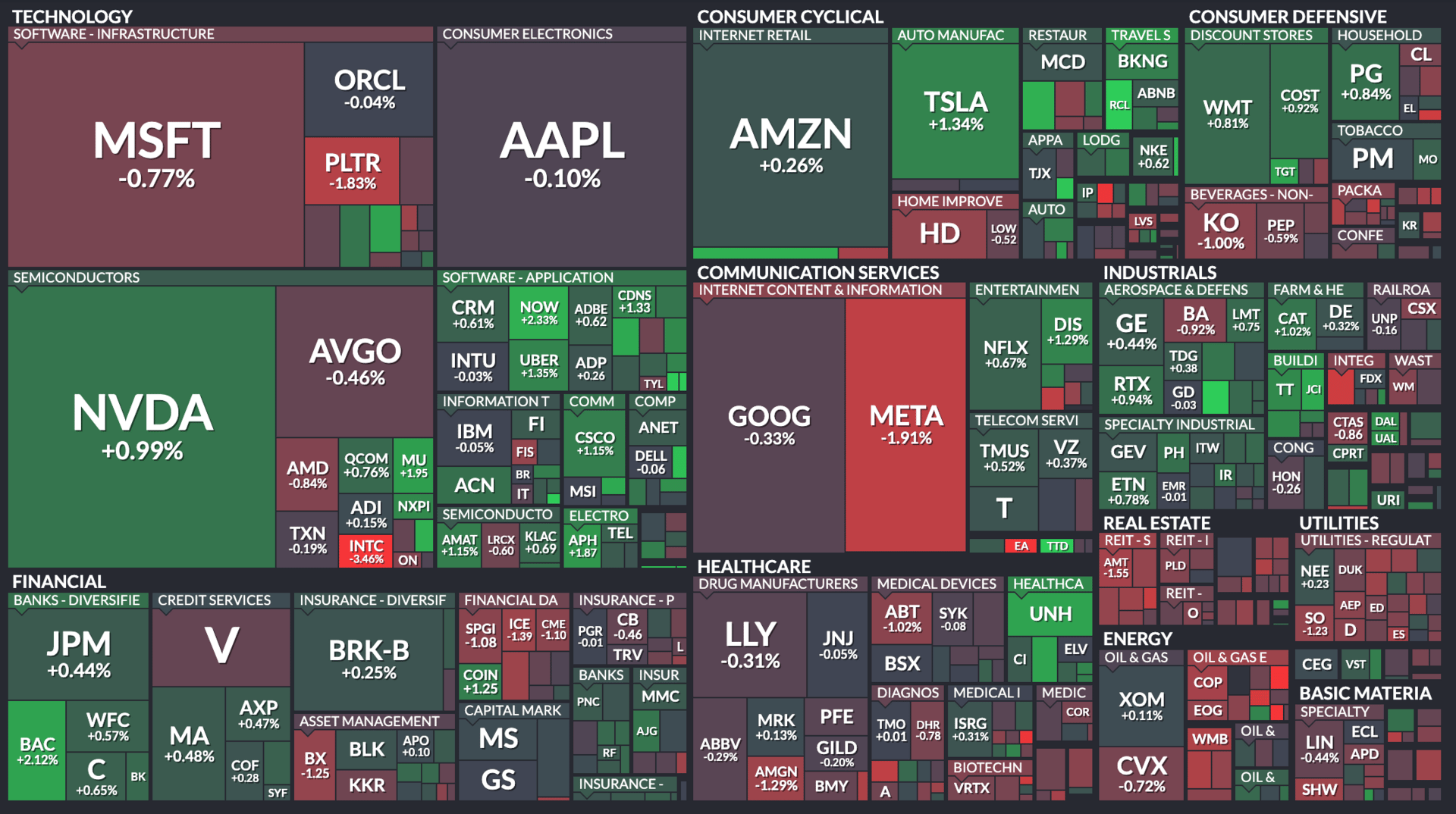

With the final numbers for indexes and the ETFs that track them, 4 of 11 sectors closed green, with industrials $XLI ( ▼ 0.78% ) leading and real estate $XLRE ( ▼ 0.66% ) lagging.

STOCKS

Palo Alto Climbs After Beating Expectations

$PANW ( ▲ 2.24% ) Palo Alto Networks climbed after hours Monday, after the cybersecurity company reported Q4 results that met Street expectations.

Revenue climbed 16% in a year to $2.54B, the company ended the quarter with $2.27B in cash, and adjusted EPS of $0.95/share all beat estimates.

The company reaffirmed the guidance it offered last month, with an announcement to buy $CYBR ( ▼ 0.09% ) for $25B. The company aims to integrate CyberArk’s identity security technology to become the most comprehensive cybersecurity platform.

For the coming fiscal year, the firm expects 13% revenue growth to $10.38B.

"Our strong execution in Q4 reflects a fundamental market shift in which customers understand that a fragmented defense is no defense at all against modern threats," Nikesh Arora, chairman and CEO of Palo Alto Networks.

SPONSORED

Discover the measurable impacts of AI agents for customer support

How Did Papaya Slash Support Costs Without Adding Headcount?

When Papaya saw support tickets surge, they faced a tough choice: hire more agents or risk slower service. Instead, they found a third option—one that scaled their support without scaling their team.

The secret? An AI-powered support agent from Maven AGI that started resolving customer inquiries on day one.

With Maven AGI, Papaya now handles 90% of inquiries automatically - cutting costs in half while improving response times and customer satisfaction. No more rigid decision trees. No more endless manual upkeep. Just fast, accurate answers at scale.

The best part? Their human team is free to focus on the complex, high-value issues that matter most.

👉 Curious how they did it? Read the full case study to learn how Papaya transformed their customer support

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ECONOMIST CHATTER

FOMC Has A Big Decision To Make. JPM: “Money Doesn’t Talk Anymore” 🧠

The FOMC has a big decision to make in September, as markets, bets, and voices call for rate cuts. Job market data at the beginning of August showed the worst additions in three years, and major reductions to past data. On the flip side, PPI inflation numbers rose at the fastest pace in two years. The Fed’s Jackson Hole summit begins this Wednesday, and investors expect a preview of the direction of monetary policy. Chair Powell has a chance, likely his last in Jackson Hole as the head of the Fed, to make a clear picture of where policy is headed.

How are they going to decide?

J.P. Morgan Economist David Kelly says the policy game is changing. One major reason: the long-honored metric of money supply has gone stale. Kelly argues that the M2 measure of money supply has officially become irrelevant. The Fed stopped targeting it decades ago, and velocity collapses have neutered its predictive power. The FOMC will have to use macro data, which is giving mixed signals, to choose the path:

📉 Monetarism once ruled the macro playbook, but its grip faded fast.

Milton Friedman’s “money = inflation” mantra dominated the 1970s

Volcker’s M2 targeting triggered two recessions but crushed inflation

By 1983, the Fed abandoned money supply targets entirely

💸 The mechanics of money have changed, and M2 no longer reflects real-world liquidity.

Velocity collapsed post-GFC and pandemic, offsetting M2 surges

Interest-bearing accounts, ETFs, and instant access tools blurred “money” definitions

M2 growth now diverges wildly from nominal GDP

📊 The Fed’s focus has shifted to demand-side components and long-term growth drivers. They are watching macro data like a hawk.

M2 is absent from Fed speeches, statements, and policy frameworks

Key signals: consumer spending, housing, business investment, trade, and government outlays

Long-term growth hinges on labor supply and productivity trends

TLDR: If the FOMC makes a move, it won’t be because of political chatter or measures of money supply; it will be with specific price inflation or labor data in hand. With PPI high and labor low, either holding or cutting asap seems plausible.

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Tickers Today 🎞

Air Canada continued to delay thousands of flights after 10,000 unionized flight attendants walked off the job.

$NNE ( ▲ 7.0% ) Nano Nuclear fell after Ladenburg downgraded the stock and slashed its price target by 75%, citing concerns over the company’s diversified strategy and lack of focus on its KRONOS reactor.

$DAY ( ▲ 1.36% ) Dayforce climbed after reports surfaced that private equity firm Thoma Bravo is in advanced talks to acquire the HR software provider, potentially valuing the deal at over $9 billion.

$AAOI ( ▲ 3.29% ) Applied Optoelectronics rose after announcing its first volume shipment of high-speed transceivers to a major hyperscaler, boosting investor sentiment despite recent earnings volatility.

$OPEN ( ▼ 2.54% ) Opendoor Technologies jumped as retail investors rallied behind leadership changes and bullish technical signals, including a Golden Cross and strong MACD momentum.

$CIFR ( ▼ 2.98% ) Cipher Mining gained after reporting $44M in Q2 revenue and energizing Black Pearl Phase I, with analysts raising price targets and praising its flexible infrastructure strategy for AI and crypto mining.

HOT OFF THE PRESSES

Top Stocktwits News Stories 🗞

Soho House climbed 15% after news Ashton Kutcher is joining the board as part of a $2.7B take-private deal led by MCR Hotels, with shareholders receiving $9/share in cash—an 83% premium.

GoodRx flew 23%, the highest on the S&P 500, after Novo Nordisk announced Ozempic will be available for $499/month to Type 2 diabetes patients paying with cash on GoodRx and platforms like NovoCare Pharmacy.

Solar Stocks Climbed after the Treasury Department updated solar incentive rules last week by removing the 5% investment safe harbor for most projects, triggering rallies in FSLR, RUN, ENPH, SEDG, and NEE.

Intel fell despite further news that the Trump administration is considering converting $10.9B in Chips Act grants into a 10% equity stake in Intel to boost domestic semiconductor production.

Bitcoin slipped to $115,200 amid a broader crypto selloff that triggered $550M in liquidations, with Cardano and Solana leading altcoin losses.

Bitdeer Technologies Group rose 7% after reporting strong Q2 earnings, beating revenue estimates and reaffirming its 2025 mining capacity goals.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: OPEC Monthly Report (7:00 AM), CPI (8:30 AM), EIA Short-Term Energy Outlook (12:00 PM), Federal Budget Balance (2:00 PM). 📊

Pre-Market Earnings: Altimmune ($ALT), Paysafe ($PSFE), Sea ($SE), Bitfarms ($BITF), Circle Internet Group ($CRCL). 🛏️

After-Hour Earnings: Inovio Pharmaceuticals ($INO), Rigetti Computing ($RGTI), LogicMark ($LGMK), Luminar Technologies ($LAZR), CoreWeave ($CRWV). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋