NEWS

Not All Mag 7's Are Created Equal

Amazon Delivery GIF - tenor

The market climbed for the eighth straight, led by strength in tech stocks after Microsoft and Meta not only beat expectations for their earnings results, but raised their planned spending on AI development this year- it’s flush times for everything computer. After Apple and Amazon reported in the evening, the market showed it was happier with digital sales than gadget sales— both firms missed future guidance and warned imports would likely suffer this quarter.

Tomorrow’s job numbers will show any economic strength the FOMC will draw on when deciding rates next week. 👀

Today's issue covers double A earnings day, Tesla [allegedly] eyeing ousting Musk, and more. 📰

Here’s the S&P 500 heatmap. 7 of 11 sectors closed green, with tech (+1.47%) leading and healthcare (-3.8%) lagging.

S&P 500 Map - finviz

And here are the closing prices:

S&P 500 | 5,604 | +0.63% |

Nasdaq | 17,710 | +1.52% |

Russell 2000 | 1,976 | +0.6% |

Dow Jones | 40,753 | +0.21% |

EARNINGS

Welcome To $A-Day 💢

Apple and Amazon reported beats to their most recent fiscal quarters, but the market seemed to have spent its positivity on Microsoft and Meta’s results, and both stocks fell after hours.

The issue?

Both tech giants are also import giants— Amazon is a huge imported goods seller, and three-quarters of Apple’s leading products come from China.

Apple Breakdown:

Apple reported Q1 EPS of $1.65 on revenue of $95.36B. iPhone revenue came in at $46.8B, higher than $45.94B estimated. According to Yahoo Finance, analysts expected $5.22/share earnings on revenue of $42.36B.

It makes three-quarters of its revenue from iPhones, Macs, and tech in China. TD Cowen thinks it will cost them 6% of earnings this year. Expected to post nearly $90B in revenue for the June Quarter.

For forward guidance, analysts were looking for $1.47/share for the quarter, revenue at $89B for the quarter, and $07.26/share, $408.3B for the full year. The firm said it expects costs upwards of $900M on imports from tariffs, even while it works to move 100% of U.S. iPhone production to India ASAP. 📱

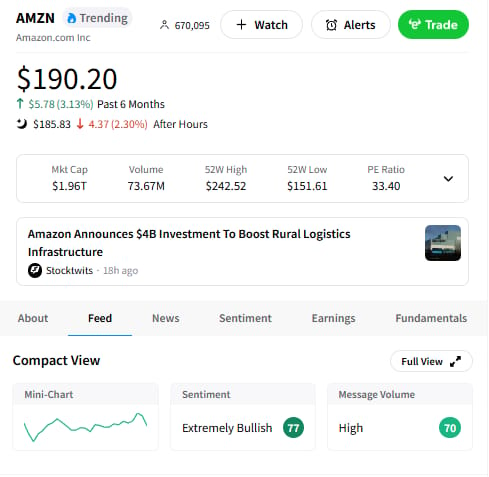

Amazon Breakdown:

Amazon fell after reporting earnings and revenue beats, but forward guidance for the current quarter was low.

Sales grew 8.4%, but the firm gave a light forecast compared to high expectations.

Amazon reported Q1 EPS of $1.59 on revenue of $155.7B. Analysts expected earnings of $1.37/share on revenue of $155.13B according to Yahoo Finance. For the current quarter, the firm sees operating income coming in $13-$17B, below analyst estimates.

AWS revenue, the hosting side that has little to do with tariffs, came mostly in line with estimates. In total sales, analysts wanted to see $166B for the coming quarter, but the firm projected $164B. 😅 📉

SPONSORED

StartEngine’s Blockbuster Year: How You Can Join The Action

StartEngine is the platform allowing accredited investors to gain exposure to some of the world’s most coveted private companies like OpenAI, Perplexity, Databricks — without paying millions.¹

Not surprisingly, they just posted new blockbuster financials:

📈 Monster (and record) Q4 revenues ($11.4M)

📈 Revenue doubled year-over-year ($23M » $48M)

They’ve been building something big, and the results speak for themselves. The even better part? The window is open (but closing soon) for you to join their latest funding round. Over 50,000 have invested $84+ million in StartEngine — and now you can get in on the action.

1. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. This is offered only to accredited investors per regulation D rules. 2. Based on our 2024 Form 10-K. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $28 million of the $48 million in revenue from 2024. Net loss also increased to $16.5 million. To understand the impact on margins, see financials.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

LOOK OUT MUSK 🙃

Speaking of the Mag 7, the Wall Street Journal reported late Wednesday rumors that the Tesla Board was sniffing around for a new CEO to possibly replace Chief Elon Musk as recently as a month ago. Thursday, board members and Musk denied the Journal's reporting.

Tesla Chair Robyn Denholm denied reports that Tesla's board was searching for a new CEO, calling the claims "absolutely false" and an "extremely bad breach of ethics."

The report found that Tesla was looking into executive search firms over concerns that Musk’s time in government negatively impacted the brand. The idea is not new. Tesla tech bull Dan Ives wrote an analysis for WedBush last month that said if Musk does not get out of Washington, Tesla may face a permanent demand injury. He gave the stock a code red. 🥵

Based on delivery numbers, demand for Teslas fell nearly 15% in Q1 alone, and the firm cut profits by 71%. That was before Musk said he would cut his time in Washington and return to Tesla.

Max Chafkin, Cohost of the Elon Inc. podcast, said today that at any other firm, news that an executive board was looking at other options after their stock tanked and demand suffered is not news at all— it’s par for the course. But Tesla and Musk are different.

He reminded the audience that this same board, which he thinks likely did at least think about switching Musk out, is also the board that has fought with the courts to get Musk his insane pay package; they have had his back. He said that the board knows Musk is what investors are putting their money on.

“People are not investing in the Model Y’s performance; they are investing in Musk- the dream for Optimus robots, self-driving cars, and AI is in Musk’s head,” Chafkin said. “If you get another CEO, you’ve just got a car company.”

He said if the company eliminates that, if Musk follows his passion for AI into his other companies, like XAI, and pursues his obvious ambitions to lead the AI space in the U.S., Tesla will not look the same. The board has to keep Musk’s attention on Tesla AI, not just AI in general.

“His new passion is XAI, not cars, and he knows he has to focus on AI entirely if he wants to lead in it,” Chafkin said.

STOCKS

Other Noteworthy Pops & Drops 📋

Microsoft ($MSFT +8%): Climbed after it reported Q3 revenue of $70.07B, beating estimates of $68.44B, with EPS at $3.46 versus $3.22 expected. Analysts raised price targets on the tech giant, citing 35% Azure growth and strong AI momentum, with Wedbush lifting its target to $515 and Barclays to $494.

Meta ($META +4%) reported Q1 revenue of $42.31B, up 16% year-over-year, beating estimates of $41.36B. EPS came in at $6.43, exceeding the forecasted $5.21. The social media giant raised its full-year capex guidance to $64B–$72B, citing increased data center investments for AI expansion.

Robinhood ($HOOD -5%): Reported Q1 revenue of $927M, up 50% year-over-year, beating estimates of $917.2M, with net income rising 114% to $336M. The brokerage firm fell in value despite extending its buyback plan by $500M to $1.5B, and even while transaction-based revenue surged 77%, driven by $252M in crypto trading.

Bitcoin ($BTC +3%): Surged past $97K, marking its highest level since February, rebounding 23% from its $78.9K low.

IDEXX ($IDXX +9%): Reported Q1 revenue of $998M, up 4% year-over-year but slightly below estimates of $999.52M. The company raised its full-year revenue guidance to $4.1B–$4.21B, citing foreign exchange benefits and improved operating margins. The veterinary stock was the highest climber on the Nasdaq 100.

Moderna ($MRNA -6%): Reported Q1 revenue of $108M, missing estimates of $115.32M, as COVID vaccine sales declined with lower vaccination rates. The pharma company delayed FDA approval for its COVID-flu combo shot to 2026, citing the need for additional efficacy data.

Eli Lilly ($LLY -12%): Reported Q1 revenue of $12.73B, beating estimates of $12.72B, but Zepbound sales missed expectations at $2.31B versus the forecasted $2.33B. The pharma company lowered its full-year EPS guidance to $22.50–$24.00, down from $22.78–$24.00, citing higher research and development costs.

Ford ($F +2%): Reported April U.S. sales of 208,675 vehicles, up 16% year-over-year, driven by strong truck and hybrid demand. EV sales fell 39%, while Ford extended employee discounts through June 2 to counter tariff impacts.

McDonald's ($MCD -2%): Reported Q1 revenue of $5.96B, down 3% year-over-year and below estimates of $6.13B, with adjusted EPS of $2.67 meeting expectations. U.S. same-store sales fell 3.6%, marking the worst decline since COVID-19, as global comparable sales dropped 1% amid weaker consumer demand.

General Motors ($GM -0.4%): Cut its full-year guidance, citing a $4B–$5B impact from Trump administration tariffs on auto imports. The car giant now expects net income of $8.2B–$10.1B, down from $11.2B–$12.5B, but aims to offset 30% of the tariff hit through supply chain adjustments.

Yum Brands ($YUM -1.2%): Reported Q1 comparable sales growth of 3%, beating estimates of 2.76%, driven by strong performance at its brands, Taco Bell and KFC. Pizza Hut lagged with a 2% decline, but the company reiterated its long-term target of 8% annual core operating profit growth.

CVS Health ($CVS +4%): Reported Q1 revenue of $94.6B, beating estimates of $93.6B, with adjusted EPS of $2.25, surpassing the forecasted $1.69. The pharmacy company raised its full-year EPS guidance to $6.00–$6.20, up from $5.75–$6.00, citing improved Medicare Advantage star ratings and cost management strategies.

Hims & Hers ($HIMS +9%): Online prescription seller Hims flew after announcing a partnership with Novo Nordisk to offer Wegovy auto-injector pens for $599/month. Analysts see the deal as a validation of Hims' direct-to-consumer model, with Needham calling it a "groundbreaking partnership" that supports its $725M weight-loss revenue target for 2025.

Qualcomm ($QCOM -9%): Issued cautious Q3 revenue guidance of $9.9B–$10.7B, below the consensus estimate of $10.35B, citing tariff uncertainties. Despite the outlook, the network and integrated circuits firm said its retail sentiment remains bullish.

SPONSORED

Adobe-Backed AI Startup Grows from $5M to $85M, Partnering with Top Brands 📋

Introducing RAD Intel, a high-growth AI startup driving success in the $633B content, data, and influencer marketing industry. Brands like Hasbro, Skechers, and Sweetgreen are using RAD Intel’s AI-powered platform to achieve up to 3.5X ROI, delivering real results that set them apart.

With backing from 7,800+ investors, including employees from Google, Meta, Amazon, and support from Adobe's Fund for Design, RAD Intel has skyrocketed from a $5M to $85M valuation in under three years. The company has already raised $35M, and now is your chance to invest early in this proven tech disruptor.

RAD Intel's platform uses AI to provide brands with data-driven insights, helping them cut through the noise and engage their audiences with precision.

Don’t miss out!

*This is a paid advertisement for RAD Intel’s Regulation CF offering. Please read the offering circular and related risks at invest.radintel.ai.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls (8:30 am), Unemployment Rate (8:30 am). 📊

Pre-Market Earnings: Exxon Mobil ($XOM), FuboTV ($FUBO), Chevron ($CVX), Shell ($SHEL), Butterfly Network ($BFLY), Wendy's ($WEN), Cinemark Holdings ($CNK), Cigna Group ($CI). 🛏️

After-Hour Earnings: none, enjoy your weekend! 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋