CLOSING BELL

Open Season Monday Meme Market

Wow, what a day… for those watching meme stocks! The market climbed at an even-ish pace, bringing the S&P 500 and Nasdaq to fresh all-time highs.

The real meat of trading centered around a single name, a stock that accounted for nearly a fifth of all trade on the Nasdaq. More on that in a bit.

Meanwhile, investors are looking forward to a chock-full earnings report week, with Tesla, Google, and IBM arriving after close on Wednesday. 👀

Today's issue covers Open season meme markets are here, SentinelOne might get a buyout, and more. 📰

With the final numbers for indexes and the ETFs that track them, 6 of 11 sectors closed green, with communications $XLC ( ▲ 0.69% ) leading and energy $XLE ( ▼ 0.09% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,305

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,180

Russell 2000 $IWM ( ▲ 1.09% ) 2,231

Dow Jones $DIA ( ▲ 0.78% ) 44,323

STOCKS

Open Season Meme Market Brings First Fun Day In A While 💯

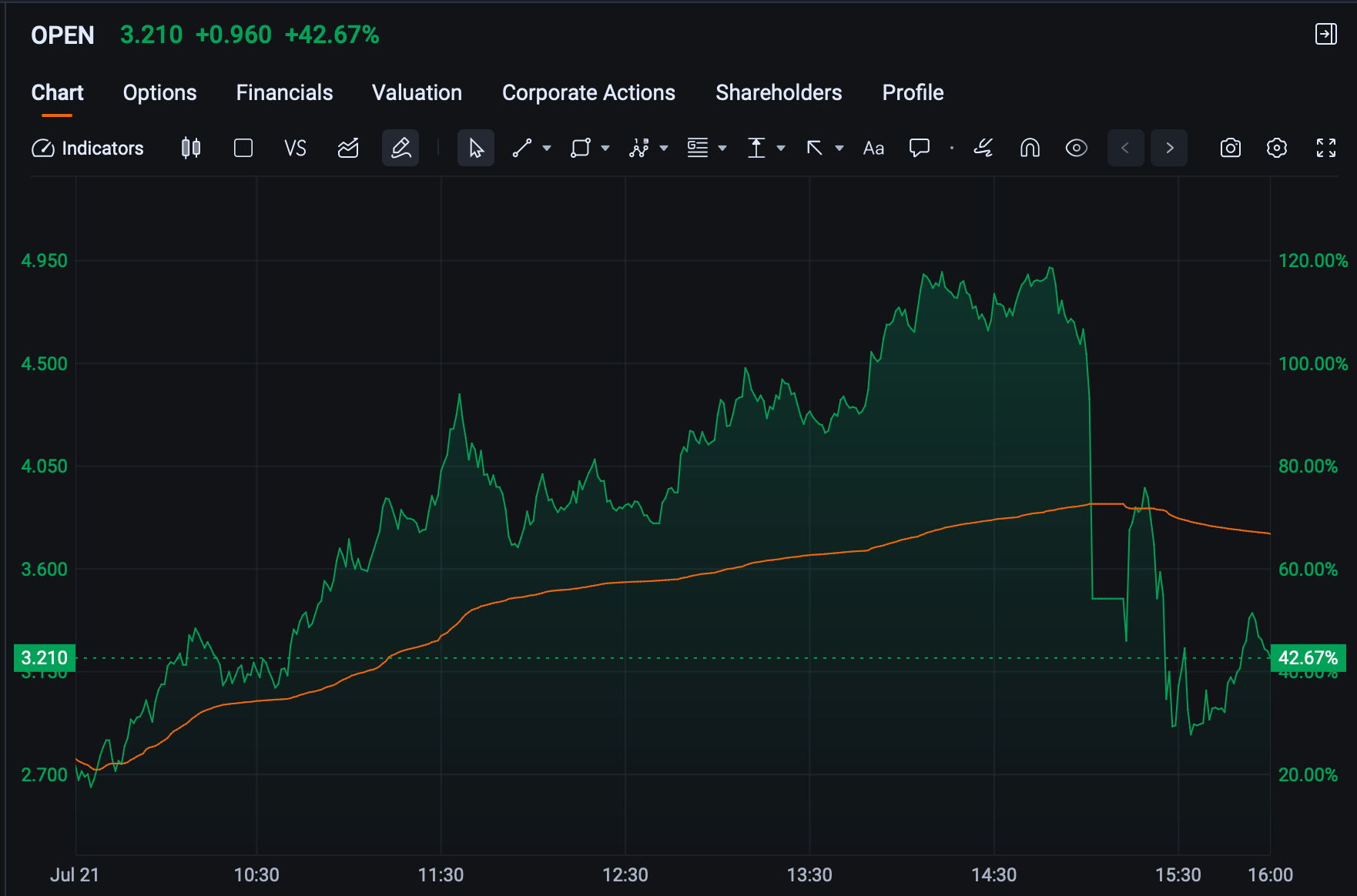

$OPEN ( ▲ 6.9% ) flew like the good ole GME days Monday, as a combination of retail hype, hedge fund analyst fervor, and short-sold shares met to send the stock flying.

The Arizona-based house-buying tech firm accounted for more than 16% of the trading volume of the entire Nasdaq exchange, as shares jumped nearly 120% before crashing, halting, and then climbing again. The stock appeared to be on track for its best day in years, although not a 120%+ day.

The stock hit a major dip and a trading halt right after 3 pm, according to moomoo

What Happened?

The craze started last week when Eric Jackson, a self-described headhunter looking for the next $CVNA ( ▲ 0.02% ) stock, or a stock that jumped from $4 to $342/share in the past three years.

Jackson took to Twitter, where he posts his Canadian hedge fund ideas, sourced from a proprietary AI and machine learning stock-picking technology at the fund he founded, EMJ Capital.

Jackson called out Opendoor as a simple 100X if the firm turns a profit. The company operates an app that enables users to list their homes for sale, allowing developers to swoop in, purchase the homes with cash, and revamp them for resale. Jackson said on Yahoo Finance last week that retail sentiment could send the stock higher.

"Let's talk upside math. If $OPEN goes to $12B in revenue in a few years (already the Bloomberg consensus estimate)... And if the market gives them a 5x EV/revenue multiple again (as it did at the 2021 peak)...That's a stock price of $82. 100x from here," he said on X.

The stock has reported a net loss since June 2023, but the firm’s margins have improved since then, although they are still losing money. Jackson seems convinced of his idea that if the firm eventually cuts costs enough to actually turn a profit, the stock will enjoy a more realistic, multi-billion-dollar valuation.

The stock is down 90%+ from its SPAC listing high, just below $40/share. It is important to remember the stock feels the pain of higher interest rates, and ongoing Fed Speak and White House pushes to cut rates will ultimately hit the housing market, and stocks like OPEN.

It was the most watched stock on Stocktwits, and the excitement was enough to drag names like $RKT ( ▲ 3.63% ) and even $GME ( ▲ 0.55% ) into the top trending slot.

According to MarketBeat and Moomoo, the stock is facing 19% short interest, meaning the possibility the stock will fall is high, but at the same time, the possibility short sellers are buying stock to close their short positions is also high.

The stock is facing a reverse split vote on July 28th: it’s been bouncing around $1 for months, and received a warning from the Nasdaq to get the share price up, or else face removal. One of the easiest ways to raise the price fast, outside of freak meme events, is to consolidate shares 10, or even 50 into a single share.

Back in 2021, GME famously shot higher as the heavily shorted stock climbed and short sellers had to buy to cover, causing all sorts of chaos, and the golden days of r/wallstreetbets.

SPONSORED

The Stock Popping Up in Big-Name Portfolios

Maveron. Greycroft. Fifth Wall. These aren't just notable venture capital firms. They've all invested in Pacaso (Nasdaq ticker reserved: PCSO).

Now everyday investors like you have the opportunity to join them.

Pacaso created the vacation home co-ownership category in 2020. Today, over 2,000 people have owned a home through their platform, helping Pacaso generate $110M+ in gross profits to date (including 41% YoY growth last year).

And they have no plans to slow down – they have their eyes on expanding to locations like Italy and the Caribbean.

You can share in that growth potential as they scale in this $1.3T market. This is your chance to invest like a venture capitalist.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

SentinelOne Climbs On Buyout News 🤔

$S ( ▲ 3.15% ), a network security firm with about a $6.6B market cap, climbed on a rumor that Palo Alto Networks $PANW ( ▼ 1.71% ) was considering a buyout. It was not a high-flying story, only reported by publications like The Motley Fool.

The stock climbed upwards of 18% before Palo Alto denied the news, cooling the bulls down a bit. Benzinga’s Investing Pro premium service reported that Palo Alto only refused to talk about the contract negotiations, not that the negotiation rumors were unfounded.

PANW pulls in about $2.3B in revenue in a good quarter, so a nearly $7B valuation firm might be a pretty big ask for investors.

Both stocks also climbed following news that Microsoft SharePoint was hit with a cyberattack on Monday.

Stocktwits users went ‘extremely bullish’ on the stock on the buyout rumor.

SPONSORED BY MONEYPICKLE

Don’t Let Gains Ghost You

Level up with a vetted advisor who knows how to turn wins into wealth.

✅ A vetted advisor can help you make smarter money moves.

✅ Ditch the guesswork, build real wealth.

✅ 3-minute quiz. Free call. Only pay if you decide to hire.

POPS & DROPS

Top Stocktwits News Stories 🗞

Domino’s CEO emphasized a strategic delivery push that’s fueling market share gains in the firm’s morning earnings report, though earnings per share came in lower than estimated. Read more

Pinterest earned a Morgan Stanley upgrade after improving its ad efficiency, boosting analyst confidence in long-term monetization growth. Read more

Scott Bessent said the U.S. won’t rush into a trade deal ahead of the August tariff deadline, emphasizing strategic patience over short-term optics. Read more

Wall Street expects GM’s Q2 revenue and earnings to decline with its report on Tuesday. Analysts are pointing to demand headwinds and cautious consumer sentiment. Read more

Trump Media revealed a $2 billion bitcoin treasury purchase, sparking retail skepticism over the strategic rationale and long-term viability. Read more

Verizon raised its 2025 cash flow forecast, signaling stronger financial performance ahead amid operational efficiencies and network investments. Read more

A GOP lawmaker accused Fed Chair Powell of lying to Congress and referred him to the DOJ for potential criminal charges, intensifying partisan scrutiny over monetary policy. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Chair Powell Speaks (9:30 AM), FOMC Member Bowman Speaks (1:00 PM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: Philip Morris Intl ($PM), Northrop Grumman ($NOC), D.R. Horton ($DHI), Danaher ($DHR), Synchrony Finl ($SYF). 🛏️

After-Hour Earnings: Capital One Finl ($COF), SAP ($SAP). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍