CLOSING BELL

Market Hits Highs, But Dow Slips

The market closed with fresh all-time highs and record finishes for the Nasdaq and S&P 500. At the same time, the Dow dropped lower on earnings disappointments and a Justice Department investigation into UnitedHealth’s Medicare billing practices.

U.S. jobless claims fell for the sixth straight week to 217K, showing some continued resiliency. Speaking of resilience, the meme stock explosion took a bit of a breather Thursday, after some morning pops for stocks like American Eagle on partnership news with Sydney Sweeney. 👀

Late Thursday, the FCC approved the merger of Paramount and Skydance Media.

Today's issue covers: Why the Dow could not keep up, Intel’s results, and More. 📰

With the final numbers for indexes and the ETFs that track them, 3 of 11 sectors closed green, with energy $XLE ( ▼ 0.09% ) leading and discretionary $XLY ( ▲ 1.52% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,363

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,219

Russell 2000 $IWM ( ▲ 1.09% ) 2,252

Dow Jones $DIA ( ▲ 0.78% ) 44,693

STOCKS

What Pulled Down The Dow? 🦳

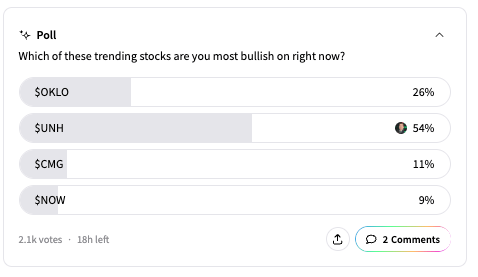

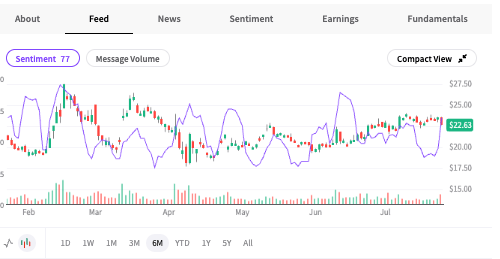

UnitedHealthcare fell 4% on Thursday as investors reacted to the latest update in a long-running tale of alleged billing malpractice from the health insurance giant. The firm filed with the SEC that it was working with the Justice Department's criminal and civil investigators in a probe related to Medicare billing.

The Wall Street Journal reported over the past year a deep dive story alleging that $UNH ( ▼ 2.97% ) hired doctors and nurses to diagnose illnesses that paid out higher prices from the Federal Government. The idea is that the firm added extra diagnoses to pull in cash, and some patients never received treatment, or worse, had already received a cure for the recorded illness.

The healthcare firm was about to release its earnings next week, with shares already underwater after the firm reported its first earnings miss since 2008. UNH representatives said in a statement that they welcomed the opportunity to review their practices.

It was not the only major name pulling down the Dow Jones Industrial Average index. $IBM ( ▲ 2.67% ) fell Thursday after the firm reported an overall earnings beat, but a slight miss in software revenue.

Analyst Dan Ives wrote that the price decline presented a buying opportunity and that the firm was well-positioned in the AI space.

"We believe that IBM is well-positioned to capitalize on the current demand shift for hybrid and AI applications with more enterprises looking to implement AI for productivity gains and drive long-term profitable growth," Wedbush's Dan Ives wrote.

While we’re talking about the Dow, why not mention the plastics supplier under the ticker DOW?

$DOW ( ▲ 2.48% ) fell after the firm cut its dividend 50C a share, and a higher adjusted loss per share than Wall Street had feared. In just one year, the firm went from a net profit and $10.9B in revenue, to a Q2 with a net loss, despite nearly the same $10.2B revenue. 😅 📉

SPONSORED

Bitcoin Depot: Shaping Bitcoin’s Physical Future

Bitcoin Depot (Nasdaq: BTM) is the world’s largest Bitcoin ATM operator, with over 8,500 locations across the U.S., Canada, and Australia. They’re the go-to physical on-ramp for crypto users of all kinds, and they just posted some impressive Q1 numbers:

Revenue up 19% YoY to $164.2M

Q1 net income up to $12.2M vs. net loss of $4.2M in Q4 2024

Adjusted profits up 92% YoY to $33.1M

The best part? Their growth hasn't historically been tied to Bitcoin’s price. Instead, they ride the growing wave of crypto adoption, generating revenue with Bitcoin ATM usage.

Since its founding in 2016, Bitcoin Depot has processed over $3 billion in total transaction volume.

However, it’s more than just transactions; it’s a commitment to long-term industry growth. Bitcoin Depot has positioned itself among forward-thinking companies that are incorporating Bitcoin into their balance sheets as crypto adoption continues to boom.

Their Bitcoin treasury strategy adds a layer of exposure to investors, helping them further benefit from Bitcoin’s potential growth trajectory.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

The above is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation, or solicitation to buy or sell a particular financial instrument. Bitcoin Depot is not a registered investment adviser under the U.S. Investment Advisers Act of 1940. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by Bitcoin Depot to buy or sell any securities or other financial instruments

COMPANY NEWS

Intel Posts A Loss But Revenue Beat, And Retail Is Bullish 🐂

Intel, the biggest name to report after the bell Thursday, fell slightly after the chip maker recorded better-than-expected revenue for its June quarter. The good news had to reason with a 10-cent-a-share loss in the quarter. Overall, it was a $2.9B net loss in the quarter, nearly double the net loss recorded in the same period last year.

Still, the firm forecasted revenue of $12.6-$13.6 billion for the current quarter, well above estimates. It was the second quarter since Lip-Bu Tan took over as CEO, and the firm announced more cost-cutting plans for its foundry division.

CFO David Zinsner told Barron’s that the firm experienced less tariff impact than initially feared in the past quarter and had nearly completed a 15% reduction in staff headcount to minimize costs.

The stock is up about 13% so far this year, after a dramatic 60% plummet in 2024, as it looked like the firm was losing out in the chip-making race big time to names like Nvidia.

Stocktwits users went ‘extremely bullish’ on INTC as the stock fell

POPS & DROPS

Top Stocktwits News Stories 🗞

Chipotle sank 14% after mixed Q2 results led Wall Street firms to cut price targets, though retail sentiment remained extremely bullish. Read more

Tesla fell over 8% after weak Q2 results, but Wedbush’s Dan Ives called it an “AI story” and said he’d buy on the dip. Read more

Las Vegas Sands surged after smashing Q2 expectations—boosted by a 36% revenue jump from Singapore casinos. Retail sentiment flipped bullish on the beat, with chatter targeting a rebound to $60. Read more

T-Mobile rallied over 5% after a blowout Q2 and raised 2025 guidance, as retail chatter spiked 960% on 5G and postpaid momentum. Read more

Oklo hit an all-time high after announcing multiple data center energy deals and completing a key nuclear regulatory milestone, echoing Jim Cramer’s “nuclear is coming back” prediction. Read more

Southwest Airlines slipped after Q2 earnings ($0.43 EPS vs. $0.51 est.) and revenue ($7.24B vs. $7.29B est.) missed expectations. Read more

Alaska Air CFO said he’s “cautiously optimistic” about sustained travel demand for the rest of 2025, driven by stable macro conditions and rising bookings. Q2 earnings beat ($1.78 vs. $1.54 est.), but Q3 guidance ($1.00–$1.40 EPS) disappointed vs. $1.63 est. Read more

American Airlines beat Q2 estimates but issued weak Q3 guidance, sparking a 7% selloff—even as retail sentiment turned extremely bullish. Read more

ServiceNow jumped over 7% after a blowout Q2 fueled by AI-driven growth, prompting BofA to hike its price target to $1,200. Read more

Mobileye hiked full-year revenue guidance and forecasted a 2027 growth inflection as demand for autonomous driving chips accelerates. Read more

Tron slid nearly 5% in its Nasdaq debut after a $100M reverse merger with SRM Entertainment, marking its blockchain treasury pivot. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

MACRO NEWS

Trump Visits Fed Reserve To Talk Real Estate

The President went across town Thursday to take a tour of the renovations to the Federal Reserve building complex, and complain about the cost of foundations.

In a now regular weekly sparring with Fed Chair Jerome Powell to entice the FOMC to lower interest rates to help home buyers, Trump said the renovations were way too expensive, and tried to hand Powell a fresh markup of the costs. Powell, whipping out his glasses, said Trump had added the cost of a building that was finished five years ago, during the first Trump administration. 🤣

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Durable Goods Orders (MoM) (8:30 AM), Atlanta Fed GDPNow (11:30 AM), U.S. Baker Hughes Oil Rig Count (1:00 PM) 📊

Pre-Market Earnings: Phillips 66 ($PSX), Centene ($CNC), Flagstar Financial ($FLG), Charter Communications ($CHTR), HCA Healthcare ($HCA), Booz Allen Hamilton ($BAH), AutoNation ($AN), 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → https://event.tixologi.com/event/5863

#Stocktoberfest25

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋