NEWS

Market Red Until Trump Posted This

Source: tenor

The market was red before the trading day even started on Wednesday, after GDP data came out for the first quarter that showed the first decline in growth for 2023. President Trump took to Truth Social and said it was Biden’s fault, and by the end of the day, the market closed in a gain—art of the deal.

Jensen Huang spoke at the White House after the market closed, cheerleading the support of the White House for AI Infrastructure. According to Bloomberg, European officials plan to propose trade deals to the U.S. next week. 👀

Today's issue covers two magnificent reports from Meta and MSFT, Robinhood falls despite beat, and Macro data sucks. 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with Health care (+1.19%) leading and energy(-2.23%) lagging.

And here are the closing prices:

S&P 500 | 5,569 | +0.15% |

Nasdaq | 17,446 | -0.09% |

Russell 2000 | 1,964 | -0.63% |

Dow Jones | 40,669 | +0.35% |

EARNINGS

Two Mag Seven Giants Beat Results 💻

Microsoft reported Q3 EPS of $3.46 on revenue of $70.07B. According to Yahoo Finance, analysts expected earnings of $3.22/share on revenue of $68.44B.

The firm’s cloud segment is expected to pull in $42.2B, up from $34.1B a year ago. Azure Revenue climbed 33%, above what the firm projected earlier in the quarter. Results rose from $2.94 EPS and $61.86B a year ago. Chief Satya Nadella said the firm delivered cloud revenue that climbed 22% YoY. 💲

“Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth," Nadella said. “From AI infra and platforms to apps, we are innovating across the stack to deliver for our customers.”

Meta mostly beat expectations, and shares climbed 6% after posting results. The social media giant reported Q1 EPS of $6.43 on revenue of $42.31B. Analysts expected earnings of $5.22/share on revenue of $42.36B according to Yahoo Finance.

For the current quarter, the firm expects Q2 rev 42.5-45.5 est $44.06B. They also said they expected to spend about $1B less this year in total expenses, but spend $4-$7B more in CapEx. 🤑

The firm did not mention allegations from the Federal government that Meta's monopolizes the personal social networking world.’ The Wall Street Journal reported that Chief Mark Zuckerberg offered to settle for $450 million, but the government won’t go lower than $18 billion.

However, the CFO, Susan Li, said on the firm’s earnings call that their upbeat guidance is based on the current conditions in April, and things are going pretty well.

Stocktwits users seemed to agree, holding at ‘extremely bullish’ during the firm’s earnings call.

Source: Stocktwits

If tech keeps delivering, this quarter’s earnings season might come in positive, one money manager said.

“Tomorrow we are getting Apple and Amazon, if we can get beats from them too, we can get some real momentum, Daniel Morgan, Synovus Trust Senior Portfolio Manager, told Bloomberg. 🚂

SPONSORED

This Asset Class Was Built for Market Chaos

Markets are volatile. Interest rates are still high. But a new real estate strategy is quietly drawing in accredited investors looking for protection and upside.

It’s called the U.S. Home Equity Fund I, and it’s one of the first ways individuals can invest in Home Equity Agreements (HEAs)—a model previously used only by hedge funds and institutions.

🏠 Built-in 40%+ downside protection

📈 Targeting 14–17% net IRRs

🔒 No tenants. No turnover. Just long-term appreciation

This fund invests in the equity of owner-occupied homes across the U.S.—giving you passive exposure to real estate appreciation, without owning a property or chasing rent checks.

👉 Accredited investors can now access this institutional strategy through Homeshares.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ECONOMY

Macro Is Bad, Should You Feel Bad? 🫠

Two macroeconomic data drops hurt investor feelings on Wednesday, before more pressing matters helped push things higher.

GDP Numbers: The first quarter Gross Domestic Product numbers came in negative, recording the first contraction in U.S. growth for three years.

PCE Index: The Fed’s preferred inflation gauge was flat in March, with annual PCE inflation at 2.3%, down from 2.5% in February. Well, the U.S. Department of Commerce revised the previous numbers upwards to 2.7%. Core PCE, which excludes food and energy, also held steady month-over-month, rising 2.6 percent year-over-year.

In response, the market turned to fall, while White House Trade Advisor Peter Navarro said it was actually good news. He told CNBC it was the “best negative print” he has ever seen. ☠

Trump ended up helping him out with a post, but Navarro went on to say that if you cut out the pain caused by tariffs, the economy would have grown.

“That is off the charts when you strip out inventories and the negative effects of the surge in imports because of the tariffs, you had 3% growth,” he said.

STOCKS

Other Noteworthy Pops & Drops 📋

Toyota ($TM -2%): Toyota and Alphabet’s Waymo said Tuesday they were in early talks to integrate Waymo’s autonomous driving systems into Toyota’s personally owned vehicles and expand Waymo’s robotaxi fleet using Toyota’s platforms.

Grab ($GRAB +2%): The Southeast Asian ride-hailing and delivery company Grab raised its 2025 EBITDA forecast to $460 million–$480 million, up from $440 million–$470 million, after reporting Q1 revenue of $773 million, beating estimates of $766.7 million.

Humana ($HUM +1%): Insurer Humana expects a 10% drop in Medicare Advantage membership for 2025 due to planned exits from unprofitable plans and select markets. Analysts project Q1 revenue of $32.22 billion, up from $29.21 billion a year earlier, with EPS forecast at $10.07 compared to a prior loss of $2.16.

Stellantis ($STLA -3%): The automaker suspended its full-year 2025 guidance after reporting Q1 revenue of 35.8 billion euros ($40.66B,) down 14 percent year-over-year. Stellantis cited tariff-related uncertainties and lower shipment volumes, noting ongoing discussions with governments and adjustments to production plans.

Caterpillar ($CAT +0.6%): The industrial giant posted Q1 revenue of $14.2 billion, missing estimates of $14.58 billion, as sales declined 10% due to lower dealer inventories and unfavorable price realization. Adjusted EPS came in at $4.25, below the 4.35-dollar forecast, with tariff-related costs expected to weigh further on Q2 results.

Etsy ($ETSY -6%): Custom shop site Etsy reported Q1 revenue of $651.2 million, beating estimates of $641.7 million, driven by strong advertising and payments growth. Despite the revenue beat, Etsy posted a net loss of $52.1 million.

Regulus Therapeutics ($RGLS +136%): Shares surged 138% after Novartis agreed to acquire the company for $7 per share, valuing the deal at $800 million upfront. Regulus shareholders may receive an additional $7 per share if its lead drug, farabursen, secures regulatory approval.

AppLovin ($APP -7%): Shares of the mobile ad firm fell after Edgewater Research lowered estimates, citing a decelerating mobile gaming sector and rising competition from Meta and Alphabet.

Nvidia ($NVDA -0.1%): Seaport Research posted a rare analyst sell rating on Nvidia, citing that AI-driven growth is already priced into the stock. The firm set a $100 price target, implying an 8 percent downside, and flagged rising competition as hyperscalers develop their own chips.

PRESENTED BY STOCKTWITS

A Stocktwits Community Trader Roundtable 🤩

Stocktwits’ Editor-in-Chief is joined by community members Kenny Glick, Hostile Charts, Lia The Trader, and Michael Nauss for an educational chat about trading the current environment. This special edition took place live in person ahead of the Stocktwits Cashtag Awards, presented by eToro, which is live in NYC tonight! 🥳

All these traders have different strategies and backgrounds, so this conversation offered an interesting perspective on how each approaches trading in 2025. Plus, they share their top trade ideas and debate several charts live. 👀

You don’t want to miss this episode! 👏

MORE EARNINGS RESULTS

Robinhood Beats, Stock Takes On Bears 🐻

Retail trading giant Robinhood posted earnings and revenue that beat estimates, but the firm was not performing well after hours. CFO Jason Warnick said revenue grew 50% from last year, and earnings grew 100%. 💯

“We started the year off strong, driving market share gains, closing the acquisition of TradePMR, and remaining disciplined on expenses,” Warnick said.

The price decline could have come from the firm’s lack of direct guidance. The firm’s Q1 transaction-based equities revenue came in a little light, at $56M, vs. analyst estimates for $60M. 😥

Robinhood reported Q1 EPS of $0.37 on revenue of $927M. Analysts expected earnings of $0.37/share on revenue of $917.16M according to Yahoo Finance. Chief Vlad Tenev said Robinhood reached record-breaking net deposits in the quarter.

“This quarter, we significantly accelerated product innovation across our key initiatives, highlighted by the Robinhood Strategies, Banking, and Cortex announcement,” Tenev said.

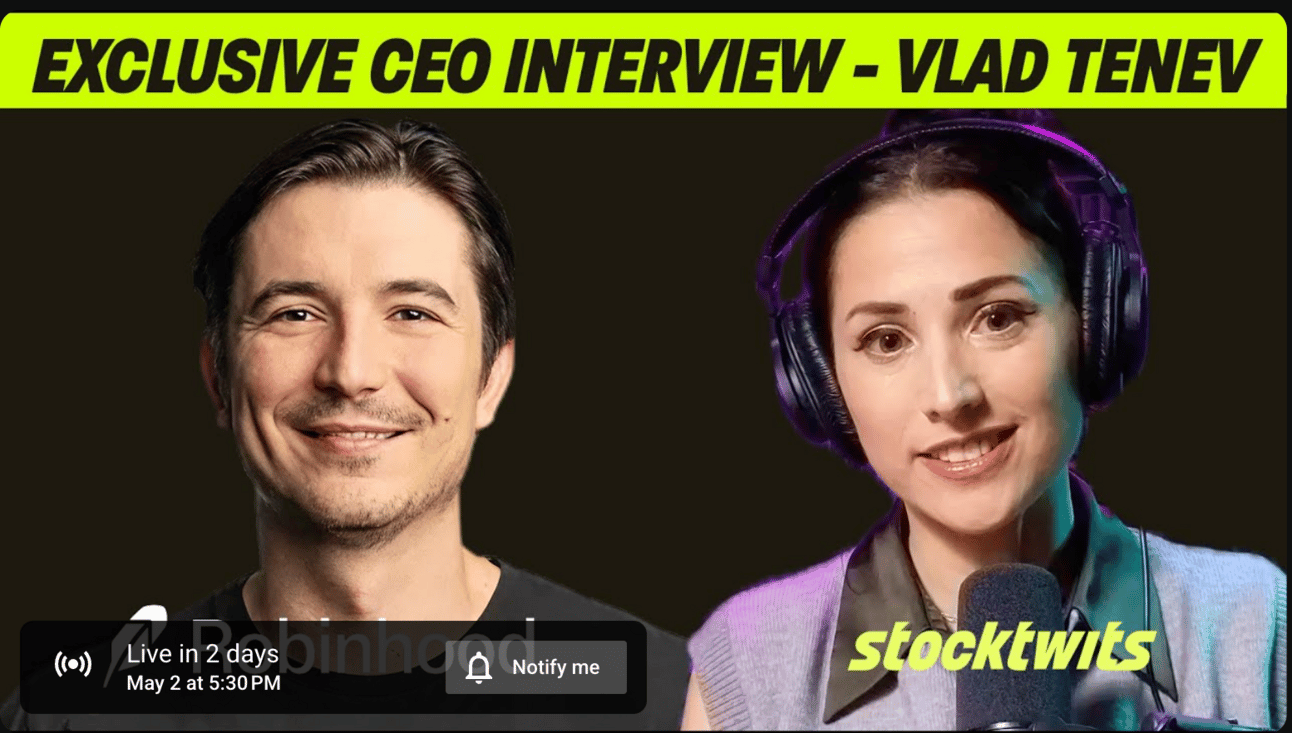

Speaking of Tenev

Robinhood is one of the most active stocks among the Stocktwits community and retail investors, and we love rewarding our fans.

Here’s what’s coming your way:

Tune into an exclusive, live interview with Robinhood CEO Vlad Tenev this Friday, May 2nd, at 5:30 pm ET.

Drop your questions for Tenev here! We’ll ask them LIVE. 📝

Watch the premiere of Stocktwits’ CEO Howard Lindzon’s interview with Robinhood CEO Vlad Tenev next Tuesday, May 6th, on Stocktwits and YouTube. 🤩

Despite the earnings backlash, Stocktwits users still rate the stock ‘extremely bullish.’ What does Chief Tenev think? Tune in Friday and find out!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Initial Jobless Claims (8:30 am), S&P Global Manufacturing PMI (9:45 am), ISM Manufacturing PMI (10:00 am). 📊

Pre-Market Earnings: SNDL ($SNDL), Moderna ($MRNA), Roblox ($RBLX), Mastercard ($MA), CVS Health ($CVS), Eli Lilly ($LLY), Sirius XM Holdings ($SIRI), Wayfair ($W), Shake Shack ($SHAK). 🛏️

After-Hour Earnings: Apple ($AAPL), MicroStrategy ($MSTR), Amazon ($AMZN), Block ($XYZ), Roku ($ROKU), Riot Platforms ($RIOT), Airbnb ($ABNB), Twilio ($TWLO), United States Steel ($X). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🤖 🚜 Duolingo launches 148 courses created with AI after sharing plans to replace contractors with AI

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋