CLOSING BELL

Meta & Microsoft Work Their Magic

Source: Tenor

It was a mixed day for risk assets, with the Fed decision and commentary weighing on risk assets intraday, but Meta and Microsoft came to the rescue with blowout earnings reports after the bell. 👀

Today's issue covers the Fed’s historic meeting, the magnificent earnings from two ‘Mag 7’ stocks, several post-earnings movers, and more from the day. 📰

With the final numbers for indexes and the ETFs that track them, 3 of 11 sectors closed green, with $XLU ( ▲ 1.11% ) leading and $XLB ( ▲ 0.76% ) lagging.

S&P 500 Heatmap - Finviz

S&P 500 $SPY ( ▲ 0.73% ) 6,363

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,345

Russell 2000 $IWM ( ▲ 1.09% ) 2,232

Dow Jones $DIA ( ▲ 0.78% ) 44,461

EARNINGS

Mag 7 Giants Move The Market 🤩

Microsoft shares are soaring 9% after the bell, hitting a new all-time high and topping the $4 trillion market cap mark after posting a beat-and-raise quarter.

Earnings per share of $3.65 and revenues of $76.44 billion topped the $3.37 and $73.81 billion anticipated by analysts. Its implied operating margin of 46.6% topped consensus estimates by 90 bps despite $30 billion in capital expenditures. 🤑

It continues to face data center infrastructure shortages, and it’s throwing money at the problem until the supply-demand balance improves. Its Intelligent Cloud unit revenue rose 26% YoY, and management revealed the size of its Azure business in dollars for the first time ever. It’s over $75 billion and rose 34% YoY.

Meta is also hitting new all-time highs after posting a double-beat and raising its forecast. Earnings per share of $7.14 on $47.52 billion in revenue topped the $5.92 and $44.80 billion expected. Its third-quarter sales forecast of $47.5 to $50.5 billion also topped consensus estimates of $46.14 billion. 📈

Like Microsoft, Meta is investing heavily in expanding its AI capacity, saying compensation related to hiring will be the “second-largest driver of growth” and contribute to a 2026 YoY expense growth rate that’s higher than 2025’s.

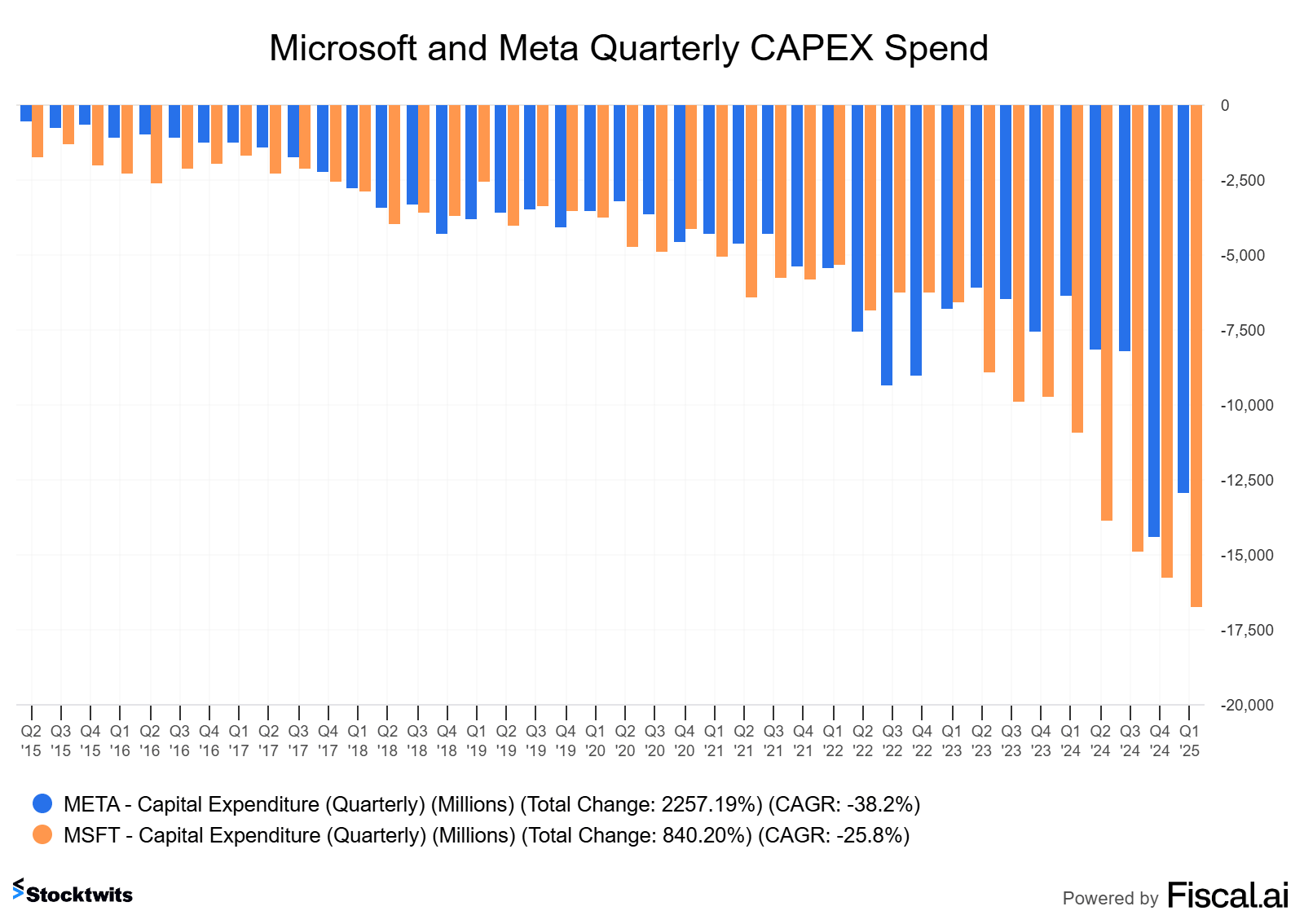

As long as these companies continue to post strong growth and print cash from their core business, investors are likely to be okay with these capital expenditures. For context, check out the chart below showing their quarterly CAPEX impact on cash flow. That’s a lot of zeros, but Wall Street is loving it! 🤯

Source: Fiscal.ai

SPONSORED

Rad Intel’s Private Round

Inner peace: knowing you backed a company with 1,600% valuation growth.* RAD Intel delivers 3.5× ROI, backed by Adobe & Fidelity. 9,000+ investors. Shares at $0.63. Reg D open to accredited only.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO

Powell Plays Good Cop & Trump Plays Bad Cop(per) 🚨

The Federal Reserve kept rates unchanged for the fifth straight meeting. However, it was a historic meeting because it was the first time two Fed governors dissented (did not vote) since 1993, with Waller and Bowman favoring a rate cut. They had expressed these views publicly, so while historic, it was not surprising. 🤷

The FOMC’s statement on Wednesday represented a slightly more negative tone toward the economy than in June. It said uncertainty about conditions “remains elevated” and recent indicators suggested economic growth moderated in H1 2025.

Fed Chair Jerome Powell reiterated that the committee has made no decisions about September, and that it’s sticking to its data-dependent path. As for tariffs, he noted, “Our obligation is to keep longer term inflation expectations well anchored and to prevent a one time increase in the price level from becoming an ongoing inflation problem,” 🌡

GDP grew at 3% in the second quarter, stronger than expected as imports surged ahead of Trump’s tariffs. Inflation remained elevated at 2.1% and core inflation of 2.5%, but were still below the first-quarter readings. 🔺

Nevertheless, Trump’s tariffs are back front and center ahead of the August 1st deadline, with him saying, "‘It stands strong, and will not be extended…’ That solidified comments from Commerce Secretary Lutnick and other officials.

Additionally, President Trump signed an executive order suspending the duty-free de minimis exemption or low-value shipments, to close the ‘catastrophic loophole’ that countries have been using to evade tariffs and funnel deadly synthetic opioids into the country. ❌

Trump said India will face a 25% tariff plus an additional penalty starting August 1st, citing high trade barriers and close ties with Russia. His Truth Social post called India’s tariffs “among the highest in the world” and criticized its purchases of Russian energy and military equipment.

As for Brazil, the White House slapped an additional 40% tariff on the country, citing ‘national security’ concerns. This brings the country’s total tariff amount to 50%, implemented to address recent policies, practices, and actions of the Brazilian government that represent a ‘national security’ threat to the U.S. 💵

Lastly, copper prices had one of their largest single-day declines in history after Trump slapped a 50% tariff on imports of semi-finished copper products. It also invoked the Defense Production Act to require 25% of high-quality copper scrap and forms of raw copper produced in the U.S. to be sold within the country.

Tariffs remain a hot-button issue for executives, with Hershey, Kraft Heinz, P&G, and other consumer goods’ management teams sharing their business impacts and how they’re managing them. ⚠

STOCKTWITS UPDATE

A new way to scan the market — through sentiment.

Stocktwits now shows the Most Bullish and Most Bearish stocks and crypto based on live community sentiment.

That means you can instantly see:

Which tickers have the strongest bullish momentum

Where bearish sentiment is stacking up

How the crowd’s positioning shifts as the price moves

It’s a great way to scan for watchlist ideas, track crowd conviction, or pressure test your thesis before a trade. The sentiment’s already out there. Now it’s ranked.

POPS & DROPS

Top Stocktwits News Stories 🗞

Wingstop soared 27% after updating its full-year global unit growth forecast, citing steady demand at its U.S. and international stores. Read more.

FuboTV jumped 24% after Wedbush maintained its ‘Outperform’ rating but raised its price target from $5 to $6, citing promising early Q2 numbers. Read more.

Etsy rose 4% after the company cited slightly healthier consumer spend across all its different cohorts, downplaying the potential tariff impacts. Read more.

Imunon, Inc. fell 4% despite its first patient being dosed with its lead candidate, IMNN-001, as part of a late-stage trial evaluating the drug in the treatment of women with newly diagnosed advanced ovarian cancer. Read more.

Ambiq Micro surged 69% in its Nasdaq debut. The Arm-backed Texas-based maker of ultra-low power chips raised $96 million in an upsized IPO. Read more.

Figma priced its IPO at $33, $1 above its expected range and netting the company $1.2 billion. It’s set to begin trading on the NYSE tomorrow. Read more.

Humana popped 11% after raising its full-year earnings outlook and beating Q2 earnings expectations. Its medical cost ratio was in line with the company’s previous guidance, near 90% (actual 89.7%). Read more.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

eToro CEO Yoni Assia Joins Daily Rip Live 👀

Regular hosts Katie Perry and Shay Boloor were joined by eToro co-founder and CEO, Yoni Assia. They cover the brokerage’s recent launch of tokenized stocks, the open vs. closed tokenization debate, cryptotech replacing fintech, and more!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Jobless Claims (8:30 am), PCE Price Index (8:30 am). 📊

Pre-Market Earnings: Roblox ($RBLX), Norwegian Cruise Line ($NCLH), Mastercard (MA), CVS Health ($CVS), SNDL Inc. ($SNDL), Aurinia Pharmaceuticals ($AUPH), Biogen ($BIIB), Cameco ($CCJ), Shake Shack ($SHAK), Anheuser-Busch ($BUD). 🛏️

After-Hour Earnings: Apple ($AAPL), Amazon ($AMZN), Coinbase ($COIN), Roku ($ROKU), Riot Platforms ($RIOT), Strategy ($MSTR), Rocket Companies ($RKT), First Solar ($FSLR), Cloudflare ($NET), Reddit ($RDDT), Bloom Energy ($BE). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋