CLOSING BELL

Oil Falls, Market Heats Up

The market reacted like there was world peace on Tuesday, after a hastily brokered and twice broken peace deal between Israel and Iran went into place. Both sides reportedly took pot shots at one another, and Trump said neither knew “What the fuck they were doing,” but Tuesday afternoon the ceasfire seemed to hold.

Oil futures tanked on the lack of tanks, and the fuel-fueled equities market climbed to within 1% of an all-time high.

Eyes turned to all the other things to worry about in the market, but with Fed speakers pointing to a summer rate cut, and earnings showing revenue growth, there is plenty of reason to be bullish at the end of June. Of course, July will bring tariff resets and missed rate cut expectations if the FOMC votes to delay. 👀

Today's issue covers Belwether earnings are showing consumers are buying, but trade is wearing shipping down, robotaxi competition is heating up, and more. 📰

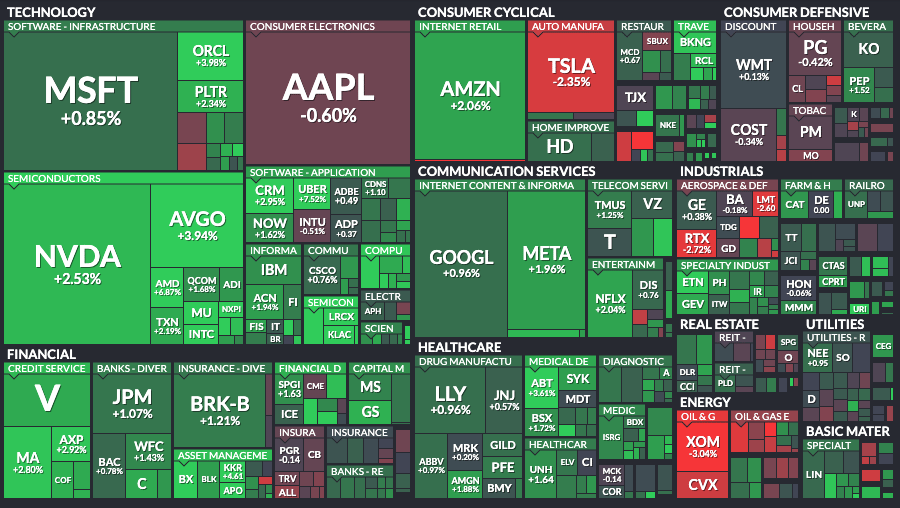

With the final numbers for indexes and the ETFs that track them, 9 of 11 sectors closed green, with technology $XLK ( ▲ 1.3% ) leading and energy $XLE ( ▼ 0.09% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,092

Nasdaq 100 $QQQ ( ▲ 1.07% ) 22,190

Russell 2000 $IWM ( ▲ 1.09% ) 2,161

Dow Jones $DIA ( ▲ 0.78% ) 43,089

STOCKS

Shipping And Cruise Earnings Show Investors Are Learning to Price In Uncertainty 🚢

In the brief, quiet weeks between the spring and summer earnings seasons, major bellwether firms are still reporting results that are moving the needle.

Carnival stock jumped $CCL ( ▲ 3.91% ) after the cruise line raised its full-year profit forecast to $1.97 EPS and posted record Q2 earnings, driven by strong ticket pricing, onboard spending, and all-time high customer deposits. Read more

It was a surprise. The firm had warned in its past guidance that they were worried about painful tariffs, trade worries, and war that would cause consumer demand for travel and luxury sunbathing on the high seas to fall in 2025. Instead, YoY revenue climbed 10%, and the cruise line said it beat its 2026 fiscal goals 18 months ahead of schedule.

It raised its fiscal year guidance, and said 2026 already had record bookings, even with higher prices.

$FDX ( ▲ 0.74% ) Fedex was not enjoying the same optimism, as the package mover fell after hours, warning global demand was volatile and that it would have to reduce its Asia-to-America shipping lane 35%.

The firm cut its full year 2026 guidance in its Tuesday afternoon report, but at least posted Q4 earnings and revenue just barely above Wall Street Estimates.

FedEx, like UPS, is down about 17% so far this year. The stock fell 5% after hours.

SPONSORED

Amp Up Your Edge: Aggressive Daily Trading on the Hottest Names

If you're the kind of trader who thrives on volatility, momentum, and making bold moves— this is for you. Direxion’s Single Stock Daily Leveraged ETFs give you the tools to supercharge your short-term trades in some of the market’s most-watched names. Want to double down on Nvidia or ride the Tesla wave?

These ETFs offer 2X or -1X daily exposure, letting you express bullish or bearish views with precision and speed. Designed for experienced traders who live for the action, this is not your average ETF—it’s your edge. Significant risk is involved.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Robot Taxis, Coming To Your Own Backyard 🤖

Ride-hailing services are not going to let Tesla’s self-driving beta tests steal their bread and butter. $UBER ( ▲ 0.93% ) climbed Tuesday after it announced a partnership to launch self-driving Waymo cars in Atlanta. Waymo, a subsidiary of $GOOG ( ▼ 0.25% ) has hit the ground running in the news this spring with their expensive but well-tested self-driving tech.

The start-up said it has achieved over 1M miles in fully autonomous rides, and even last year counted 150,000 paid trips every week, out of its San Francisco hometown.

Tuesday, Uber posted dozens of Waymo cars for self-driving trips across 65 square miles of the Atlanta area.

$LYFT ( ▲ 1.81% ) climbed and it wasn’t even part of the news, instead the stock enjoyed an analyst update. TD Cowen upgraded shares of the ride-hailing company to Buy from Hold and boosted the price target to $21 from $16. TD dubbed Lyft its "Best Smidcap Idea for 2025."

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Fed official Raphael Bostic said rate cuts can wait, citing stable jobs and inflation risks, and expects only one cut in late 2025 as businesses prepare to raise prices due to tariffs. Fed official Barr echoed his claims right after the close. Read more

Jerome Powell also spoke, and told Congress the Fed is “well positioned to wait” on rate cuts despite mounting pressure from Trump, citing tariff-driven inflation risks and economic uncertainty. He left a slim opening for a sooner rate cut. Read more

OpenAI is developing a productivity suite with collaborative editing and chat features inside ChatGPT, directly challenging Microsoft Office and Google Workspace. Read more

Amazon-backed Anthropic won a key ruling as a judge deemed its AI training on copyrighted books “fair use,” but it must face a December trial over storing 7 million pirated copies. Read more

Mark Rutte said the U.S. has “total commitment” to NATO under Trump, while backing his push for allies to boost defense spending and calling out Europe and Canada for lagging contributions. Read more

Broadcom stock hit a record high after HSBC upgraded it to “Buy” and raised its price target to $400, citing stronger visibility into its AI-focused ASIC pipeline and rising demand from hyperscalers. Read more

Nektar Therapeutics more than doubled after its eczema drug Rezpegaldesleukin showed significant improvement in a mid-stage trial, with some patients seeing up to 90% severity reduction. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Building Permits (May) (8:30 AM), Fed Chair Powell Speaks (10:00 AM), New Home Sales (10:00 AM), Crude Oil Inventories (10:30 AM), 5-Year Note Auction (12:00 PM). 📊

Pre-Market Earnings: General Mills ($GIS), Novagold Resources ($NG), Paychex ($PAYX), and Winnebago Industries ($WGO).🛏️

After-Hour Earnings: Micron Technology ($MU), and Steelcase ($SCS). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋