Presented by

CLOSING BELL

One Week Till Santa Rally

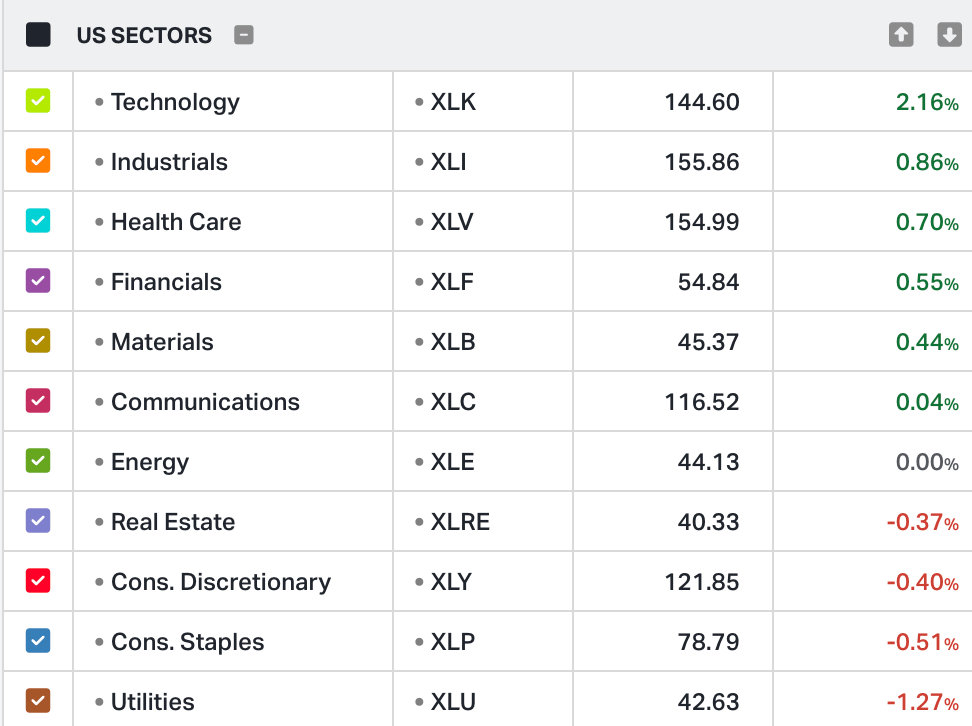

Happy Friday, markets closed green, and tech was really green after Micron kept climbing, ripping the Nasdaq 100 higher for the second day. Other memory providers like SanDisk were also on the way up, even AMD was dusting off its eyes and climbing in the green. Nvidia was up on a report that it was going to start shipping its advanced chips to China.

In macro, morning PCE data came in… absent, delayed for the third time, giving markets no reason to pause.

Michigan Consumer Sentiment numbers climbed to the highest since Lib Day, when Trump set off the tariff tirade. It’s still down 28% from a year ago. What changed? Even Bitcoin was climbing, bouncing +3% off $85k. CoinDesk cited the turbulence in the forex market after the Fed Bank of Japan voted to raise its interest rates to 0.75%, its highest rates in thirty years.

U.S. forces started bombing Syria Friday night, for revenge over three dead U.S. troops, according to a Hegseth tweet.

Tens of thousands of pages of Epstein case files started to appear on the Justice Department website Friday, right as the market closed. The Fed has said it will take weeks to drag their feet post the files they have, after a historic law passed to force their publication. The Dept. Attorney General said they had censored the files, in part to protect the identities of over 1,200 victims, so the total files will not make the midnight deadline.

The files include flight logs, investigative records, court deals, and anything else boring or shocking that the Fed collected on the long road to convicting the well connected pedophile sex trafficker.

TRENDING ROUND UP

Yee Haw, Ain’t Nothin’ Better Than A Week End Round Up 🤠

Nike $NKE ( ▲ 1.59% ) : Shares plunged over 10% after CEO Elliott Hill cautioned that the company faces a "longer road" to recovery. Its earnings showed a drop in margins and a 32% fall in profit from tariffs.

CoreWeave $CRWV ( ▲ 9.31% ) : Shares surged 20% after Citi resumed coverage with a "Buy" rating and a $135 price target, and the company joined the Department of Energy's Genesis mission to help cobble together advanced computing for Uncle Sam.

Intuitive Machines $LUNR ( ▲ 4.19% ) : The stock skyrocketed over 30% as investors bet on the company becoming a primary beneficiary of the Trump administration’s newly signed space policy executive order.

Rivian Automotive $RIVN ( ▲ 1.07% ) : Rivian climbed more than 11% today after Wedbush raised its price target to $25, highlighting 2026 as a massive inflection point.

Carnival Corp $CCL ( ▲ 3.91% ) reported strong fiscal fourth quarter results on December 19, 2025. The company posted record profits and announced it is reinstating its quarterly dividend at $0.15 per share. While revenue of $6.33 billion slightly missed analyst estimates, the adjusted earnings per share of $0.34 significantly beat the expected $0.25.

SPONSORED

The Aviation Stock Palantir Is Quietly Backing

Dear Investor,

Most people ignored BYD until it was the world’s top‑selling EV maker.

A similar industry disruptor could be forming in the sky.

While “air mobility” companies chase prototypes, Surf Air Mobility Inc. (NYSE:SRFM) approach starts with real operations already in service.

Over the last 12 months, it carried about 312,000 passengers on more than 63,000 flights and generated roughly $108 million in revenue. This is not a slide deck. It is a live airline.

Surf Air Mobility is one of the largest commuter airlines in the US by scheduled departures and the largest passenger operator of Cessna Grand Caravan aircraft.

That gives it something rare in this space: real routes, real customers, and real data flowing through the system.

Now it is layering in two powerful levers.

First, software. Surf Air Mobility is rolling out SurfOS, an AI‑driven operating system for regional aviation. It is powered by Palantir Technologies (NASDAQ:PLTR), the same firm behind battlefield and government intelligence systems. Palantir is not just a contractor here. It’s a large Surf Air Mobility shareholder, and SurfOS already has early beta users.

Second, electrification. Instead of waiting for air taxis to get certified, Surf Air Mobility plans to electrify proven platforms. It has a re‑fleeting strategy around the Caravan and agreements in place with a next‑generation eSTOL aircraft OEM designed for short runways and lower operating costs.

The target is one of the most overlooked spaces in transport: short‑haul regional routes that could unlock a projected $75–115 billion global market by 2035.

Put together, you get a company that:

Flies a network today and books meaningful revenue, pre-electrification

Is embedding Palantir‑grade AI into its operations

Has a clear roadmap to electrified aircraft on an existing network

If you think the next “BYD‑style” industry disruptor story in transportation could come from the air, Surf Air Mobility Inc. (NYSE:SRFM) deserves a closer look.

The best place to start is the company’s own deck. It walks through the numbers, the Palantir partnership, the electrification plan, and how Surf Air Mobility stacks up against high‑flying, pre‑revenue rivals.

Remember to do your own research.

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Big Enough To Be Macro: Oracle Is The New TikTok Bag Holder 🤳

Oracle $ORCL ( ▲ 3.42% ) shares jumped 8 percent on Friday following news that TikTok parent ByteDance has signed binding agreements to spin off its U.S. operations into a new entity named TikTok USDS Joint Venture LLC.

The joint venture will be majority-owned by a group of American and global investors. The new structure satisfies the U.S. divestment law that prohibits apps from being more than 20 percent owned by a foreign adversary. Sure enough, China will still own about 19% of the social media giant that 170M Americans browse.

Managing Investors: Oracle, Silver Lake, and Abu Dhabi-based MGX will each hold a 15 percent stake.

Existing Stakeholders: Affiliates of current ByteDance investors will hold 30.1 percent.

ByteDance Retention: The China-based parent company will retain exactly 19.9 percent ownership.

Oracle will serve as the data security partner. Beyond its 15 percent equity stake, the company secures a massive long-term contract to host all U.S. user data within its Oracle Cloud Infrastructure.

The joint venture will have the exclusive authority to retrain the TikTok algorithm on U.S. user data to ensure the feed remains free from outside manipulation. The move helps Americans feel more comfortable, with only homegrown tech leviathans controlling their digital lives. While ByteDance will license the core algorithm to the new entity, Oracle will oversee the code and software assurance to validate and change the algorithm.

Analysts from Mizuho and Evercore ISI note that this deal secures TikTok as a key customer for Oracle, potentially driving over $1 billion in annual cloud revenue. It’s revenue Oracle needs, this week making headlines that it was facing issues trying to fundraise for its data center plans. The deal is expected to officially close on January 22, 2026.

POPS & DROPS

Top Stocktwits News Stories 🗞

Rocket Lab shares rose on defense developments and launch activity.

NioCorp was a top critical metals climber this year, along with TMC and TMQ.

Altimmune rose on positive mid-stage clinical data for liver disease.

MicroStrategy and Bit Mining rose after the BoJ rate decision sparked a crypto rebound.

Bitcoin could hit $1 million following BoJ rate hike.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋