CLOSING BELL

Markets Climb On Wednesday Deals

The market climbed on Wednesday, hitting fresh highs for the S&P 500, Dow, and Russell 2000 after the president announced a fresh 15% tariff trade deal with Japan, and touted that a promise of a $550B Japanese investment in the U.S. helped push the deal along.

It gave investors hope that upcoming talks with China and ongoing gripes with the EU might find similar pathways to completion. The EU said it would impose tariffs on $100 billion in goods if it doesn’t reach a deal before August 1, though Treasury Secretary Bessent said that was just a negotiating shot across the bow. To his point, the EU has seemed to accept the idea of 15% tariffs on all goods.

In stock news, earnings results from tech giants showed the market is pricing every penny very carefully- unless it’s a heavily short-sold meme stock, in which case it’s a clown show or a casino, depending on how you roll the dice. 👀

Today's issue covers: how the market reacted to big boy tech earnings, an ever-changing cast of meme coins, and more. 📰

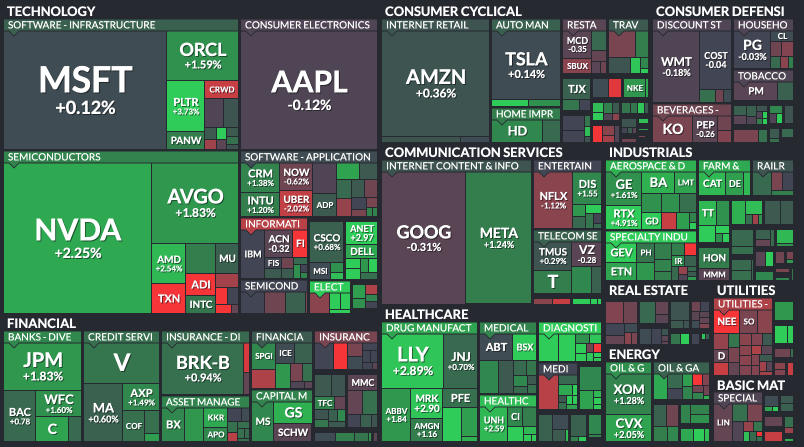

With the final numbers for indexes and the ETFs that track them, all 11 sectors closed green, with health care $XLV ( ▼ 0.42% ) leading and staples $XLP ( ▲ 0.87% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,358

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,162

Russell 2000 $IWM ( ▲ 1.09% ) 2,283

Dow Jones $DIA ( ▲ 0.78% ) 45,010

STOCKS

Tesla Is No Longer A Car Company, But… Google Is? 🤖

$TSLA ( ▲ 2.39% ) fell slightly after reporting worse revenue in Q2 than last year, and even worse than analysts had thought. It was about a 10% drop from the same period last year, at $22.5B, and adjusted earnings per share also came in low or near estimates at 40C. It was the steepest drop in revenue for over a decade, according to Business Insider.

The firm’s gross margin grew in the quarter, but after two periods of declining sales, Chief Musk had his work cut out for him to convince investors that future prospects look good. Tesla is a stock that is priced entirely on the future: low-cost EVs, self-driving cars, robots, and its adjacency in the Musk empire of companies to space travel and advanced AI.

The firm did not update on forward guidance. Just one year ago, before the election and DOGE debacle, the firm reported revenue of $25.5 billion and adjusted EPS of $0.52.

According to data from Fiscal.ai, Tesla sales are down bad, though energy is growing.

Speaking on the call, Musk said Tesla was much better than Google at self-driving and AI, and that Tesla aims to bring robotaxis to half the U.S. population this year. Bloomberg reported that the firm has not applied for automated driving clearance with the California DMV yet, which leaves a significant portion of people out.

Musk said the future of his firm lay in batteries, energy, and robotics, and he seemed less focused on producing models of EVs. With cut tax credits making their cars more expensive, it could be a rough couple of quarters going forward. The future also includes $300M in tariff costs, according to CFO Vaibhav Taneja.

Teneja confirmed that the firm wants to test in San Francisco, but lacks the permits quite yet, and will test with a ride-along driver watching the wheel.

Stocktwits users went ‘bearish’ on Tesla back in the spring

Google’s earnings call, on the other hand, championed its fleet of self-driving cars, check it out below vvv

SPONSORED

Wall Street Insiders Love This “Very Disruptive” Stock

From his days as an NFL linebacker to exits totaling nearly $1B, Wall Street insider Jon Najarian knows what it takes to reach the top. When it comes to Pacaso, he has three words: “I love it.”

He’s not alone. Pacaso’s luxury real estate disruption has already earned investment from major firms like Maveron, Greycroft, and Fifth Wall. By turning luxury vacation homes into co-owned assets, Pacaso is turning a $1.3T market on its head.

Look no further than the $110M+ they’ve earned in gross profits thus far, including 41% YoY growth last year alone. They even reserved the Nasdaq ticker PCSO.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. The testimonials presented are the opinions of the individuals providing them. They may not represent the experience of all clients or investors and are not a guarantee of future performance or success. Individuals were compensated $50,000 for providing these testimonials and therefore, have a financial or other interest that could affect the objectivity of their statements.

STOCKS

Tesla Is No Longer A Car Company, But… Google Is? 🚘

$GOOG ( ▼ 0.25% ) on the other hand, climbed after the search giant reported rev $96.42B and $2.31 EPS. The company said AI is positively impacting every aspect of business, and beat estimates across the board. Although this included higher CapEx spending than analysts had anticipated, investors needed to hear that Google would not lose its ad revenue giant to AI chatbot search competition.

In the past quarter, business segments were healthy at GOOG: Google Cloud revenue climbed 32% to $13.6B, ad revenue grew 10% all told. Search climbed 10% to $54B from last year.

The firm said it had $45 billion more this year to spend on CapEx, bringing the total to $85 billion. In the earnings call, the company did its best to show that search was solid, nothing to see here.

According to Fiscal.ai Google Cloud keeps growing, and Search is not slowing down

Managing partner of DeepWater Asset Management Gene Munster said on twitter the risk of weak search during the AI search craze is still on the table, but “Search was so strong that investors will likely come back to the stock over the next few months.”

Speaking of coming back to the stock, the firm said it was going to ‘allocate more resources to Waymo’ but did not specify what that meant. Waymo pulled in $373M in Q2, less than estimates for $429.1M, but more than the unreported amount from Tesla’s Austin tests.

“Last month, Waymo launched in Atlanta…more than doubled its Austin service territory…and expanded its Los Angeles and San Francisco Bay Area territories by approximately 50%,” CEO Sundar Pichai told investors on the call. “The Waymo Driver has now autonomously driven over one hundred million miles on public roads. And the team is testing across more than 10 cities this year, including New York and Philadelphia. We hope to serve riders in all 10 in the future.”

Stocktwits users went ‘extremely bullish’ on the stock.

In non-self-driving car measuring contest news:

$IBM ( ▲ 2.67% ) meanwhile beat expectations, said its gen AI book of business involves over $7.5B in expected sales, but the market did not seem to care, and the stock sold off 5% after the market closed.

$NOW ( ▲ 1.68% ) fell during trade but climbed 7% after reporting Q2 revenue up $3.21B over estimates, and said business subscription growth accelerated 22% year over year.

POPS & DROPS

Top Stocktwits News Stories 🗞

Lucid partnered with four key mineral producers to reinforce its supply chain and support long-term electric vehicle production goals. Read more

GoPro stock nearly doubled in a meme-stock-fueled rally sparked by retail enthusiasm following DNUT and KSS jump and dumps. Read more

Toyota Motor, General Motors, and Li Auto led retail chatter among automotive stocks, reflecting heightened investor interest ahead of earnings season. Read more

Opendoor faces a volatile path as traders debate its staying power in the meme stock arena following recent surges in retail attention. Read more

AT&T and GE Vernova ranked among the most trending stocks as retail traders keyed in on utility plays and yield dynamics. Read more

Texas Instruments saw retail sentiment hit a three-month high as traders responded to earnings, though the stock sold off despite a beat and rise report. Read more

U.S. existing home sales fell 2.7% in June, reinforcing signs of a cooling market amid shifting buyer demand and rising inventory. Read more

BTIG named AppLovin a top pick, citing strong execution and upside potential amid growing mobile ad demand. Read more

Aehr Test Systems attracted investor buzz after announcing new AI chip orders, signaling rising demand in the semiconductor space. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

SPONSORED BY MONEYPICKLE

Don’t Let Gains Ghost You

Level up with a vetted advisor who knows how to turn wins into wealth.

✅ A vetted advisor can help you make smarter money moves.

✅ Ditch the guesswork, build real wealth.

✅ 3-minute quiz. Free call. Only pay if you decide to hire.

PRESENTED BY STOCKTWITS

🎥 Stocktwits Product Highlight Episode 1: Building In Public

In this video, Stocktwits founder Howard Lindzon offers a behind-the-scenes look at how the platform is evolving to serve modern investors. Key themes include:

🧱 "Building in Public": Lindzon shares how transparency and user feedback drive product development.

🔧 New Features & Upgrades: The team highlights upcoming changes aimed at boosting engagement and community-driven insights.

🌐 Community Power: Emphasis on the influence of user-generated content and real-time sentiment data.

🗣️ Founder Vision: Lindzon discusses the future of investor platforms and the importance of adapting to changing retail investor behavior.

The episode sets the stage for a series that will follow the product’s evolution over time, showcasing decisions and challenges in real time.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Building Permits (8:30 AM), Initial Jobless Claims (8:30 AM), New Home Sales (10:00 AM), 10-Year TIPS Auction (1:00 PM), Fed's Balance Sheet (4:30 PM) 📊

Pre-Market Earnings: American Airlines Group ($AAL), Nokia ($NOK), Southwest Airlines ($LUV), Blackstone ($BX), Mobileye Global ($MBLY), and Honeywell Intl ($HON) 🛏️

After-Hour Earnings: Intel ($INTC), Ocean Power Techs ($OPTT), Invesco Mortgage Capital ($IVR), and Newmont ($NEM) 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋