CLOSING BELL

My Dogs Are Barking For A Day Off

The short day closed with fresh records, as Americans head to beaches, carnivals, and fireworks shows to celebrate the 4th. Apparently, the White House is heading back to the negotiating table with Vietnam, as the two parties have reportedly not yet settled on the figures announced yesterday.

Still, who cares? The market is soaring on low unemployment and a massive tax bill passed in the House, to the chant of ‘USA, USA, USA,’ despite a record-setting eight-hour speech on the House floor in protest. All that and the promise of three days without trading markets makes Thursday’s short day a win for equities.

Today's issue covers DataDog flies on addition to S&P 500, OpenAI says RobinHood does not have the right to sell its shares, BitMine’s ETH buy sent it up 3,000%, and more. 📰

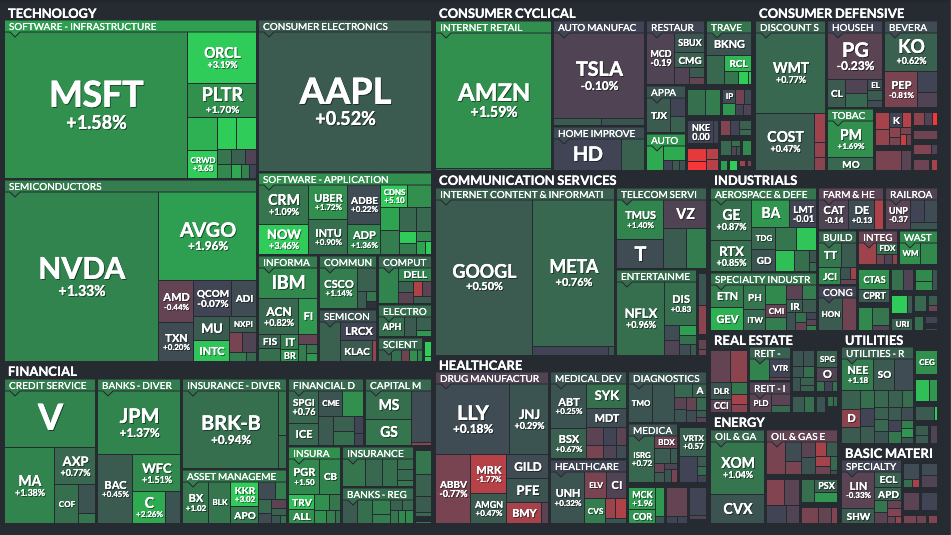

With the final numbers for indexes and the ETFs that track them, 9 of 11 sectors closed green, with tech $XLK ( ▲ 1.99% ) leading and materials $XLB ( ▼ 0.37% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,279

Nasdaq 100 $QQQ ( ▲ 1.36% ) 22,866

Russell 2000 $IWM ( ▲ 0.56% ) 2,249

Dow Jones $DIA ( ▲ 0.58% ) 44,828

STOCKS

This Dog Is Barking On News It’s Joining The Cool Kids’ Club 🐶

Datadog jumped $DDOG ( ▲ 5.46% ) after S&P Global announced its inclusion in the S&P 500 later this month. The cloud applications and security provider will replace Juniper Networks by July 9th, after $HPE ( ▲ 1.95% ) bought the firm for $14B.

Tech bull analyst Dan Ives pointed to the firm’s recent partnership with OpenAI, and said DataDog is well-positioned to flourish in a big data LLM world, according to Bloomberg.

Macquarie analyst Steve Koenig said the stock will continue to outperform.

“We expect DDOG's stable usage trends, share gains in a growing market, and conservative guidance approach to position it for continued outperformance,” Koenig said.

The news hurt other contenders for the throne, like $HOOD ( ▲ 5.9% ) , who hope to see an addition to the most popular and arguably important group of stocks in the world.

Of course, Robinhood had more than that to worry about VVV

COMPANY NEWS

Are The OpenAI Shares In The Room With Us Now, Robinhood?

This week, Robinhood hit all-time highs after the firm announced they were selling crypto tokens to give holders access to pre-IPO shares of OpenAI and SpaceX. But the stock fell Thursday.

Turns out, pre-IPO investing is not as simple as that, and some heads of state-level tech nerds are getting involved in the discussion. Last night, OpenAI informed Reuters that they had not authorized any pre-IPO share sales, and the firm clarified on X that OpenAI tokens are not OpenAI equity.

“Any transfer of OpenAI equity requires our approval—we did not approve any transfer,” OpenAI said. “Please be careful.”

Pre-IPO private companies have right of first refusal on the equity they sell to investors, and can bar those shares from switching hands… mostly. A Robinhood spokesperson told CNBC that the tokens provide investors with indirect exposure to private markets, facilitated through a special purpose vehicle that Robinhood owns.

According to the $HOOD ( ▲ 5.9% ) help page, investors are more playing a matching game than actually owning anything.

“You are not buying the actual stocks — you are buying tokenized contracts that follow their price, recorded on a blockchain,” Robinhood wrote in its help center page.

Elon Musk of SpaceX commented, “Your ‘equity’ is fake” in a dig at the firm he co-founded, or at customers buying OpenAI’s equity. User Stock Talk said “no sh^% sherlock’ as if it were obvious Robinhood was selling tokens that are more adjacent to value.

In related, albeit outdated, news, moderators of r/wallstreetbets have already done this, but for publicly traded companies. The website no longer loads, and if I were not a fintech reporter four years ago, it might have never seen the light of day again, but check it out:

The venture was founded in part by WSB Mod Jaime Rogozinski during the defi and DAO craze in what feels like decades ago in crypto time. The group had the goal of enabling users to buy and sell public equity tokens, using an underlying $wsb token. Shortly after launch, one of the founding members rug pulled the token for $600k+ Eth, and it seems like the project went on pause.

Remember, history doesn’t necessarily repeat itself, but it sure does rhyme.

SPONSORED

Cybersecurity Leader Cycurion (NASDAQ: CYCU) $CYCU Poised for Growth Now!

$69 Million in Recent Contract Awards for Innovative, Disruptive Cybersecurity Leader with a Multi-layered SaaS Solution: Cycurion, Inc. (Nasdaq: CYCU) $CYCU

$CYCU Reports 2025 Q1 Gross Profit of $677,673, Up 95.4% Year-Over-Year, with 17.5% Gross Margin Increase.

Clients and Partners Include: US Dept. of Defense, Defense Intelligence Agency, Dept. of Homeland Security, US Navy, Fortune 100 & 500 Companies and Major Private Sector Companies.

Advancement of Plans for AI-Powered Next-Generation Cybersecurity Platform with Partner $IQST

Expansion into Latin America via Partnership with LSV-TECH International Extending Sales Presence Into 135 Countries via Nokia Agreement.

Other Notable Cybersecurity Leaders: Palo Alto $PANW, Zscaler $ZS, CrowdStrike $CRWD, Category F5 $FFIV, Checkpoint $CHKP, CyberArk $CYBR, Fortinet $FTNT, Okta $OKTA and Cloudflare $NET

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. https://corporateads.com/disclaimer/ Disclosure listed on the CorporateAds website

POPS & DROPS

Top Stocktwits News Stories 🗞

Bitcoin surged to nearly $110K, just 1.8% below its record, driven by strong ETF inflows and renewed speculation around Trump’s Fed stance. Read more

Krispy Kreme named international division head Raphael Duvivier as CFO, replacing Jeremiah Ashukian just a week after ending its McDonald’s partnership. Read more

Apple reversed a two-year sales slump in China with an 8% Q2 iPhone rebound, powered by trade-in deals and strategic discounts during the 618 shopping festival. Read more

Nvidia hit a new record high Thursday and briefly topped $160.93, nearing Apple’s all-time $3.91T peak as analysts tout accelerating AI data center demand. Read more

AST SpaceMobile secured a $100M non-dilutive equipment financing deal led by Trinity Capital to fund satellite manufacturing and expand its network over the next two years. Read more

AstraZeneca is in talks with Summit Therapeutics for a potential $15B licensing deal on Ivonescimab, an experimental lung cancer drug that showed strong progression-free survival data. Read more

Macro And Policy

June payrolls rose by 147,000—beating expectations—while unemployment held at 4.1%, reflecting labor market resilience despite tariff and rate cut uncertainties. Read more

Scott Bessent said there are “a lot of good, strong candidates” to replace Fed Chair Powell after Trump demanded his immediate resignation over rate cut disputes. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Ben’s Portfolio Revealed: Biotech, Bitcoin Miners & Big Surprise

Ben opens up his portfolio and walks through the wild world of his current holdings—featuring biotech moonshots, Bitcoin miners, drone stocks, and cosmetic lipo-sculpture plays. It’s part market insight, part therapy session.

👉 Whether you're looking for early biotech alpha, Bitcoin mining hype, or stocks that remind you of dermatology, Ben’s got you covered.

PRESENTED BY STOCKTWITS

BitMine FLEW On ETH Treasury, Let’s Check In

$BMNR ( ▲ 12.45% ) flew this week after the news broke the firm had established a treasury to buy $ETH.X ( ▲ 11.46% ), with Tom Lee as a chair on the board.

The BMNR stock flew this week

It’s not the first firm to section out a part of the balance sheet just for holding ETH, here’s a list of the top holders based on Finchat data:

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋