CLOSING BELL

Nvidia Can Trade Chinese Chips... For A Price

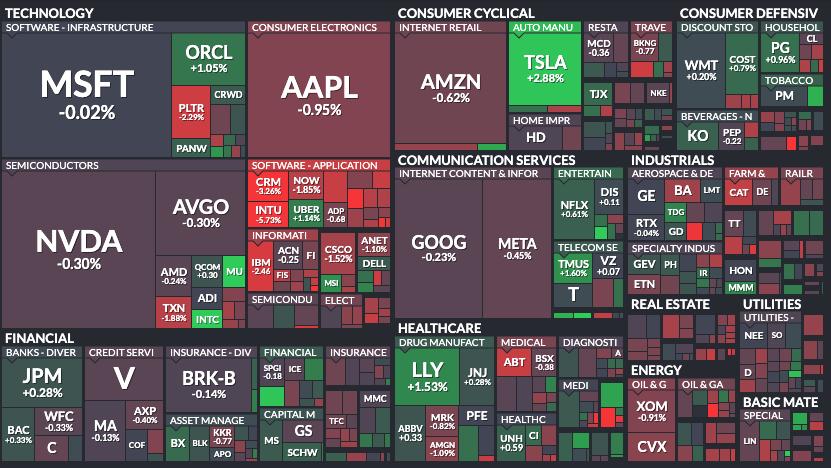

The market closed slightly lower Monday ahead of a fresh new CPI inflation reading on Tuesday. It’s about a week after startlingly bad jobs data forced investors and policy makers alike to keep a closer watch on macro data coming down the pike.

Trump again delayed implementation of Chinese tariffs, and despite ongoing trade drama, things are going well: four out of five S&P 500 companies have reported beating results this season, according to FactSet. 👀

Today's issue covers Nvidia made a deal to pay Uncle Sam 15% to sell chips to China, Gold is (not) on the tariff menu, what to watch in the CPI release, and more. 📰

With the final numbers for indexes and the ETFs that track them, 3 of 11 sectors closed green, with communications $XLC ( ▲ 0.21% ) leading and energy $XLE ( ▼ 0.58% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 6,373

Nasdaq 100 $QQQ ( ▲ 1.36% ) 23,526

Russell 2000 $IWM ( ▲ 0.56% ) 2,216

Dow Jones $DIA ( ▲ 0.58% ) 43,9775

EARNINGS AFTER THE CLOSE

Major Stocks Reported Beats, But Today’s Results Would Skew That Perception (They Sucked) 😦

Despite this earnings season’s high expectations, most stocks beat. You would be pressed to think that watching the after-market moves of these major reports:

BigBear.ai Holdings $BBAI ( ▲ 2.82% ), fell big time after the AI software firm posted a report and outlook that was way below what the Street wanted to see. Revenue was $32.5m in Q2, a miss of nearly $8M. The company’s Virginia-based military and intelligence analytical tech is not hot right now, despite the gains of competitors in the big military data space like $PLTR ( ▲ 4.46% ): BBAI expects a full-year revenue range of about $125M-$140M, while Wall Street analysts wanted at least $160m.

Eastman Kodak $KODK ( ▲ 1.06% ) fell after the printing and imaging company reported a quarterly loss, and said it was going to cut its retirement plan to pieces to help pay off debt. The stock fell as investors were worried it was a sign the company may face bankruptcy, Bloomberg reported. The firm was briefly in bankruptcy proceedings in 2012, left behind by the digital revolution of photography a long time ago. 📉

SPONSORED

Rad Intel’s Private Round

Inner peace: knowing you backed a company with 1,600% valuation growth.* RAD Intel delivers 3.5× ROI, backed by Adobe & Fidelity. 9,000+ investors. Shares at $0.63. Reg D open to accredited only.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Nvidia And AMD Will Pay 15% To Sell To China 🦅

The big news Monday was a reverse tariff deal: Nvidia CEO Jensen Huang and team reportedly reached an agreement with the White House to pay Uncle Sam 15% of their China sales revenue, paying for the right to sell its lower-tech M20 chips. AMD also clinched the deal to sell its M1308 chips.

$AMD ( ▼ 1.07% ) and $NVDA ( ▲ 2.25% ) fell on the news, though analysts said it is better to get in 85% of sales than 0%. Wells Fargo said in a note that it expects the new deal, alongside imports of automated data processing machines, could drive NVDA’s price 20% higher. Nvidia had warned it would lose $8B a quarter on the total block of the chip trade, meaning the firm would pay up $1.2B and keep $6.8B.

“From an investor perspective, it’s still a net positive, 85% of the revenue is better than zero,” Ben Barringer, global technology analyst at Quilter Cheviot, told CNBC.

Speaking at the White House, Trump said he wanted 20%, but Chief Huang gave him a hard bargain. The unusual agreement mirrors a relaxed tariff facing Apple’s India imports after Chief Tim Cook last week made a pledge to spend billions to build touchscreen glass in the U.S.

U.S. President Donald Trump shakes hands with Nvidia CEO Jensen Huang after Huang delivered remarks in the Cross Hall of the White House during an event on "Investing in America" on April 30, 2025 in Washington, DC. (Photo by Andrew Harnik/Getty Images)

SPONSORED BY MONEYPICKLE

Don’t Let Gains Ghost You

Level up with a vetted advisor who knows how to turn wins into wealth.

✅ A vetted advisor can help you make smarter money moves.

✅ Ditch the guesswork, build real wealth.

✅ 3-minute quiz. Free call. Only pay if you decide to hire.

POPS & DROPS

Top Stocktwits News Stories 🗞

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: OPEC Monthly Report (7:00 AM), CPI (8:30 AM), EIA Short-Term Energy Outlook (12:00 PM), Federal Budget Balance (2:00 PM). 📊

Pre-Market Earnings: Altimmune ($ALT), Paysafe ($PSFE), Sea ($SE), Bitfarms ($BITF), Circle Internet Group ($CRCL).🛏️

After-Hour Earnings: Inovio Pharmaceuticals ($INO), Rigetti Computing ($RGTI), LogicMark ($LGMK), Luminar Technologies ($LAZR), CoreWeave ($CRWV). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋